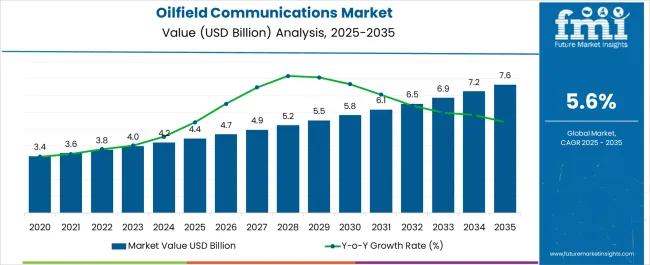

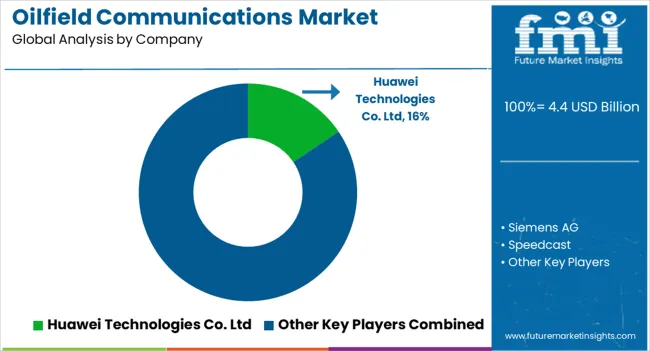

The Oilfield Communications Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Oilfield Communications Market Estimated Value in (2025 E) | USD 4.4 billion |

| Oilfield Communications Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The oilfield communications market is expanding steadily, supported by the increasing need for high-speed data transfer, real-time monitoring, and secure connectivity in exploration and production activities. Industry journals and company announcements have highlighted the rising adoption of digital oilfield solutions, where seamless communication networks are critical to operational efficiency. Remote and offshore oilfields have required robust communication infrastructures to manage drilling, production, and safety operations effectively.

Investments in satellite and wireless communication technologies have enabled oil companies to maintain connectivity across challenging geographies. Additionally, the integration of IoT, automation, and cloud platforms has raised the demand for advanced communication solutions capable of handling large volumes of data.

Government policies encouraging digital transformation in energy sectors, along with private investments in communication hardware and network infrastructure, are further driving growth. Looking ahead, market expansion is expected to be led by solutions for communication management, VSAT networks ensuring reliable coverage, and upstream operations that demand advanced connectivity to optimize resource exploration and extraction.

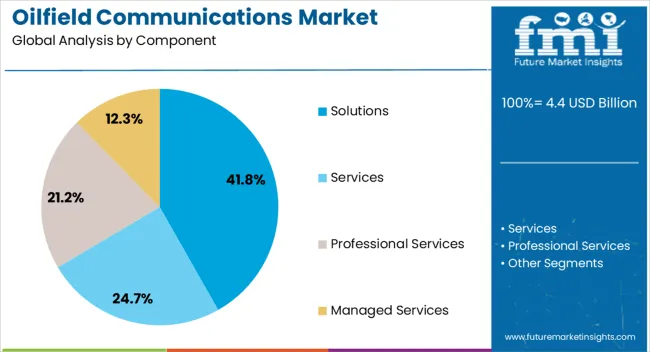

The Solutions segment is projected to account for 41.8% of the oilfield communications market revenue in 2025, establishing itself as the leading component category. Growth of this segment has been supported by the increasing requirement for integrated communication platforms that enable real-time collaboration, remote monitoring, and secure data transfer.

Oil and gas operators have prioritized solutions that provide end-to-end communication management, including cybersecurity, data analytics, and remote operations control. Industry reports have emphasized that solutions are increasingly bundled with managed services, enhancing their value proposition for operators seeking operational efficiency and reduced downtime.

The rising complexity of oilfield operations has made communication solutions indispensable, as they integrate various hardware and network elements into a unified system. As digital oilfields become more prevalent, the Solutions segment is expected to maintain its dominance, driven by its role in ensuring reliability, scalability, and safety in communication networks.

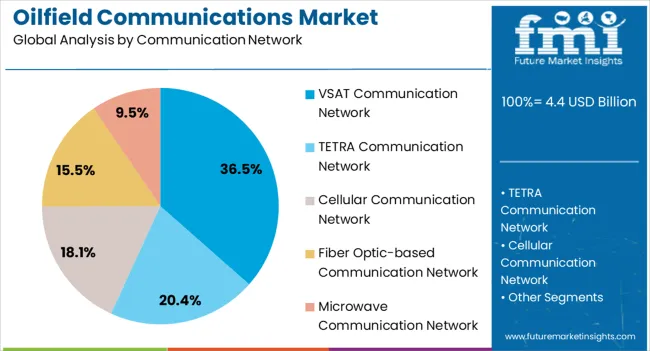

The VSAT Communication Network segment is projected to capture 36.5% of the oilfield communications market revenue in 2025, retaining its leadership among communication network types. This dominance has been attributed to VSAT’s ability to deliver reliable and secure connectivity in remote and offshore oilfield environments where terrestrial networks are unavailable.

VSAT technology has been widely adopted due to its high bandwidth capacity, global coverage, and resilience against harsh environmental conditions. Industry updates have noted that oilfield operators rely on VSAT systems for mission-critical functions, including drilling data transmission, asset tracking, and video surveillance.

Moreover, advances in satellite technologies have reduced latency and improved cost efficiency, further strengthening the role of VSAT in oilfield communication infrastructure. With exploration activities expanding into deeper offshore fields and remote onshore regions, the demand for VSAT communication networks is expected to remain strong, supporting uninterrupted operations and worker safety.

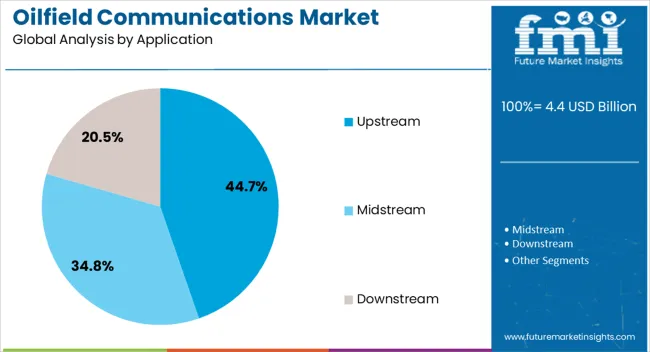

The Upstream segment is projected to hold 44.7% of the oilfield communications market revenue in 2025, making it the leading application area. This growth has been driven by the critical role of communication networks in exploration, drilling, and production activities.

Upstream operations, often located in remote and hostile environments, have required robust communication systems to support real-time data transfer, seismic analysis, and drilling management. Industry publications have highlighted that digitalization of upstream processes, including remote sensing and automated drilling, has amplified the need for advanced communication networks.

Furthermore, safety compliance and environmental monitoring requirements have reinforced investment in upstream communication systems. The adoption of satellite and wireless solutions has allowed upstream operators to maintain continuous connectivity and optimize decision-making. As energy companies intensify exploration activities and push towards deeper reserves, the Upstream segment is expected to sustain its leading position, driven by high data intensity and operational complexity.

Although there is still uncertainty about 5G adoption plans, it is already speculated that 5G is going to become a real competitive advantage for the market. The oilfield communications market is expected to benefit from the rapid adoption of oilfield communications along with wireless 4G communication networks and the implementation of 5G standards in industrial activities.

Agility and efficiency in oil exploration and production (E&P) activities are becoming an unavoidable requirement, which is spurring ambitious digital initiatives in the oil E&P sector boosting the market key trends and opportunities.

Oil is a finite resource that will not last indefinitely. Oil prices have also been volatile over the years due to changes in demand for oilfield communications and supply, as well as geopolitical events.

Geoscientists are constantly working to discover new oil sources and explore untapped reserves. On the other hand, scientists are working around the clock to investigate alternative energy sources. Oil prices are dropping impulsively as the viral outbreak spreads to more countries, and demand for oilfield communications along with market future trends weakens.

If the situation continues to deteriorate for another year, it will be devastating to the market. Exporting countries will have a negative impact on the market.

The oilfield communications market has a long history with digital technologies, particularly upstream, and there is still a lot of room for digitalization to improve operations for the market.

Oilfield communications market companies continue to invest in improved technologies for oilfield communications solutions despite rising costs and declining revenues.

The market is becoming more efficient as IoT integration, cloud computing, fleet management solutions, and automation become more efficient witnessing an escalation in market key trends and opportunities.

The digitalization of oilfield communications reduces human errors and allows for real-time data monitoring, resulting in long-term revenue. The market has finally made the transition to digital process control and automation. Robotic Drilling Systems AS of Norway and Siemens, for example, have collaborated to develop a drill floor solution based on robotic technology for fully unmanned oil and gas drill floor operations.

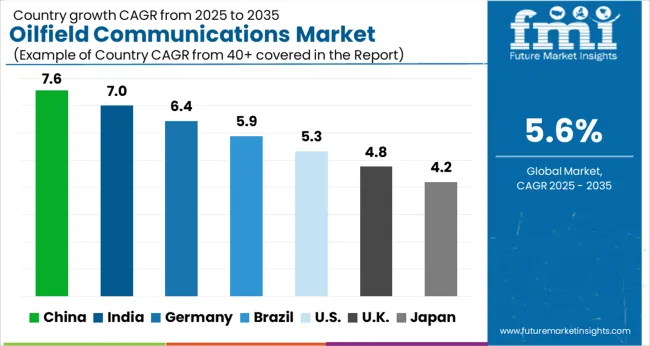

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| United Kingdom | 4.4% |

| China | 4.7% |

| Japan | 4.0% |

| South Korea | 3.3% |

North America is expected to dominate the oilfield communications market, owing to increased demand for oilfield communications and utilization of these technologies in large oilfields and offshore sites.

With rapidly rising production and exploration activities and newly discovered shale resources, the region is expected to emerge as one of the largest markets during the forecast period.

The Middle East and Africa (MEA) are expected to grow the fastest during the forecast period, while Europe is expected to gain a significant oilfield communications market share, following North America.

Numerous exploration activities and an increasing number of oil refineries in the region demonstrate market expansion.

The MEA region has several rigs, refineries, and exploration sites that use conventional control systems, which would boost the market growth even further.

The Middle East oilfield communications market, which has manufacturing costs far below current oil prices, has been heavily investing in the digital market in order to increase its crude recovery rate.

The European market is exhibiting incremental market growth and a significant increase in the implementation of oilfield communications technology, which is expected to positively impact the market opportunities over the next few years.

There are a few major players in the market who offer a full range of solutions. The market study report will provide a valuable insight with an emphasis on global market including some of the major players such Huawei Technologies Co., Ltd., Siemens AG, Speedcast, Weatherford International plc, Ceragon.

Oilfield communications manufacturers are pursuing various expansion strategies in order to increase their market share in the oilfield communications market. To deepen their penetration across lucrative market, the players employ a variety of market expansion strategies.

Product launches, collaborations with the market key players, partnerships, acquisitions, and the strengthening of regional and global distribution networks are examples of these strategies.

Recent Developments:

Partnership:

Installation:

Product Launches:

The global oilfield communications market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the oilfield communications market is projected to reach USD 7.6 billion by 2035.

The oilfield communications market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in oilfield communications market are solutions, services, professional services and managed services.

In terms of communication network, vsat communication network segment to command 36.5% share in the oilfield communications market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Oilfield Roller Chain Market

Rig and Oilfield Mat Market Size and Share Forecast Outlook 2025 to 2035

Digital Oilfield Solutions Market Growth - Trends & Forecast 2025 to 2035

Digital Oilfield Market Growth – Trends & Forecast 2024-2034

Operational Digital Oilfield Solution Market Size and Share Forecast Outlook 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Japan Communications Platform as a Service Market Growth - Trends & Forecast 2025 to 2035

Unified Communications and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Tactical Communications Market Size and Share Forecast Outlook 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA