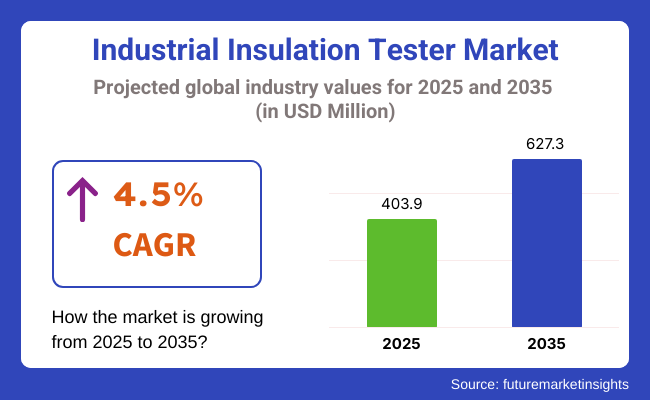

The global industrial insulation tester market is projected to grow from USD 403.9 million in 2025 to USD 627.3 million by 2035, recording a CAGR of 4.5% during the forecast period. Growth is expected to be driven by the expansion of high-voltage industrial applications, stringent workplace safety regulations, and the modernization of power infrastructure. Industries including utilities, oil & gas, heavy machinery, and manufacturing are actively investing in insulation diagnostics to minimize equipment failures and ensure continuous operations.

In 2024, a patent filed by Beijing Dingchen Technology Co., Ltd. (Publication No. CN221239011U) detailed a compact high-voltage insulation resistance testing system. The innovation features a digital interface and adjustable pulse output capable of measuring insulation deterioration in real-time. The design allows for flexible field deployment in dense industrial environments.

Leading manufacturers are emphasizing safety, precision, and traceability. According to Viper Innovations, “Insulation resistance testing is vital for identifying insulation degradation and preventing catastrophic electrical failures.” Continuous testing is now being favored in mission-critical environments such as offshore rigs and underground cable installations, where pre-failure diagnostics reduce costly downtime.

Megger has introduced handheld testers such as the MIT525 and MIT1525, offering 5kV to 15kV test ranges and automated IR testing routines. These systems are being adopted in transformer substations and control panel commissioning tasks where high-resistance integrity must be confirmed before load connection.

ECASA South Africa has reported the emergence of wireless insulation testers that eliminate lead-handling risks while enhancing user mobility in field conditions. Their review emphasizes that “no more shocking inaccurate insulation testing” is possible due to improved probe sensitivity and onboard result validation tools.

With infrastructure aging in North America and Asia, and high-voltage integration rising in renewable grids, demand for precision insulation testers is expected to remain stable. Product development is being guided by real-time logging, Bluetooth telemetry, and AI-driven failure prediction models.

This market’s trajectory aligns with global industrial safety priorities, where condition-based maintenance and automated testing platforms are being adopted to ensure equipment resilience and worker safety through 2035.

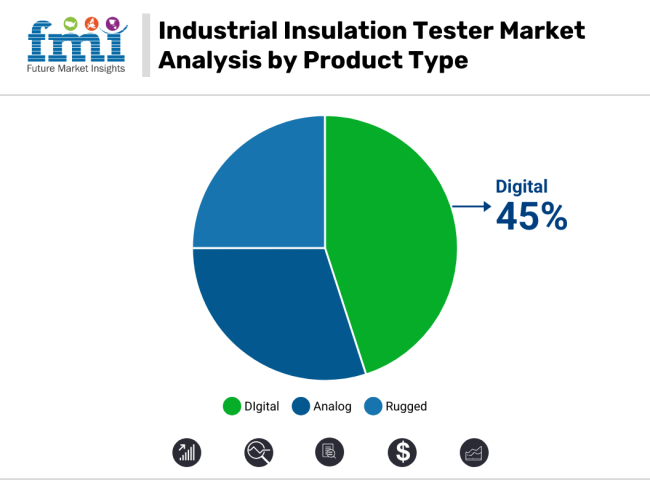

Digital industrial insulation testers are projected to command approximately 45% of the global market share in 2025. Over the forecast period from 2025 to 2035, this segment is expected to expand at a compound annual growth rate (CAGR) of 4.3%. The adoption of digital testers has been driven by the increasing demand for high-accuracy measurement, integrated data logging, and improved user safety in industrial environments.

These instruments are being preferred in applications where detailed resistance diagnostics, automated testing sequences, and seamless data transfer are critical. Industries engaged in electrical maintenance, substation commissioning, and predictive asset management have incorporated digital testers into routine workflows to minimize human error and enable traceable recordkeeping.

Manufacturers have responded by introducing devices with LCD interfaces, programmable test voltage levels, Bluetooth connectivity, and remote monitoring capabilities. These features are allowing field engineers to access results instantly and streamline test documentation. As electrical systems grow more complex, digital insulation testers are expected to remain a vital tool for ensuring regulatory compliance and maintaining system integrity across energy, transport, and manufacturing sectors.

Portable industrial insulation testers are expected to account for nearly 55% of the global market share by 2035. This segment is projected to grow at a compound annual growth rate (CAGR) of 4.6% over the forecast period. The increasing preference for on-site diagnostics and flexible testing solutions has driven the widespread adoption of portable testers across utility substations, heavy machinery installations, and industrial control systems.

These devices are being deployed in remote or space-constrained environments where fixed testing infrastructure is impractical. The ability to perform quick assessments without disassembling equipment has been seen as a significant advantage in preventive maintenance schedules. Field technicians have relied on portable testers to validate insulation integrity during commissioning, shutdown inspections, and cable installations.

Recent models have been equipped with rugged enclosures, rechargeable batteries, and multi-voltage range capabilities. Their integration with cloud-based reporting platforms and wireless data transmission has improved traceability and minimized test cycle delays. As industrial maintenance practices move toward mobility and efficiency, portable insulation testers are expected to remain central to condition-based monitoring strategies through 2035.

The North America region is a prominent market for the industrial insulation testers, which is further augmented by stringent regulatory standards, one of the highest industrial automation levels, and notable investments in electrical safety. The USA and Canada have a developed industrial sector and insulation testing is required in power plants, factories and infrastructure projects.

It is stated by National Fire Protection Association (NFPA) and Occupational Safety and Health Administration (OSHA) that strict guidelines regarding electrical insulation safety must be followed which promotes the industries to adopt reliable insulation testing equipment. The market is also driven by the growing38 39 renewable energy projects and the upgrading of aging electrical infrastructure.

Increasing investments in power distribution networks in Canada and the oil & gas industry is driving the need for specialized insulation testers for harsh environment. North America is expected to construct vast quantities of bondage due to the presence of market key players and developed distribution systems.

Europe takes the largest market share place with industrial sites in countries like Germany, France, and the UK, respectively, taking the lead in both energy efficiency and industrial safety initiatives. Stricter safety regulations in the European Union along with growing installations of renewable energy are driving high-precision insulation testing devices traffic.

Germany is a leading centre for industrial automation worldwide, with demanding electrical testing and preventive maintenance requirements in factories. Likewise, both France and the UK are investing in modernizing power grids, railway electrification, and industrial automation requiring high-performance insulation testers.

Such regulations in industrial sectors stemming from the European Green Deal and related carbon neutrality objectives have encouraged them to adopt effective insulation solutions that have gradually increased the demand for periodic insulation test service offerings. Additionally, trends such as predictive maintenance, and digital insulation testing, are also becoming popular in the region.

Asia-Pacific Market Expected to Register Highest Growth for Industrial Insulation Testers Due to industrialization and infrastructure expansion in the region coupled with stringent safety regulation by the government, the Asia-Pacific market for industrial insulation tester is expected to register highest growth.

Insulation Testing Equipment Consumption and Production Statistics Region-wise Major producing countries include China, India, Japan, South Korea etc. on demand side, it focuses on power efficiency, industrial safety and fine milling of the insulation testing equipment market.

The development of highly efficient electrical systems, expansion of renewable energy market in addition to rapid industrial automation in China is driving the demand for the sophisticated insulation testers. Additionally, a boom in semiconductor manufacturing is likely to create demand for precision insulation testing devices in the country.

The Make in India initiative is driving demand for improved manufacturing capabilities and modernized electrical networks, thereby boosting demand for high-performance insulation testers. Furthermore, the significant involvement of multinational and domestic testing equipment manufacturers is enhancing market accessibility.

Smart manufacturing, 5G infrastructure and AI-driven industrial safety solutions are needed in the advanced manufacturing sectors of the technologically progressive nations like Japan and South Korea, creating the demand for intelligent insulation testing solutions.

Challenges

For industrial flooring, technology has not progressed beyond the confines of limiting factors (high initial cost + slow adoption) - Advanced digital, AI-enabled insulation testers have high initial investment costs, which lag behind in adoption in small-scale industries.

Opportunities

At the same time, the rise of smart industrial infrastructure, as industries transition to Industry 4.0, IoT-integrated testing, and AI-driven monitoring, is fueling demand for insulation testing solutions that integrate between the field and the cloud.

The industrial insulation tester market grew steadily from 2020 to 2024, fueled by rising industrial automation, growth in power infrastructure, and greater emphasis on electrical safety regulations. Industries like manufacturing, oil & gas, power generation, aerospace, and transportation are deploying insulation testers in their industrial facilities to guarantee electrical systems operate flawlessly and efficiently.

With the expansion of industries and the addition of more sophisticated electrical grids, routine insulation resistance testing became vital to avoid unpredictable failures, enhance safety, and minimize interruption to production.

Electrical safety standards became even tighter under government regulatory entities, driving the industries to adapt to cutting-edge insulation testing solutions. To achieve these objectives, Organizations needed Insulation testers that were more accurate, efficient and reliable than the Insulation testers available previously which meet International safety standards including IEEE, IEC, and NFPA & OSHA.

The focus in industrial plants, mainly in high-voltage atmosphere, was on predictive maintenance and responding to this, the need for testers that offered real-time diagnostics, early fault detection, and automated reporting became imperative. Demand for portable, handheld and multi-function insulation testers that delivered improved precision and efficiency in a broad range of operational environments increased in the market.

The Industry 4.0 and IoT-based automation also impacted the demand pattern in the market. Digitalization Counteract the risk of insulation failure as companies integrated insulation testers with other digital monitoring systems, data could be collected remotely, trend analysis could be achieved and predictive maintenance strategies could be employed. The improved sensor technology means engineers are able to better assess insulation health in an efficient manner and reduce the number of manual inspections.

Moreover, the increasing demand for insulation testers resulting from the rapid expansion of renewable energy infrastructure such as wind and solar as well as ensuring optimum performance of high voltage electrical components, is expected to positively influence the product demand from 2023 to 2032.

Nonetheless, factors such as supply chain disruptions, high cost of equipment, and unskilled technicians slightly restrained bunch market growth. With continued evolution in the industrial landscape, the next-generation insulation testers will witness higher demand, primarily due to smart grid electrification, renewable energy integration, and high-voltage electrical networks.

Insulation testing is increasing in its demand due to the proliferation of EV and BESS; both require high quality insulation testing in order to operate safely and for long lives. Growing hydrogen energy infrastructure and deploying offshore wind farms will also require insulation testers able to work in extreme environments, driving advancements in rugged, weatherized testing apparatus.

The growing presence of self-healing insulation materials, innovative coatings using nanotechnology, and advanced dielectric materials will pose new challenges in testing, driving manufacturers to develop tailored tools for insulation assessment.

In addition, automation and AI-powered diagnostics will become a pivotal feature of insulation testing in the future. Real-time condition monitoring, cloud-based data analytics and digital twin technology will shift industries from reactive maintenance to predictive and proactive maintenance strategies.

This change will reduce operating costs dramatically, increase electrical system reliability, and give the workplace a safe non-hazardous environment. With growing focus on sustainability, insulation testers will allow industries to curb energy losses and carbon emissions, and optimize power distribution, making them a must-have in today industry ecosystem.

From 2025 to 2035, the industrial insulation tester market will be overhauled leveraging automation, AI-enabled diagnostics, and sustainability measures. Further developments in insulation testing will be driven by the increasing complexity of electrical grids, smart manufacturing initiatives, and the growing uptake of electric vehicles (EVs).

Smart insulation testers will become the standard in years to come, featuring wireless connectivity, cloud-based storage, and AI-enhanced predictive analytics that identifies potential insulation failures before they can result in critical malfunctions.

Other factors include sustainable development trends and energy efficiency legislation. Industries would need to test insulation to mitigate energy losses, enhance electrical system longevity, and comply with stringent environmental policies.

The levels of innovative experiments will also require newer specifications and testing solutions like for example newer, greener insulation materials with the development material science. The ever-increasing scope of insulation testing applications will be further fueled by the rise of hydrogen energy, high-voltage DC transmission, and next-generation battery storage technologies needed to ensure safe and efficient energy distribution.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments implemented stringent electrical safety codes which drives wider adoption of insulation testing in high-risk industries. Starting in October 2023, compliance with standards like IEEE, IEC, NFPA, and OSHA were required. |

| Technological Advancements | Whereas beforehand digital insulation testers were still very basic, models with enhanced precision for automated logging and troubleshooting purposes became widely available. |

| Industrial Applications | Issues had the potential to bring down an entire plant, and operations like power generation, oil refining, aerospace, and large-scale manufacturing infrastructure relied on insulation testers to ensure electrical integrity and mitigate costly failures. |

| Adoption of Smart Testing Equipment | Dentists adopted handheld digital insulation testers equipped with Bluetooth and USB for transmittance of data in real-time. Fault detection in high-voltage systems has improved with the development of multi-range resistance testers. |

| Sustainability & Energy Efficiency | The ability to size up electrical systems also brought some benefits, as insulation testers were used to find energy losses and develop better energy management strategies over time. |

| Data Analytics & Predictive Maintenance | From the historical insulation resistance data, the companies made their maintenance plans with the intention to predict the probability of critical failures. Custom cloud data storage for analysis was implemented by some early adopters. |

| Production & Supply Chain Dynamics | Global crises caused supply chain disruptions, impacting availability of insulation testers. Manufacturers opened up source lists for suppliers and sourced more of the parts they needed close to home to stabilize supply. |

| Market Growth Drivers | Robust growth was led by industrial automation, growing demand for electrical safety compliance and expanding power distribution networks. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | There will be increasing regulatory focus on sustainability and energy efficiency, with industries needing insulation testing to be part of wide-reaching carbon-reduction strategies. Insulation material testing will be influenced by a circular economy. |

| Technological Advancements | Machine learning-based predictive analytics-driven, cloud storage-enabled, real-time monitoring facilitated sales of AI-powered insulation testers dominate. On-site insulation assessments will get automated by robotic testers in dangerous environments. |

| Industrial Applications | New and emerging industries (including hydrogen energy, EV infrastructure, and high-capacity energy storage) will demand modern insulation testing solutions. Non-destructive and remote testing technologies will be needed increasingly for high-voltage applications. |

| Adoption of Smart Testing Equipment | Automated, connected IoT insulation testers will allow for continuous monitoring, and AI-enabled predictive maintenance will minimize manual intervention; reduce system downtime; and minimize safety risks. |

| Sustainability & Energy Efficiency | Carbon-neutral insulation testing becomes a new hot area while the industry turns to using AI-based optimization tools to achieve efficiencies on power distribution and some energy wastage. New testing methodologies will be needed for self-healing insulation materials too. |

| Data Analytics & Predictive Maintenance | AI-driven predictive maintenance will be prevalent, enabling businesses to anticipate insulation degradation trends, prevent failures and enhance system efficiency through automated fault detection. |

| Production & Supply Chain Dynamics | These shifts will reduce the effects of supply chain disruptions, such as material shortages, flooding, or conflict, and provide insulation testers without any delays in production and distribution by means of AI-assisted automation in MTB production. We will see sustainable manufacturing practices take the lead. |

| Market Growth Drivers | In this sector, as renewable energy, smart grids, electric mobility, and green manufacturing continue to gain traction, insulation testers with advanced automation and digital capabilities will find new opportunities. |

The American market for industrial insulation testing equipment is flourishing owing to incremental investments in infrastructure, heightened demand for electrical safety and stringent regulatory adherence. Industrial insulation testers are used in industries like power generation, oil & gas, manufacturing, aerospace, and construction to test the integrity of electrical insulation and avoid equipment failure.

The modernization of the USA power grid is one area propelling demand. With more than 7,300 power plants and 600,000 miles of transmission lines, keeping electrical insulation in power systems is vital to avoid blackouts and pricey repairs. Government programs, such as the more than USD 65 billion being put towards grid modernization by the Bipartisan Infrastructure Law, are further accelerating the adoption of insulation testers.

The manufacturing sector itself accounts for over USD 2.3 trillion of the USA economy and is another key driver of the market. Insulation testing is important for various industries to minimize machine breakdown and ensure the safety of workers. There is a wide range of application for insulation testers in oil & gas industry as well because there 500,000 miles of pipelines in oil & gas which need continuity monitoring to avoid insulation break down.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

Around United Kingdom, the industrial insulation tester market is primarily depends on stringent electrical safety regulations, rapid industrial expansion, and the increasing demand for predictive maintenance solutions. Standards like BS 7671 Wiring Regulations and the Electricity at Work Regulations 1989, both enforced by the UK government, make regular electrical insulation testing mandatory in all sectors.

Market Driver: Growth of Renewable Energy Sector the UK is the world-leader in offshore wind energy, with more than 14 GW of capacity currently installed and an ambition of reaching 50 GW by 2030. Wind farms will need turbine electrical systems, substations, and transmission networks to be tested with insulation testing equipment to keep the gears of this machinery turning.

Another major contributor to the demand for insulation testers is the £190 billion manufacturing sector. As much of industry relies on automated machinery, robotics, and high-voltage equipment, insulating testers keep systems operating efficiently and prevent expensive failures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Strict environmental legislation, quick industrial automation, and the growth of investments in renewable energy infrastructure combine to shape the European Union industrial insulation tester market. Germany France and Italy are big players with strong automotive, aerospace, and construction industries fueling demand.

One of the major driving force for market growth is the REACH regulation as well as EU Directive 2014/35/EU, which require industrial and commercial electrical installations to undergo thorough insulation testing. Due to this, European companies are investing in sophisticated insulation testers to comply with workplace safety.

An automotive manufacturing heavyweight producing in excess of four million vehicles every year, Germany requires insulation testers for all manners of EV battery testing, high-voltage power systems, and robotic assembly lines. Likewise, France’s aerospace sector, which includes Airbus and Safran, uses insulation testers for aircraft electrical systems.

Another key driver is the renewable energy transition. The EU has mandated 42.5% renewable energy for 2030, resulting in billions of dollars of investment in solar farms, wind turbines, and smart grids-all of which need to undergo insulation testing for electrical integrity.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Japan’s advancement in technology, precise manufacturing and strict laws governing electrical safety has continued to drive growth of the industrial insulation tester market. Japan has a widely established industrial economic system and some of the largest electronics, automotive, and aerospace manufacturers, all of which rely on maintaining safety and efficiency through the use of insulation testers.

The electronics industry, which has an estimated worth of over USD 120 billion to date, is one of the biggest consumers of insulation testers. Insulation testing plays a crucial role in ensuring that semiconductors, circuit boards, and other electronic components function correctly-even under harsh environmental conditions.

Japan also boasts Toyota, Honda and Nissan, as well as a major manufacturer of electric and hybrid vehicle. As battery production for EVs increases, the demand for insulation testers has heightened as insulation is crucial for the vehicle's battery safety, powertrain integrity, and overall durability.

Japan is also a trailblazer in nuclear power, and the energy industry requires stringent testing of insulation to ensure no electrical failures at power plants and grid infrastructure. This demand for insulation testers is furthermore increased by the government focus on renewable energy especially solar and hydrogen fuel cells.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The factors leading to the growth of the South Korea Industrial insulation tester market include the booming industries such as semiconductor, electronics, and automotive. As the government encourages industry 4.0 and smart factories, alongside high-tech manufacturing, insulation testers are in great demand.

The South Korea semiconductor sector, with Samsung and SK Hynix the dominant players, represents more than USD 150 billion in annual exports. These companies count on precision insulation testing to avoid electrical failures in microchips and circuit boards.

Drive Insulation testers are also a major consumer in the automotive industry, producing over 4 million vehicles per year. As the world shifts its investments into EV and battery production, insulation testing can play an important role in ensuring battery reliability and charging station safety.

Furthermore, with the growth of key infrastructure projects in South Korea, including high-speed rail, smart grids as well as 5G networks, there is a need for high-performance insulation testing solutions.

The government is also pushing industries to adopt low-toxicity insulation materials in order to achieve attractive eco-friendly industrial processes as well as energy-efficient electrical systems, which are boosting the insulation tester market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The industrial insulation tester market is expanding due to increasing demand for electrical safety testing, predictive maintenance, and high-voltage equipment diagnostics. Companies are focusing on portable and automated insulation testers, digital measurement technologies, and IoT-based real-time monitoring solutions to enhance equipment reliability, worker safety, and energy efficiency.

The market includes global leaders and specialized manufacturers, each contributing to technological advancements in high-precision insulation resistance testing, dielectric assessment, and industrial safety compliance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fluke Corporation | 12-17% |

| Megger Group Limited | 10-14% |

| Hioki E.E. Corporation | 8-12% |

| Chauvin Arnoux Group | 7-11% |

| KYORITSU Electrical Instruments Works, Ltd. | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fluke Corporation | Develops portable and high-voltage insulation testers with advanced digital interfaces and wireless monitoring capabilities. |

| Megger Group Limited | Specializes in diagnostic insulation resistance testers, high-voltage insulation analyzers, and dielectric testing solutions. |

| Hioki E.E. Corporation | Manufactures precision insulation testers and multi-function electrical safety analyzers for industrial and utility applications. |

| Chauvin Arnoux Group | Provides digital insulation resistance testers with predictive maintenance features for power plants, electrical substations, and industrial facilities. |

| KYORITSU Electrical Instruments Works, Ltd. | Offers compact and high-accuracy insulation testers for industrial safety and compliance with international electrical standards. |

Key Company Insights

Fluke Corporation (12-17%)

Fluke leads the industrial insulation tester market, offering rugged, field-ready insulation resistance testers for industrial maintenance, power distribution, and HVAC applications. The company focuses on wireless data logging, predictive fault detection, and AI-powered diagnostic tools.

Megger Group Limited (10-14%)

Megger specializes in high-voltage insulation analysis, providing automated testing solutions for industrial, electrical, and utility applications. The company integrates cloud-based asset management systems for real-time condition monitoring.

Hioki E.E. Corporation (8-12%)

Hioki designs high-precision insulation testers with multi-functional diagnostic features, catering to electrical utilities, renewable energy plants, and high-voltage equipment manufacturers. The company emphasizes automated data collection and fault prediction.

Chauvin Arnoux Group (7-11%)

Chauvin Arnoux focuses on digital insulation testers with automated reporting and safety compliance monitoring. Its testers are widely used in power plants, industrial automation, and large-scale electrical infrastructure.

KYORITSU Electrical Instruments Works, Ltd. (5-9%)

KYORITSU manufactures compact and portable insulation testers for low, medium, and high-voltage applications. The company integrates intelligent measurement systems with real-time diagnostic capabilities.

Other Key Players (45-55% Combined)

Several manufacturers contribute to regional industrial safety regulations, cost-effective insulation testing solutions, and customized industrial diagnostic tools. These include:

The overall market size for Industrial Insulation Tester Market was USD 403.9 Million in 2025.

The Industrial Insulation Tester Market is expected to reach USD 627.3 Million in 2035.

The demand for industrial insulation testers is expected to rise due to rapid industrialization, growing emphasis on electrical safety, and increasing applications in industries such as power generation, manufacturing, and oil & gas, where insulation integrity and preventive maintenance are crucial

The top 5 countries which drives the development of Industrial Insulation Tester Market are USA, UK, Europe Union, Japan and South Korea.

Digital insulation testers to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Operation, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Operation, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Operation, 2023 to 2033

Figure 23: Global Market Attractiveness by Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Operation, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Operation, 2023 to 2033

Figure 47: North America Market Attractiveness by Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Operation, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Operation, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Operation, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Operation, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Operation, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Operation, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Operation, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Operation, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Operation, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Operation, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Operation, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Operation, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Operation, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA