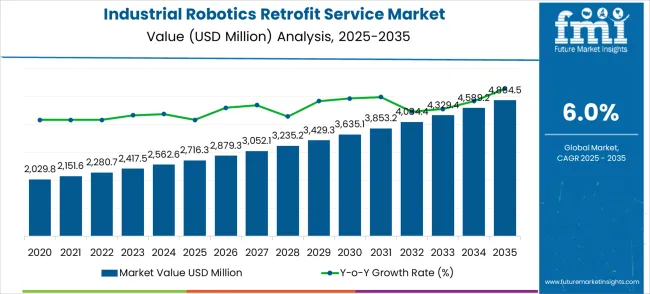

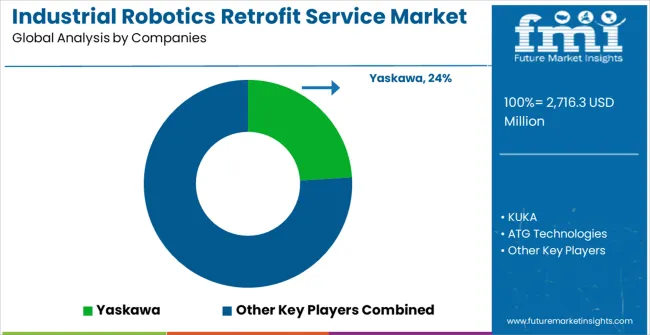

The industrial robotics retrofit service market is expected to reach USD 2,716.3 million in 2025 and grow to USD 4,864.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.0%. This growth is driven by the increasing need for upgrading and modernizing existing robotic systems in manufacturing and industrial sectors. Retrofitting extends the operational lifespan of robots, improves efficiency, and reduces capital expenditure compared with purchasing new units. As industries adopt advanced automation technologies, the demand for services that enhance robot performance, integrate new software, and improve connectivity is rising. The market trajectory demonstrates the growing importance of retrofit services in maintaining productivity, minimizing downtime, and ensuring compatibility with Industry 4.0 standards across global manufacturing operations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,716.3 million |

| Forecast Value in (2035F) | USD 4,864.5 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

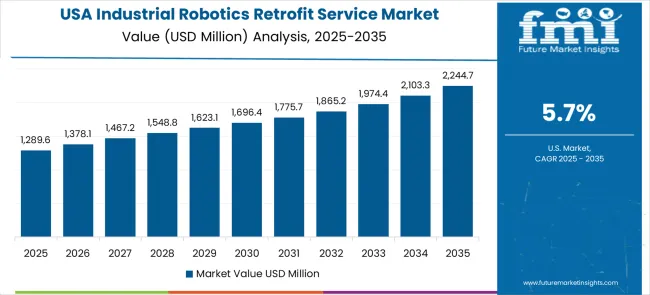

A key factor fueling market growth is the focus on cost-effective modernization and operational optimization. Year-on-year (YoY) growth indicates a steady upward trend, with market values increasing from USD 2,029.8 million in 2023 to USD 2,716.3 million in 2025, and continuing to rise consistently over the forecast period. Retrofitting services allow manufacturers to upgrade robot controllers, sensors, and software without replacing the entire system, offering significant savings while improving performance. Strategic partnerships between service providers and robotics manufacturers are further enhancing market adoption. Additionally, industries are increasingly prioritizing sustainability and energy efficiency, which retrofit solutions can address by optimizing older robots for lower power consumption and improved operational reliability.

Looking ahead, the industrial robotics retrofit service market is expected to maintain moderate growth, with market values reaching USD 3,635.1 million by 2030 and eventually USD 4,864.5 million by 2035, reflecting a CAGR of 6.0%. Rolling CAGR analysis indicates consistent and steady expansion across the forecast period, driven by the continuous demand for automation upgrades and the integration of advanced technologies into legacy systems. As manufacturers seek to enhance productivity while minimizing capital investment, retrofit services will play a critical role in supporting operational efficiency. Overall, the market outlook highlights sustained long-term opportunities, with retrofit services enabling industries to maximize the value of existing robotic assets and maintain competitiveness in a rapidly evolving industrial landscape.

Market expansion is being supported by the significant cost advantages of retrofitting existing robotic systems compared to complete replacement, enabling manufacturers to achieve modern automation capabilities while minimizing capital expenditure. Industrial facilities worldwide are seeking to upgrade their legacy robotics installations with advanced control systems, enhanced sensors, and improved connectivity features that support Industry 4.0 initiatives. Retrofit services provide a practical pathway for manufacturers to modernize their automation infrastructure incrementally while maintaining operational continuity.

The growing complexity of manufacturing requirements and increasing emphasis on operational efficiency are driving demand for comprehensive retrofit solutions that enhance productivity, quality, and safety performance. Companies are recognizing that properly executed retrofit projects can significantly extend equipment lifespan, improve energy efficiency, and reduce maintenance costs while providing access to advanced features and capabilities. Regulatory compliance requirements and safety standards are also influencing retrofit decisions as manufacturers seek to ensure their robotic systems meet current and future operational requirements.

The Industrial Robotics Retrofit Service market is set for a strong transformation, expanding from USD 2.7 billion in 2025 to USD 4.9 billion by 2035 at a 6.0% CAGR. Retrofit demand is fueled by cost savings versus new installations, Industry 4.0 integration, and sustainability goals. Together, these pathways unlock USD 2.0–2.5 billion in incremental revenue opportunities by 2035.

Upgrading legacy robots with advanced controllers and motion software enhances precision, speed, and connectivity. Largest near-term retrofit pool worth USD 600–800 million.

Adding AI-driven cameras, LIDAR, and smart sensors enables predictive maintenance, defect detection, and flexible automation. Creates a high-value pool of USD 400–600 million.

Replacing arms, actuators, and end-effectors extends robot life cycles by 7–10 years while improving performance. Unlocks USD 350–500 million opportunity.

Targeting automotive, electronics, food & beverage, and pharmaceuticals, where compliance and precision are critical, drives demand. Expected pool: USD 300–450 million.

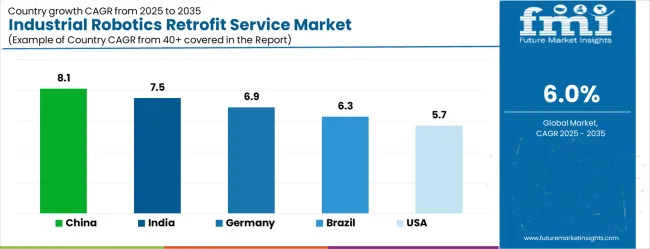

China (8.1% CAGR) and India (7.5% CAGR) lead retrofit growth, supported by government automation programs and SME adoption. Represents USD 250–350 million pool.

Retrofits reduce e-waste and extend robot lifecycles, aligning with ESG and circular economy goals. Adds USD 100–150 million opportunity.

Robotics-as-a-Service (RaaS) retrofit bundles, including predictive maintenance and upgrades, open new recurring revenue streams. Expected pool: USD 80–120 million.

Cloud-linked retrofit solutions for data collection, real-time monitoring, and AI-driven optimization. Smaller but disruptive pool of USD 50–100 million.

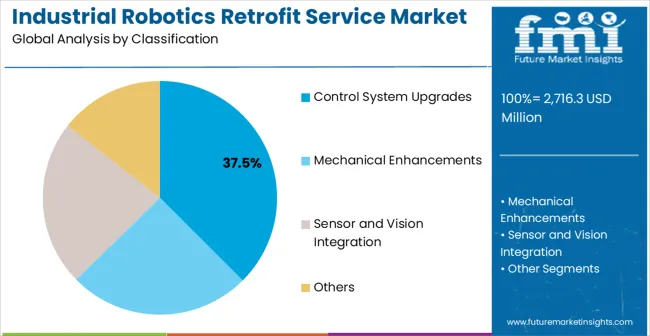

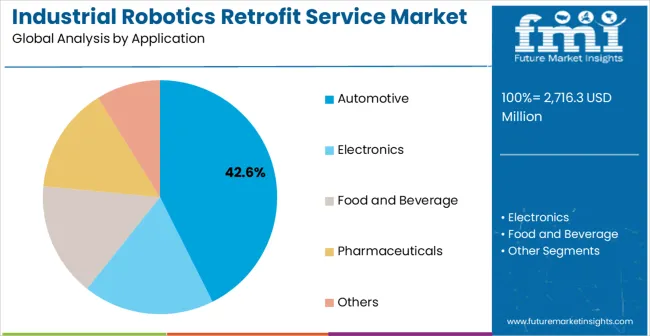

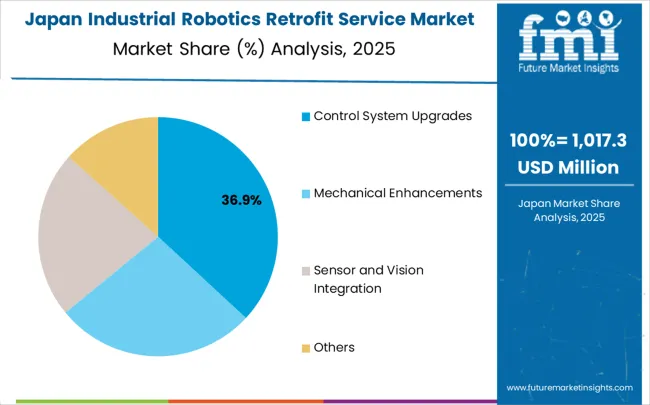

The market is segmented by service type, end-use industry, and region. By service type, the market is divided into control system upgrades, mechanical enhancements, sensor and vision integration, and others. Based on end-use industry, the market is categorized into automotive, electronics, food and beverage, pharmaceuticals, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Control system upgrades are projected to account for 37.5% of the industrial robotics retrofit service market in 2025. This leading share is supported by the critical importance of modern control systems in achieving enhanced performance, connectivity, and operational efficiency. Control system retrofits enable legacy robots to interface with contemporary manufacturing execution systems, implement advanced programming capabilities, and support real-time data analytics. The segment benefits from rapid technological advancement in control hardware and software, making upgrades essential for maintaining competitive manufacturing operations. Modern control systems provide enhanced safety features, improved precision, and better integration capabilities that significantly enhance overall system performance and reliability.

Advanced control system technologies are enabling manufacturers to implement sophisticated automation strategies including predictive maintenance, adaptive control algorithms, and integrated quality management systems. The segment growth reflects increasing demand for connectivity solutions that support Industrial Internet of Things implementations and cloud-based monitoring platforms. Manufacturers are investing in control system upgrades to achieve better production visibility, enhanced process optimization, and improved operational decision-making capabilities that support lean manufacturing principles and continuous improvement initiatives.

Automotive applications are expected to represent 42.6% of industrial robotics retrofit service demand in 2025. This dominant share reflects the automotive industry's extensive use of industrial robotics and continuous pressure to improve production efficiency, quality, and flexibility. Automotive manufacturers operate large fleets of robotic systems that require regular upgrades to meet evolving production requirements, implement new technologies, and maintain competitive manufacturing capabilities. The segment benefits from ongoing model changes, production line reconfigurations, and the transition toward electric vehicle manufacturing that requires specialized automation capabilities and enhanced precision in assembly processes.

Automotive industry transformation toward electric and autonomous vehicles is driving significant retrofit demand as manufacturers adapt existing production lines to accommodate new technologies and materials. The segment expansion reflects increasing emphasis on flexible manufacturing systems that can handle multiple vehicle variants, advanced materials processing requirements, and stringent quality standards. Retrofit services enable automotive manufacturers to implement collaborative robotics solutions, advanced vision systems, and artificial intelligence applications that enhance production efficiency while maintaining the substantial investments in existing automation infrastructure.

The industrial robotics retrofit service market is advancing steadily due to increasing cost pressures on manufacturers and growing recognition of retrofit value propositions. However, the market faces challenges including technical complexity of integration projects, varying compatibility requirements across different robot manufacturers, and need for specialized technical expertise. Technological standardization efforts and comprehensive service offerings continue to influence market development and customer adoption patterns.

The growing integration of artificial intelligence and machine learning capabilities into retrofit services is enabling predictive maintenance, adaptive control systems, and intelligent optimization algorithms that enhance overall system performance. AI-powered retrofit solutions provide real-time performance monitoring, automated fault detection, and proactive maintenance scheduling that reduce operational downtime and extend equipment lifecycles. These advanced technologies enable manufacturers to achieve higher levels of operational efficiency and quality consistency while reducing maintenance costs and improving overall equipment effectiveness.

Service providers are developing modular retrofit packages and standardized upgrade components that reduce implementation complexity and accelerate project timelines. Standardized solutions enable more cost-effective retrofits while maintaining compatibility across different robot platforms and manufacturing environments. This trend supports broader market adoption by reducing technical barriers and providing more predictable project outcomes for manufacturers considering retrofit investments.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| United States | 5.7% |

| United Kingdom | 5.1% |

| Japan | 4.5% |

The industrial robotics retrofit service market demonstrates varied growth patterns across key countries, with China leading at an 8.1% CAGR through 2035, driven by massive manufacturing sector expansion, government automation initiatives, and rising demand for production efficiency improvements. India follows at 7.5%, supported by growing manufacturing capabilities, increasing foreign investment, and expanding automotive and electronics sectors. Germany records 6.9% growth, emphasizing advanced engineering solutions, Industry 4.0 implementation, and comprehensive service capabilities. Brazil shows steady growth at 6.3%, developing retrofit service capabilities to support industrial modernization. The United States maintains 5.7% growth, focusing on manufacturing competitiveness and automation advancement. The United Kingdom demonstrates 5.1% expansion, supported by manufacturing sector revitalization and digital transformation initiatives. Japan records 4.5% growth, leveraging technological leadership and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from industrial robotics retrofit services in China is projected to exhibit the highest growth rate with a CAGR of 8.1% through 2035, driven by massive manufacturing sector modernization, government support for automation adoption, and increasing emphasis on production efficiency and quality improvements. The country's comprehensive industrial development strategy includes extensive robotics deployment across manufacturing sectors, creating substantial demand for retrofit services as facilities upgrade and optimize their automation systems. Major manufacturing hubs are implementing sophisticated retrofit programs to enhance competitive positioning in global markets. Local service providers are expanding capabilities to support diverse industrial requirements across automotive, electronics, and consumer goods sectors.

Revenue from industrial robotics retrofit services in India is projected to expand at a CAGR of 7.5%, supported by rapid manufacturing sector development, increasing foreign direct investment, and growing adoption of automation technologies across automotive, electronics, and pharmaceutical industries. The country's emphasis on cost-effective manufacturing solutions is driving demand for retrofit services that provide advanced capabilities without requiring complete system replacements. Government initiatives promoting manufacturing excellence are creating favorable conditions for retrofit service adoption. Industrial clusters are implementing comprehensive modernization programs to enhance export competitiveness and production capabilities.

Demand for industrial robotics retrofit services in Germany is projected to grow at a CAGR of 6.9%, supported by the country's leadership in advanced manufacturing technologies, comprehensive Industry 4.0 implementation, and emphasis on precision engineering solutions. German manufacturers are implementing sophisticated retrofit solutions that integrate cutting-edge technologies while maintaining stringent quality and performance standards. The country's extensive automotive and machinery sectors are driving significant retrofit demand for enhanced automation capabilities. Research institutions are collaborating with industry partners to develop next-generation retrofit technologies and standardized implementation methodologies.

Revenue from industrial robotics retrofit services in Brazil is projected to grow at a CAGR of 6.3%, driven by industrial modernization initiatives, increasing competitiveness pressures, and growing awareness of retrofit service benefits for manufacturing efficiency improvements. Brazilian manufacturers are investing in retrofit solutions to enhance productivity and quality while managing capital expenditure constraints. The country's automotive and food processing sectors are leading retrofit adoption as companies seek to improve operational efficiency. Government programs supporting industrial development are facilitating access to financing and technical resources for retrofit projects.

Demand for industrial robotics retrofit services in the United States is projected to expand at a CAGR of 5.7%, driven by manufacturing sector revitalization, emphasis on domestic production capabilities, and ongoing technology advancement initiatives. American manufacturers are implementing retrofit solutions to maintain global competitiveness while leveraging existing automation investments. The aerospace and defense industries are driving significant retrofit demand for enhanced precision and security requirements. Regional manufacturing clusters are developing specialized service capabilities to support diverse industrial automation upgrade needs.

Demand for industrial robotics retrofit services in the United Kingdom is projected to grow at a CAGR of 5.1%, supported by manufacturing sector modernization, government industrial strategy implementation, and increasing emphasis on productivity improvements. British manufacturers are investing in retrofit solutions to enhance competitiveness and operational efficiency. The pharmaceutical and food processing sectors are leading retrofit adoption to meet stringent regulatory requirements and quality standards. Advanced manufacturing partnerships are facilitating technology transfer and knowledge sharing to accelerate retrofit implementation across industrial sectors.

Revenue from industrial robotics retrofit services in Japan is projected to expand at a CAGR of 4.5%, supported by advanced robotics technology development, comprehensive manufacturing expertise, and emphasis on continuous improvement principles. Japanese manufacturers are implementing sophisticated retrofit solutions that demonstrate superior performance and reliability characteristics. In addition, strong government initiatives supporting smart manufacturing are accelerating retrofit adoption. The presence of globally recognized robotics players further strengthens Japan’s leadership in delivering cutting-edge retrofit services.

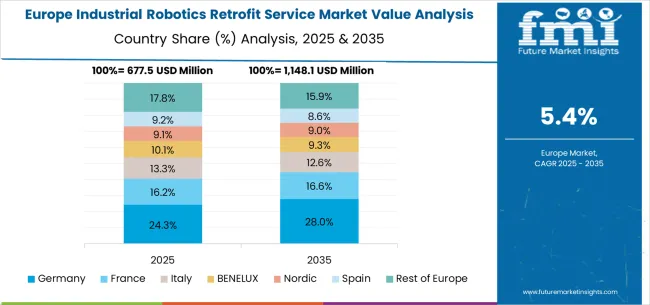

The industrial robotics retrofit service market in Europe is projected to grow from USD 734.2 million in 2025 to USD 1,315.4 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership despite a slight reduction in share from 31.4% in 2025 to 30.8% by 2035, supported by its extensive manufacturing base and strong robotics industry presence. France follows with 19.8% market share in 2025, projected to grow to 20.2% by 2035, driven by automotive manufacturing modernization and industrial digitalization initiatives.

The Rest of Europe region is projected to gain ground, expanding its share from 16.7% to 17.9%, attributed to increasing retrofit adoption in Eastern European manufacturing centers and Nordic industrial automation programs. United Kingdom maintains 15.2% share in 2025, expected to reach 15.4% by 2035, supported by manufacturing sector modernization and government Industry 4.0 initiatives. Italy contributes 16.9% in 2025, projected to decline slightly to 15.7% by 2035, while other European countries demonstrate steady growth patterns reflecting regional manufacturing development and retrofit service accessibility improvements.

The industrial robotics retrofit service market is characterized by competition among established robotics manufacturers, specialized service providers, and systems integrators. Companies are investing in advanced retrofit technologies, comprehensive service capabilities, technical expertise development, and customer support programs to deliver precise, reliable, and cost-effective modernization solutions. Strategic partnerships, technological innovation, and service portfolio expansion are central to strengthening market positions and customer relationships.

Yaskawa, Japan-based, offers comprehensive retrofit services with focus on control system upgrades, mechanical enhancements, and integration solutions for diverse industrial applications. KUKA, Germany, provides advanced retrofit capabilities emphasizing precision engineering, Industry 4.0 integration, and comprehensive technical support services. ATG Technologies specializes in customized retrofit solutions with focus on legacy system modernization and performance optimization. ABB, Switzerland, delivers comprehensive retrofit portfolios with emphasis on connectivity, digitalization, and operational efficiency improvements.

Stäubli International, Switzerland, focuses on high-precision retrofit solutions for demanding applications with emphasis on reliability and performance enhancement. Universal Robots, Denmark, emphasizes collaborative robotics retrofit capabilities and flexible automation solutions.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2,716.3 million |

| Service Type | Control System Upgrades, Mechanical Enhancements, Sensor and Vision Integration, and Others |

| End-use Industry | Automotive, Electronics, Food and Beverage, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Yaskawa, KUKA, ATG Technologies, ABB, Stäubli International, Universal Robots, Axus Technology |

| Additional Attributes | Dollar sales by service type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established robotics manufacturers and specialized service providers, buyer preferences for comprehensive versus modular retrofit solutions, integration with Industry 4.0 technologies and digital manufacturing platforms, innovations in predictive maintenance capabilities and artificial intelligence applications, and adoption of collaborative robotics integration and flexible automation solutions for enhanced manufacturing productivity and operational efficiency. |

The global industrial robotics retrofit service market is estimated to be valued at USD 2,716.3 million in 2025.

The market size for the industrial robotics retrofit service market is projected to reach USD 4,864.5 million by 2035.

The industrial robotics retrofit service market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in industrial robotics retrofit service market are control system upgrades, mechanical enhancements, sensor and vision integration and others.

In terms of application, automotive segment to command 42.6% share in the industrial robotics retrofit service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA