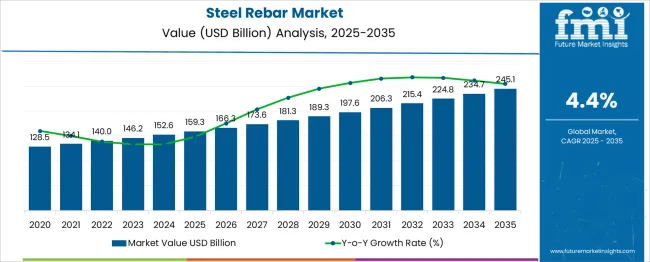

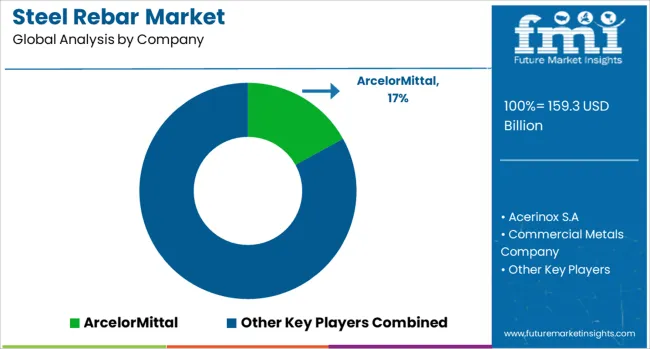

The Steel Rebar Market is estimated to be valued at USD 159.3 billion in 2025 and is projected to reach USD 245.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

During the early phase from 2025 to 2030, the market expands from USD 159.3 billion to USD 197.6 billion, reflecting an absolute gain of USD 38.3 billion. This growth is expected to be influenced by infrastructure buildouts in emerging economies, public-sector housing projects, and bridge rehabilitation programs. Moderate value increases averaging USD 7.7 billion per year suggest a stable, policy-driven demand base, especially in regions where rebar-intensive civil construction remains underfunded. In the late phase from 2030 to 2035, the market rises from USD 197.6 billion to USD 245.1 billion, delivering a larger absolute gain of USD 47.5 billion. This segment of the curve reflects more diversified growth, supported by increased demand for earthquake-resistant and high-strength rebar products in urban redevelopment and transport mega-projects. The higher value addition in the second half indicates mild acceleration, driven by improved manufacturing efficiencies and wider adoption of higher-grade products. While both periods reflect steady expansion, the late-stage curve shows stronger value compounding, aligned with long-term urban infrastructure upgrades and rising construction standards.

| Metric | Value |

|---|---|

| Steel Rebar Market Estimated Value in (2025 E) | USD 159.3 billion |

| Steel Rebar Market Forecast Value in (2035 F) | USD 245.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The steel rebar market is witnessing steady growth, driven by increased infrastructure development, urbanization trends, and a surge in construction spending across both public and private sectors. Rising investments in transport networks, energy facilities, and high-rise structures are boosting demand for reinforced steel products that offer high tensile strength and structural reliability.

Regulatory mandates on building safety, earthquake resistance, and durability have fueled the adoption of certified rebar grades globally. The integration of steel rebar in prefabricated structures and the growing use of automated bending and cutting equipment in modern construction sites further support market expansion.

Long-term growth is expected to benefit from green construction initiatives, wherein recycled steel-based rebar plays a pivotal role in achieving sustainability goals.

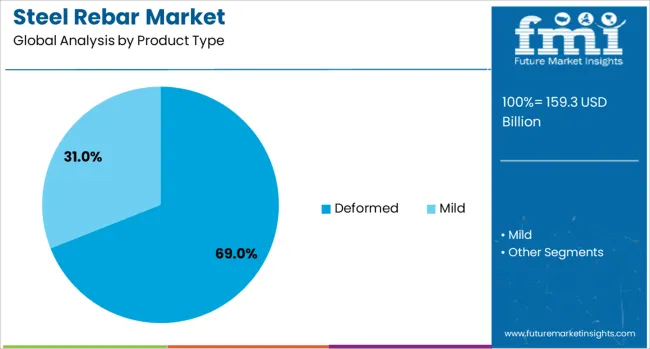

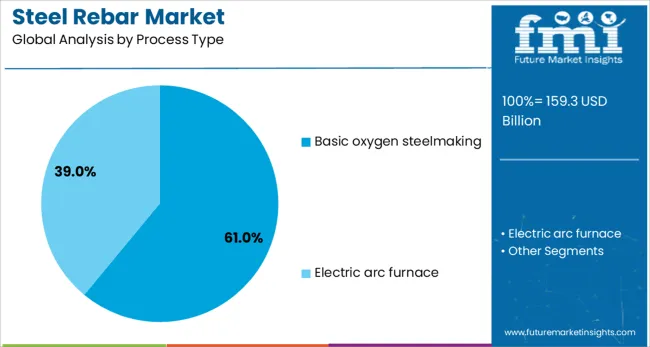

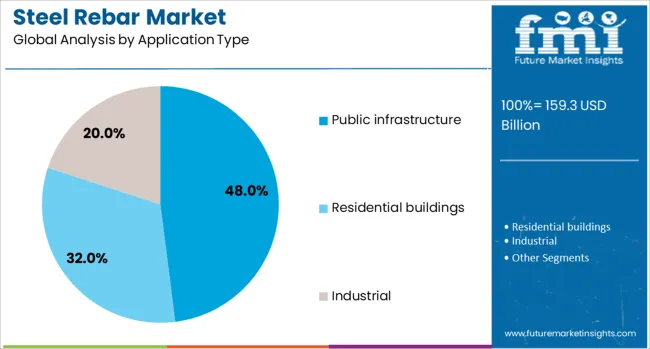

The steel rebar market is segmented by product type, process type, application type, and geographic regions. The steel rebar market is divided by product type into Deformed and Mild. The steel rebar market is classified into Basic oxygen steelmaking and Electric arc furnace. Based on the application type, the steel rebar market is segmented into Public infrastructure, Residential buildings, and Industrial. Regionally, the steel rebar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Deformed steel rebar is projected to account for 69.0% of the total steel rebar market share by 2025, establishing it as the leading product type. This dominance stems from its superior bonding strength with concrete due to surface ridges, which significantly improves structural integrity in buildings and infrastructure.

Deformed bars are preferred in seismic zones and heavy-load applications because they offer enhanced stress distribution and crack resistance. Their widespread usage across residential, commercial, and industrial construction has been bolstered by strict regulatory standards for reinforced concrete.

The longevity and cost-effectiveness of deformed bars also make them the material of choice in mega-infrastructure projects and government-funded schemes.

The basic oxygen steelmaking (BOS) method is expected to command a 61.0% share of the global steel rebar market by 2025, making it the predominant process type. BOS offers scalability, high throughput, and consistent chemical composition, making it ideal for producing rebar at commercial volumes.

The process’s ability to convert iron ore and scrap into molten steel efficiently is a key factor for its adoption among major manufacturers. It also allows better control over alloying elements and impurity removal, ensuring high-quality end products.

BOS’s widespread deployment in integrated steel plants worldwide reinforces its position as the preferred method for producing structural-grade rebars used in critical construction applications.

Public infrastructure is projected to be the leading application segment, with an estimated 48.0% share of the steel rebar market in 2025. This growth is being driven by expanding investment in highways, bridges, railways, and airport expansions.

Governments across developed and emerging economies are prioritizing large-scale civil engineering projects to boost economic development and urban resilience. Steel rebar’s critical role in reinforcing load-bearing structures, resisting dynamic stress, and extending asset life aligns with the technical demands of modern infrastructure design.

Additionally, the trend of smart cities and climate-resilient development is expected to further stimulate demand for high-grade rebars in public infrastructure over the next decade.

The steel rebar market is witnessing steady expansion due to ongoing construction and infrastructure projects worldwide. Global consumption surpassed 600 million tons in 2024, with the Asia Pacific region representing more than half of this demand. Residential and commercial construction, roadways, and bridges are key drivers. High-strength rebar with improved bonding and corrosion resistance is increasingly used to ensure structural stability. Rising urban development in emerging markets and modernization efforts in developed countries contribute to the adoption of advanced rebar types.

Demand for steel rebar is driven primarily by high-rise buildings, highways, bridges, and industrial facilities. On average, 50 to 70 kilograms of rebar is required per square meter of concrete. Rapid expansion in Asian countries, particularly India, China, and Vietnam, accounts for over 55% of global demand, while North America and Europe are focusing on renovations and infrastructure upgrades. Advanced rebar, including micro-alloyed and epoxy-coated varieties, enhances resistance to corrosion and seismic stress, extending structural lifespan by 20–30%. Government initiatives for metro networks, highways, and urban housing schemes are significantly increasing consumption, alongside private residential and commercial construction projects seeking cost-efficient, high-strength materials.

High-strength rebar exceeding 500 MPa is gaining traction as it reduces overall material requirements and lowers construction costs. Epoxy-coated and corrosion-resistant varieties are increasingly used in coastal and humid regions, prolonging structural life by up to 30%. Innovations in alloy composition improve flexibility and ductility, allowing structures to withstand heavy dynamic and seismic loads. Modern rolling mills and automated production reduce inconsistencies and defects by 15–20%, increasing overall output. Demand in infrastructure, industrial facilities, and urban construction is driving manufacturers to invest in enhanced production capacity and R&D. Long-term durability requirements and regulatory compliance are encouraging widespread use of advanced coated rebar in new construction projects.

Developing countries in Asia, Latin America, and Africa are experiencing annual growth rates of 6–8% in steel rebar consumption. Expanding urban housing, government-funded infrastructure projects, and industrial facilities are driving this trend. Local manufacturers are establishing cost-efficient production facilities to meet domestic demand, while exports to neighboring countries are increasing. Seismic-resistant and corrosion-resistant rebar are being adopted in coastal and earthquake-prone areas. Investments in automated rolling mills and digital quality monitoring improve consistency and output efficiency. Specialized grades of rebar are being used in high-rise buildings, bridges, and industrial complexes. The adoption of sustainable construction practices is encouraging wider use of high-performance and coated rebar.

Steel rebar production relies heavily on raw materials such as scrap steel, iron ore, and ferroalloys. Fluctuations in these inputs can influence production costs by 10–20%, affecting profit margins. Energy-intensive manufacturing processes further increase operational expenditures, especially in regions with high electricity and fuel costs. Scaling production while maintaining consistent quality demands significant investment in automated equipment and skilled labor. Trade policies, import tariffs, and compliance with regional construction standards create additional complexity. Manufacturers must carefully manage procurement, operational efficiency, and pricing strategies to maintain competitiveness, ensure adherence to safety regulations, and deliver rebar that meets evolving building performance and durability requirements.

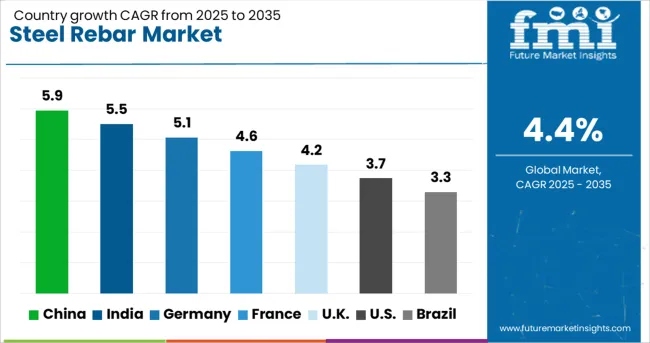

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global steel rebar market is expected to expand at a CAGR of 4.4% from 2025 to 2035. China, India, and Germany are projected to grow at 5.9%, 5.5%, and 5.1% respectively, all outperforming the global average. The United Kingdom and the United States are forecast at 4.2% and 3.7% respectively, supported by retrofit projects and infrastructure maintenance. Growth in each region is shaped by construction policy shifts, residential steel intensity, and circular rebar production technology. National codes related to seismic safety and environmental steel grades have influenced material mix and bar diameters. Integration of thermomechanically treated (TMT) rebars has gained traction across commercial and urban infrastructure projects.

China is projected to expand at a CAGR of 5.9% from 2025 to 2035 in the steel rebar market. Output continues to grow across Hebei, Jiangsu, and Shandong, supported by policy incentives for low-emission EAF steelmaking. Vertical integration from ore to rolling has improved price control and scheduling efficiency for domestic contractors. Rebar demand remains concentrated in Tier 2 and Tier 3 city real estate projects and public rail infrastructure. Export capacity for anti-corrosion coated rebars has increased, targeting Southeast Asia and Africa. Government-mandated restrictions on substandard bars have supported consolidation and product quality upgrades.

India is forecast to register a CAGR of 5.5% from 2025 to 2035 in the steel rebar market. Production is growing in states like Odisha, Jharkhand, and Chhattisgarh where integrated steel plants have scaled TMT and corrosion-resistant variants. Metro rail, expressway, and port infrastructure projects are the primary rebar consumers, driving regional demand for seismic-grade and Fe500D bars. Expansion of rebar welding technology and lattice girder applications has improved steel utilization across modular construction formats. Steel rebar recycling volumes remain modest but are gaining traction as state policy transitions toward circularity.

Germany is expected to grow at a CAGR of 5.1% from 2025 to 2035 in the steel rebar market. Demand is concentrated in bridge retrofits, industrial park development, and offshore wind base construction. Regional mills in North Rhine-Westphalia and Baden-Württemberg have optimized EAF routes for low-carbon rebar output. New rebar grades complying with Eurocode 2 standards are being deployed for high-load-bearing columns and precast assemblies. Hydrogen-based reduction pilots are under evaluation to substitute carbon-intensive phases in billet manufacturing. Export of green-labeled rebars to Scandinavian markets has gained momentum.

The United Kingdom is projected to grow at a CAGR of 4.2% from 2025 to 2035 in the steel rebar market. Demand is concentrated in social housing, NHS health infrastructure, and tunneling initiatives. Regional re-rollers have increased output of BS4449-compliant bars with welded mesh compatibility. Policy shifts favoring brownfield regeneration have supported higher usage of bent and cut rebars across mixed-use commercial structures. Import volumes from Turkey and Spain remain relevant, particularly in London and Manchester. Strengthened fire resistance specifications and corrosion fatigue standards are guiding procurement norms.

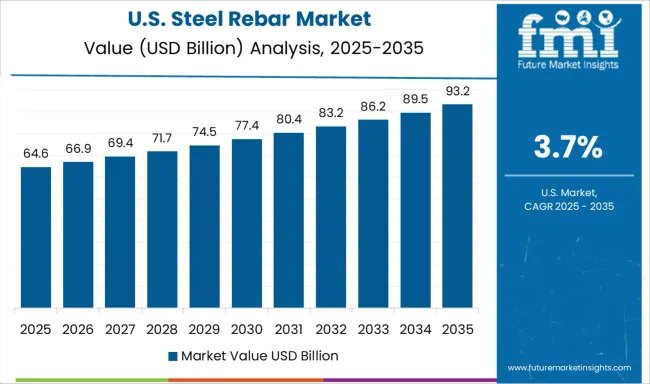

The United States is forecast to grow at a CAGR of 3.7% from 2025 to 2035 in the steel rebar market. Growth remains steady across highway reinforcement, coastal building retrofits, and earthquake resilience upgrades. EAF-based minimills in Alabama and Texas have enhanced rebar quality through tighter chemical controls and digital rolling. Procurement for DOT (Department of Transportation) projects has favored epoxy-coated and stainless rebar in high-humidity zones. Scrap-fed billet casting remains central to cost competitiveness. However, rebar availability gaps in western states have created partial reliance on imported semi-finished billets.

ArcelorMittal maintains a prominent position in the global steel rebar market with large-scale production facilities across Europe, Asia, and the Americas, serving infrastructure and commercial construction sectors. The company’s rebar portfolio includes high-strength and corrosion-resistant grades designed for high-load structures. Acerinox S.A, while primarily focused on stainless products, supplies niche rebar solutions used in coastal and corrosive environments.

Commercial Metals Company (CMC) operates rebar mills in the US and Poland, emphasizing scrap-to-rebar efficiency through electric arc furnace operations. Daido Steel Co Ltd targets specialty-grade rebar for high-performance concrete applications, with an emphasis on metallurgical consistency and fatigue resistance. Gerdau S/A is one of the largest rebar producers in Latin America, with operations extending into North America, offering cut and bend services and downstream fabrication. HBIS Group and Jiangsu Shagang Group drive large-volume output in China, supplying civil and industrial projects with domestically sourced billets. JSW and SAIL support India’s infrastructure pipeline with wide-diameter and earthquake-resistant rebar products.

NIPPON STEEL CORPORATION and POSCO HOLDINGS INC. supply thermo-mechanically treated (TMT) rebars for high-rise and seismic-prone regions. Nucor and Steel Dynamics, Inc focus on regional supply chains in North America with mini-mill efficiency. Tata Steel and NLMK serve both domestic and export markets with rebar solutions aligned to international construction standards.

Between 2023 and 2025, the steel rebar market experienced notable shifts driven by construction demand, raw material volatility, and energy costs. Prices rose globally as production faced constraints from high energy tariffs and decarbonization targets. Investments in advanced rebar manufacturing included new mills equipped with automated rolling lines and energy-efficient furnaces.

High-strength, corrosion-resistant rebar variants gained traction in coastal and infrastructure projects. Manufacturers adopted AI-based predictive maintenance and digital process optimization to enhance output reliability while meeting evolving standards in durability and structural performance. Additional Attributes

| Item | Value |

|---|---|

| Quantitative Units | USD 159.3 Billion |

| Product Type | Deformed and Mild |

| Process Type | Basic oxygen steelmaking and Electric arc furnace |

| Application Type | Public infrastructure, Residential buildings, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcelorMittal, Acerinox S.A, Commercial Metals Company, Daido Steel Co Ltd, Gerdau S/A, HBIS Group, Jiangsu Shagang Group, JSW, NIPPON STEEL CORPORATION, NLMK, Nucor, POSCO HOLDINGS INC., SAIL, Steel Dynamics, Inc, and Tata Steel |

The global steel rebar market is estimated to be valued at USD 159.3 billion in 2025.

The market size for the steel rebar market is projected to reach USD 245.1 billion by 2035.

The steel rebar market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in steel rebar market are deformed and mild.

In terms of process type, basic oxygen steelmaking segment to command 61.0% share in the steel rebar market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Overview of Steel Drum Market Share

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA