The industrial insulation market is expanding steadily due to increasing emphasis on energy efficiency, operational safety, and environmental sustainability across industrial sectors. Growing demand from oil and gas, power generation, and manufacturing industries is driving adoption of advanced insulation materials that enhance thermal performance and reduce energy losses. Current market dynamics are being shaped by regulatory initiatives targeting emission reduction and improved energy conservation in industrial processes.

The future outlook remains strong as modernization of aging infrastructure and expansion of heavy industries continue to stimulate material demand. Market growth is further supported by technological advancements in insulation design, improved fire resistance, and extended service life.

Increasing focus on cost optimization, process reliability, and compliance with international energy standards is expected to sustain investments in high-quality insulation solutions The overall growth rationale centers on the role of industrial insulation in improving system efficiency, minimizing operational risks, and supporting sustainability goals, which are collectively driving consistent revenue expansion globally.

| Metric | Value |

|---|---|

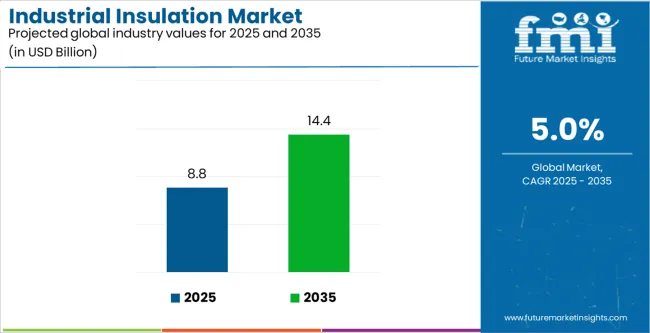

| Industrial Insulation Market Estimated Value in (2025 E) | USD 8.8 billion |

| Industrial Insulation Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

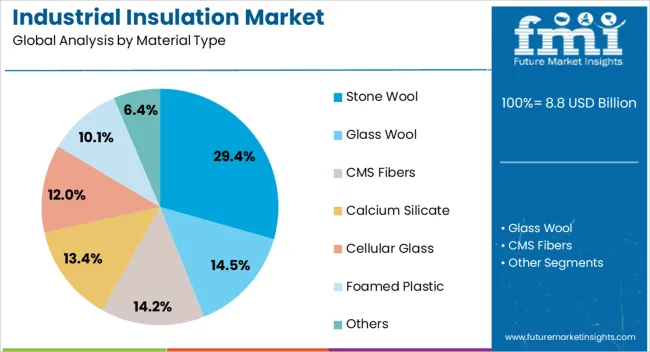

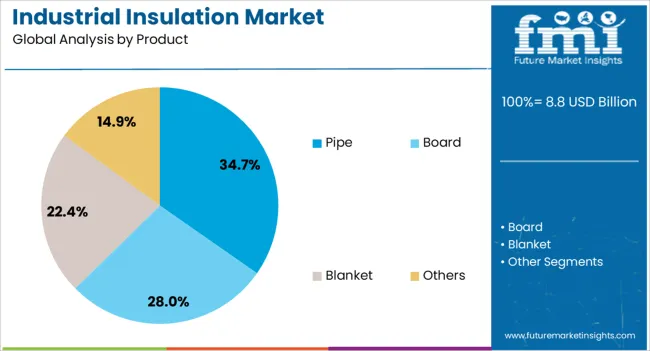

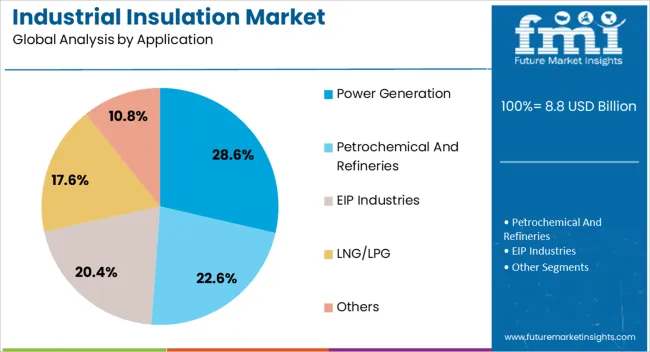

The market is segmented by Material Type, Product, and Application and region. By Material Type, the market is divided into Stone Wool, Glass Wool, CMS Fibers, Calcium Silicate, Cellular Glass, Foamed Plastic, and Others. In terms of Product, the market is classified into Pipe, Board, Blanket, and Others. Based on Application, the market is segmented into Power Generation, Petrochemical And Refineries, EIP Industries, LNG/LPG, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stone wool segment, holding 29.40% of the material type category, has established its dominance owing to its excellent thermal insulation, fire resistance, and acoustic absorption properties. It is being widely adopted in high-temperature industrial applications where durability and energy conservation are critical. The segment’s performance advantage is supported by continuous improvements in manufacturing technology and raw material processing.

Its inherent non-combustible nature and environmental compatibility have strengthened its market position amid tightening safety regulations. Demand is also being supported by government policies promoting energy-efficient industrial operations.

The segment’s competitive edge lies in its versatility and long lifespan, which reduce maintenance costs and ensure reliable thermal management Growing adoption across petrochemical, cement, and power plants is expected to sustain its leading share and drive long-term market growth.

The pipe insulation segment, accounting for 34.70% of the product category, has remained the leading product type due to its critical role in maintaining temperature stability and minimizing heat loss in industrial piping systems. Its wide applicability across oil and gas refineries, chemical processing units, and power plants has ensured consistent demand.

Enhanced product performance through improved material formulations and installation techniques has contributed to extended service life and reduced operational costs. Market share retention is being further supported by regulatory standards emphasizing insulation efficiency in fluid transport systems.

Manufacturers are focusing on lightweight, corrosion-resistant, and high-durability solutions to cater to the evolving industrial requirements Continued infrastructure expansion and retrofitting projects are expected to strengthen the segment’s growth trajectory over the coming years.

The power generation segment, representing 28.60% of the application category, has been leading the market due to the high insulation requirements in boilers, turbines, and heat recovery systems. The segment’s growth is driven by ongoing energy transition trends and the modernization of thermal power plants to improve efficiency and reduce emissions.

Industrial insulation plays a vital role in maintaining optimal operating temperatures, preventing heat losses, and enhancing overall plant performance. Increasing investments in renewable and conventional power infrastructure have further fueled demand.

Compliance with stringent environmental and energy efficiency regulations has reinforced the use of advanced insulation materials in power generation facilities Continuous development of high-performance insulation solutions, combined with global initiatives for energy conservation, is expected to ensure sustained growth of this segment throughout the forecast period.

Rising Technological Innovations to Benefit the Industry

Leading companies are prioritizing energy efficiency to reduce costs and achieve sustainability goals, leading to a high demand for advanced insulation materials such as vacuum insulation panels. This material offers superior thermal resistance, durability, and space efficiency compared to traditional options like fiberglass and mineral wool.

Technological innovations are fueling the development of smart insulation systems with sensors for real-time monitoring and digital modeling tools for optimal insulation design. The trend of real-time tracking is likely to fuel growth in this landscape.

High-performance Insulation Solutions Taking Manufacturers' Attention

High-performance insulation solutions are gaining traction due to regulatory standards for energy conservation, emissions reduction, and workplace safety. Compliance with standards such as the American Society for Testing and Materials (ASTM) and The International Organization for Standardization (ISO) is vital for leading manufacturers to gain momentum in the business. This is another primary factor contributing to the success of the sector.

Rising Focus on Sustainability to Surge Sales

Sustainability is gaining significant attention across various sectors due to high prominence in people's minds. Key manufacturers are focusing on developing sustainable insulation solutions, using eco-friendly materials for recycling and reusability. Emerging economies are prioritizing energy-efficient industrial facilities to meet growing demand for industrial insulation products due to rapid industrialization in developing regions.

High Initial Investment and Operational Cost to Slow Down Growth

Advanced insulation materials are costly initially, potentially deterring several industrial facilities from investing in energy-efficient solutions. The installation process is complex, especially in large facilities with intricate equipment, potentially hindering growth.

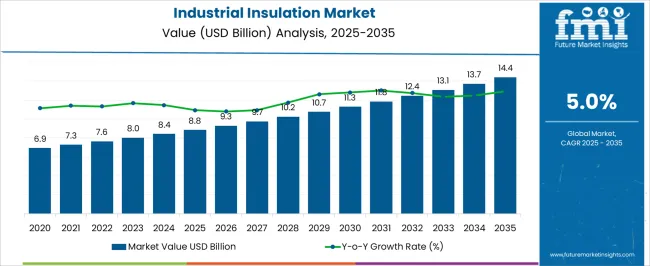

The industrial insulation sector grew at a CAGR of 3.9% from 2020 and 2025. The market reached USD 8,088.6 million in 2025. The industry has transitioned from traditional materials like fiberglass and mineral wool to more eco-friendly options like aerogels, polyurethane foams, and vacuum insulation panels (VIPs). These materials offer better thermal performance, durability, and space efficiency, fueling adoption in various industrial applications.

Regulatory changes and standards compliance have influenced the market, leading to rising adoption of high-performance insulation solutions that meet regulatory requirements. Different industrial sectors have unique insulation requirements based on factors such as operating temperatures, chemical exposure, and safety regulations.

For instance, the oil and gas sector requires insulation solutions capable of withstanding high temperatures and corrosive environments. In contrast, food and beverage manufacturers prioritize hygiene and cleanliness alongside thermal efficiency.

Global economic trends and industrial activities have also impacted the demand for insulation materials. Economic growth further surged demand for insulation products to support new construction and infrastructure projects, while downturns reduced investment in industrial facilities and infrastructure.

Growing awareness of environmental sustainability has led to an increasing demand for eco-friendly insulation materials with minimal environmental impact. Manufacturers are developing recyclable, reusable, and sustainable insulation products to gain a competitive edge in the business.

Technological developments, including advanced thermal imaging techniques and smart insulation systems with real-time temperature and energy-efficiency monitoring, have significantly benefited the sector. Over the forecast period, the industry is poised to exhibit healthy growth, reaching USD 13,731.1 million by 2035.

The section discusses region-wise insights into the industrial insulation market. Based on these analytics, it can be inferred that Asian countries like China, India, and Japan are at the forefront of this sector. In the Western world, the United States and the United Kingdom are also performing very well due to robust investments in technological progressions and innovation by both private and public companies.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.8% |

| United Kingdom | 2% |

| Spain | 3.8% |

| China | 5.6% |

| India | 7.5% |

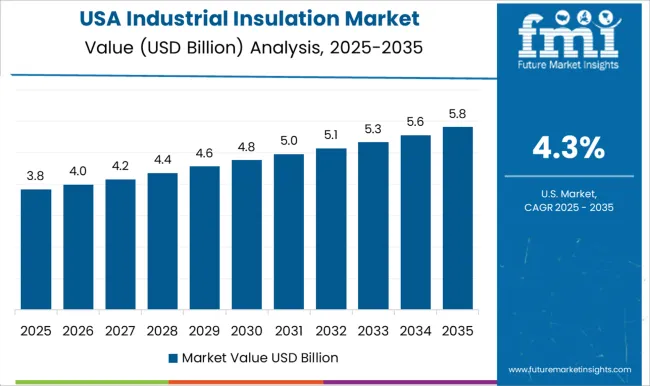

Over the assessment period, demand in the United States is set to rise at 2.8% CAGR. The country is gaining traction due to extensive infrastructure in manufacturing, oil and gas, chemicals, and power generation.

Energy-efficiency regulations, infrastructure upgrades, and technological developments are set to surge growth in the United States. Regulatory standards established by organizations like the American Society of Heating, Refrigerating and Air-conditioning Engineers (ASHRAE) and the American Society for Testing and Materials (ASTM) are further projected to shape the market.

Demand for industrial insulation in the country is propelled by improving energy efficiency, reducing costs, and the need to comply with environmental regulations. Industrial insulation is gaining traction in several sectors to minimize heat loss, control temperature fluctuations, enhance process efficiency, and ensure worker safety.

By 2035, India is set to remain dominant due to strict regulations. At the same time, increased awareness of rising energy costs and the need for energy efficiency are projected to boost demand. Furthermore, fast-paced growth in the industrial sector of the country is set to propel sales.

India, with an advanced industrial sector, is estimated to hold the leading share. The country is projected to capture a significant value by 2035 due to rising awareness and industrial developments.

China is a leading producer of innovative insulation materials and technologies, including aerogels, vacuum insulation panels, and spray polyurethane foam. These materials cater to industrial applications and integrate smart insulation systems with sensors for real-time energy efficiency optimization.

Factors such as product quality, performance, price, and customer service characterize the competitive industrial insulation market. As environmental sustainability is gaining traction, manufacturers are developing eco-friendly insulation solutions with recycled content and reduced environmental impact. Over the forecast period, demand in China is set to increase at a steady CAGR of 5.6%.

The industrial insulation market is categorized on the basis of material type, product, and application. The two leading categories are discussed in the section below.

| Segment | Foamed Plastic (Material Type) |

|---|---|

| Value Share (2025) | 29.5% |

Foamed plastic insulation materials offer moisture resistance, chemical resistance, mechanical strength, and durability. Such properties make these highly suitable for industrial environments like petrochemical plants and refineries.

The insulation is lightweight, easy to handle, and is fabricated into custom shapes and sizes to fit complex equipment configurations. Fire safety is an essential consideration in industrial insulation applications. Foamed plastics are formulated with fire-retardant additives or coatings, thereby fueling sales.

| Segment | Petrochemical and Refineries (Application) |

|---|---|

| Value Share (2025) | 30.3% |

Industrial insulation is vital in petrochemical plants and refineries for controlling process temperatures, minimizing heat loss, and maintaining optimal operating conditions. This insulation also ensures worker safety by preventing contact with hot surfaces and reducing the risk of burns or injuries. The growing manufacturing sector and stringent regulatory norms by the European Commission are further set to fuel the segment’s growth in the forecast period.

By 2025, the petrochemical and refineries segment is set to account for a 30.3% share. Specialized insulation materials, coatings, and barriers are set to be used to protect against chemical attacks and maintain insulation integrity in aggressive environments.

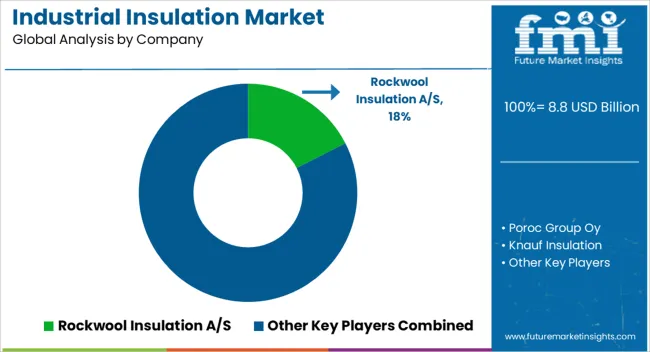

Rockwool Insulation A/S, Poroc Group Oy, Knauf Insulation, and TechnoNICOL Corporation are the key companies in the industrial insulation market. The industry is dominated by companies focusing on organic growth rather than mergers and acquisitions.

Leading manufacturers are broadening product portfolios by developing cost-effective insulation products with enhanced properties. Companies and start-ups are also extending manufacturing capabilities to meet rising product demand.

Key manufacturers and companies further use growth strategies such as partnerships and endorsements to strengthen positions. These tactics aim to increase brand visibility, establish credibility, and gain a competitive advantage in the dynamic industrial insulation market.

Industry Updates

As per material type, the sector has been categorized into stone wool, glass wool, CMS fibers, calcium silicate, cellular glass, foamed plastic, and others.

The industry has been segmented into pipe, board, blanket, and others.

In terms of applications, the industry is divided into power generation, petrochemical and refineries, EIP industries, LNG/LPG, and others.

Business analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global industrial insulation market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the industrial insulation market is projected to reach USD 14.4 billion by 2035.

The industrial insulation market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in industrial insulation market are stone wool, glass wool, cms fibers, calcium silicate, cellular glass, foamed plastic and others.

In terms of product, pipe segment to command 34.7% share in the industrial insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Insulation Tester Market Growth - Trends & Forecast 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Industrial Pipe Insulation Market

Industrial Furnace Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Industrial Absorbent Market Size and Share Forecast Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA