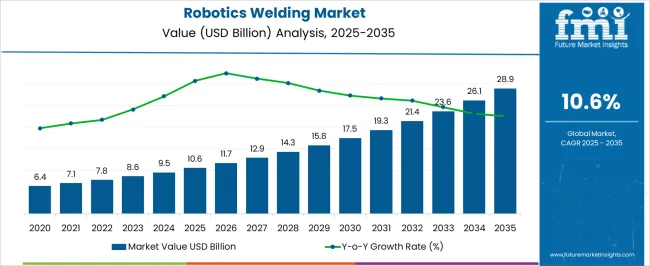

The robotics welding market is valued at USD 10.6 billion in 2025 and is anticipated to reach USD 28.9 billion by 2035, growing at a CAGR of 10.6%. In the early phase from 2021 to 2025, the market is projected to grow from USD 6.4 billion to USD 10.6 billion, with incremental growth to USD 7.1 billion, USD 7.8 billion, USD 8.6 billion, and USD 9.5 billion. This period is marked by rising adoption of robotic welding solutions in industries such as automotive, aerospace, and electronics, driven by the demand for improved precision, speed, and efficiency in welding operations.

As manufacturers look to enhance productivity and reduce labor costs, robotics systems are increasingly integrated into production lines. From 2026 to 2030, the market expands from USD 10.6 billion to USD 19.3 billion, progressing through USD 11.7 billion, USD 12.9 billion, USD 14.3 billion, and USD 15.8 billion. Growth during this phase is driven by advancements in robotic technologies, such as the integration of artificial intelligence and machine learning, which enable greater flexibility, adaptability, and precision. Between 2031 and 2035, the market is expected to continue growing at a strong pace, reaching USD 28.9 billion. Values move through USD 17.5 billion, USD 19.3 billion, USD 21.4 billion, USD 23.6 billion, and USD 26.1 billion, fueled by the increasing use of robots in high-demand industries and expanding applications across various sectors, contributing to the strong compound annual growth rate.

| Metric | Value |

|---|---|

| Robotics Welding Market Estimated Value in (2025 E) | USD 10.6 billion |

| Robotics Welding Market Forecast Value in (2035 F) | USD 28.9 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The industrial robotics market is the largest contributor, accounting for approximately 40-45% of the market. Robotic welding is a sub-segment within this market, where robotic arms and automation systems are increasingly integrated into manufacturing lines to enhance welding processes, providing improved speed, consistency, and precision. The manufacturing automation market contributes around 25-30%, focusing on the use of robotics to automate various production processes. Welding applications in this market are especially critical in automotive and heavy industries, where precision and repetitive tasks are essential.

The automotive industry market holds about 15-18% of the share, as robotic welding is a cornerstone of car manufacturing, particularly for welding car bodies, chassis, and other components that require high precision and consistency. The heavy machinery and equipment market is expected to grow by approximately 10-12%, where robotic welding systems are utilized to fabricate parts for large machines and equipment in sectors such as construction and mining, necessitating robust and durable welding solutions. The electronics and electrical equipment market accounts for approximately 5-8%, with robotic welding being utilized for the precise welding of small parts and components, particularly in the production of electrical assemblies and electronic devices.

The robotics welding market is progressing steadily, supported by the increasing adoption of automation in manufacturing and fabrication processes to enhance productivity, precision, and safety. Global industrial sectors are integrating robotic welding systems to meet the demands of higher production volumes, consistent quality, and reduced operational costs.

The current landscape is shaped by a combination of labor shortages, stricter workplace safety regulations, and the need for improved welding accuracy, which are driving the replacement of manual welding with robotic alternatives. Technological advancements, including AI-driven control systems, advanced sensors, and real-time quality monitoring, are further accelerating market penetration.

Additionally, industries such as automotive, construction machinery, and metal fabrication are scaling investments to modernize welding operations, reinforcing the long-term relevance of robotic systems. With ongoing innovations in collaborative robots and integration of Industry 4.0 principles, the market is positioned to witness sustained expansion, catering to both high-volume production environments and specialized manufacturing needs across global industrial hubs.

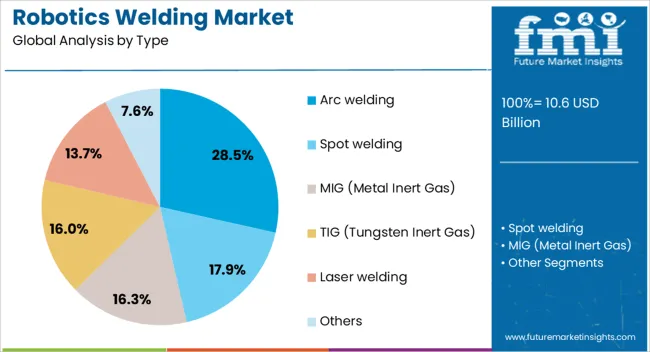

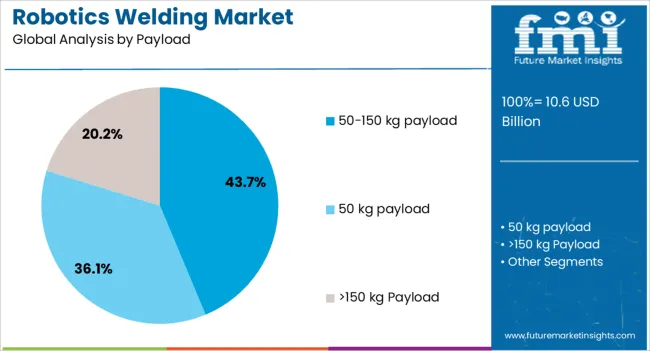

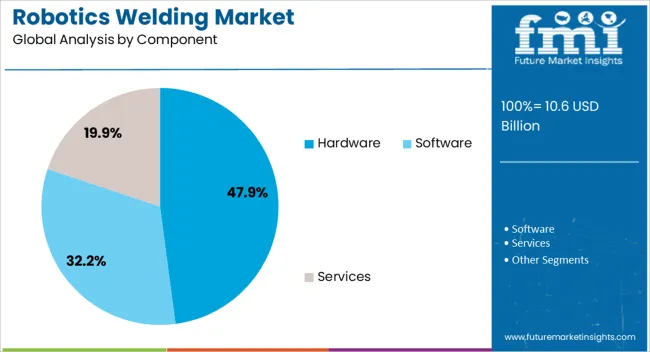

The robotics welding market is segmented by type, payload, component, end use, and geographic regions. By type, robotics welding market is divided into Arc welding, Spot welding, MIG (Metal Inert Gas), TIG (Tungsten Inert Gas), Laser welding, and Others. In terms of payload, robotics welding market is classified into 50-150 kg payload, 50 kg payload, and >150 kg Payload. Based on component, robotics welding market is segmented into Hardware, Software, and Services. By end use, robotics welding market is segmented into Automotive & transportation, Metals & machinery, Electrical & electronics, Aerospace & defense, and Others. Regionally, the robotics welding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The arc welding segment leads the robotics welding market by type, representing approximately 28.5% of the total share. Its prominence is attributed to its versatility in handling a wide range of materials and applications, coupled with the ability to produce high-quality welds in complex geometries.

Adoption of robotic arc welding has been accelerated by its capability to deliver consistent results, reduce welding defects, and minimize material wastage, making it a preferred choice in industries requiring precision and repeatability. The integration of automated arc welding systems has been particularly impactful in automotive and heavy machinery production lines, where high throughput is essential.

Continuous enhancements in arc welding technologies, including adaptive control features and multi-process capabilities, have reinforced its dominance. This segment’s growth is expected to be sustained by the combination of operational efficiency, improved weld integrity, and adaptability to diverse industrial requirements, ensuring its leading role in the overall market.

The 50–150 kg payload segment accounts for approximately 43.7% of the robotics welding market, establishing itself as the most significant payload category. This dominance is linked to its suitability for handling medium to large components, offering a balance between strength and flexibility in welding operations. Industries with high structural integrity demands, such as automotive frame assembly and heavy equipment manufacturing, rely heavily on this payload capacity for precision and efficiency.

The segment benefits from compatibility with various welding processes, allowing integration into production lines with diverse requirements. Additionally, its capability to manage complex welding tasks while maintaining cycle time efficiency has reinforced its adoption.

The 50–150 kg payload range strikes an optimal cost-to-performance ratio, appealing to both high-volume manufacturers and custom fabrication facilities. This combination of versatility, durability, and production efficiency positions it as the most widely utilized payload range in the robotics welding market.

The hardware segment dominates the robotics welding market by component, holding approximately 47.9% of the share. Its leading position is driven by the essential role of hardware elements—such as robotic arms, controllers, sensors, and welding equipment—in ensuring operational accuracy and performance reliability. Investments in durable and high-precision hardware have increased as manufacturers prioritize system longevity, minimal downtime, and enhanced productivity.

The segment’s growth is also supported by advancements in lightweight yet robust materials, enabling faster operation speeds without compromising stability. Hardware improvements have allowed for better integration with software systems, facilitating real-time adjustments and adaptive welding processes.

Additionally, the hardware segment benefits from recurring demand in both new installations and replacement cycles, given the wear-intensive nature of welding operations. This sustained requirement, coupled with the push for technologically advanced and energy-efficient components, is expected to keep the hardware segment at the forefront of the robotics welding market throughout the forecast period.

The robotics welding market is rapidly expanding as industries increasingly adopt automation for higher precision, reduced labor costs, and enhanced production efficiency. Demand is particularly driven by the automotive, aerospace, and manufacturing sectors seeking consistent, high-quality welds with minimal defects. Challenges include the high capital cost of robotic systems, integration complexity, and the need for skilled personnel to manage and maintain equipment. Opportunities are emerging in the use of collaborative robots (cobots), AI-powered welding techniques, and predictive maintenance systems. Trends include the adoption of advanced welding technologies, such as MIG, TIG, and laser welding, alongside increased use of Industry 4.0 solutions.

As manufacturers look to increase efficiency and reduce human error, the demand for robotic welding solutions is growing. Robotic systems offer enhanced speed, precision, and quality, making them ideal for industries like automotive, aerospace, and heavy machinery. These systems allow for 24/7 production, improved weld quality, and minimized downtime, driving adoption across diverse sectors. Moreover, robotic welding enhances workplace safety by reducing the need for human operators in hazardous environments. As companies continue to pursue higher production volumes and quality standards, robotic welding is becoming an essential component in the modernization of manufacturing processes. The growing trend toward automation is thus positioning robotic welding as a key enabler for future industry growth.

Robotic systems require significant investment in both equipment and training, which can deter smaller manufacturers from adopting these technologies. The need for skilled operators and technicians to program, monitor, and maintain robotic systems is another limiting factor. Regulatory requirements around safety standards and emissions add further complexity, particularly in industries like automotive and aerospace. Achieving compatibility with various welding techniques (e.g., MIG, TIG, and laser welding) requires highly specialized technical knowledge. To overcome these barriers, buyers seek suppliers who offer turnkey solutions with comprehensive support, training, and system customization.

Opportunities in the robotics welding market are emerging from the rise of collaborative robots (cobots), which can safely work alongside human operators to increase flexibility and efficiency in smaller-scale operations. AI-driven welding solutions are gaining traction, as these systems can offer real-time feedback, automatically adjust welding parameters, and predict potential failures, leading to improved quality and reduced operational costs. Advanced welding technologies such as laser welding and hybrid welding methods are opening up new applications for robotic systems. The integration of Industry 4.0 principles, including IoT connectivity, predictive maintenance, and digital monitoring, is also driving growth by enhancing system performance and enabling more efficient manufacturing.

The robotics welding market is increasingly incorporating Industry 4.0 technologies, such as predictive maintenance, real-time data analytics, and AI-driven monitoring. Predictive maintenance reduces unplanned downtime by anticipating system failures before they occur, thus optimizing efficiency. Real-time data collection and machine learning allow for continuous performance monitoring, ensuring higher-quality welds and greater process optimization. Digital sensors integrated with robotic systems are enabling more precise welding, improving weld consistency and reducing waste. These advancements are accelerating the adoption of robotic welding across various industries, as manufacturers seek smarter, more cost-efficient solutions. Suppliers that provide systems capable of real-time data analysis, automated quality checks, and remote monitoring will be well-positioned to meet the evolving needs of the market.

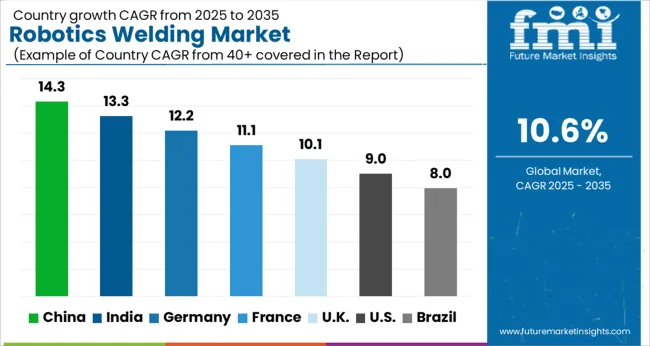

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

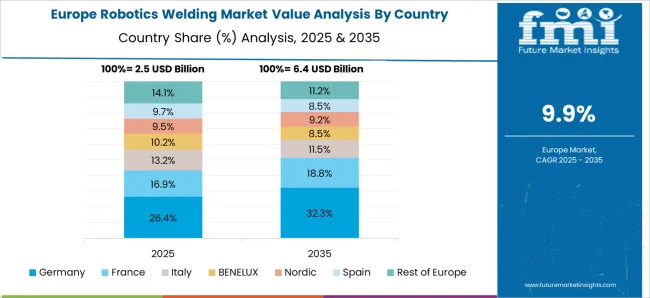

The global robotics welding market is set to grow at a CAGR of 10.6% from 2025 to 2035. China leads with a 14.3% CAGR, followed by India at 13.3% and France at 11.1%. The market is driven by increasing industrial automation, demand for precision welding, and advancements in manufacturing technologies. The automotive, aerospace, and heavy machinery sectors are key drivers of market growth, while government support for Industry 4.0 and smart manufacturing plays a crucial role in fostering adoption. As the market evolves, companies across these regions are leveraging robotic welding solutions to enhance productivity, reduce costs, and improve product quality. The analysis spans over 40+ countries, with the leading markets shown below.

The robotics welding market in China is projected to grow at a CAGR of 14.3% from 2025 to 2035, driven by rapid industrialization, the expansion of manufacturing sectors, and increasing adoption of automation technologies. Robotics welding is particularly prominent in automotive, electronics, and heavy machinery manufacturing. China’s push to modernize its industrial base through advanced manufacturing technologies is significantly boosting the demand for robotic welding systems. As labor costs rise, manufacturers are turning to automated solutions to improve production efficiency, reduce errors, and enhance product quality. The Chinese government’s emphasis on smart manufacturing and the development of advanced industrial infrastructure further supports market growth.

The robotics welding market in India is expected to grow at a CAGR of 13.3% from 2025 to 2035, as a result of increasing demand for automation across industries like automotive, aerospace, and metal fabrication. The growing need for higher production quality and consistency is pushing Indian manufacturers to integrate robotics welding solutions. The rapid growth of the country’s manufacturing sector and the rise of smart factories are contributing to the market’s expansion. Government initiatives like the Make in India program are promoting the adoption of advanced technologies in the industrial sector, including robotics welding, to enhance productivity and global competitiveness.

France is forecast to experience a CAGR of 11.1% in the robotics welding market from 2025 to 2035. The demand for robotic welding systems in France is driven by the country’s strong automotive and aerospace sectors, which require high-precision welding for manufacturing processes. As companies aim for enhanced productivity and reduced operational costs, robotics welding solutions are becoming essential for improving efficiency and consistency in manufacturing. The French government’s focus on digitization and Industry 4.0 is facilitating the adoption of robotic welding technologies, leading to market expansion. The increasing shift towards clean energy production is creating new opportunities for robotics welding in renewable energy manufacturing.

The UK robotics welding market is projected to grow at a CAGR of 10.1% from 2025 to 2035. As the manufacturing sector in the UK increasingly embraces automation, robotics welding is becoming a vital component of production processes, particularly in the automotive and aerospace industries. The need to improve operational efficiency, enhance product quality, and reduce manufacturing costs is driving the growth of robotics welding systems. The UK government’s push towards digital transformation in the manufacturing sector through initiatives like the Made Smarter program is expected to further accelerate the adoption of robotics welding solutions.

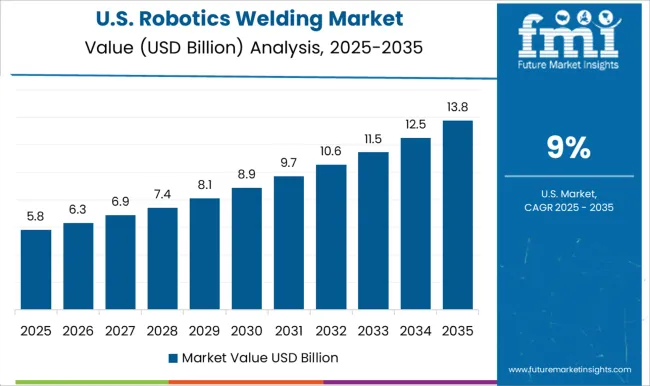

The USA robotics welding market is expected to grow at a CAGR of 9.0% from 2025 to 2035. The demand for robotic welding systems is being driven by industries such as automotive, aerospace, electronics, and heavy machinery, where precision and efficiency are critical. USA manufacturers are increasingly adopting robotics welding solutions to address labor shortages, improve productivity, and ensure consistency in production. As industries increasingly adopt advanced manufacturing technologies such as Industry 4.0 and smart factories, the demand for robotic welding systems is set to rise significantly. The USA government’s focus on advancing manufacturing technologies supports market growth.

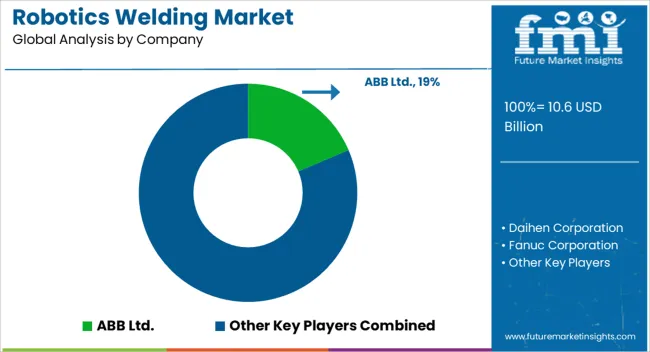

In the robotics welding market, competition is driven by advanced automation, precision, and integration capabilities. ABB Ltd. leads the market with its extensive range of welding robots that offer high flexibility, speed, and accuracy. The company competes by providing welding solutions across industries such as automotive, aerospace, and heavy manufacturing, integrating advanced sensors and vision systems to enhance performance. Daihen Corporation focuses on delivering high-performance welding robots, often used in industrial sectors requiring precise, heavy-duty welding, such as shipbuilding and construction. The company emphasizes energy efficiency and ease of integration into existing manufacturing systems. Fanuc Corporation competes with its broad portfolio of welding robots designed for high throughput, precision, and seamless integration with other industrial automation systems, making it a preferred choice for large-scale manufacturing operations. Kawasaki Heavy Industries, Ltd. offers a wide range of robotic welding solutions, focusing on high-speed welding applications and the automotive industry. The company stands out with its expertise in robotic arms and precise motion control systems.

Kuka AG focuses on industrial automation and robotics with welding applications, particularly in the automotive and electronics industries, providing customized solutions that improve production efficiency and quality. Panasonic Corporation competes by offering high-performance robotic welding solutions known for their precision and reliability, especially in the automotive industry, where speed and consistency are crucial. Yaskawa Electric Corporation positions itself as a leader in welding automation, with its Motoman series offering robust performance in high-volume manufacturing and heavy industries. Strategies in this market center on product innovation, cost efficiency, and integration with Industry 4.0 technologies. Companies like ABB, Kuka, and Panasonic focus on continuous innovation in robot capabilities, while Fanuc, Kawasaki, and Daihen emphasize ease of integration and scalability for different industry applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 Billion |

| Type | Arc welding, Spot welding, MIG (Metal Inert Gas), TIG (Tungsten Inert Gas), Laser welding, and Others |

| Payload | 50-150 kg payload, 50 kg payload, and >150 kg Payload |

| Component | Hardware, Software, and Services |

| End Use | Automotive & transportation, Metals & machinery, Electrical & electronics, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Daihen Corporation, Fanuc Corporation, Kawasaki Heavy Industries, Ltd., Kuka AG, Panasonic Corporation, and Yaskawa Electric Corporation |

| Additional Attributes | Dollar sales by robot type (articulated, Cartesian, SCARA), welding technology (MIG, TIG, laser, spot), and industry application (automotive, aerospace, manufacturing, metalworking). Demand dynamics are driven by automation adoption, the need for improved welding quality, and rising labor costs. Regional growth is strong in North America, Europe, and Asia-Pacific, supported by the automotive and manufacturing industries' push for automation and efficiency. |

The global robotics welding market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the robotics welding market is projected to reach USD 28.9 billion by 2035.

The robotics welding market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in robotics welding market are arc welding, spot welding, mig (metal inert gas), tig (tungsten inert gas), laser welding and others.

In terms of payload, 50-150 kg payload segment to command 43.7% share in the robotics welding market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotics Sweeper Market

Lab Robotics Market

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Warehouse Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robotics Retrofit Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Robotics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robotics Market Growth – Trends & Forecast 2025-2035

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Cyber Security in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Medical Rehabilitation Robotics Market Trends - Growth & Forecast 2025 to 2035

Motion Control Software in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA