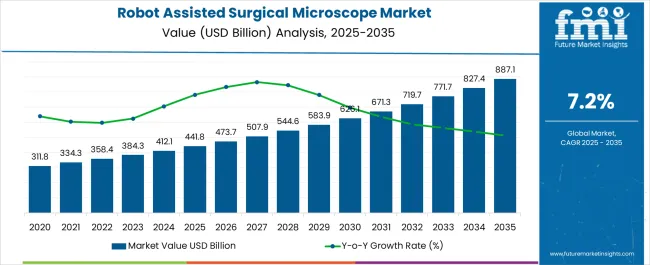

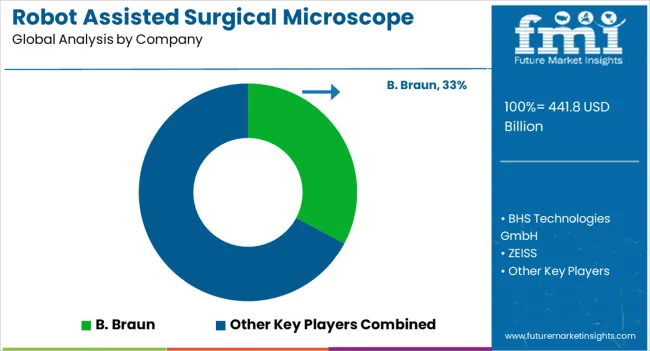

The Robot Assisted Surgical Microscope Market is estimated to be valued at USD 441.8 billion in 2025 and is projected to reach USD 887.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Robot Assisted Surgical Microscope Market Estimated Value in (2025 E) | USD 441.8 billion |

| Robot Assisted Surgical Microscope Market Forecast Value in (2035 F) | USD 887.1 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The robot assisted surgical microscope market is expanding rapidly as advanced imaging technologies and precision driven robotic systems transform surgical practices. Increasing demand for minimally invasive procedures and the need for enhanced visualization in complex surgeries are driving adoption.

These systems allow surgeons to perform with higher accuracy, reduced fatigue, and improved ergonomics, directly improving patient outcomes. Investments from hospitals and research institutions into robotic platforms are accelerating integration into surgical workflows.

Continuous innovation in optics, robotics, and AI supported guidance systems is further strengthening market potential. The outlook remains favorable as healthcare providers prioritize technologies that enhance surgical safety, efficiency, and long term patient recovery, reinforcing the role of robot assisted surgical microscopes as a key enabler in modern operating rooms.

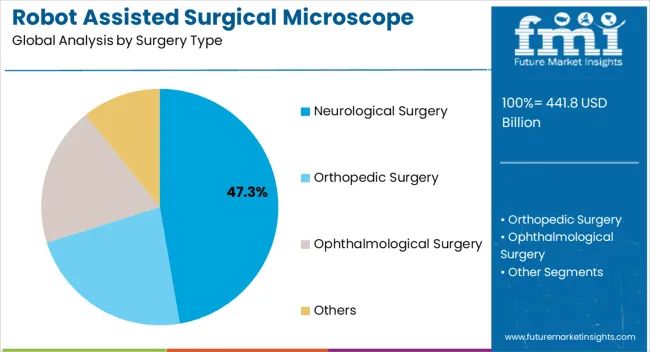

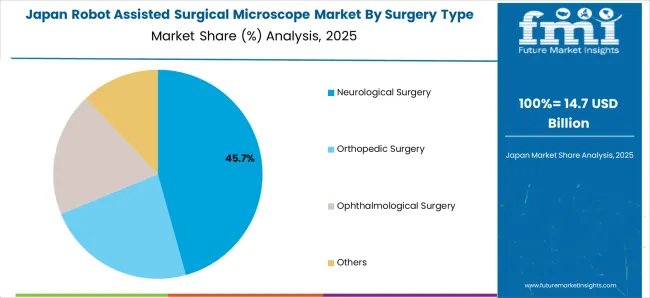

The neurological surgery segment is projected to hold 47.30% of market revenue by 2025, establishing itself as the dominant surgery type. This is due to the increasing incidence of neurological disorders and the critical requirement for high precision in brain and spinal procedures.

Robot assisted surgical microscopes provide surgeons with enhanced magnification, stable visualization, and improved accuracy that is essential in delicate neurological operations. Advancements in robotic arms and real time 3D imaging have significantly reduced error margins while improving surgical efficiency.

The complexity of neurological surgeries and the demand for improved patient outcomes have reinforced the leadership of this segment within the overall market.

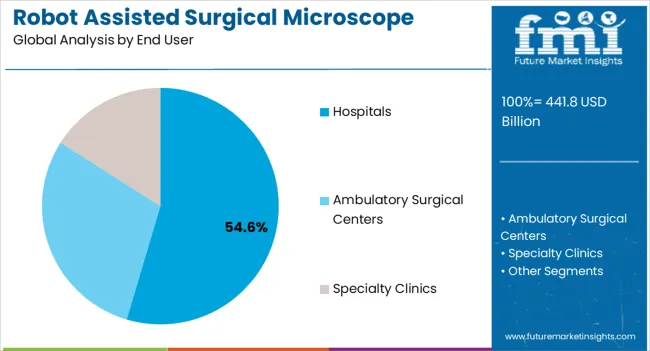

The hospitals segment is expected to account for 54.60% of total market revenue by 2025, positioning it as the largest end user category. This growth is being driven by the concentration of advanced surgical infrastructure, skilled professionals, and high patient volumes within hospital settings.

Hospitals have greater financial capacity to invest in high cost robotic systems and integrate them into multidisciplinary surgical departments. Furthermore, the rising preference for minimally invasive procedures and the pressure to reduce surgical complications have accelerated adoption.

Training programs and partnerships with technology providers have also supported widespread implementation. These factors collectively strengthen hospitals as the primary end user driving growth in the robot assisted surgical microscope market.

From 2012 to 2025, the global robot-assisted surgical microscope market experienced a CAGR of 4.2%, reaching a market size of USD 441.8 million in 2025.

From 2012 to 2025, the global robot-assisted surgical microscope market industry witnessed steady growth due to the increased advancements in robotics surgeries. The market for robotics-assisted surgical microscopes is relatively new and has experienced significant growth in recent years. The adoption of robotics-assisted surgical systems, including microscopes, has been driven by advancements in robotics technology, increasing demand for minimally invasive surgeries, and the need for improved surgical precision.

Future Forecast for Robot-assisted Surgical Microscope Market Industry:

Looking ahead, the global robot-assisted surgical microscope market industry is expected to rise at a CAGR of 7.6% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 887.1.0 million by 2035.

The robot-assisted surgical microscope market industry is expected to continue its growth trajectory from 2025 to 2035. Beyond the original uses, robotic-assisted surgical microscopes are constantly being improved and modified for a larger variety of surgical operations. The market potential for these devices is expected to grow as they are used in orthopedics, neurosurgery, cardiovascular surgery, and other specialties. The adoption rate of robotics-assisted surgical microscopes is projected to rise as surgeons gain more skill and confidence in utilizing them. Surgeon training programs and increased familiarity with these technologies might help to increase acceptability and utilization, resulting in market growth.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 887.1.0 million |

| CAGR % 2025 to End of Forecast (2035) | 4.5% |

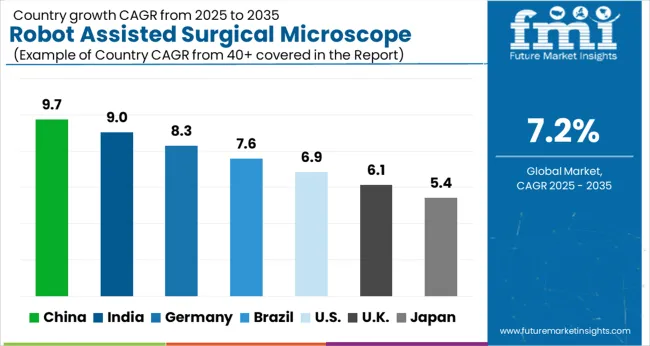

The robot-assisted surgical microscope market industry in the United States is expected to reach a market size of USD 887.1.0 million by 2035, expanding at a CAGR of 4.5%. Due to the increasing incidence of chronic diseases nationwide the market is on the rise. The increased frequency of chronic illnesses such as cancer, cardiovascular disease, and neurological problems is driving the demand for better surgical technology. Robotic-assisted surgical microscopes enable surgeons to conduct difficult procedures with higher accuracy, leading to market growth.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 37.4 million |

| CAGR % 2025 to End of Forecast (2035) | 4.6% |

The robot-assisted surgical microscope market industry in the United Kingdom is expected to reach a market value of USD 37.4 million, expanding at a CAGR of 4.6% during the forecast period. The United Kingdom market is projected to growth of the market due to the growing personalized medicine initiatives. With a greater emphasis on patient safety and surgical results, there is an increased need for surgical technologies that provide accurate visualization, increased dexterity, and improved surgical precision. These needs are met by robotic-assisted surgical microscopes, which are becoming more popular in the UK market.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 45.1 million |

| CAGR % 2025 to End of Forecast (2035) | 7.8% |

The robot-assisted surgical microscope market industry in China is anticipated to reach a market size of USD 45.1 million, moving at a CAGR of 7.8% during the forecast period. Chinese market is expanding predominantly due to the high demand for stereomicroscopes across various healthcare industries.

Further, growing investments by government organizations for the development of diagnostic settings, and collaborative efforts for microscopy research have further boosted the market in this region. Emergence of advanced technologies such as artificial intelligence in automated microscopy, growing usage of scanning tunneling microscopes along with favorable business climate is likely to boost the market further.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 35.0 million |

| CAGR % 2025 to End of Forecast (2035) | 7.6% |

The robot-assisted surgical microscope market industry in Japan is estimated to reach a market size of USD 35.0 million by 2035, thriving at a CAGR of 7.6%. The market in Japan is predicted to grow because of the surge in surgical procedures. Various causes, including increased healthcare knowledge and changing lifestyle habits, have contributed to an increase in surgical operations in Japan. Robotic-assisted surgical microscopes let surgeons conduct difficult procedures with greater visibility and precision, which contributes to market growth.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 22.7 million |

| CAGR % 2025 to End of Forecast (2035) | 7.4% |

The robot-assisted surgical microscope market industry in South Korea is expected to reach a market size of USD 22.7 million, expanding at a CAGR of 7.4% during the forecast period. Minimally invasive procedures have grown in popularity due to advantages such as smaller incisions, less discomfort, shorter hospital stays, and quicker recovery. Robotic-assisted surgical microscopes play an important role in easing these operations, resulting in greater usage and market development.

The other surgeries such as cardiovascular surgeries and various tumor surgeries is dominating the robot-assisted surgical microscope market industry with a market share of 29.2% in 2025. Due to its high adoption by the healthcare professionals to enhance the surgical precision and improve patient outcomes.

This devices provide surgeons with high definition, thee-dimensional visualization of the surgical field, allowing for precise identification and anastomosis of grafts.

The hospitals is dominating the robot-assisted surgical microscope market with the market share of 51.1% in 2025. This growth is due to high adoption of these microscopes in the hospitals. The usage of robotic assisted surgical microscopes in hospitals is driven by the aim to improve surgical outcomes, enhance visualization, facilitate minimally invasive techniques, and promote precision in various surgical specialties. As technology advances and surgical techniques continue to evolve, the adoption of these microscopes is expected to grow further, which may enhance the adoption in hospitals.

The robot-assisted surgical microscope sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

Product Development

Key players invest heavily in research and development activities to continuously innovate and improve their robotics-assisted surgical microscopes. They focus on enhancing imaging capabilities, developing advanced features, improving ergonomics, and integrating with other surgical systems. Research and development efforts allow them to stay at the forefront of technology and offer cutting-edge solutions to healthcare providers.

Strategic Alliances & Collaborations

Collaboration with healthcare institutions, surgeons, and research organizations is crucial for key players to gain insights into clinical needs and emerging trends. By partnering with key stakeholders, they can develop tailored solutions that address specific surgical requirements, optimize workflow, and enhance patient outcomes. Collaborations also help in expanding their market presence and accessing new customer segments.

Expansion into Emerging Markets

Key players strive to expand their market presence by entering new geographical regions and target markets. They identify growth opportunities, conduct market research, and develop strategies to penetrate new markets effectively. This may involve establishing partnerships with distributors, engaging in mergers and acquisitions, or setting up local manufacturing facilities to cater to regional demands.

Acquisitions and mergers

Key companies in the robot-assisted surgical microscope market routinely employ mergers and acquisitions to strengthen their market positions, broaden their product offerings, and enter new markets.

Key Developments in the Robot-assisted Surgical Microscope Market:

The global robot assisted surgical microscope market is estimated to be valued at USD 441.8 billion in 2025.

The market size for the robot assisted surgical microscope market is projected to reach USD 887.1 billion by 2035.

The robot assisted surgical microscope market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in robot assisted surgical microscope market are neurological surgery, orthopedic surgery, ophthalmological surgery and others.

In terms of end user, hospitals segment to command 54.6% share in the robot assisted surgical microscope market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robot Sensor Market Size and Share Forecast Outlook 2025 to 2035

Robotaxi Market Size and Share Forecast Outlook 2025 to 2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robot Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA