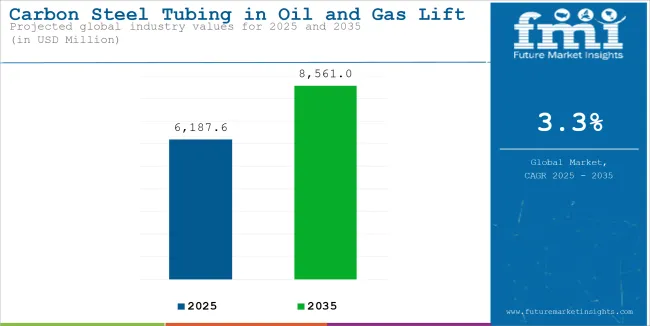

The carbon steel tubing industry for oil and gas lift applications is on the way to steady growth thanks to several factors, including the development of oilfields, the use of improved extraction techniques, and the demand for cheap and long-lasting materials. The carbon steel tubing industry for the oil and gas lift application sector is likely to be valued at USD 6,187.6 million in 2025 and increase to roughly USD 8,561.04 million by 2035, which involves a compound annual growth rate (CAGR) of 3.3% in the estimated period.

The worldwide rise in energy demand and the need for better running wells are the primary drivers for the market. Carbon steel tubing has always been the optimal choice for oil and gas lift equipment as it shows exceptional strength, mechanical stress resistance, and is relatively cheaper as compared to other materials.

The counting of deepwater and ultra-deepwater daring explorations and additionally, recovery of oil (EOR) techniques, which are the most essential are other important contributors to the market demand. Add to that the fact that protective coatings and corrosion-resistant devices, newly invented, not only keep the carbon steel tubing working for a longer period of time but also make it the possible part of a mature oilfield's permanent work.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6,187.6 million |

| Industry Value (2035F) | USD 8,561.04 million |

| CAGR (2025 to 2035) | 3.3% |

The continued dependence on oil and gas also acts as a supporter for the carbon steel tubing market particularly through developing countries' production. The market is also profiting from the technological advancements made in the extraction processes of oil and gas, for instance, by using hydraulic fracturing, artificial lift systems, and gas lift methods that all demand high strength tubing.

Besides, the outdoor oil field's advancements and the shift towards the unconventional resources like shale oil tight gas are also significant contributors to the growth of the market.

Industry rules and standards have also turned the market around with manufacturers being pushed to improve tubing quality, while also introducing high-performance anti-corrosion materials. The rise in investments on pipeline infrastructure and well intervention services, in addition, will be a huge breakthrough for the use of high-grade carbon steel tubing.

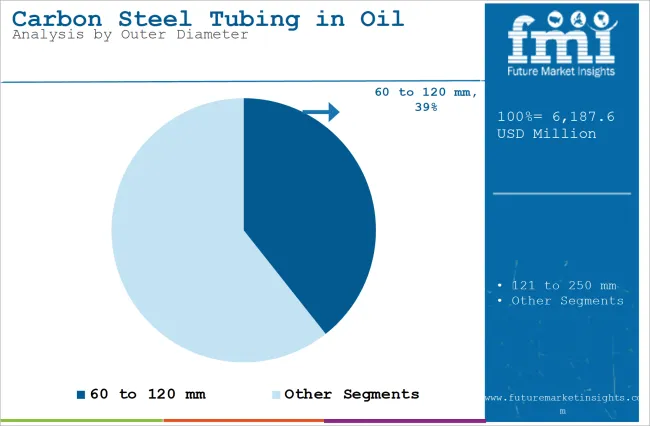

60 to 120 mm Tubing Leads the Market Due to Its Versatility in Oil and Gas Lift Applications

Carbon steel tubing with 60 to 120 mm outer diameter is the most sold type in the oil and gas lift applications, largely due to its diffusion in the middle-depth wells sector. It is the best choice for different artificial lift systems thanks to the inner and outer walls thicknesses provided between flexibility and durability.

Tubing solutions are now being developed more reliably as a result of the overall increase in the demand for oil and gas along with other technologies being utilized in the process. The growth of this segment is further supported by the investments in mature oilfields especially in the North American region and the Middle East. Also, the ongoing research into tubing materials with better corrosion resistance is likely to bring about inventions in the market.

121 to 250 mm Tubing Witnesses Growth with the Expansion of Deepwater and High-Pressure Operations

The segment of 121 to 250 mm is enjoying spectacular growth, as it is increasingly used for deep and ultra-deep water drilling. Wider tubing is necessary for more pressure and more production in complex wells. The rising deepwater projects and newer EOR methods have caused the high demand for strong tubing solutions.

Besides, the governmental initiatives on the offshore exploration projects are the main causes for investments in high-capacity tubing systems, especially in areas like the Gulf of Mexico, the North Sea, and the Asia-Pacific.

Internally Coated Tubing Dominates the Market Due to Its Superior Corrosion Resistance

Internally coated carbon steel tubing is a widely recommended product in oil and gas lift applications to mitigate internal corrosion caused by exposure to harsh chemicals, sour gas, and high-pressure fluids. Among the reasons this section is gaining attention is the fact that it leads to a longer tubing lifespan and lower maintenance costs.

The need for well integrity and long-standing operational efficiency has become the base for investing in high-quality internal coatings. Besides, the inclusion of such unconventional oil and gas production as shale reserves in North America is deeply influencing the rise of this section. The development of enhanced coating technologies will, among other things, introduce greener alternatives and is bound to shape future trends.

Externally Coated Tubing Gains Momentum with Rising Offshore and Harsh Environment Applications

Externally coated tubing is a necessity to prevent the corrosion of external pressure from environmental elements like soil contact, moisture, and corrosive offshore conditions from damaging carbon steel pipes. This segment is gaining considerable contracts always hence will be obstructed once it is established as a result of its role in pipelines longevity and decreased infrastructure maintenance costs.

Externally coated tubing is making great steps in oil and gas lift applications due to the growing interest in offshore exploration and subsea producing. The commitment to environmental protection and adhering to safety regulations are critical reasons that promote this market. With rising levels in the offshore drilling sectors such as the Gulf of Mexico, West Africa, and the North Sea, a healthy demand is being recorded.

The oil and gas lift application carbon steel tubing market is on the upswing as a result of the necessities for energy, the use of advanced technology, and the emphasis on the quality of the pipeline. Even though the use of smaller diameter tubing in traditional wells is still widespread, the trend is changing as the availability of bigger diameter variants is being increased in the deep water and high-pressure situations.

Internally and externally coated tubing alternatives are also experiencing a growing trend, spurred on by the corrosion protection and operational efficiency needs. The carbon steel tubing market will remain firm with the continuity of oil and gas projects and innovations in materials science.

Impact of Fluctuating Crude Oil Prices

Crude oil prices volatility has a great impact on investment decisions in exploration and production segments of the oil and gas industry. As prices decline, and companies cut back on capital spending budgets, projects essential to producing oil and gas are delayed or scrapped entirely. Such challenges not only curtail project work in the short term but also create instability over the long run, complicating strategic planning and making it hard for organizations to remain on course for planned growth.

However, this concept of crude oil price volatility leads to a financial burden along the entire supply chain, affecting stakeholders from producers to equipment manufacturers, resulting in diminished overall confidence and investment in the industry.

Corrosion and Scaling Issues

The oil and gas industry has struggled with corrosion and scaling: two common enemies, particularly in tubing and critical equipment. These issues are compounded by harsh environmental conditions, including extreme salinity, extreme temperatures, and exposure to a multitude of chemicals.

Corrosion can attack and ultimately fail equipment, while scaling, caused by mineral deposition on pipe walls, can cause blockage of fluids and hinder operating efficiency. These problems lead to constant maintenance, unplanned downtimes, and excessive operational costs, making it difficult for companies which want to achieve optimal productivity and profitability.

Competition from Alternative Materials

The increasing use of alternative materials like stainless steel, composites, and advanced polymers poses a significant risk to conventional tubing manufacturers. These materials provide better corrosion and scaling resistances, making them more suitable for contemporary oil and gas activities.

This drive has prompted the uptake of such alternatives as a response from the industry to seek more durable and sustainable solutions. These advancements instill in conventional tubing manufacturers, the need to adapt and innovate in order to maintain and improve on their product performance and longevity standards.

Development of Advanced Coatings and Alloys

Development of corrosion and wear resistant coatings and alloys∼ and their applications in oil and gas sector∼ represents a major opportunity. Advancements in material engineering are making tubing resistant against extreme operational conditions, ensuring longer equipment life and lower maintenance requirements. With new coatings reducing wear and corrosion, and new alloys improving ruggedness.

Such technologies not only enhance operational efficiency and reduce costs, they also drive profitability in onshore and offshore space.

Expansion of oil and gas operations in emerging economies.

Countries in Central and South America, Asia, and Africa which have emerging economies are experiencing an increase in oil and gas exploration and production activity. This growth is fuelled by accelerating energy demand, positive political landscapes, and new reserve discoveries.

With the growing oil and gas infrastructure in these regions, high durable tubing specifications are sought to meet the unique requirements of resource extraction in different environments. This trend presents lucrative prospects for tubing manufacturers to expand into emerging markets, form strategic alliances, and address the changing requirements of the sector.

Increased focus on deepwater and ultra-deepwater projects requiring high-strength tubing.

To fulfill the tremendous demand for these tubing in oil fields and the increasing trend of deepwater and ultra-deepwater exploration. Such projects are known for extreme operational conditions for instance high pressures, corrosive environments and great depths. Various tubing solutions including high-strength, corrosion-resistant options are in high demand for the successful execution of such complex operations.

This allows them to manufacture customized tubing that adheres to the strict demands of deepwater projects, establishing credibility in a specialized sector and making them forerunners in supplying state-of-the-art solutions for the most testing oil and gas settings.

The market for carbon steel tubing in oil and gas lift applications has grown significantly from 2020 to 2024, due to the increase in global energy demands, the introduction of new extraction methods in oil and gas, and the more frequent exploration in both onshore and offshore fields. The long-lasting, cost-effective, and high tensile strength of carbon steel tubing have made it a widely accepted material for artificial lift systems, especially in the areas where the production rates are higher.

The regulations and standards of safety have also been predominant topics that have formed the market through the material specifications, and performance requirements. The industry foresees significant market changes as the 2025 to 2035 period is reached, with more and more automation, digitalization, and better material inventions being the main drivers.

The engagement of manufacturers with the sustainability of energy production and reduction of carbon emissions may lead to the risk of the production of textures for coatings, corrosion-inhibitive formulations, and hybrid materials that could improve tubing performance and durability. Moreover, the geopolitical factors that keep on resurfacing, energy policies that are switching, and economic variables will use their influence on the growth path of the carbon steel tubing field.

The carbon steel tubing market for oil and gas lift applications is forecasted to experience major developments, with innovation and sustainability taking the center stage. The integration of AI-based predictive maintenance will empower operators to spot erosion and corrosion in real-time, thus allowing them to optimize the tubing replacement routines that will eventually cut down on the operational downtime.

Progress in material science is expected to make the development of lighter and stronger carbon steels more corrosion-resistant thus prolonging the operation of tubing under extreme conditions.

As the global energy sector continues to transition towards a cleaner and more efficient mode of operation, the companies that will be ready for a long time ahead are the ones that will invest in technological innovation and the sustainability of their products. All the time the present rule changes and the development of the market with demand for new passionate products and great technology advances like the one mentioned before will be determinant for the future of the carbon steel tubing company in the oil and gas lift market.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter safety and performance standards govern material quality and operational safety. |

| Technological Advancements | Installation of improved coatings, material strength methods, and digital monitoring solutions. |

| Industry-Specific Demand | The main factor being the shale and deepwater drilling operations need from North America and the Middle East. |

| Sustainability & Circular Economy | The first endeavors were taken to increase recyclability and to cut off material waste. |

| Market Growth Drivers | Rise in global energy consumption, new improved oil recovery projects are launching, and the advancements in tubing materials. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Upgraded global environmental regulations push down emissions and increase material efficiency. |

| Technological Advancements | Applying AI-run Predictive Maintenance, Nanotechnology-based Corrosion Resistant, and Smart Tubing Technologies. |

| Industry-Specific Demand | Entering into the markets with high potential, promoting EOR more and more, and directing attention to efficiency are some of the expansion strategies. |

| Sustainability & Circular Economy | Manufacturing technology using less energy, cutting the carbon footprint, and reusability of systems in production is emphasized more. |

| Market Growth Drivers | Increased automation, stronger focus on efficiency, and the need for cost-effective yet durable tubing solutions are the main drivers of technological advances. |

The USA is a prominent hub of the worldwide oil and gas lift applications carbon steel tube market, primarily owing to its continuous financing in oil exploration and production. The nation is witnessing an amazing performance in the oil and gas sector, especially in the shale oil and offshore drilling projects.

On top of that, it is the USA government’s priority to energy independent and increase oil recovery that thus drives the need for carbon steel tubing. Innovations in carbon steel production, such as corrosion resistance and longer-lasting materials, are even more favorable to the market. The requirement of strong, tight and pressure-resilient tubing solutions as well as the transfer of fluids and run the facilities under extreme conditions make the USA the best market for growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

The UK's carbon steel tubing market in oil and gas lift applications gets the extra support from the increase in ongoing exploration activities in the North Sea and neighboring regions. Besides, the UK, which is concentrating on energy security, is the oil and gas sector which is experiencing infrastructure investment growth. As managers engage in the transport and pressure management of fluids, a new trend is to look for more efficient and durable materials, such as high-performance tubing solutions especially for offshore and deepwater drilling.

Plus, priority is given to sustainable energy generation and carbon emissions reduction, which results in the progress of the environmental tube manufacturing industry. Hence the overall market's growth is at its best. Certainly, the major positive impact is by:

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

The EU carbon steel tubing market in offshore and gas lifting applications is the fastest growing one, due to the increased demand for strong and high-quality materials in the offshore and deep-water drilling projects. EU countries such as Norway, Germany, and The Netherlands are at the forefront of oil and gas exploration, also they have a greater emphasis on selling.

Another reason is that the increasing application of enhanced oil recovery (EOR) technologies in the area is pushing for the requirement of more durable and trustworthy carbon steel tubing. Besides that, the EU`s regulations for cutting down carbon emissions, are one of the main drivers of the push for manufacturing process improvement and recycling of the oil and gas industry by the different companies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

The offshore segment of Japan's oil and gas industry is the one that is driving the demand for carbon steel tubing in lift applications. Being a significant energy importing country, Japan is channeling its resources into the research and development of technologies to strengthen its very own oil and gas infrastructure.

Energy security that the country is committed to is also a direct link to the need for more contemporary materials, such as high-strength and corrosion-resistant carbon steel tubing. Apart from that, the efforts of Japan to boost energy efficiency and minimize ecological consequences are causing the emergence of the tubing materials, which are available with enhanced durability and longer lifetime thus inspiring the further development of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

South Korea's oil and gas industry, which has been significantly impacted by the offshore exploration and production growth, is now the top user of carbon steel tubing for lift applications. The country's relentless efforts in diversifying the energy supply and technological breakthroughs in the oil recovery cycle are driving the rise in plastic tubing solutions for super performance.

South Korea’s innovation of the ecologically sound and the super corrosion-resisting tubing materials also plays a role in the satisfaction of the market’s requirements. With the increase in energy infrastructure investment and recoveries of the booming oil industry, South Korea is arising as a major market player.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

Carbon Steel Tubing Market for Oil and Gas Lift Applications is an important part of oilfield services as a whole. Carbon steel tubing is most commonly used in the artificial lift systems such as rod lift, gas lift, and electric submersible pumps (ESPs) because it has the highest mechanical strength, is the most cost-effective, and is the best to resist high pressures and temperatures among all materials available on the market.-based.

Among the key companies in the sector are Tenaris, Vallourec, Nippon Steel Corporation, USa Steel, and Jindal SAW Ltd. They compete on grounds of material innovations, corrosion resistance enhancements, and supply chain efficiency. The market growth is driven by increased energy demand, technological advancements in enhanced oil recovery (EOR), and regulations that mandate the health and durability of well normal operations.

Technological advancement, safety measures, and increasing global energy consumption are the primary forces acting in the Carbon Steel Tubing Market for Oil and Gas Lift Applications. The market is primarily led by the established players, such as Tenaris, Vallourec, and Nippon Steel Corporation, who offer high-performance materials and provide innovative solutions.

New entrants focus mainly on cost-effectiveness and market adaptability. The continued growth of the market is promised thanks to digitization and material innovations shaping the industry ahead.

| Company Name | Estimated Market Share (%) |

|---|---|

| Tenaris | 20-25% |

| Vallourec | 15-20% |

| Nippon Steel Corporation | 12-16% |

| USA Steel | 8-12% |

| Jindal SAW Ltd. | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tenaris | Delivers premium carbon steel tubing with a variety of corrosion-resistant coatings to meet your high-performance demands for artificial lift systems. |

| Vallourec | Focuses on seamless carbon steel tubing for high-pressure conditions, and devotes significant effort to metallurgical research. |

| Nippon Steel Corporation | Manufactures high-strength tubing with improved fatigue resistance for extended service life in harsh drilling conditions. |

| USA Steel | Delivers competitive cost and low-cost, high-performance carbon steel tubing for rod lift and gas lift applications, focusing on domestic manufacture. |

| Jindal SAW Ltd. | Wide variety of oilfield usage of welded and seamless carbon steel tubing with unique specifications. |

Tenaris

Tenaris is the leading provider of advanced steel tubing solutions for artificial lift applications. The focus of the company is on corrosion-resistant coatings, high-yield strength materials, and the development of new threading technologies that will improve the lifespan of the well. The company also focuses on digital integration in its manufacturing processes for the purpose of optimizing quality and supply chain efficiency.

Vallourec

Vallourec is the main supplier of seamless carbon steel tubing, especially for high-pressure applications. The firm invests in advanced metallurgy, developing tubing solutions that can withstand severe temperatures and extreme mechanical stresses. Without a doubt, Vallourec's global presence and strong showing in offshore drilling are the two strong pillars of this company in the market.

Nippon Steel Corporation

Nippon Steel Corporation has launched high-strength, fatigue-resistant tubing that is mainly used in difficult oilfield conditions and is designed for an extended service life. The company's investment in the research and development area is the reason behind the emergence of specialty alloys and coatings that enhance tubing durability.

USA Steel

USA Steel has made it a point to offer cost-effective carbon steel tubing solutions for the oil industry, especially for rod lift and gas lift applications. This is the best company because of its strong domestic production and quality control, making it the number one supplier for North American oilfields.

Jindal SAW Ltd.

Jindal SAW Ltd. is the company that deals with welded and seamless carbon steel tubing for oil and gas industry. The venture concentrates on customization and flexibility in specifications as the main focus of interest, serving a wide range of artificial lift applications.

The Carbon Steel Tubing in Oil and Gas Lift Applications Market can be segmented based on

The market is estimated to reach a value of USD 6,187.6 million by the end of 2025.

The market is projected to exhibit a CAGR of 3.3% over the assessment period.

The market is expected to clock revenue of USD 8,561.04 million by end of 2035.

Key companies in the Carbon Steel Tubing in Oil and Gas Lift Applications market include Tenaris, Vallourec, Nippon Steel Corporation, USA Steel, Jindal SAW Ltd.

On the basis on end use, onshore to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (KT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 4: Global Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 6: Global Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (KT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 12: North America Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 14: North America Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (KT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 20: Latin America Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 22: Latin America Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (KT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 28: Europe Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 30: Europe Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: South Asia Market Volume (KT) Forecast by Country, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 36: South Asia Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 37: South Asia Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 38: South Asia Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 39: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: South Asia Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (KT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 44: East Asia Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 46: East Asia Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: East Asia Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (KT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 52: Oceania Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 54: Oceania Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Market Volume (KT) Forecast by End Use, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (KT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Outer Diameter, 2018 to 2033

Table 60: MEA Market Volume (KT) Forecast by Outer Diameter, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Coating, 2018 to 2033

Table 62: MEA Market Volume (KT) Forecast by Coating, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: MEA Market Volume (KT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Coating, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (KT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 10: Global Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 14: Global Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 22: Global Market Attractiveness by Coating, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Coating, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 34: North America Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 38: North America Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 46: North America Market Attractiveness by Coating, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Coating, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 58: Latin America Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 62: Latin America Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Coating, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Coating, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 82: Europe Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 86: Europe Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 94: Europe Market Attractiveness by Coating, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: South Asia Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) by Coating, 2023 to 2033

Figure 99: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: South Asia Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 103: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 106: South Asia Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 110: South Asia Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 111: South Asia Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 112: South Asia Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 113: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: South Asia Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 115: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: South Asia Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 118: South Asia Market Attractiveness by Coating, 2023 to 2033

Figure 119: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 120: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Coating, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 130: East Asia Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 131: East Asia Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 133: East Asia Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 134: East Asia Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: East Asia Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 139: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: East Asia Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 142: East Asia Market Attractiveness by Coating, 2023 to 2033

Figure 143: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 144: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Coating, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 154: Oceania Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 158: Oceania Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: Oceania Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Coating, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Outer Diameter, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Coating, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (KT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Outer Diameter, 2018 to 2033

Figure 178: MEA Market Volume (KT) Analysis by Outer Diameter, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Outer Diameter, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Outer Diameter, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Coating, 2018 to 2033

Figure 182: MEA Market Volume (KT) Analysis by Coating, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Coating, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Coating, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: MEA Market Volume (KT) Analysis by End Use, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: MEA Market Attractiveness by Outer Diameter, 2023 to 2033

Figure 190: MEA Market Attractiveness by Coating, 2023 to 2033

Figure 191: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

Carbon Steel IBC Market Demand and Forecast 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Coiled Tubing Market Analysis by Service, Operation, Application and Region Through 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Valve Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA