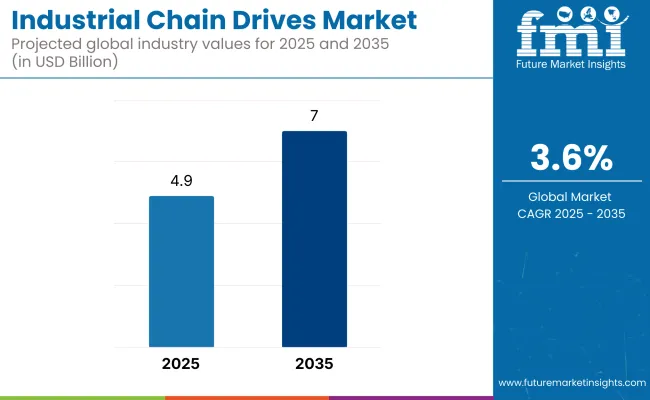

The global industrial chain drives market is projected to expand from USD 4.9 billion in 2025 to USD 7.0 billion by 2035, progressing at a CAGR of 3.6%. This steady rise is primarily driven by surging automation in manufacturing, mining, and logistics sectors.

The United States, Germany, and China are among the largest contributors, with China leading in production scale while Europe leads in sustainable innovation. Asia-Pacific countries, including India and Vietnam, are also becoming competitive due to localized manufacturing and growing industrial automation.

Key drivers fueling demand include the rising emphasis on energy efficiency, predictive maintenance, and eco-friendly materials. Chain drives are essential in power transmission systems across a wide array of industries-particularly those involving high-load, continuous-duty applications.

Single-strand chains remain dominant in standard applications, while double-pitch and multi-strand chains gain favor in heavy-load and conveyor systems. The use of smart sensors and AI-enabled chain systems is expected to rise sharply, particularly in Germany, the USA, and South Korea.

From 2025 onward, manufacturers are likely to pivot toward high-precision, corrosion-resistant, and self-lubricating chains. Sustainability trends will accelerate the adoption of lightweight composite materials, especially in Europe. While cost pressures remain significant, particularly due to volatile steel prices, leading firms are responding with regional manufacturing hubs and modular product lines to balance durability, performance, and cost-efficiency.

Moreover, the market is witnessing a strategic shift as companies align with regional regulatory frameworks and industrial modernization programs. In the United States and Western Europe, compliance with OSHA, ANSI, and EU Machinery Directives is pushing innovation in safety and energy-efficient chain solutions.

Meanwhile, South Korea and Japan are prioritizing compact, automation-ready chains tailored for space-constrained industrial environments. Strategic partnerships, such as those between chain manufacturers and automation firms, are accelerating the integration of real-time diagnostics and remote monitoring capabilities.

As Industry 4.0 gains momentum, the industrial chain drives market is evolving beyond mechanical components into digitally enhanced systems that offer predictive maintenance, reduced downtime, and optimized lifecycle performance.

The single-strand chain is the most common type of industrial chain drive in the industry, due to its simple structure, low cost, and good reliability, so it will continue to be used in more industries. Industries will continue to have a preference for single-strand chains for a variety of standard power transmission applications, particularly in areas where machinery requires moderate load-bearing ability. Improved materials and lubrication technologies will increase durability and reduce maintenance requirements.

The double-pitch chain is expected to become increasingly popular in various sectors that need efficient yet lightweight material handling and conveyor solutions. Its large pitch configuration leads to the best-suited application for low-speed, high-load areas for logistics, packaging, and warehouse automation.

The growing adoption of e-commerce and automated distribution centers will increase the demand for double pitch chains and manufacturers are expected to focus on improved corrosion resistance and wear protection to deliver longevity of performance.

The multi-strand chain will see steady demand growth driven by high-performance industrial applications with demands for better load distribution and power transmission. Key multi-strand chains are becoming the go-to choice among industries dealing with high-torque applications; be it heavy machinery, mining, or high-speed production lines, as they are better suited to handle extreme levels of stress and torque.

Leading end-users of industrial chain drives, manufacturing will continue to dominate demand, supported by increasing automation and expansion of smart factories. Predictive maintenance and AI-powered production systems are embedding themselves into all forms of industry, from small operations to entire supply chains, and chain drives will be fitted with real-time monitoring systems that will mitigate the risk of unplanned production halt.

Mining is still an important field for industrial chain drives, and the demand for heavy-duty and wear-resistant chains that can be used under extreme environmental conditions is increasing. Manufacturers will also be compelled to develop corrosion-resistant and high-strength chain drives that have longer replacement periods, owing to the increased emphasis on eco-friendly mining processes.

Agriculture will remain a prominent end-user segment, as chain drives are crucial for farming equipment, harvesters, and irrigation systems. As the agricultural industry moves toward precision farming and automation, the need for high-durability, lightweight, and weather-resistant chains will increase.

Infrastructure development projects across the globe will foster steady demand for industrial chain drives, especially in construction. High-load capacity chain drives, which can withstand extreme stress and harsh environmental conditions, will be needed for heavy machinery, cranes, and lifting equipment.

The demand for industrial chain drives will remain attributed to energy, logistics, and marine applications, among other industries. The renewable energy industry will need durable chains for wind turbines and hydroelectric plants, driving manufacturers to find innovative environmentally friendly materials.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in the USA, Western Europe, Japan, and South Korea)

Efficiency & Durability: 74% of stakeholders identified long-lasting, high-performance chain drives as a top priority.

Regional Variance

Investment in IoT & Predictive Maintenance

Rising Raw Material Costs: 85% of stakeholders cited steel price volatility as a major challenge.

Regional Variance

72% of stakeholders plan to increase R&D spending on automation & predictive maintenance technologies.

Regional Focus Areas

Regulatory & Compliance Challenges

High Consensus: Safety, durability, and automation are universal priorities across regions.

Key Regional Variances

A one-size-fits-all strategy won’t work-manufacturers must adapt product portfolios to regional demands (e.g., stainless steel dominance in the US, eco-friendly materials in Europe, compact hybrid designs in Asia).

| Country/Region | Government Regulations & Mandatory Certifications Impacting the Market |

|---|---|

| United States (USA) | OSHA (Occupational Safety and Health Administration) enforces workplace safety compliance, with manufacturers being forced to meet strict industrial safety standards. - ANSI (American National Standards Institute) B29.1 & B29.2 define design and performance requirements for roller and silent chain drives. - EPA (Environmental Protection Agency) regulations promote the use of energy-efficient, low-emission chain drive systems. - API (American Petroleum Institute) 7F certification is required for chain drives in oil & gas applications. |

| Western Europe | The EU Machinery Directive (2006/42/EC) imposes strict safety standards on mechanical transmission systems, such as chain drives. - CE (Conformité Européenne) Certification of chain drives industry in the EU guarantees compliance with health, safety, and environmental protection requirements. - REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) Regulations limit dangerous materials in chain production. - ISO 10823:2004 international standards inform fatigue failure and lifespan calculation for industrial chain drives. |

| Japan | JIS (Japanese Industrial Standards) B1801 & B1802 establish standards for industrial roller chains and silent chains. - METI (Ministry of Economy, Trade, and Industry) encourages energy-efficient industrial machinery, which has implications for chain drive design in reducing power consumption. - Japanese Environmental Standards have the effect of pushing the use of lightweight, recyclable chain material. |

| South Korea | KOSHA (Korean Occupational Safety and Health Agency) Regulations mandate safety and durability levels of chain drives in manufacturing. |

In the USA, the Industrial Chain Drives industry between 2025 and 2035 will be stimulated by the growing take-up of intelligent and automated chain drive systems in manufacturing, food processing, and logistics industries. OSHA and API regulations will also determine industry demand, necessitating improved safety, toughness, and energy efficiency. The drive toward predictive maintenance and IoT-supported chain drive solutions will gain pace with more than 70% of manufacturers predicted to adopt real-time monitoring technologies through 2030.

Moreover, supply chain localization will continue to be a concern as firms attempt to decrease dependence on foreign suppliers, especially amid volatile steel prices and geopolitical trade risks.

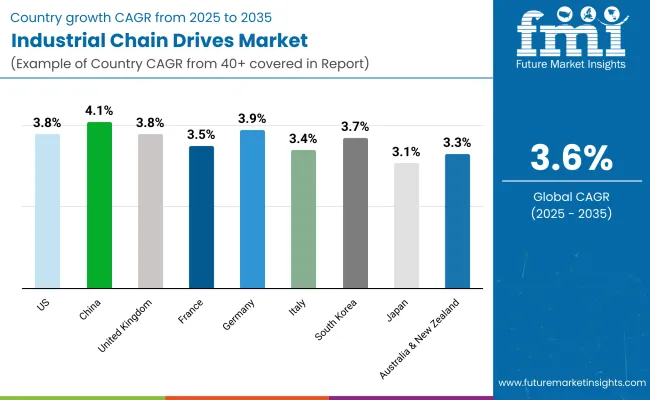

FMI opines that the United States industrial chain drives sales will grow at nearly 3.8% CAGR through 2025 to 2035.

The industrial chain drive industry in the UK will be dominated by post-Brexit trade policy, sustainability targets, and growing industrial automation. CE marking and UKCA marking will be required, making chain drive manufacturing comply with stringent environmental and safety standards. Carbon-neutral manufacturing efforts will drive demand for recyclable and energy-efficient chain drive systems.

Between 2025 and 2035, British manufacturing and logistics industries will concentrate on automated material handling systems, thus boosting demand for high-efficiency chain drives with real-time monitoring. The increasing renewable energy industry (offshore wind, hydrogen production) will demand heavy-duty, corrosion-proof chain drives to enable industrial infrastructure development.

FMI opines that the United Kingdom industrial chain drives sales will grow at nearly 3.8% CAGR through 2025 to 2035.

France's Industrial Chain drives industry will be heavily impacted by EU environmental regulations, compelling manufacturers to adopt low-emission, high-efficiency chain solutions. The automotive, aerospace, and food processing industries will remain the key drivers of demand, especially for customized, high-durability chain drives that are compatible with Industry 4.0 automation.

2025 to 2035 will witness tremendous emphasis on supply chain resilience, with French manufacturers seeking to minimize dependence on imports through material sourcing from within the region and sophisticated production methods. France's stringent safety standards (AFNOR standards) will also influence procurement decisions, resulting in greater investment in high-quality chain drives that enable predictive maintenance. Sustainability will promote the adoption of lightweight, environmentally friendly materials, further tilting industry inclinations toward next-generation chain drive solutions.

FMI opines that France's industrial chain drives sales will grow at nearly 3.5% CAGR through 2025 to 2035.

Germany's chain drive industry will be among the most technologically superior as a result of its heavy emphasis on automation, precision engineering, and eco-friendliness. Industrial buildings are predicted to include predictive maintenance and AI diagnostics by 85% by the year 2035, supporting Germany's status as a leading nation in Industry 4.0 technologies.

The automotive and heavy machinery industries will remain the drivers of demand, with the transition to electric vehicles (EVs) and sustainable manufacturing impacting the application of lightweight chain drive materials. More stringent EU sustainability laws will drive the use of composite and hybrid chain materials, lowering carbon footprints.

FMI opines that Germany's industrial chain drives sales will grow at nearly 3.9% CAGR through 2025 to 2035.

Italy's drive industry for chain drives will be influenced by robust demand from the food & beverage, automotive, and textile sectors. Between 2025 and 2035, Italian producers will concentrate on high-performance corrosion-resistant chain drives designed to meet demanding industrial applications.

Automation will be a key driver, with IoT-enabled solutions becoming increasingly popular. The Italian government's emphasis on smart manufacturing incentives will increase investment in high-tech, energy-efficient chain drives. EU sustainability requirements will also demand low-emission production processes, compelling Italian manufacturers to seek out biodegradable and recyclable chain materials. Even with economic volatility, the nation's industrial modernization push will maintain steady industry growth.

FMI opines that Italy's industrial chain drives sales will grow at nearly 3.4% CAGR through 2025 to 2035.

South Korea's industrial chain drive industry will be dominated by automation, robotics, and intelligent manufacturing programs. More than 60% of chain drive systems employed in South Korean industries will have advanced automation and real-time analytics by 2035.

The heavy industry, automotive, and semiconductor industries will propel the demand for wear-resistant, high-precision chain drive systems. Government-sponsored programs, including K-Smart Manufacturing, will challenge local manufacturers to invest in energy-efficient, automated chain systems. Supply chain breakdowns in the early 2020s will also drive increased regional material sourcing initiatives, enhancing domestic production capacities.

FMI opines that South Korea's industrial chain drives sales will grow at nearly 3.7% CAGR through 2025 to 2035.

Japan's Industrial Chain Drive industry will emphasize cost efficiency, precision engineering, and miniaturization. Demand in the period between 2025 and 2035 for durable, compact chain drives will be on the rise, especially within robotics, automobile, and automated applications.

The aging working population will compel industries to embrace automated solutions, necessitating the demand for maintenance-free, AI-based chain systems. Japan's dedication to sustainability will also determine material choice, and the industry will witness an increase in hybrid and light metal alloys.

FMI opines that Japan's industrial chain drives sales will grow at nearly 3.1% CAGR through 2025 to 2035.

China's Industrial Chain Drives industry will grow at a fast pace between 2025 and 2035, with mass industrialization, automation, and the emergence of smart factories. Made in China 2025 initiatives will drive high-tech, automated manufacturing solutions, taking IoT-based chain drive adoption to over 70% by 2030.

The construction, mining, and heavy machinery industries will continue to be leading end-users, driving demand for rugged, high-load capacity chain drives. China's emphasis on sustainability will also see a move toward recyclable and low-emission chain materials.

FMI opines that China's industrial chain drives sales will grow at nearly 4.1% CAGR through 2025 to 2035.

The Australian and New Zealand (ANZ) Industrial Chain Drives industry will experience steady growth with rising demand from mining, agriculture, and renewable energy industries. The use of high-strength, corrosion-resistant chain drives will increase between 2025 and 2035, especially in offshore oil rigs, wind farms, and farm equipment.

Australia's emphasis on sustainability and lower carbon emissions will compel domestic producers to create eco-friendly, energy-efficient chain drives. Moreover, logistics and mining automation will ensure demand for smart, IoT-connected chain solutions.

FMI opines that the Australia-NZ industrial chain drives sales will grow at nearly 3.3% CAGR through 2025 to 2035.

| 2020 to 2024 | 2025 to 035 |

|---|---|

| The industrial chain drives industry experienced steady growth, mainly driven by increasing automation in manufacturing, logistics, and heavy industries. Demand remained stable despite supply chain disruptions caused by global events like the COVID-19 pandemic. | The industry is expected to expand rapidly due to the widespread adoption of AI-powered automation, predictive maintenance, and smart industrial solutions, transforming supply chains and production efficiency. |

| Industries started integrating basic automation and IoT-enabled chain drives for remote monitoring and efficiency improvements. However, many systems still relied on traditional mechanical operations. | The future will see highly advanced chain drives embedded with AI, real-time analytics, and self-diagnosing capabilities, reducing downtime and improving efficiency. Blockchain technology may enhance supply chain transparency. |

| Chain drives were predominantly made from traditional steel and alloys with limited advancements in material innovation. Some industries experimented with coated surfaces for durability. | By 2035, manufacturers will use lightweight composite materials and advanced coatings that improve wear resistance, reduce energy consumption, and enhance longevity, leading to more sustainable and high-performance chain systems. |

| Companies began focusing on energy efficiency and low-maintenance solutions to reduce operational costs. Sustainability initiatives were emerging but not a primary driver. | Sustainability will become a core focus, with companies moving toward net-zero emissions, recyclability, and eco-friendly lubrication systems. Circular economy models will drive material reuse and waste reduction. |

| The early adoption of Industry 4.0 saw challenges in seamless connectivity and data integration. Some businesses hesitated due to high implementation costs and technical complexities. | Full-scale adoption of Industry 4.0 technologies will drive real-time data sharing, AI-driven automation, and self-optimizing chain drive systems, making industries more autonomous and efficient. |

| Standardized solutions dominated the industry, with only large industries opting for customized chain drive configurations to meet specific operational needs. | The industry will shift towards modular, highly customizable chain drive systems, allowing businesses to configure solutions specific to their processes, reducing energy consumption and enhancing performance. |

| Global supply chains faced major disruptions, leading to delays in production and increased costs. Companies explored localized manufacturing and digital tracking systems to manage risks. | By 2035, supply chains will be highly digitalized, localized, and automated, reducing dependency on global networks and making production more resilient against external shocks. |

| Some improvements in chain drive efficiency were made, but most systems still relied on mechanical optimization rather than smart energy-saving technology. | Future chain drives will feature self-regulating energy-saving systems, with sensors and AI-driven automation adjusting operations in real time to minimize waste. |

| Governments introduced new environmental regulations, pushing manufacturers to adopt energy-efficient solutions and reduce carbon footprints. However, enforcement remained inconsistent. | Stricter regulations and incentives will drive widespread compliance with carbon neutrality mandates, sustainable sourcing, and waste reduction policies, making green manufacturing the industry standard. |

| Chain drives were mainly used in automotive, manufacturing, logistics, and heavy machinery industries, with growing adoption in warehouse automation. | New industries such as electric vehicles, renewable energy, robotics, and smart factories will drive demand for next-generation intelligent chain drives optimized for energy efficiency and seamless integration. |

| Traditional manufacturers held the dominant industry share, with new competitors struggling to gain traction due to high investment costs and industry standardization. | The rise of tech-driven startups, AI-powered manufacturing solutions, and digital-first industrial automation firms will challenge traditional players, driving innovation and lowering barriers to entry. |

The industrial chain-drives industry is a part of the mechanical power transmission equipment segment, which is a vital subsector of the overall industrial machinery and equipment space. It has close linkage to manufacturing, mining, agricultural, construction, and logistics sectors. The sector is very sensitive to macroeconomic conditions like industrial production, commodity prices, infrastructure activity, and technological changes.

The industry is on track for sustained long-term growth through growth in industrial automation, demand for global manufacturing, and migration toward energy-saving and long-lasting mechanical components. Favorable economic policies toward the expansion of infrastructure, particularly in the developing world, will stimulate industrial chain drive demand.

The industrial chain drives leading suppliers in the industry to compete based on pricing, innovation, alliances, and geographic expansion. Large-scale companies target high-duty chain drives for heavy industries such as manufacturing and mining, while medium-sized companies target price-conscious industries. Price competition is high in the Asia-Pacific region, where regional producers provide lower-cost options.

The firms have been investing in light and corrosion-proof chain materials, self-lubricating chain components, as well as real-time monitoring sensors and predictive maintenance. Most of them make regional expansions, acquisitions, and partnerships in automation to solidify their presence. Several of them are localizing manufacturing and establishing regional manufacturing centers as a way of reducing risks associated with supply chains. The above strategies assist companies to remain competitive while being in compliance with changing industry regulations and sustainability objectives.

The industrial chain drives industry is moderately consolidated with Tsubaki, Renold, Rexnord, and Timken's respective industry leaders promising good R&D and distribution networks.

single strand chain, double-pitch chain, and multi-supply chain

Manufacturing, mining, agriculture, construction, and others

North America, Latin America, Europe, Asia-Pacific, The Middle East and Africa (MEA)

Technological advancements, automation, sustainability initiatives, and increasing demand from industries like manufacturing, mining, and construction.

By investing in innovation, smart monitoring solutions, durable materials, strategic partnerships, and regional expansion.

Companies are adopting eco-friendly materials, energy-efficient designs, and greener manufacturing processes to meet regulatory and consumer demands.

North America and Europe lead in automation and smart technologies, while Asia-Pacific focuses on affordability and scalability.

IoT-enabled monitoring, predictive maintenance, and AI-driven analytics enhance performance, reduce downtime, and improve efficiency.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA