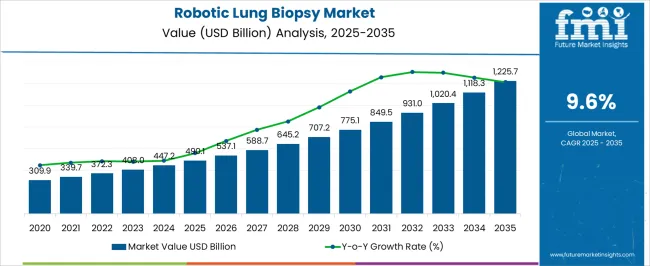

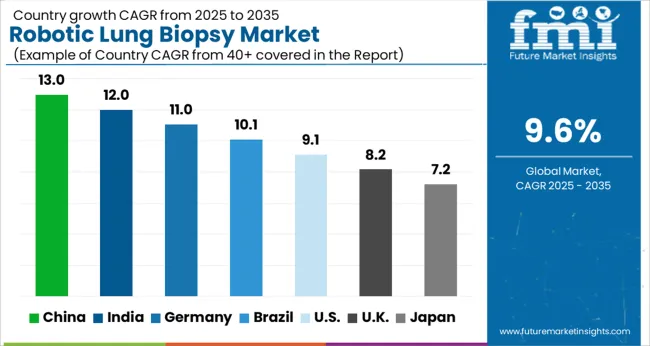

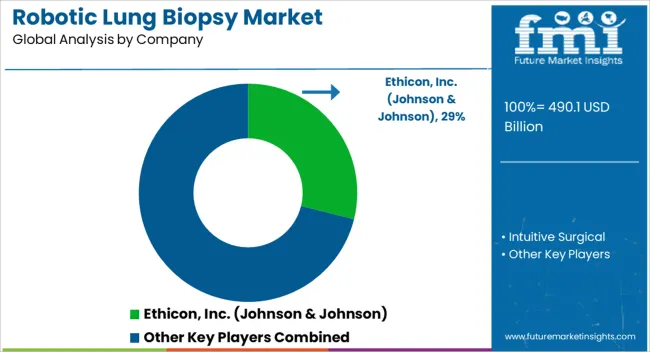

The Robotic Lung Biopsy Market is estimated to be valued at USD 490.1 billion in 2025 and is projected to reach USD 1225.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period.

| Metric | Value |

|---|---|

| Robotic Lung Biopsy Market Estimated Value in (2025 E) | USD 490.1 billion |

| Robotic Lung Biopsy Market Forecast Value in (2035 F) | USD 1225.7 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The robotic lung biopsy market is expanding steadily as healthcare systems seek to improve early detection of lung cancer and other pulmonary disorders through minimally invasive techniques. The increasing global burden of lung cancer, coupled with the limitations of conventional biopsy methods, has accelerated the adoption of robotic solutions.

Advancements in precision imaging, real time navigation, and robotic control are improving diagnostic yield while minimizing patient discomfort and procedural risk. Rising investments in surgical robotics and integration of AI supported imaging are further enhancing the capabilities of these systems.

Hospitals and research centers are increasingly incorporating robotic lung biopsy into their diagnostic pathways to improve patient outcomes and reduce repeat procedures. The future outlook remains positive with a clear focus on technological innovation, improved accessibility, and clinical efficiency.

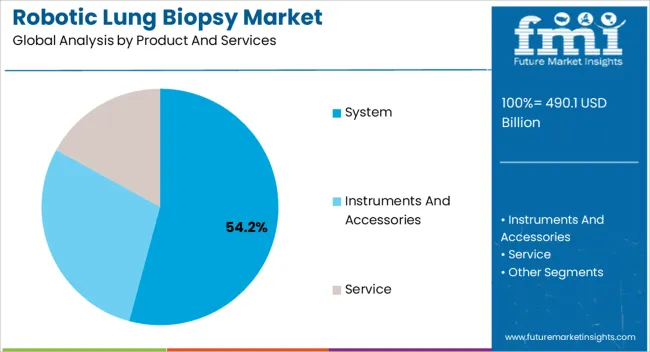

The system segment is projected to account for 54.20% of total revenue within the product and services category, making it the leading contributor. Growth in this segment is driven by the adoption of integrated robotic platforms that enhance precision, reduce variability, and improve diagnostic success rates.

Systems are being widely implemented due to their ability to combine imaging, navigation, and robotic control in a single solution, thereby supporting procedural efficiency and standardization.

Continuous technological advancements and hospital investments in robotic infrastructure have further solidified the dominance of this segment.

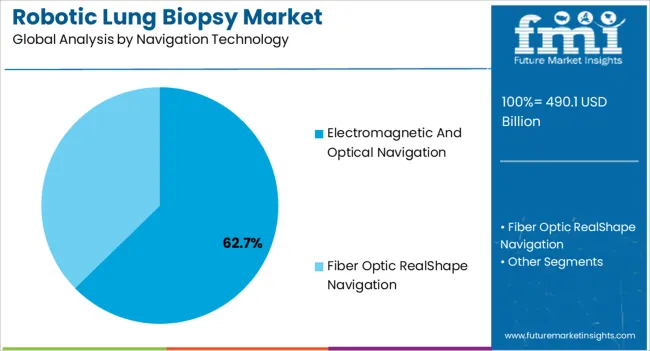

The electromagnetic and optical navigation segment is expected to represent 62.70% of total revenue within the navigation technology category, positioning it as the dominant segment. This leadership is attributed to its ability to provide real time guidance, improve localization accuracy, and enhance physician confidence during complex procedures.

The increasing reliance on advanced navigation tools for accessing small and hard to reach lung nodules has accelerated adoption.

Furthermore, integration with imaging modalities and robotic systems has reinforced its role as the preferred navigation approach in robotic lung biopsies.

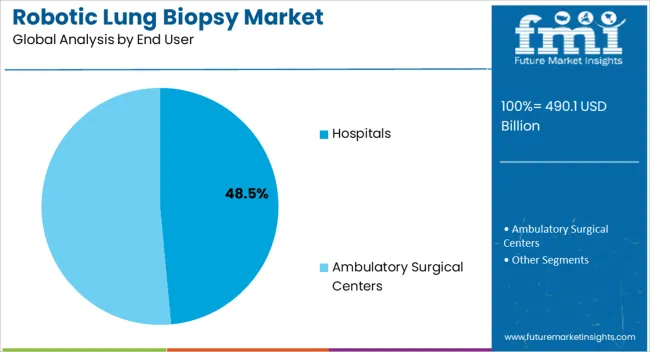

The hospitals segment is anticipated to capture 48.50% of the overall market share by 2025 within the end user category, establishing it as the leading segment. Hospitals are the primary centers for advanced diagnostic procedures due to their access to robotic systems, trained specialists, and supporting infrastructure.

Rising patient inflow, strong reimbursement structures, and hospital led investments in minimally invasive technologies are driving growth in this segment.

Hospitals are increasingly adopting robotic lung biopsy systems to enhance patient safety, reduce diagnostic turnaround time, and expand procedural offerings, thereby securing their position as the largest end user group.

From 2020 to 2025, the global robotic lung biopsy market experienced a CAGR of 11.2% CAGR. Total market value at the end of 2025 reached around USD 379.7 million.

From 2020 to 2025, the global robotic lung biopsy industry witnessed steady growth due to the rising demand for lung cancer control systems. The market for robotic lung biopsies was just getting started at the time, and adoption rates were quite low.

Due to their high price, limited availability, and the perceived risk associated with robotic surgery, many healthcare professionals were reluctant to invest in these systems.

As per estimates from Intuitive Surgical in 2025, a total of 321 Ion end luminal systems were installed globally.

Looking ahead, the global robotic lung biopsy industry is expected to progress at a CAGR of 9.6% from 2025 to 2035. By the end of 2035, the market size is expected to reach USD 1,023.05 million.

Rising cases of lung cancer and shift towards minimally invasive procedures are key factors that are expected to drive the global market forward.

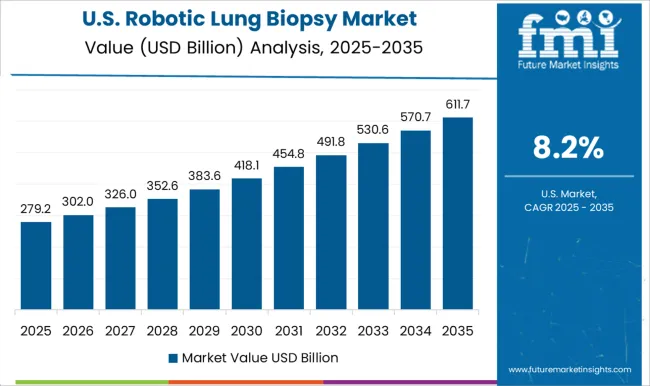

Minimally Invasive Procedures Fueling Robotic Lung Biopsy Demand in the United States

| Country | United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 1225.7 million |

| CAGR % from 2025 to the End of Forecast (2035) | 10.8% |

The United States robotic lung biopsy industry is expected to reach a valuation of USD 1225.7 million by 2035. Overall demand for robotic lung biopsies in the country is set to increase at a CAGR of 10.8% from 2025 to 2035.

High penetration of robotics in healthcare sector and rising preference for minimally invasive procedures are key factors boosting the United States robotic lung biopsy market.

Other factors expected to drive the demand for robotic lung biopsies in the country are:

High Adoption of Robotic Technologies in Healthcare to Boost the United Kingdom Market

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 58.5 million |

| CAGR % from 2025 to the End of Forecast (2035) | 8.2% |

Robotic lung biopsy sales revenue in the United Kingdom is expected to surge at 8.2% CAGR during the assessment period. By 2035, the United Kingdom market value is projected to cross USD 58.5 million.

Rising adoption of robotic technologies in disease diagnosis and treatment is a prominent factor driving the United Kingdom. Similarly, favorable government support will facilitate market expansion in the country.

The National Health Service (NHS) in the United Kingdom is also pushing for increased use of robotic technologies in healthcare. This is increasing both healthcare professionals' and patients' knowledge of these technologies as well as fueling adoption of cutting-edge medical equipment.

Rising Prevalence of Lung Cancer to Boost China’s Robotic Biopsy Sector

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 23.4 million |

| CAGR % from 2025 to the End of Forecast (2035) | 7.7% |

Robotic lung biopsy demand in China is anticipated to surge at 7.7% CAGR from 2025 to 2035. Total market valuation in China at the end of 2035 is expected to reach USD 23.4 million. Increasing cases of lung cancer is a key factor boosting the robotic lung biopsy industry in China.

The development of this industry is also being aided by technological and robotic developments that have made lung biopsy procedures safer, less intrusive, and more effective.

Finally, development of the robotic lung biopsy industry in China is significantly influenced by the Chinese government's support for medical technology and innovation.

Increasing Adoption of Advanced Medical Technologies Spurring Growth in Kapan Market

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 37.0 million |

| CAGR % from 2025 to the End of Forecast (2035) | 9.7% |

he robotic lung biopsy industry in Japan is estimated to reach a market share of USD 37.0 million by 2035. It is expected to thrive at a CAGR of 9.7% over the next ten years. Growing adoption of advanced medical technologies is expected to boost Japan market during the assessment period.

There is now a sizable market in Japan for precise diagnostic equipment, such as robotic lung biopsy systems. In the healthcare industry, Japan is renowned for being an early user of new technology, which has helped to fuel the quick expansion of this business.

The Japanese government also places a high priority on encouraging medical innovation and funding the creation of cutting-edge technologies. This is creating a conducive environment for robotic lung biopsy device manufacturers.

Growing Awareness About the Positive Outcomes of Robotic Lung Biopsies Fueling Demand in Korea

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 11.2 million |

| CAGR % from 2025 to the End of Forecast (2035) | 5.5% |

The robotic lung biopsy industry in South Korea is anticipated to cross a valuation of USD 11.2 million by 2035. It is likely to exhibit a CAGR of 5.5% during the forecast period.

Growth in the market is driven by continuous advancements in medical technologies and rising awareness about the benefits of robotic lung biopsies.

The government aggressively encourages the quick uptake of innovative technologies, such as robotics, in the healthcare industry. Compared to conventional approaches, robotic lung biopsy operations are more accurate and efficient, carry a lower risk of complications, and result in faster patient recovery periods.

Last but not least, South Korea's advanced and well-established healthcare system offers a favorable atmosphere for the commercial expansion of robotic lung biopsies.

Increasing Usage by End-users Fueling Demand for Instruments and Accessories

According to Future Market Insights (FI), demand in the market will remain high for instruments and accessories. The target segment is expected to progress at a CAGR of 10.9% from 2025 to 2035. This is due to rising usage of robotic lung biopsy instruments and accessories in hospitals and ambulatory surgical centers.

During a biopsy, robotic instruments and accessories are designed to allow precise and accurate tissue manipulation. The robotic arms provide surgeons with more dexterity and fine control, allowing them to make delicate movements with greater precision. This precision aids in the targeting of specific areas of interest as well as the collection of correct tissue samples for diagnosis.

Robotic systems help surgeons by converting hand movements into precise actions via robotic instruments. This decreases the physical strain and tiredness that surgeons suffer throughout extensive surgeries. The ergonomic design of the instruments and accessories allows for comfortable manipulation and enhances the surgeon's control.

Fiber Optic RealShape Navigation to Remain the Most Popular Navigation Technology

As per the latest report, fiber optic realshape navigation segment is expected to thrive at 10.4% CAGR from 2025 to 2035. It is likely to remain the most widely used technology in robotic lung biopsies. This is due to ability of this ground-breaking technology to enable real-time 3D visualization of full shape devices inside the body.

In robotics biopsy treatments, fiber optic realshape navigation provides higher accuracy, increased reach, and real-time visualization. This leads to a more successful and least invasive approach to lung biopsies.

Fiber optic realshape navigation, by generating a three-dimensional map of the patient's airways, can provide real-time advice. This assists the surgeon in precisely navigating to the desired region, increasing the likelihood of collecting a tissue sample from the intended site.

Hospitals Segment to Dominate the Global Market Through 2035

The hospitals segment is expected to dominate the robotic lung biopsy industry, accelerating at a CAGR of 9.9% from 2025 to 2035. This is due to increasing number of robotic biopsy procedures performed in hospitals.

Hospitals are increasingly recognizing the advantages of robotic biopsy procedures, such as increased accuracy & precision and less invasive approaches. As a result, there has been a rise in the adoption of robotic surgical systems for performing biopsies, including lung biopsies.

The field of robotics has seen significant advancements, leading to more sophisticated and capable robotic systems. These developments include improved robotic arms, greater imaging technology, and better ergonomics for surgeons. Robotic biopsy procedures have become more precise, efficient, and safe as a result of such advancements and hospitals are becoming key end users for advanced robotic systems.

The robotic lung biopsy industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Leading companies are investing in research and development to introduce advanced robotic systems and services for robotic lung biopsies. Product innovation will allow them to differentiate themselves from their competitors while also catering to the changing needs of end users

Strategic Partnerships and Collaborations

Key players frequently develop strategic partnerships and collaborations with other companies to expand their market presence. They can also gain access to new technologies and markets through such collaborations.

Expansion into Emerging Markets

The robotic lung biopsy industry is witnessing significant growth in emerging markets such as China and the United States. Key robotic lung biopsy device manufacturers are expanding their presence in these markets by establishing local manufacturing facilities and strengthening their distribution networks.

Mergers and Acquisitions

Key players in the robotic lung biopsy industry often engage in mergers and acquisitions to strengthen their market position, expand their product portfolio, and gain access to new markets.

Key Players in the Robotic Lung Biopsy Industry

Key Developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 490.1 billion |

| Projected Market Size (2035) | USD 1225.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 9.6% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; and Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, Türkiye, South Africa, GCC Countries, Others. |

| Key Segments Covered | Product & Services, Navigation Technology, End User, and Region |

| Key Companies Profiled | Ethicon, Inc. (Johnson & Johnson); Intuitive Surgical. |

The global robotic lung biopsy market is estimated to be valued at USD 490.1 billion in 2025.

The market size for the robotic lung biopsy market is projected to reach USD 1,225.7 billion by 2035.

The robotic lung biopsy market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in robotic lung biopsy market are system, instruments and accessories and service.

In terms of navigation technology, electromagnetic and optical navigation segment to command 62.7% share in the robotic lung biopsy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Robotic Grippers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA