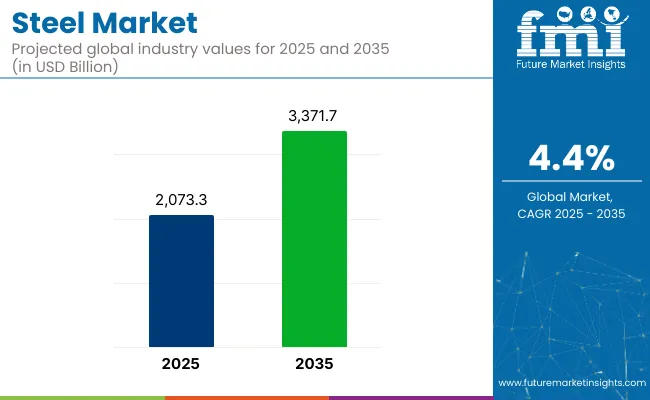

The steel market is valued at USD 2,073.3 billion in 2025 and is projected to reach USD 3,371.7 billion by 2035, expanding at a CAGR of 4.4%. Global demand for steel has been supported by construction, automotive, and infrastructure sectors. As economies invest in urban development and renewable energy, structural-grade and specialty steels are gaining attention for their durability, cost-effectiveness, and versatility in large-scale applications.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 2,073.3 billion |

| Industry Value (2035F) | USD 3,371.7 billion |

| CAGR (2025 to 2035) | 4.4% |

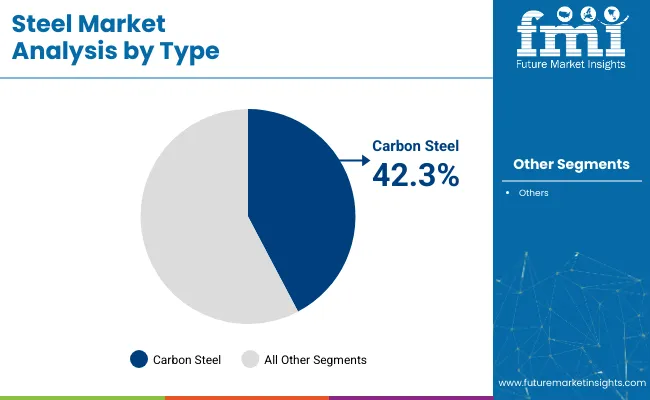

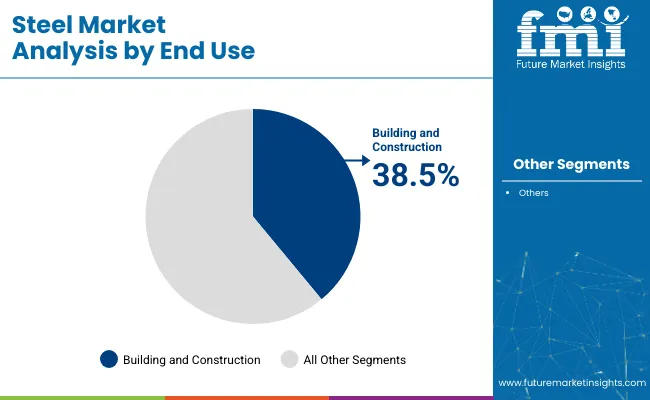

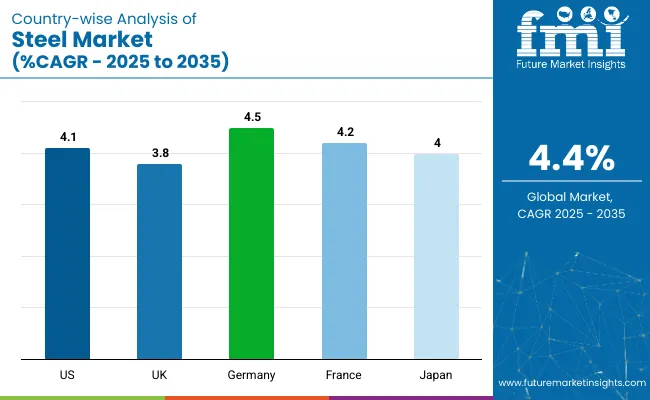

Carbon steel is anticipated to hold the highest share among material types due to its wide applications across infrastructure and machinery, contributing approximately 42.3% of total revenue in 2025. In end-use, building and construction is likely to lead with over 38.5% share. Meanwhile, Germany is expected to register the fastest growth at a CAGR of 4.5%, driven by its automotive and shipbuilding industries.

The steel market holds approximately 70% to 75% share in the ferrous metals market, given its dominant role among iron-based materials. Within the metals market, steel accounts for around 45% to 50%, supported by its widespread industrial use. In the construction materials market, it represents 30% to 35%, being vital for structural applications.

The automotive materials market sees a 25% to 30% share for steel, particularly in vehicle frames and body parts. Steel also holds about 20% in the industrial raw materials market and 15% to 20% in engineering materials, where strength, durability, and cost-efficiency are key factors.

Innovation in the steel market has focused on hydrogen-based production processes, electric arc furnace (EAF) integration, and lightweight high-strength alloys for EV manufacturing. Manufacturers are shifting toward customized steel grades for specific end-use industries, with R&D investments targeting better corrosion resistance, heat tolerance, and recyclability. Advanced digital manufacturing tools such as AI-driven quality monitoring and predictive maintenance are being adopted across production lines.

Sustainability has become a critical pillar of growth in the steel industry. Countries such as Germany, France, and Japan are incentivizing low-carbon technologies, while steelmakers globally are investing in green hydrogen, carbon capture, and EAF upgrades. Regulatory mechanisms like the Carbon Border Adjustment Mechanism (CBAM) in the EU and incentives under the USA’s Inflation Reduction Act are encouraging firms to accelerate their decarbonization roadmaps.

Geopolitical instability and raw material cost fluctuations have emerged as challenges in global steel production. In response, steel producers are securing long-term supplier agreements and building regional production hubs to strengthen supply chain resilience. Demand remains strong across EVs, offshore wind, and infrastructure sectors, suggesting continued market robustness through 2035.

The market is segmented by type, end use, and region. By type, the market is categorized into carbon steel (low-carbon steel, medium-carbon steel, high-carbon steel), stainless steel (austenitic, ferritic, martensitic, others), alloy steel (high strength steel, low alloy steel), tool steel, and others (weathering steel).

Based on end use, the market is segmented into building and construction (escalators and lifts, cladding, frames and supporting rails, piping, plumbing and drainage, roofing), automotive (chassis, automotive body parts, others), railways, shipbuilding and marine, aerospace, oil and gas and energy, heavy machinery and equipment, consumer appliances, and cutting tools and agriculture equipment. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa.

Carbon steel is expected to dominate the steel type segment, capturing 42.3% of the global market share in 2025. Its widespread use in construction, automotive, pipelines, and heavy equipment is due to its cost-effectiveness, tensile strength, and versatility.

The building and construction segment is projected to account for 38.5% of the global steel demand by 2025. The expansion of public infrastructure, housing projects, and commercial buildings has significantly contributed to the segment’s growth.

The global steel market is experiencing consistent growth, driven by rising infrastructure investment, demand from automotive and energy sectors, and decarbonization-led innovation. Manufacturers are increasingly shifting toward electric arc furnaces (EAFs) and green hydrogen technologies to align with carbon regulations and cost efficiency.

Recent Trends in the Steel Market

Challenges in the Steel Market

Germany leads steel market growth among the listed countries with a projected CAGR of 4.5% (2025 to 2035), driven by EV demand, renewable energy investments, and hydrogen-based steelmaking. France follows at 4.2%, supported by offshore wind projects and green steel policies.

The USA shows a 4.1% CAGR, fueled by infrastructure spending and reshoring. Japan, at 4.0%, benefits from specialty steel exports and AI-integrated production despite slowing domestic demand. The UK lags slightly with a 3.8% CAGR, focusing on decarbonization and stainless steel applications. Across these regions, climate goals, EV sector growth, and digital transformation are shaping steel market expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The sales of steel in the USA is forecasted to grow at a CAGR of 4.1% from 2025 to 2035. This is driven by strong infrastructure spending, demand from EV and energy sectors, and reshoring initiatives aimed at reducing import reliance.

The steel revenues in the UK is projected to grow at a CAGR of 3.8% during the forecast period. Green steel initiatives and regulatory support for decarbonization are central to its transformation.

Demand for steel in Germany is expected to register a CAGR of 4.5% from 2025 to 2035. The country's leadership in automotive and renewable energy is enhancing demand for advanced, sustainable steel solutions.

Steel sales in France is projected to expand with a CAGR of 4.2% through 2035. Offshore wind energy and EV sectors are key drivers, with strong regulatory support for low-emission steelmaking.

Japan’s steel revenue is anticipated to grow at a CAGR of 4.0% over the forecast period. High-quality specialty steel exports and precision manufacturing are sustaining growth.

The global steel market is moderately consolidated with dominant players and regional competitors shaping growth through sustainability, capacity expansion, and product innovation. Strategic partnerships, AI-integrated manufacturing, and investments in low-carbon technologies are key competitive levers.

Top-tier firms such as China Baowu Steel Group, ArcelorMittal, POSCO, Nippon Steel, and JSW Steel are scaling electric arc furnace (EAF) projects, advancing specialty steel production, and expanding into green hydrogen steelmaking.

Recent Steel Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2,073.3 billion |

| Projected Market Size (2035) | USD 3,371.7 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in metric tons |

| By Steel Type | Carbon Steel (Low-, Medium-, High-Carbon), Stainless Steel (Austenitic, Ferritic , Martensitic , Others ), Alloy Steel (High Strength, Low Alloy ), Tool Steel, Others |

| By End Use | Building and Construction (Escalators & Lifts, Cladding, Frames, Piping, Drainage, Roofing), Automotive (Chassis, Body Parts, Others), Railways, Shipbuilding and Marine, Aerospace, Oil & Gas and Energy, Heavy Machinery and Equipment, Consumer Appliances, Cutting Tools and Agriculture Equipment |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East, Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, India, Italy |

| Key Players | Baowu Group Corporation Limited, ArcelorMittal , Nippon Corporation, Thyssenkrupp AG, Nucor Corporation, JFE Corporation, Tata Limited, Posco International, Cleveland-Cliffs Inc , EVRAZ Plc, Gerdau S.A., Hyundai Co, Jiangsu Shagang Group Co., Ltd., United States Corp., Novolipetsk Steel, Severstal , Authority of India Limited, and JSW Limited. |

| Additional Attributes | Market share analysis by steel type and region, policy impact tracking, decarbonization investment trend, and country-wise CAGR analysis |

Carbon Steel, Low-Carbon Steel, Medium-Carbon Steel, High-Carbon Steel, Stainless Steel, Austenitic Stainless Steel, Ferritic Stainless Steel, Martensitic Stainless Steel, Others, Alloy Steel, High Strength Steel, Low Alloy Steel, Tool Steel, Others

Building and Construction, Escalators and Lifts, Cladding, Frames and Supporting Rails, Piping, Plumbing and Drainage, Roofing, Automotive, Chassis, Automotive Body Parts, Others, Railways, Shipbuilding and Marine, Aerospace, Oil and Gas and Energy, Heavy Machinery and Equipment, Consumer Appliances, Cutting Tools and Agriculture Equipment

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East, Africa

The market is expected to reach USD 3,371.7 billion by 2035.

The market is projected to grow at a CAGR of 4.4% during this period.

Carbon steel is expected to lead with a 42.3% market share in 2025.

Building and construction is expected to hold a 38.5% share of the market in 2025.

Germany is anticipated to be the fastest-growing market with a CAGR of 4.5% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA