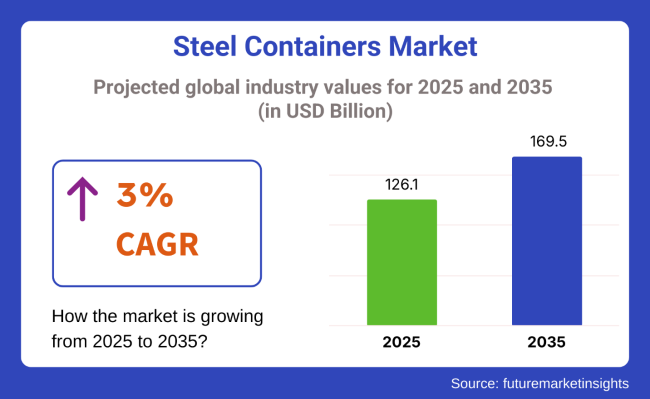

The global steel containers market is on a steady growth trajectory, projected to rise from USD 126.1 billion in 2025 to USD 169.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3% over the forecast period. Sales in 2024 reached USD 122.4 billion, reflecting stable demand across industrial and commercial packaging sectors.

The growth is driven by increasing demand across various industries, including food and beverage, pharmaceuticals, logistics, and hazardous material storage, where durable and sustainable packaging solutions are essential. Steel containers, known for their robustness and recyclability, are becoming the preferred choice for applications that require both functionality and environmental compliance.

THIELMANN, a global leader in stainless steel container solutions, marked a significant innovation milestone in November 2024 with the launch of the VERTEX keg the world’s first duplex stainless steel keg designed specifically for the beverage industry.

The VERTEX keg is engineered to be 30% lighter than conventional kegs while enhancing durability and lifecycle performance. "We are incredibly proud of our R&D team for achieving this remarkable breakthrough," said Alberto Borque, Chief Operating Officer at THIELMANN.

“The VERTEX keg is a testament to their expertise, tenacity, and dedication to creating sustainable solutions for the brewing industry. This keg will redefine industry standards and pave the way for a greener, more efficient future for brewing.”

The shift towards eco-friendly and recyclable materials is a significant driver in the steel containers market. Manufacturers are investing in coating technologies that enhance the durability of containers without compromising their recyclability. Additionally, the integration of digital tracking allows for better inventory management and supply chain efficiency. These innovations not only meet environmental standards but also offer functional benefits to end-users.

By 2035, the steel containers market is expected to create an incremental opportunity of USD 43.4 billion. The market's expansion is supported by regulatory measures against single-use plastics and the increasing adoption of sustainable practices by businesses. Companies that prioritize innovation, sustainability, and customization are well-positioned to capitalize on emerging opportunities in this sector.

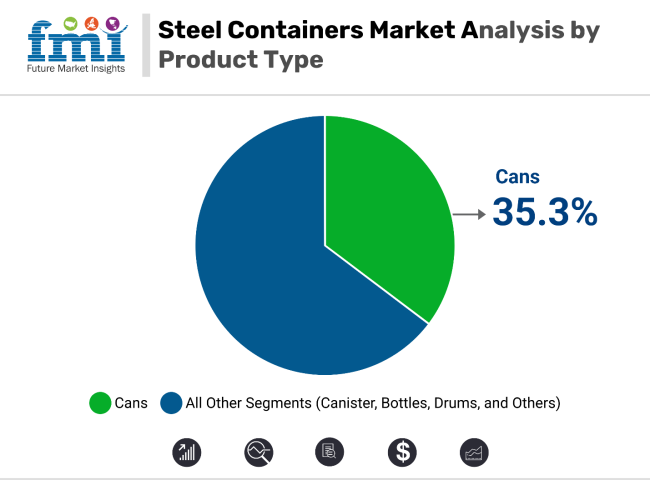

Cans are forecasted to dominate the product type segment of the steel containers market with a 35.3% market share in 2025, owing to their widespread use across food, beverage, paint, chemical, and aerosol packaging industries. Known for their structural integrity, resistance to pressure, and efficient recyclability, steel cans offer a safe and sustainable solution for both liquid and semi-solid contents.

The robust nature of steel cans makes them ideal for carbonated beverages, oil-based products, and materials sensitive to light and oxygen exposure. Their compatibility with high-speed filling and sealing lines enables mass production efficiency, making them the preferred choice for fast-moving consumer goods (FMCGs). Furthermore, steel’s impermeability and tamper-proof features add a layer of product protection and consumer safety.

Modern steel cans often include easy-open ends, protective lacquers, and corrosion-resistant coatings, enhancing usability and shelf life. With a high recycling rate and the ability to be reprocessed indefinitely without quality loss, steel cans align well with circular economy goals.

As demand grows for sustainable and convenient packaging across retail and industrial sectors, steel cans are set to retain their stronghold through 2025 by offering durability, cost-effectiveness, and eco-conscious advantages.

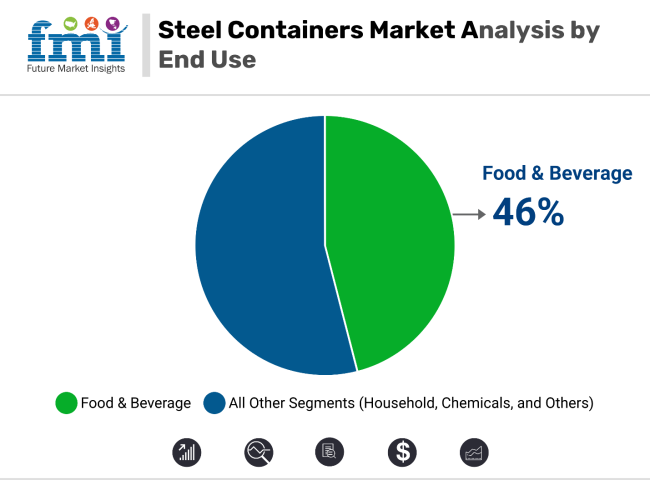

The food and beverage industry is projected to dominate the steel container market in 2025, accounting for an estimated 46% share. This leading position is attributed to the sector’s stringent requirements for hygiene, durability, and extended shelf life areas where steel containers offer unmatched value.

These containers provide superior protection against contamination, oxidation, and environmental impact, making them ideal for packaging canned foods, dairy products, ready-to-drink beverages, and nutritional liquids. Steel containers are extensively adopted for both primary and bulk packaging needs in food processing plants and beverage production lines.

Their ability to withstand high heat and pressure makes them particularly effective for sterilized products and pasteurized goods. Moreover, steel’s impermeability ensures flavor integrity and prevents chemical leaching, which is especially crucial for sensitive or acidic food formulations.

The integration of tamper-evident features, corrosion-resistant coatings, and sustainable recyclability further cements steel containers as a reliable packaging choice in the food and beverage domain. With rising demand for packaged and processed foods-particularly in urban and export-driven markets-the adoption of steel containers is expected to rise steadily.

As manufacturers increasingly prioritize safety and shelf-stability, the food and beverage segment will continue to drive the largest volume and value demand in the global steel container ecosystem.

Sustainability and Recyclability Initiatives to Propel Product Demand

Steel containers are highly recyclable, which is in line with the growing consumer and regulatory focus on sustainability. This eco-friendly attribute has contributed to their growing use in industries looking to reduce their carbon footprint and meet stricter environmental standards, further driving the market for steel packaging solutions.

Rising Industrialization and Urbanization to Impel Product Sales

The growth of industrial activities and urbanization in emerging markets has fueled the market demand for steel containers. As manufacturing, logistics, and distribution sectors expand, the need for safe, reliable, and efficient storage and transport solutions like steel containers increases, thereby fueling market growth.

Advancements in Steel Containers

The developments in steel containers have made them lighter, more corrosion-resistant, which have enhanced their durability and made them easier to transport. New coatings and linings have been developed to prevent contamination and enhance food safety. Innovation in design has led to efficient, stackable, and customizable steel containers, optimizing space and reducing costs in logistics.

Preference for Non-toxic Solutions

A mega consumer trend in the steel containers market is the preference for safe, non-toxic, and eco-friendly packaging solutions. Consumers are becoming increasingly health and environmentally conscious about the effects of packaging, and thus there is a need for steel containers that can offer durability, recyclability, and sustainability in several industries.

This is driven by regulatory pressure and the growing demand of consumers for more eco-friendly packaging solutions that can reduce waste and promote recycling.

High Cost May Limit Demand

One of the major restraining factors in the steel container market is the high initial cost and price volatility of raw materials. Industrial storage, shipping, and packaging steel containers are made from high-grade steel whose prices fluctuate with changes in global steel supply, trade policies, and production costs.

The rising cost of raw materials affects the profit of manufacturers and puts a higher end price on its final product from supply chain disturbances, increased demands, and increased tariffs on importation of the steel.

The USA is set to register a 19.8% share in 2025. From 2023 to 2025, USA consumers shift their purchases to high-quality and durable steel containers. Preference is growing toward storage containers that provide extra safety, corrosion resistance, and sustainability. Food and beverage, chemicals, and others operate in more specialized packaging with added features like storage for a long time.

Increased per capita consumption arises as the industry and consumers alike have increased dependence on steel containers as the ultimate form of safe, durable storage. The protection provided by steel containers makes them an obvious choice for many industrial and commercial ventures.

Per capita spending has increased as consumers focus on investing in premium steel containers that are more reliable, stronger, and environmentally friendly. The trend of investing in long-lasting, recyclable products is responsible for higher spending.

ArcelorMittal, Nippon Steel, and Tata Steel are some of the top companies that cater to these preferences through the development of advanced steel alloys, improvement of product features, and sustainability efforts. Mauser Group and Schutz respond to the increasing demand for custom solutions and eco-friendly packaging by extending their product offerings to meet the needs of consumers.

There is an increasing demand for containers with extra safety, corrosion-resistance, and sustainability attributes. Consumers and industries also prefer secure robust packaging solutions of various applications which range from the storage of foods to industrial products. Steel containers are the preferable option for lasting and safe storages.

Consumers spend more money on high-grade steel cans with better performance and eco-friendly qualities. There has been higher spending in the market due to an increased demand for long-lasting and recyclable packaging.

The German market is projected to observe 6.3% CAGR during the study period. Per capita consumption has increased because of stricter safety requirements and the need for more reliable packaging in sectors like industry. Steel containers have become popular because they are non-degradable products, and this has resulted in maintaining the quality of the product over a period of time.

Per capita spending has increased because consumers have started focusing on premium steel containers, with better functionality, corrosion resistance, and eco-conscious design. The heightened need for high-performance solutions results in higher spending.

ArcelorMittal, Nippon Steel, and Tata Steel are key companies that have placed their focus on product innovation and sustainability to meet growing market demands. The Mauser Group and the Schutz expand their product range through highly specialized and customizable solutions for different application fields, considerably enhancing the functionality and safety of their steel containers.

There has been a trend of purchasing steel containers in China from 2023 to 2025 with increased emphasis on convenience and functionality. There is a higher demand for convenient, easy-to-handle, and efficient storage solutions in specific sectors, including food, chemicals, and pharmaceuticals.

There are increased levels of per capita consumption because of the widespread use of steel containers in the manufacturing, transportation, and packaging sectors.

A preference for better-to-handle container designs specific to certain industries, such as food, beverage, and pharmaceutical, is growing as demand for safe and efficient storage increases.

Per capita consumption has increased with the increase in use of steel containers across different manufacturing, food processing, and logistics sectors, and increased demand for safe and effective storage.

Per capita spending has increased, with companies and consumers investing in specialized steel containers that suit them, such as those with increased capacity and handling features for efficiency and effectiveness.

| Demographic Aspect | Key Shifts |

|---|---|

| Industry Type | Manufacturing sector showing 35% higher adoption across regions |

| Business Size | SMEs increasing purchase by 40% YoY |

| Geographic Location | Coastal regions showing 2.5x higher demand for corrosion-resistant containers |

| Usage Pattern | 55% shift toward rental/leasing models in developed markets |

| Environmental Focus | 60% increase in recycled steel container demand |

| Storage Purpose | Chemical storage growing fastest at 45% YoY |

SteelPack Solutions is a startup, which specializes in providing superior steel containers to the food and beverage sector. It aims to grow through customized solutions that best fit client requirements and specialized focus on sustainability and better life product characteristics using innovative technologies. SteelPack will extend its market share by targeting emerging smaller markets and significant players in the packaging industry.

EcoSteel Containers is a startup focused on providing green and cost-effective steel container solutions for the chemicals and pharmaceutical industries. The company's strategy is to make products that are environmentally responsible with enhanced durability and safety features.

The company is looking to expand its brand recognition through competitive pricing, increasing distribution channels, and meeting global demand for sustainable packaging solutions.

Recent Developments

The market has been studied based on segments, including product type, capacity type, end use, and region.

With respect to product type, the market is divided into jars, cans, canister, bottles, drums, kegs, and IBCs.

By capacity type, the market is classified into less than 2 liter, 2 - 10 liter, 10 - 20 liter, 20 - 50 liter, 50 - 100 liter, and more than 100 liter.

By end use, the market is divided into food, beverage, household, chemicals, and others.

From the regional standpoint, the market is segregated into Latin America, Asia Pacific, the Middle East & Africa, North America, and Europe.

The market is anticipated to reach USD 126.1 billion in 2025.

The market is predicted to reach a size of USD 169.5 billion by 2035.

Some of the key companies manufacturing the product include Supermonte Group Italy, Inc., SCHÄFER Container Systems, Unique Steel, and others.

The USA is a prominent hub for product manufacturers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 44: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Capacity Type, 2017 to 2032

Table 46: Middle East and Africa Market Volume (Units) Forecast by Capacity Type, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End Use, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 21: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Capacity Type, 2022 to 2032

Figure 23: Global Market Attractiveness by End Use, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 45: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Capacity Type, 2022 to 2032

Figure 47: North America Market Attractiveness by End Use, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Capacity Type, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 93: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Capacity Type, 2022 to 2032

Figure 95: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Capacity Type, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by End Use, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Capacity Type, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by End Use, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 130: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Capacity Type, 2017 to 2032

Figure 134: Middle East and Africa Market Volume (Units) Analysis by Capacity Type, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity Type, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity Type, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 138: Middle East and Africa Market Volume (Units) Analysis by End Use, 2017 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Product Type, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Capacity Type, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Steel Containers Industry

Foldable Steel Containers Market Insights & Growth 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA