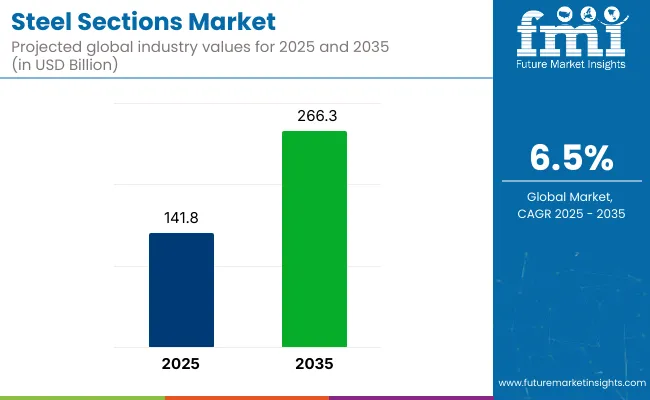

The global steel sections market is valued at USD 141.8 billion in 2025 and is poised to reach USD 266.3 billion by 2035, reflecting a CAGR of 6.5%. Growth will be driven by increasing investments in infrastructure, urbanization, and industrial development worldwide.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 141.8 billion |

| Projected Market Size in 2035 | USD 266.3 billion |

| CAGR (2025 to 2035) | 6.5% |

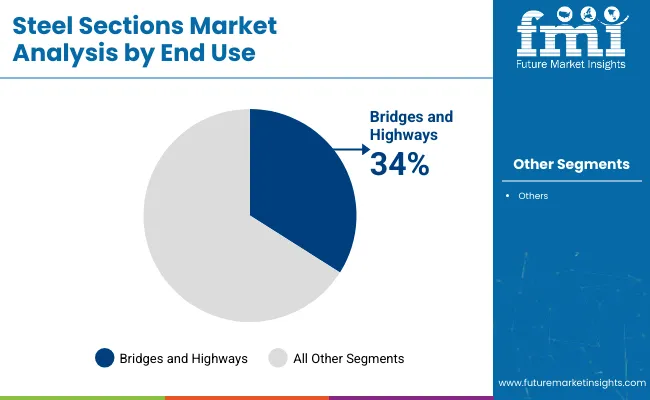

Rising demand for steel sections in bridges, highways, and high-rise buildings is expected to support market expansion. Additionally, advancements in automation and digitalization are being integrated to enhance production efficiency and quality standards across the value chain.

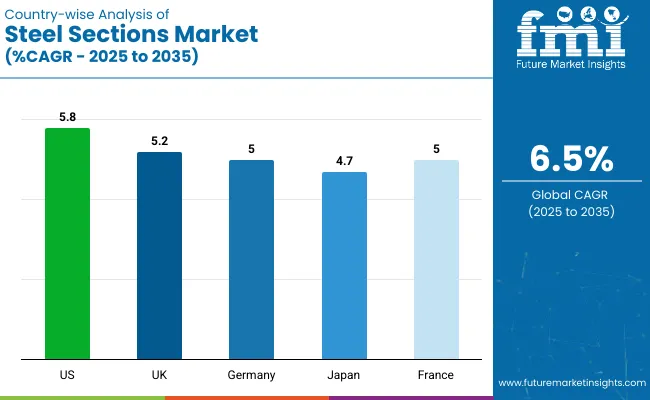

The USA is projected to grow at a CAGR of 5.8% between 2025 and 2035, driven by strong investments in infrastructure modernization and manufacturing expansion. The UK is expected to grow at a CAGR of 5.2%, supported by ongoing infrastructure projects and the shift toward sustainable construction.

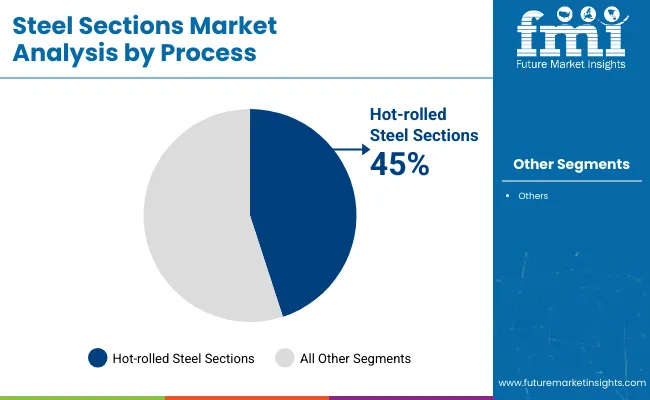

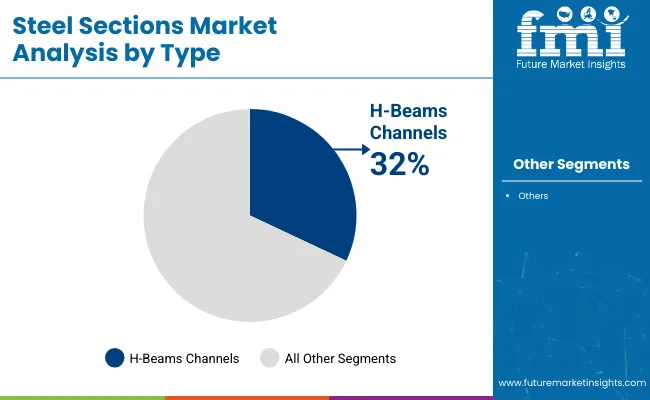

Germany is forecast to grow at a CAGR of 5.0%, with demand driven by renewable energy developments, electric vehicle production, and industrial automation, despite challenges from rising energy costs and strict carbon regulations. In 2025, hot-rolled steel sections lead the process segment with a 45% share, while H-beams channels dominate the type segment, capturing 32% market share in 2025, due to their extensive use in infrastructure and industrial projects.

Government regulations are expected to significantly influence the steel sections market over the forecast period. In the USA, a 25% tariff on steel imports has been imposed to protect domestic producers, while the European Union is set to implement the Carbon Border Adjustment Mechanism by 2026 to encourage low-carbon imports. India mandates BIS certification for steel products to ensure quality and safety, along with introducing a green steel classification based on carbon emissions.

The steel sections market accounts for approximately 12-15% of the overall steel market, driven by its extensive use in construction, infrastructure, and industrial frameworks. Within the broader metals and mining market, steel sections represent about 2-4%, as this parent category includes various non-ferrous and precious metals.

In the construction materials market, steel sections contribute roughly 6-8%, reflecting their critical role in structural applications. They hold an estimated 20-25% share of the structural steel market, given their direct categorization under beams, channels, and sections. Within industrial materials, steel sections account for about 5-7%, supporting heavy machinery and manufacturing facilities.

The steel sections market is segmented by process, type, end use, and region. By process, the market is segmented into hot-rolled steel sections, cold-formed steel sections, welded steel sections, and seamless steel sections. By type, it is classified into I-beams channels, H-beams channels, and angles hollow sections.

By end use, it is divided into residential buildings, commercial buildings, bridges and highways, industrial plants, and oil and gas refineries. By region, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic countries, Middle East and Africa (MEA), East Asia, and South Asia and Pacific.

Hot-rolled steel sections are projected to dominate the process segment, driven by their superior strength and suitability for heavy industrial applications. This segment is expected to account for 45% market share by 2035.

H-beams channels are forecasted to lead the type segment, capturing nearly 32% market share in 2025. Their widespread adoption in heavy machinery structures, bridges, and mega infrastructure projects supports their dominance.

Bridges and highways are projected to remain the largest end-use segment, holding around 34% market share by 2035.

The global steel sections market is growing steadily, driven by increasing infrastructure investments, rising demand for high-strength construction materials, and advancements in sustainable and precision steel manufacturing.

Recent Trends in the Steel Sections Market

Key Challenges in the Steel Sections Market

Between 2025 and 2035, the USA steel sections market shows the highest growth among these countries with a CAGR of 5.8%, driven by infrastructure modernization and manufacturing reshoring. The UK follows with a 5.2% CAGR, supported by net-zero carbon initiatives and infrastructure projects.

Germany and France both exhibit a CAGR of 5.0%, with Germany driven by renewable energy investments and France by urban redevelopment. Japan records the slowest growth at 4.7% CAGR, constrained by its aging population but supported by earthquake-resistant construction. Overall, the USA leads growth due to diversified infrastructure and industrial demand expansions.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA steel sections revenue is projected to grow at a CAGR of 5.8% from 2025 to 2035. Strong investments in infrastructure modernization and the reshoring of manufacturing activities are driving market expansion.

Steel sections revenue in the UK is forecasted to grow at a CAGR of 5.2% from 2025 to 2035. Growth is driven by continued infrastructure projects and a focus on net-zero carbon building initiatives.

Steel sections’ demand in Germany is anticipated to grow at a CAGR of 5.0% from 2025 to 2035. Growth is supported by investments in renewable energy plants, industrial automation, and electric vehicle production.

Sales of steel sections in France are expected to grow at a CAGR of 5.0% from 2025 to 2035. Growth is fueled by urban redevelopment and transportation infrastructure projects, alongside government policies favoring low-carbon and recycled steel.

Japan’s steel sections revenues are projected to grow at a CAGR of 4.7% from 2025 to 2035. Infrastructure renewal projects and earthquake-resistant building requirements drive market growth.

The market is moderately consolidated, with tier-one players such as ArcelorMittal, Tata Steel, and Nucor Corporation holding significant global shares. These companies compete through strategic investments in green steel production, regional expansions, and technological innovations to strengthen their market positions.

ArcelorMittal has been focusing on decarbonization projects to align with global sustainability goals, while Tata Steel is enhancing its product offerings with high-strength and lightweight steel solutions. Nucor Corporation is expanding its low-carbon production capabilities to cater to the rising demand from the infrastructure and automotive industries.

Recent Steel Sections Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 141.8 billion |

| Projected Market Size (2035) | USD 266.3 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Process | Hot-rolled Steel Sections, Cold-formed Steel Section, Welded Steel Section, and Seamless Steel Section |

| By Type | I-beams Channels, H-beams Channels, and Angles Hollow Sections |

| By End Use | Residential Buildings, Commercial Buildings, Bridges and Highways, Industrial plants, Oil and Gas Refineries |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Tata Steel, ArcelorMittal, Nucor Corporation, SSAB, Vallourec, Yuantai Derun Group, Anyang Steel Group, Youfa Steel Pipe Group, POSCO, Baoshan Iron & Steel Co. Ltd, Nippon Steel Corporation, Ansteel Group, Hyundai Steel, Liberty Steel, JFE Steel Corporation, Tenaris S.A., Marcegaglia S.p.A., Salzgitter AG, Severstal, Gerdau S.A., JSW Steel Ltd., Zekelman Industries, Valmont Industries, Liaoning Zhongwang Group Co., Ltd., Barrett Steel, Viohalco Group, Celsa Steel, APL Apollo, Atlas Tube, Maruichi Steel Tube Ltd., Searing Industries, Hannibal Industries, United States Steel Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is projected to reach USD 266.3 billion by 2035.

The market is expected to grow at a CAGR of 6.5% from 2025 to 2035.

The USA is the fastest-growing country, with a projected CAGR of 5.8% from 2025 to 2035.

The market is valued at USD 141.8 billion in 2025.

H-beams hold the largest share in the type segment, with a projected 32% market share by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Overview of Steel Drum Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA