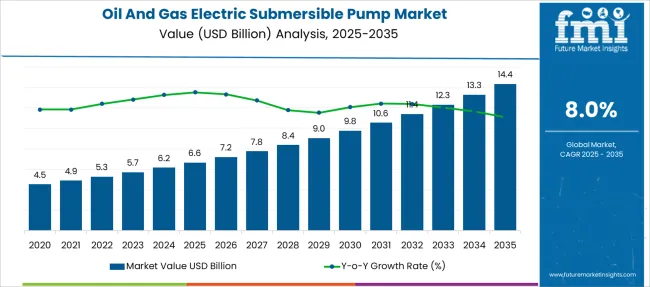

The Oil And Gas Electric Submersible Pump Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Oil And Gas Electric Submersible Pump Market Estimated Value in (2025 E) | USD 6.6 billion |

| Oil And Gas Electric Submersible Pump Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The oil and gas electric submersible pump market is expanding steadily, driven by growing demand for efficient artificial lift solutions in both mature and developing oil fields. Operators are increasingly focusing on enhancing production rates and extending the life of reservoirs. Technological advancements in pump design and materials have improved operational reliability and energy efficiency.

The onshore oil and gas segment has seen substantial investments due to the need for enhanced recovery in conventional and unconventional reservoirs. Additionally, ongoing exploration and production activities in various regions are contributing to market growth.

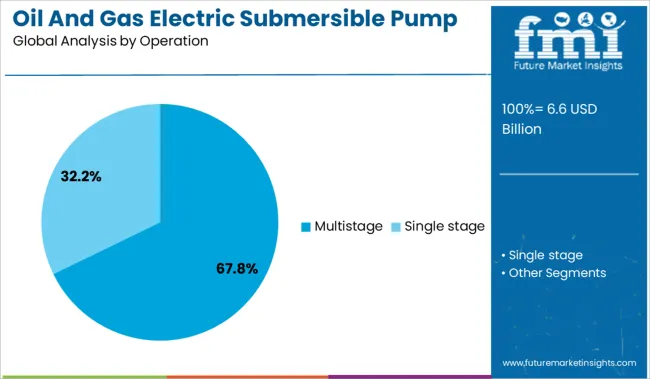

Operational improvements, including multistage pump designs, offer better handling of variable flow rates and increased pressure requirements. This has encouraged widespread adoption of multistage electric submersible pumps for a variety of well conditions. The market outlook remains positive with increasing emphasis on optimized production and reduced operational costs. Segmental growth is anticipated to be driven by the Onshore application segment and Multistage operation type.

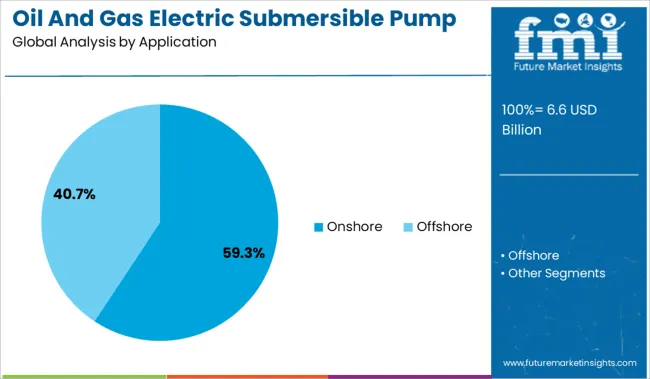

The oil and gas electric submersible pump market is segmented by application and operation and geographic regions. By application of the oil and gas electric submersible pump market is divided into Onshore and Offshore. In terms of operation of the oil and gas electric submersible pump market is classified into Multistage and Single stage. Regionally, the oil and gas electric submersible pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Onshore segment is expected to account for 59.3% of the market revenue in 2025, leading the application category. This growth is attributed to the extensive development of onshore oil and gas fields worldwide. Onshore operations typically involve easier access and lower development costs compared to offshore, driving higher deployment of electric submersible pumps.

The ability to manage varying reservoir conditions and increase production in onshore wells has positioned this segment as a key driver in the market. Increased drilling activities and enhanced oil recovery projects are further boosting demand.

Moreover, regulatory frameworks and infrastructure availability favor onshore installations, sustaining the segment’s dominance.

The Multistage operation segment is projected to hold 67.8% of the market revenue in 2025, establishing it as the leading operation type. Multistage pumps are preferred for their ability to handle high pressure and flow rate requirements in challenging well environments. These pumps provide enhanced lift capacity by utilizing multiple impellers in series, which improves efficiency and reliability.

Operators favor multistage designs for their adaptability to a range of well depths and production conditions. The improved durability and reduced maintenance costs associated with multistage pumps contribute to their popularity.

As wells become deeper and production demands increase, multistage electric submersible pumps are expected to maintain their leading role in the market.

Demand for electric submersible pumps in oil and gas is being driven by mature field optimization and deeper offshore exploration. Sales of high-temperature, multi-stage ESP systems are growing as operators prioritize uptime, artificial lift efficiency, and reduced intervention costs in both onshore and subsea operations.

Demand for oil and gas electric submersible pumps rated above 1,000 bbl/day rose 21% in 2025, as operators enhanced recovery from aging fields in Texas, the North Sea, and West Siberia. Offshore wells with declining natural pressure integrated multi-stage ESPs with pressure ratings above 3,000 psi, extending production life by 3.4 years on average. Operators in Saudi Arabia and Brazil adopted advanced thermal-rated ESPs to handle fluid temperatures exceeding 300°F, especially in steam-assisted gravity drainage (SAGD) wells. Remote condition monitoring reduced unplanned pullouts by 17%, with predictive failure analytics improving uptime in high-GOR zones and water-cut management regimes.

Sales of ESP systems configured for unconventional shale wells jumped 28% YoY in 2025, as USA Permian and Canadian Montney operators optimized artificial lift in horizontal completions. Compact ESPs with gas-handling stages improved lift efficiency in high-sand, high-gas environments where rod pumps underperformed. In Argentina’s Vaca Muerta, dual-frequency VSD-enabled ESPs allowed rapid speed modulation during early flowback phases, reducing motor trips by 31%. Integrated downhole sensors enabled precise drawdown control, enhancing fluid production without coning water or gas. ESP unit lifespan in horizontal wells was extended by 22% through new abrasion-resistant coatings and advanced rotor-bushing assemblies.

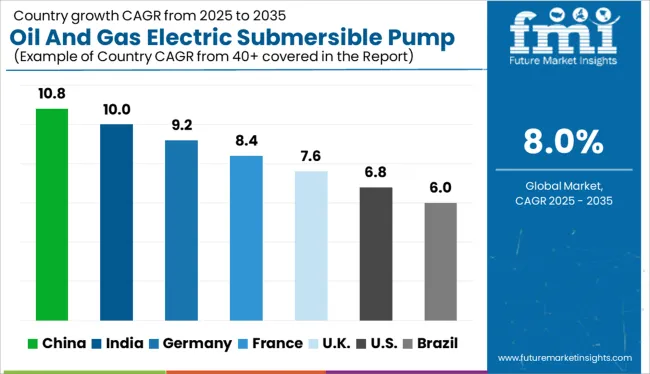

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

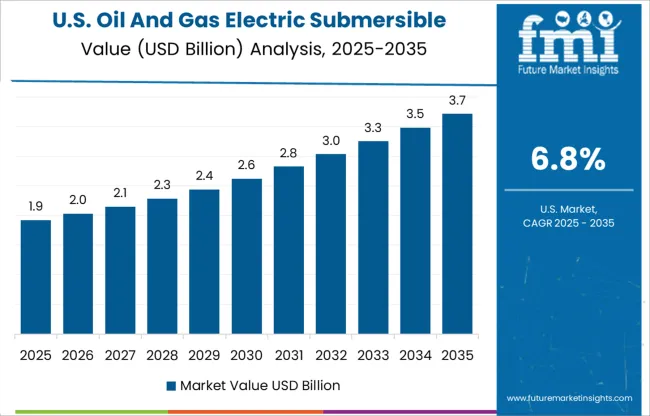

| USA | 6.8% |

| Brazil | 6.0% |

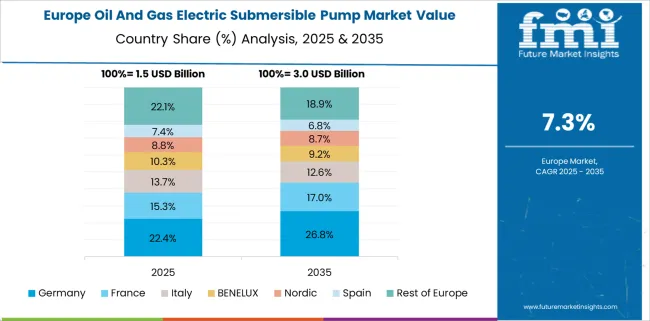

The global oil and gas electric submersible pump (ESP) market is set to expand at a CAGR of 8.0% from 2025 to 2035. China is leading growth at 10.8%, driven by deep-well extraction needs and upgrades in mature oilfields. India is close behind at 10.0%, supported by rising domestic energy demands and upstream modernization in ONGC and private fields. Among OECD countries, Germany is growing at 9.2%, backed by technological integration in offshore platforms and enhanced oil recovery initiatives. The UK, with a projected CAGR of 7.6%, is seeing uptake in the North Sea basin through platform optimization. The USA trails at 6.8%, where ESP demand remains stable but tempered by shale cycle volatility. While BRICS economies like China and India are advancing at double-digit rates, steady growth across Europe and North America highlights investment continuity in artificial lift technologies for production efficiency. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s oil and gas electric submersible pump market is projected to expand at a CAGR of 10.8% from 2025 to 2035, driven by intensified oil recovery efforts and government mandates to improve energy output per well. From 2020 to 2024, adoption of ESP systems was mainly limited to mature onshore fields in Xinjiang and Daqing. Over the next decade, new investments in tight oil and deep-well projects are expected to generate substantial demand for high-temperature, high-pressure ESP units. Domestic OEMs are also advancing variable speed drive (VSD)-enabled pump models to support automation in upstream operations.

India is anticipated to witness a CAGR of 10.0% in its oil and gas electric submersible pump market from 2025 to 2035, backed by ONGC and private sector push for enhanced oil recovery (EOR). Between 2020 and 2024, ESP demand was modest, largely tied to marginal field operations. Moving forward, rising energy import bills and greater focus on domestic production are propelling the use of ESP systems in offshore assets and mature well zones across Rajasthan and Assam. Indian oilfield service providers are entering partnerships with international pump manufacturers to localize high-capacity pump production.

Germany’s oil and gas electric submersible pump market is set to grow at a CAGR of 9.2% through 2035, as brownfield development strategies and CO₂-neutral oil production targets reshape upstream planning. From 2020 to 2024, ESP usage was limited to a few legacy onshore fields. In the coming years, operators are investing in advanced ESPs with intelligent monitoring capabilities to improve extraction efficiency in aging reservoirs. Technological advancements such as sensor-integrated ESPs are gaining favor, particularly in pilot projects involving geothermal co-production wells in Lower Saxony.

The United Kingdom is expected to see its oil and gas electric submersible pump market grow at a CAGR of 7.6% from 2025 to 2035, fueled by brownfield optimization across the North Sea and decommissioning delay strategies. Between 2020 and 2024, ESP demand was stable, tied mainly to offshore redevelopment projects. Going forward, operators are focusing on deploying ESPs designed for deep-sea high-viscosity crude and gas-lifted wells. Local EPC contractors are sourcing energy-efficient pump variants to meet carbon intensity benchmarks under the North Sea Transition Deal.

The USA oil and gas electric submersible pump market is projected to grow at a CAGR of 6.8% between 2025 and 2035, supported by unconventional oil recovery and digital field upgrades in key basins. From 2020 to 2024, ESP deployment was focused on Permian and Bakken wells with high water cut. In the next decade, advanced ESPs featuring fiber optic monitoring and automated shutoff systems are becoming integral to reducing operational costs and downtime. Service companies are scaling artificial lift packages tailored to shale assets with variable flow characteristics.

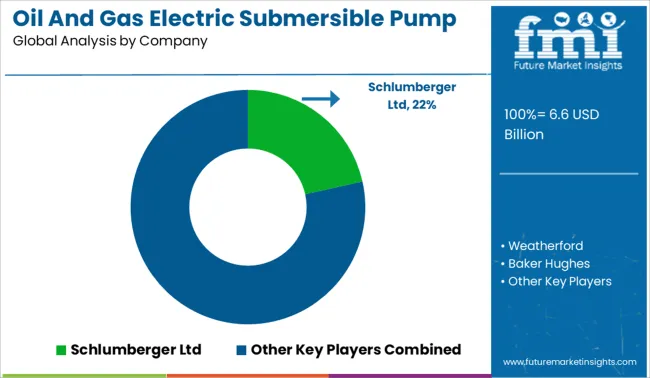

Demand for electric submersible pumps (ESPs) in the oil and gas sector remains robust in 2025, driven by increased offshore drilling and mature field recovery efforts. Schlumberger Ltd leads the market with a 21.5% share, leveraging its REDA ESP systems across both conventional and unconventional wells. Baker Hughes and Weatherford are expanding their portfolios by integrating AI-based pump monitoring, boosting uptime and operational efficiency. Sales of ESPs by Flowserve and Sulzer Ltd have grown in the Middle East, where high-temperature, sand-laden wells dominate deployment. Novomet and Halliburton are advancing in niche regions with compact, corrosion-resistant designs. Companies like EBARA, WILO, and Grundfos are gaining traction by tailoring pump solutions for water-injection and shale-related applications globally.

In April 2024, Schlumberger (SLB) launched its Reda Agile compact wide-range ESP and PowerEdge ESPCP rodless progressing cavity pump systems. These innovations deliver broader operating ranges, reduce installation time, and cut CO₂ emissions by up to 55%.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Application | Onshore and Offshore |

| Operation | Multistage and Single stage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger Ltd, Weatherford, Baker Hughes, Flowserve Corporation, EBARA CORPORATION, Atlas Copco AB, WILO SE, Grundfos Holding A/S, Gorman-Rupp Pumps, Crompton Greaves Consumer Electricals Limited, Sulzer Ltd, Tsurumi Manufacturing Co.Ltd., Novomet, and Halliburton |

| Additional Attributes | Dollar sales by pump type and well depth classification, demand dynamics across offshore and unconventional drilling operations, regional trends in artificial lift system deployment, innovation in high-temperature motor designs and variable speed drives, environmental impact of power consumption and equipment failure rates, and emerging use cases in enhanced oil recovery and marginal well revitalization. |

The global oil and gas electric submersible pump market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the oil and gas electric submersible pump market is projected to reach USD 14.4 billion by 2035.

The oil and gas electric submersible pump market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in oil and gas electric submersible pump market are onshore and offshore.

In terms of operation, multistage segment to command 67.8% share in the oil and gas electric submersible pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA