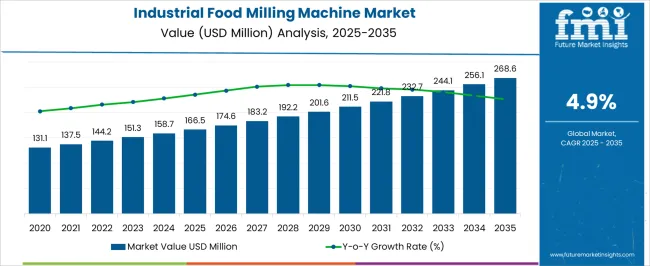

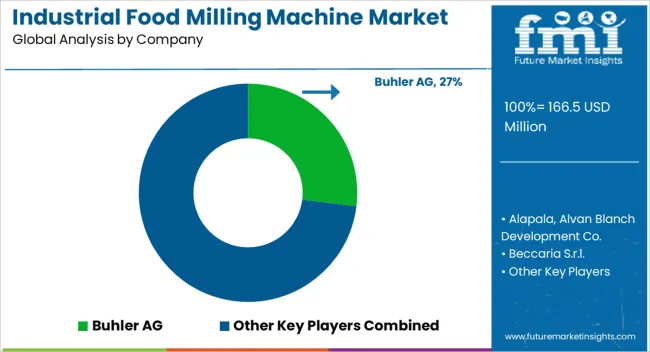

The Industrial Food Milling Machine Market is estimated to be valued at USD 166.5 million in 2025 and is projected to reach USD 268.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Food Milling Machine Market Estimated Value in (2025 E) | USD 166.5 million |

| Industrial Food Milling Machine Market Forecast Value in (2035 F) | USD 268.6 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Industrial Food Milling Machine market is expanding steadily, driven by increasing demand for efficient and scalable food processing technologies. Advancements in automation, energy efficiency, and compliance with food safety standards are accelerating adoption across food manufacturing units. Technology-focused publications and annual reports from industrial equipment manufacturers have emphasized that the shift toward large-scale production and reduced downtime has encouraged businesses to invest in precision milling equipment.

Growth is being further supported by rising consumption of processed food products and the globalization of food supply chains. Press releases from key manufacturers suggest a growing preference for equipment that offers flexibility, consistent particle size reduction, and easy integration with digital monitoring systems.

As sustainability initiatives gain momentum, energy-efficient milling machines with minimal product waste are being prioritized The future outlook remains optimistic, with continued investments in food infrastructure and modernization of existing facilities paving the way for strong market expansion in both developed and emerging economies.

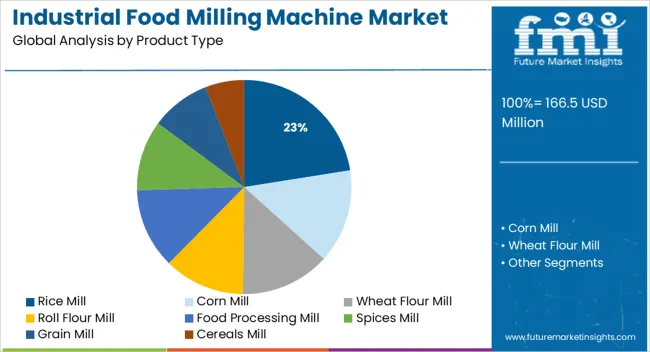

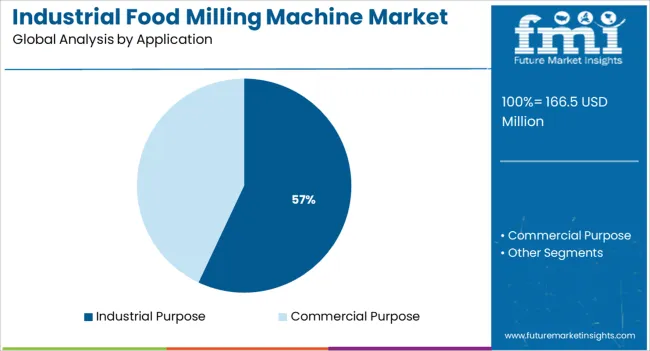

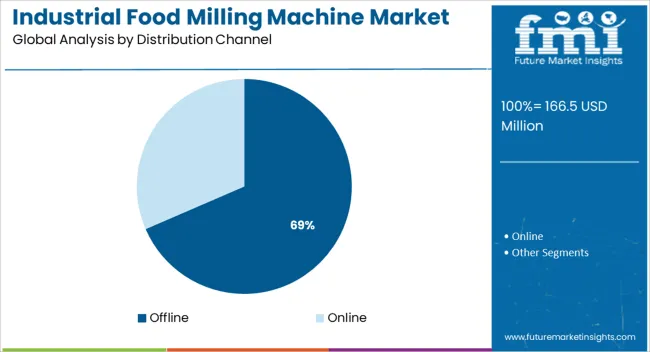

The market is segmented by Product Type, Application, and Distribution Channel and region. By Product Type, the market is divided into Rice Mill, Corn Mill, Wheat Flour Mill, Roll Flour Mill, Food Processing Mill, Spices Mill, Grain Mill, and Cereals Mill. In terms of Application, the market is classified into Industrial Purpose and Commercial Purpose. Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rice mill product type segment is projected to account for 22.5% of the Industrial Food Milling Machine market revenue share in 2025, making it the leading product category. Its growth is being driven by the global rise in rice consumption and the need for efficient post-harvest processing solutions. Industry publications and manufacturing news updates have observed that rice mills are increasingly favored for their ability to ensure high throughput, low breakage rates, and precise grain separation.

Additionally, manufacturers are integrating modern rice mills with automation and dust control systems to enhance operational efficiency and comply with health standards. The ability to process multiple rice varieties while maintaining nutritional value and output consistency has contributed to their wide-scale adoption.

Furthermore, their compatibility with modular factory setups and minimal maintenance requirements have strengthened their appeal in both large-scale and regional food processing industries These advantages have reinforced the rice mill segment’s leading position in the overall market.

The industrial purpose application segment is expected to dominate the market with a 57.0% revenue share in 2025. This leadership is supported by growing demand from large-scale food manufacturing facilities that prioritize high-capacity, continuous milling solutions.

Investor briefings and engineering-focused journals highlight that industrial users are increasingly investing in equipment with advanced automation, real-time control, and self-cleaning capabilities to reduce operational costs and production downtime. The ability of industrial milling machines to handle bulk materials, ensure consistent particle sizing, and adapt to various raw materials has made them a preferred choice for food manufacturers.

Furthermore, regulatory requirements for hygiene and food safety are encouraging the use of machines that support CIP systems and hygienic design principles The industrial segment’s position has also been strengthened by its role in supporting 24/7 production cycles across global food processing hubs, reflecting strong alignment with operational efficiency and productivity goals.

The offline distribution channel segment is projected to lead the Industrial Food Milling Machine market with a 68.5% revenue share in 2025. Its continued dominance is being attributed to the specialized nature of the equipment and the reliance on physical demonstrations, after-sales service, and direct consultations. Industry trade publications and business reports confirm that buyers of industrial milling machinery often require on-site assessments, installation support, and technical training, which are best delivered through offline channels.

Distributors and equipment manufacturers have been focusing on expanding their regional dealership networks and service centers to provide personalized support and long-term maintenance contracts. The trust factor associated with offline procurement, especially in high-investment purchases, has further supported this channel.

Moreover, custom configuration needs and large-scale factory integration projects often demand a collaborative offline purchasing process, reinforcing its leadership in the distribution landscape These attributes have ensured that offline channels remain the preferred route for capital equipment procurement in the milling machinery sector.

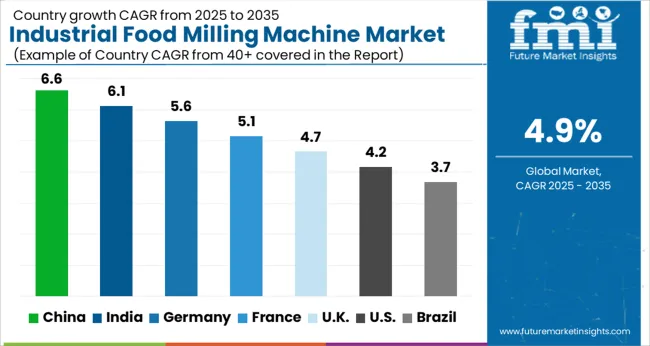

The global demand for industrial food milling machines is expected to grow at a CAGR of 4.9% during the forecast period (2025 to 2035), in comparison to the 4.2% CAGR registered from 2020 to 2025.

Growing demand for processed and packaged foods, the increasing popularity of healthy and nutritious food, and the rising adoption of advanced food processing machines in the food & beverage industry are some of the key factors driving the global industrial food milling machine market.

Industrial food milling machines have gained immense traction across the food industry due to their various benefits. These machines can help to improve the quality of finished products, reduce contamination, and increase the efficiency of the production process. As a result, they are being increasingly employed across food manufacturing and processing industries.

Regionally, the Asia-Pacific region is projected to emerge as the fastest-growing industrial food milling machine market owing to a rapidly growing population, rising disposable incomes, and expansion of the food processing industry.

A number of influential factors have been identified that are expected to spur growth in the global industrial food milling machine market during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence industrial food milling machine sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Growing Adoption of Advanced Food Processing Technologies Driving the USA Market

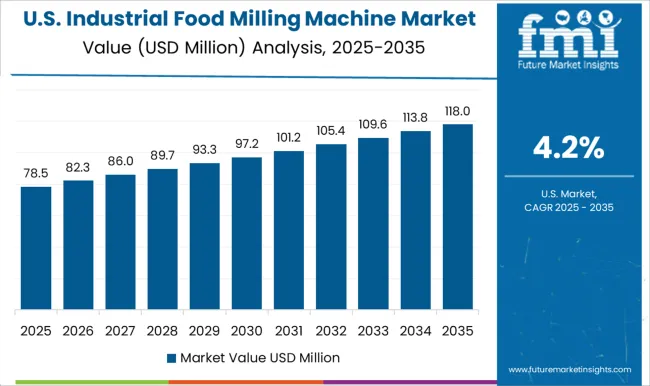

As per FMI, the USA will continue to remain the most dominant industrial food milling machine market during the forecast period, owing to the rising adoption of advanced food milling machines across the food industry.

Similarly, the growing focus on improving food quality and safety and the strong presence of leading manufacturers are expected to generate high demand for industrial food milling machines in the USA during the projection period.

Industrial food milling machines are large equipment used to process and grind various food products. In the USA, these machines are commonly used in commercial kitchens and restaurants.

They allow companies to increase their productivity, reduce costs, and minimize the risk of food contamination. As a result, more and more industries are installing them. This will boost the USA market over the next ten years.

Rapid Expansion of Food Processing Industry Generating Demand in India

According to the FMI, the industrial food milling machine market in India will grow at a robust CAGR of 6.3% during the forecast period, making it one of the fastest-growing markets across South Asia. A rapidly growing population, increasing consumer spending on processed food products and favorable government support are driving the Indian market.

Industrial food milling machines are an important piece of equipment for any food processing facility. India is a country with a rapidly growing food processing industry, and the demand for industrial food milling machines is on the rise. There are many different types and models of industrial food milling machines available on the market, and each has its own unique set of features and benefits.

Some of the most popular brands of industrial food milling machines include Buhler, Fritsch, GEA Group, JASTA, Kady International, and Netzsch. These manufacturers offer a wide variety of machines with different features and price points.

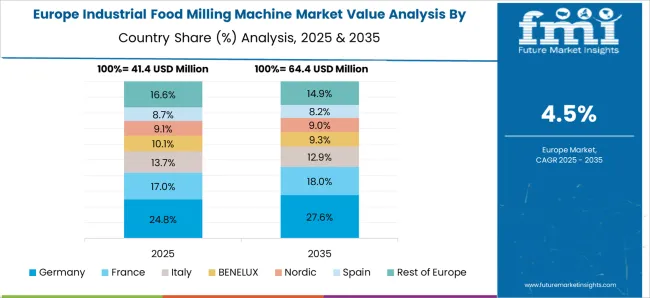

Presence of Leading Food Milling Machine Positioning Germany in Front Seat

Germany is likely to remain at the top of the ladder in the Europe industrial food milling machine market during the forecast period, owing to the rising demand for packaged and ready-to-eat food products and the heavy presence of leading manufacturers such as Ziermann Holvrieka.

The German company, Ziemann Holvrieka, is the leading manufacturer of food milling machines in Europe. With a market share of over 50%, the company has a significant advantage over its competitors. The company's products are used in a variety of industries, including the food and beverage industry, where they are used to process and package food products.

Ziemann Holvrieka has been able to maintain its position as the leading manufacturer of food milling machines in Europe due to its innovative designs and high-quality products. The company's products are constantly being updated and improved to meet the needs of its customers. In addition, Ziemann Holvrieka offers a wide range of services to its customers, including technical support and training.

Various Benefits of Online Distribution Channels Making Them Ideal for Purchasing These Machines

Based on the distribution channel, the online segment is likely to grow at the highest pace during the forecast period, owing to the increasing penetration of online shopping platforms and rising consumer inclination towards purchasing these food processing machines through online mode.

Online sales channels have played a major role in driving the growth of industrial food milling machines. These channels offer a convenient way for customers to purchase products like industrial food milling machines and have helped to reach a wider audience.

Key players operating in the global market include Alapala, Alvan Blanch Development Co., Beccaria S.r.l., Brabender GmbH and Co. KG, Buhler AG, Erich NETZSCH GmbH and Co. Holding KG, FRITSCH GmBH, FUCHS Maschinen AG, Glen Mills Inc., Hosokawa Micron Corp., IDEX Corp., IKA Werke GmbH and CO. KG, Isimsan Muh. San ve Tic. A.S., Jas Enterprises, Kice Industries Inc., Mill Powder Tech Co. Ltd., Omas Srl, ProXES GmbH, Royal Duyvis Wiener BV, and Satake Corp. among others.

These players are constantly adopting various strategies such as new product launches, partnerships, mergers, acquisitions, facility expansions, and collaborations to increase their revenue and gain a competitive edge in the market. For instance,

Searching for the Right Food Milling Tool! Get Novel Milling Technologies of Buhler AG and Satake Corp. for Better Experience!

With the growing need for improving product quality and production efficiency, food manufacturing and processing industries are increasingly installing industrial food milling solutions in their facilities. This has generated huge demand in this space and to meet this burgeoning demand, manufacturers are coming up with new products with advanced features.

Founded in 1896 as the first motorized rice milling machine manufacturer in Japan, Satake Corp. has become a leading manufacturer and supplier of industrial food milling machines. The company operates in over 150 countries. Its products range from rice milling systems, flour milling machinery, microbial analyzers for ballast water, and biomass gasification systems to packaged rice for the food industry.

Satake is continuously adopting various tactics such as new product launches, mergers, acquisitions, and facility expansion to increase its revenues and customer bases. For instance, in September 2020, a new addition to its oversea product brand REACH, SYSTEM 3.0, a semi-assembled rice milling plant geared towards smaller-scale rice processors mainly in Asian and African regions was announced by Satake. Similarly, in August 2025, Satake announced the opening of a new office in the Middle East region to further accelerate sales growth.

Another prominent manufacturer and supplier of food milling machines are Buhler AG. The company develops the best process solutions for a wide range of industries. It is estimated that around 2 billion people consume foods such as flour, rice, pasta, beer, coffee, and beer, that are made with Buhler processes on a daily basis.

In November 2024, Buhler launched Arrius, a fully integrated grinding technology for milling wheat, rye, barley, corn, and durum. With this new launch, Buhler has entered into a new milling era. The new integrated and self-adjusting grinding system is set to drive product quality, consistency, and profits in the milling industry.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 166.5 million |

| Projected Market Size (2035) |

USD 268.6 million |

| Anticipated Growth Rate (2025 to 2035) | 4.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Application, Distribution Channel, Region |

| Key Companies Profiled | Alapala; Alvan Blanch Development Co.; Beccaria S.r.l.; Brabender GmbH and Co. KG Buhler AG; Erich NETZSCH GmbH and Co. Holding ; KG; FRITSCH GmBH; FUCHS Maschinen AG; Glen Mills Inc.; Hosokawa Micron Corp.; IDEX Corp.; IKA Werke GmbH and CO. KG; Isimsan Muh. San ve Tic. A.S.; Jas Enterprises; Kice Industries Inc.; Mill Powder Tech Co. Ltd.; Omas Srl; ProXES GmbH; Royal Duyvis Wiener BV; Satake Corp |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global industrial food milling machine market is estimated to be valued at USD 166.5 million in 2025.

The market size for the industrial food milling machine market is projected to reach USD 268.6 million by 2035.

The industrial food milling machine market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in industrial food milling machine market are rice mill, corn mill, wheat flour mill, roll flour mill, food processing mill, spices mill, grain mill and cereals mill.

In terms of application, industrial purpose segment to command 57.0% share in the industrial food milling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA