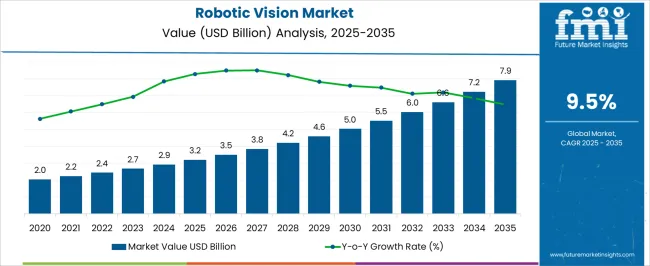

The Robotic Vision Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Robotic Vision Market Estimated Value in (2025 E) | USD 3.2 billion |

| Robotic Vision Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The robotic vision market is experiencing accelerated growth driven by increasing automation across industrial environments, rising demand for precision in quality control, and advancements in artificial intelligence and imaging technologies. As industries strive to improve operational efficiency, reduce human error, and meet stringent regulatory standards, robotic vision systems are being integrated into production lines to enable real time monitoring and decision making.

Technological improvements in 3D vision, machine learning algorithms, and sensor miniaturization have expanded the scope of deployment in sectors such as automotive, electronics, and pharmaceuticals. The push toward smart manufacturing and Industry 4.0 frameworks is further reinforcing the adoption of robotic vision solutions.

The market outlook remains strong as manufacturers and integrators continue to invest in scalable vision systems that enhance productivity, ensure safety, and support continuous operational insights.

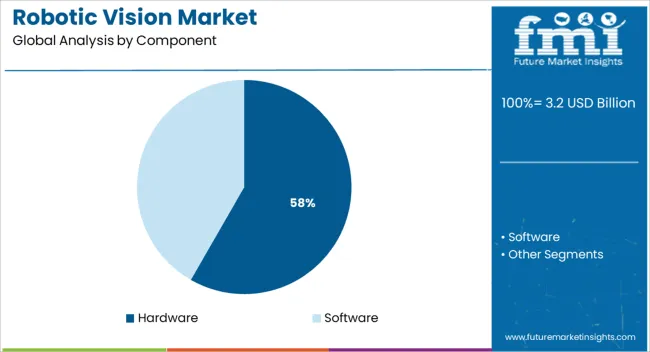

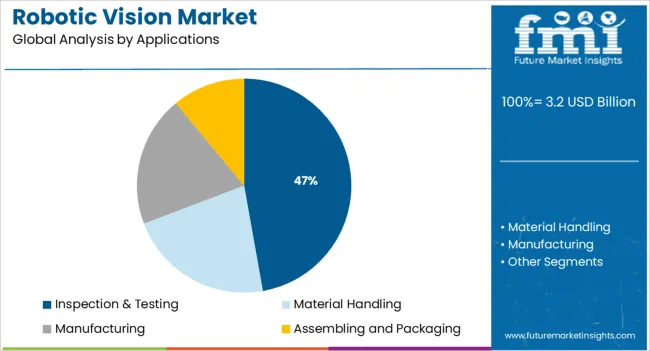

The market is segmented by Component and Applications and region. By Component, the market is divided into Hardware and Software. In terms of Applications, the market is classified into Inspection & Testing, Material Handling, Manufacturing, and Assembling and Packaging. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is anticipated to represent 58.30% of total market revenue by 2025 within the component category, establishing it as the dominant segment. This is primarily due to the growing need for advanced image sensors, high resolution cameras, frame grabbers, and lighting systems that form the core infrastructure of robotic vision setups.

These components enable accurate image capture, enhanced spatial recognition, and real time data processing required for high speed automation. The expansion of production lines and integration of robotics in harsh or complex environments have further increased demand for durable and high performance hardware.

As innovation continues to improve resolution, speed, and processing power, the hardware segment is expected to maintain its leadership, supported by consistent investments from manufacturers focused on upgrading their vision infrastructure.

The inspection and testing segment is projected to contribute 47.20% of total market revenue by 2025 within the application category, placing it at the forefront of robotic vision use cases. This leadership is driven by the need for accurate and non contact inspection of products to ensure adherence to quality and safety standards across industries.

Robotic vision systems are enabling automated defect detection, dimensional accuracy verification, and surface flaw identification with high speed and repeatability. In industries such as automotive and electronics, where precision is critical, these systems reduce downtime, limit manual error, and improve yield rates.

Additionally, regulatory compliance and growing customer expectations are prompting manufacturers to deploy vision guided inspection as a standard part of their quality assurance processes. As a result, inspection and testing remains the most widely adopted application, solidified by its ability to deliver measurable improvements in quality control and production efficiency.

Intelligent homes are specifically designed for the ageing population, where robots are capable to assists the elderly people in day-to-day tasks. The demand for intelligent homes is continuously increasing, as the ageing population is growing with significant rate across the globe.

Increase in demand for intelligent homes, government regulations about sanitation in food processing industry and rising need of precise, safe and reliable vision guided robots in different verticals are major driving factors of the robotic vision market.

However, high initial investment and lack of global standards for robotic implementation are some of the major challenges for the robot vision market.

On the basis of component, the market can be bifurcated into hardware and software.Hardware segment consists of camera, sensors, lightning, and optics. Camera, sensors, lightning and optics incorporate with each other in order to facilitate the collapsible free movement of robot in environment.

Camera, lightning and optics are used to capture the images while sensors allows obstacle free movement of robots. Software segment is composed of object tracking and image processing software.

Robotic vision has high demand in wide range of industries including food processing, automotive and aerospace for several applications. On the basis of applications, the robotic vision market is segmented into inspection & testing, material handling, manufacturing, assembling and packaging.

Manufacturing and packaging are the dominating segments in the category, as the governments across the major countries maintain stringent sanitation standards in food processing & packaging industry.

On the basis of type, the market can be categorised in to 3D and 2D. 3D vision is more precise and capable of providing accurate dimensional data of an object. Currently, 3D robotic vision systems are more expensive than 2D and restricted for specialised operations.

Robotic Vision Market is segmented into 7 key regions- North America, Latin America, Eastern Europe, Western Europe, Asia Pacific excluding Japan, Japan and Middle East & Africa.

North America was the largest market of robotic vision in terms of consumption in 2020. USA was the leading market in the region, as there was significant growth in rate of deployment of reliable and precise vision guided robot systems in food and manufacturing industries in 2020.

By the end of year 2020, Asia Pacific was the fastest growing market for robotic vision, due to significant growth in demand for industrial robots in manufacturing and automotive industries in the region. China, South Korea and Japan were the leading regional markets in Asia Pacific.

Robot vision market in Europe is driven by the metal, automotive and food & beverage industry. Germany was the largest market in the region in terms of volume consumption in 2020.

Omron Adept Technologies, Inc (USA), ComauS.p.A.(Italy), MVTec Software GmbH (Germany),Matrox Electronic Systems Ltd. (Canada), ABB Ltd (Switzerland), Point Grey Research, Inc. (USA),Cognex Corporation (USA), Matrox Electronics Systems Ltd (Canada), Keyence Corporation (Japan), IVISYS (Sweden).

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global robotic vision market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the robotic vision market is projected to reach USD 7.9 billion by 2035.

The robotic vision market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in robotic vision market are hardware and software.

In terms of applications, inspection & testing segment to command 47.2% share in the robotic vision market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA