The industry is expected to expand steadily, reaching an estimated value of USD 31.17 billion in 2025, and it is further anticipated to reach about USD 48.70 billion by 2035, indicating a CAGR of about 4.6%. This expansion is driven by factors such as increasing energy demand and rising global complexities in oil and gas operations.Improved oil recovery (EOR) methods are also a major demand driver.

EOR operations are heavily dependent on specialty chemicals such as alkali-surfactant-polymer (ASP) systems and biopolymers to enhance sweep efficiency and push out more hydrocarbons. As aging fields deplete, EOR usage continues to increase, particularly in North America and the Middle East.

The offshore sector is also propelling development, with fresh investment in Southeast Asia, West Africa, and Brazil. Harsh offshore environments demand high-performance additives like hydrate control agents, corrosion inhibitors, scale inhibitors, and demulsifiers to protect infrastructure and ensure flow assurance uninterrupted.However, the industry is also facing growing pressures regarding environmental regulation.

Chemicals released as a result of operations must meet increasingly stringent environmental regulations. There is a shift toward biodegradable and sustainable chemical formulation, with opportunities for innovation and sustainable product development.

Price volatility in crude oil remains a dominant driver. Expenditures on capital expenditures in production and exploration follow the trend of the price of oil, hence impacting demand for oilfield chemicals directly. As such, suppliers are focusing on cost-effective, performance-based formulas that deliver the highest yield at low dosages.

New technologies like nanofluids, intelligent polymers, and real-time reservoir monitoring systems are defining the future of oilfield chemistry. These new technologies provide more precise control over fluid behavior, improve reservoir characterization, and facilitate the industry's shift to more intelligent and automated field operations.

Market Metrics - Oilfield Chemicals Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 31.17 billion |

| Industry Value (2035F) | USD 48.70 billion |

| CAGR (2025 to 2035) | 4.6% |

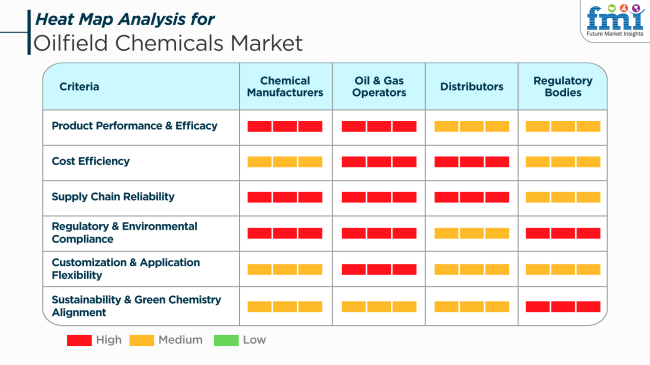

The oilfield chemicals industry is growing strongly, spurred by rising demand for improved oil recovery and effective drilling operations. Chemicals are instrumental in enhancing the productivity and efficiency of oil and gas production processes. Chemical manufacturers target creating high-performance products that meet the demanding needs of oil and gas operations. They invest in R&D to innovate and provide tailor-made solutions to enhance drilling efficiency and reduce environmental impact.

Oil and gas operators appreciate low-cost and reliable chemical solutions with optimal performance across various drilling conditions. They seek chemicals with high effectiveness, conform to environmental norms, and can be tailored to suit particular operating needs. Distributors highlight the necessity of ensuring an efficient supply chain to keep up with oil and gas operator requirements. They work towards providing a wide array of products catering to various applications along with on-time delivery and affordable prices.

Regulatory agencies mandate adherence to environmental and safety regulations, spurring the use of green and sustainable chemical solutions. They are a crucial force in determining the direction of the industry by proposing rules that promote the use of green chemistry and minimize the environmental impact of oilfield activities.

Throughout the period between 2020 and 2024, the oilfield chemical market was driven by volatility in oil prices and pandemic-related slowdowns in production and exploration. While upstream activity slowed temporarily, chemical producers responded by increasing the production of corrosion inhibitors, biocides, and demulsifiers to assist in better oil recovery and equipment maintenance on tight budgets. There is a growing demand for cleaner formulations in the offshore segment.

During 2025 to 2035, the market will shift towards sustainability, digitalization, and performance optimization.

There will be environmentally driven demand and more pressure to decarbonize oil and gas operations. Chemical formulations will similarly progress with biodegradable and low-toxicity ingredients. Also, digital oilfield technology like AI-based monitoring of chemical dosing will be the norm, ensuring peak efficiency and reducing wastage to a minimum. Companies will more often partner with tech companies to co-engineer smart chemical delivery systems that adapt in real-time to reservoir conditions.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Recovered after the disruptions of the pandemic, gradual recovery was witnessed. | Anticipated to grow modestly due to cleaner formulators as well as intelligent chemical systems. |

| Established infrastructure upgrading and maintenance, cost reduction, and process support. | Mandate of the environment and requirement for low-toxicity, high-performance chemicals. |

| Use of traditional inhibitors as well as conventional surfactants with limited environmentally friendly modifications. | Integration with AI and IoT in chemical dosing and smart delivery systems. |

| Dominated by North America and the Middle East in upstream operations. | Asia-Pacific and Africa growth with heightened exploration and EOR activities. |

| Minimal environment-based uptake; compliance-based changes in the majority. | Forceful shift to green chemistry and zero-discharge products. |

| Occupied with traditional formulations in corrosion and scaling prevention. | Innovation of biodegradable, nanotech-enriched, and reservoir-targeted chemicals. |

The crude oil prices are constantly changing. In 2024, unstable oil prices resulted in uncertainty in drilling and exploration operations. As oilfield chemicals are directly connected with upstream functions, falling rig counts and reductions in exploration expenditures made a significant hit in the Middle Eastern and North American short-term demand.

Environmental standards are growing more stringent, particularly regarding drilling fluids and stimulation chemicals. In 2024, new regulations in various countries necessitated greater biodegradability and reduced toxicity. Compliance not only drove formulation expenses higher but also slowed approvals for new chemical products in oilfield operations.

Operational risks were experienced in 2024 as a result of supply chain congestion. Importation of raw materials, particularly specialty surfactants and polymers, was delayed, leading to increased lead times for customers. Such disruptions affected inventory planning and forced suppliers to diversify the source, primarily at an additional cost, in a bid to sustain service levels geographically throughout the oil-producing world.

Technological disruption is a rising threat in this industry. Laggard companies that are slow to adopt or build high-performance, low-environmental-impact additives are losing their share. Demand in 2024 moved toward nano-based inhibitors and next-generation corrosion control formulations, putting pressure on legacy chemical providers to invest in short-cycle innovation pipelines.

In 2024, the industry was at high risk in terms of price volatility, environmental regulations, supply chain risk, sluggish innovation, and industry dependency. Mitigating these risks means that there has to be a balanced strategy combining sustainability, supply robustness, and flexible technology investment.

| Countries | CAGR (%) |

|---|---|

| USA | 4.8% |

| UK | 3.9% |

| France | 3.7% |

| Germany | 3.8% |

| Italy | 3.4% |

| South Korea | 4.2% |

| Japan | 3.3% |

| China | 5.7% |

| Australia | 3.5% |

| New Zealand | 3.1% |

The USA is projected to advance at a CAGR of 4.8% over the 2025 to 2035 timeframe. Growth is largely fuelled by ongoing shale growth, deepwater exploitation, and improved hydraulic fracturing technology. Chemicals such as biocides, corrosion inhibitors, and friction reducers are being increasingly sought to boost operational effectiveness and reservoir productivity. The regulatory focus on environmental adherence is driving the usage of green and biodegradable chemical products.

Large operators like Halliburton, Baker Hughes, and Chevron Phillips Chemical invest significantly in R&D to create multifunctional, cost-efficient chemical blends. The application of enhanced oil recovery (EOR) methods is also on the rise, further driving chemical demand. A strategic partnership among service companies and chemical providers continues to enhance innovation and volume in USA upstream operations.

The UK is expected to expand at a CAGR of 3.9% between 2025 and 2035. North Sea activity continues to be a prime driver, with improved recovery operations and offshore maintenance providing consistent demand for corrosion inhibitors, scale inhibitors, and demulsifiers. Environmental stewardship-based regulatory policies are driving the use of low-toxicity and environmentally friendly formulations.

UK operations are increasingly centered on the economic recovery of existing fields. Companies are investing in chemical solutions to prolong equipment life and maximize productivity. Having established service companies and close relationships with leading global chemical manufacturers gives access to the latest oilfield formulations and, thus, the resilience needed amidst operational volatility.

France is anticipated to have a CAGR of 3.7% in the industry over the forecast period. Though there is restricted direct exploration activity, France is an important hub for research, development, and export of specialty chemicals for application in global oilfield operations. Demand is influenced by the continued encouragement of innovation for drilling fluids, cementing additives, and production enhancement chemicals.

French specialty chemical makers are creating advanced water treatment and anti-scaling products for use in overseas oilfields. The nation also gains from integration with European energy service companies, supporting export-driven growth. Policy imperatives and concerns for the environment are driving standards of chemical formulation and aiding the production of biodegradable additives.

Germany is anticipated to expand at a CAGR of 3.8% during the period from 2025 to 2035. Though domestic hydrocarbon production is not significant, Germany is responsible for the growth and supply of high-performance chemical formulations to global oil and gas industries. There are robust chemical manufacturing capabilities backing innovation in rheology modifiers, dispersants, and wellbore cleaning agents.

German companies are increasingly joining research partnerships focused on enhancing EOR effectiveness and water management. The incorporation of sustainability metrics into oilfield operations is also increasing demand for low-impact chemicals. Germany's chemical industry, dominated by companies such as BASF and Evonik, is still a critical supplier to European and international oilfield service providers.

Italy is expected to expand at a CAGR of 3.4% from 2025 to 2035. Mediterranean offshore projects and collaborations with North African exploration activities drive the industry. Demand is concentrated on drilling fluids, cementing chemicals, and improved production treatments. Italian chemical companies are customizing products more and more for offshore and high-salinity conditions.

Local suppliers are working in accordance with European environmental guidelines by producing oilfield chemicals with greater ecological friendliness. Advances in polymer-based and surfactant-fortified products are picking up. Italy's traditional infrastructure and supply networks also make it a logistics hub for delivering chemicals to local oil-producing countries.

South Korea's oilfield chemical sales are set to record a CAGR of 4.2% during the forecast period of 2025 to 2035. Despite the lack of available domestic oil, South Korea provides value-added chemicals for international offshore and subsea operations. Its strong shipbuilding and engineering industry drives demand that is fueled by these sectors with the regular inclusion of oilfield chemical services in packages of equipment and installations.

South Korean manufacturers are concentrating on high-temperature and high-pressure (HTHP) chemical solutions that are specific to complex conditions. R&D facilities are developing technologies in corrosion prevention and flow assurance. Export schemes are enhancing the competitiveness of the nation, specifically in providing chemicals for operations in Southeast Asia and the Middle East.

Japan is expected to grow at a CAGR of 3.3% during the forecast period. The country emphasizes offshore alliances and the development of advanced materials. Japanese companies enhance oilfield efficiency by providing chemical solutions like paraffin inhibitors, gas hydrate suppressants, and emulsion breakers for deepwater and unconventional resources.

Advanced engineering and innovation capacity allow Japan to manufacture highly dependable chemical additives with minimal environmental footprint. Export-oriented producers are incorporating automation and digital modeling to improve accuracy in chemical dosing. International oilfield service companies' partnerships guarantee ongoing viability in global exploration and production activities.

China’s oilfield chemical sales are likely to grow at a CAGR of 5.7% during 2025 to 2035. It is being boosted by intense onshore and offshore exploration, particularly in areas like Xinjiang, Bohai Bay, and the South China Sea. Shale development and activities related to EOR are accelerating the use of surfactants, demulsifiers, and cement additives. Government favor for energy security is supporting in-country production strength.

Large-scale chemical manufacturers are integrating oilfield chemical operations with drilling service units, enhancing cost efficiency and supply chain responsiveness. Environmental mandates are shaping the composition of chemical products, promoting the development of water-soluble and non-toxic options. China's growing influence in overseas oilfield services is also generating demand for localized chemical supply chains abroad.

Australia will grow at a CAGR of 3.5% from 2025 to 2035. Offshore exploration and LNG production in areas like the Northwest Shelf and the Browse Basin are key drivers of chemical demand. Chemicals for drilling mud, cementing, and well-stimulation operations are under the spotlight as offshore projects increase in size and complexity.

Australian companies and subsidiaries of multinational providers are investing in high-technology chemical logistics to underpin remote offshore operations. Environmental compliance is a driving force behind the demand for low-toxicity additives and biodegradable surfactants. Strategic partnerships with Asian manufacturers are extending access to high-performance chemical formulations specifically designed for Australian operating conditions.

New Zealand is predicted to witness a CAGR of 3.1% during the 2025 to 2035 forecast period. Although domestic oilfield activity is comparatively low, there continues to be solid demand for chemicals underpinning well maintenance, improved recovery, and production optimization. Offshore basins such as the Taranaki Basin continue to attract attention in focused exploration activity.

Regional import channels from Australia and East Asia support the industry. Focus on protecting the environment and marine safety is impacting product choices towards water-based and non-hazardous chemical options. Localized supply alliances and joint ventures are becoming strategic means to guarantee reliability and conformity with emerging energy standards.

The Drilling and Completion segment is anticipated to dominate with a share of 28%. Followed by Cementing Chemicals with 22% industry share.This segment encompasses products used in the drilling and completion operations of oilfields, including drilling fluids, lubricants, and additives essential in ensuring safety and efficiency during drilling. Drilling fluids maintain hydrostatic pressure, cool the drill bit, and carry cuttings to the surface.

Increasing worldwide demand for oil and gas is the main driver for growth in the Drilling & Completion segment. Newer, improved drilling technologies are required. Exploration activities are moving into very difficult environments, such as deepwater and unconventional oil resources; this will likely create demand for specialized chemicals that ensure wellbore stability, reduce friction, and enhance the overall drilling process. Some leading suppliers of drilling and completion chemicals are Halliburton, Schlumberger, and Baker Hughes, providing tailored solutions to address the specific needs of oil fields.

The Cementing Chemicals segment is close behind, with a 22% industry share. Cementing chemicals act to seal and protect wellbores in ensuring forestalling fluid migration on the wellbore and providing zonal isolation in the sphere, ultimately enhancing production and reservoir integrity after this time. Greater emphasis on well productivity and prevention of wellbore damage will drive consistent demand for cementing chemicals, especially in countries active in exploration and production.

By terrain type,onshore is projected to capture 58% of the share, and offshore will account for a 42% share in the industry. Onshore oil and gas operations involve exploration and extraction activities that occur only on land and require a variety of oilfield chemicals, such as drilling fluids, production chemicals, and enhancers of oil recovery (EOR) agents. Significant market share of onshore operations can be attributed to the extensive infrastructure in land-based oil fields, mostly in North America, the Middle East, and some parts of Asia.

Onshore dominance can also be hugely attributed to the increasing development of oilfields in land-based regions as well as the exploration and development of unconventional resource types, such as shale oil and tight gas. Besides, a steady increase in investments in onshore drilling projects and technology advancement in drilling and production is expected to drive continuous growth in this segment. Some of the major companies, Halliburton, Schlumberger, and Baker Hughes, have made significant contributions to the supply of chemicals used for onshore drilling operations, working with solutions geared toward improved operational efficiencies and environmental safety.

The offshore segment will be projected to have a share of 42%. Offshore oil and gas operations refer to extraction beneath the seabed and entail high-pressure environments, inclement weather, and complicated logistics, making them more challenging than traditional onshore operations. Demand for oilfield chemicals in offshore operations has peaked since they tend to be needed increasingly with the exploration and production activities in deepwater and ultra-deepwater reserves.

Commercial offshore drilling generally requires special chemicals to solve problems related to well control, the prevention of corrosion, and the management of conditions in deepwater reservoirs. Offshore oilfield chemicals are therefore stocked heavily by big companies in the industry like BP, TotalEnergies, and Equinor, whose operations or projects mainly target offshore exploration.

There is tough competition among international manufacturers of chemicals and suppliers serving the industry for drilling fluids, cementing additives, corrosion inhibitors, and enhanced oil recovery solutions. The leading players, such as Baker Hughes, Halliburton, and Schlumberger, have used research and development, technology enhancement, and strategic alliances with oil and gas operators to stand apart in the market. They will still have an edge with respect to customized chemical solutions pertaining to good conditions and the prevailing regulations within the region.

Such companies are essentially those such as BASF SE, Albemarle Corporation, Akzo Nobel N.V., etc., interested in the making of environmentally safe oilfield chemicals even as they enhance their operational efficiencies. Innovations such as biodegradable surfactants, low-toxicity corrosion inhibitors, and polymer-based fluid loss additives give them a competitive advantage in sustainability.

Smaller players like Flotek Industries and GEO Drilling Fluids, Inc., are interested in high-performance specialty chemicals developed for shale operations, offshore drilling, and unconventional reservoirs.

Mergers and acquisitions are major determinant factors in shaping the competitive environment, and most of the major players keep on enlarging their already broad portfolios through mergers and acquisitions, investing in nanotechnology-based chemicals, water treatment solutions, and more advanced fluid additives. It is the companies that positively optimize, for example, supply chain logistics and regional distribution networks, that will most optimally place themselves to tap into developing markets like the Middle East, North America, and Asia-Pacific at their very early stages.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Baker Hughes, a GE Company LLC | 20-25% |

| Halliburton Co. | 15-20% |

| Schlumberger Limited | 12-16% |

| BASF SE | 10-14% |

| Albemarle Corporation | 8-12% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Baker Hughes, a GE Company LLC | Develops drilling, production, and completion chemicals for offshore and onshore operations. |

| Halliburton Co. | Specializes in well-stimulation, enhanced oil recovery, and water treatment chemicals. |

| Schlumberger Limited | Provides advanced cementing additives and fluid loss control technologies. |

| BASF SE | Focuses on biodegradable oilfield surfactants, corrosion inhibitors, and specialty polymers. |

| Albemarle Corporation | Innovates in high-performance bromine-based completion fluids and chemical catalysts. |

Key Company Insights

Baker Hughes, a GE Company LLC (20-25%)

Leads in comprehensive oilfield chemical solutions, integrating digital monitoring and fluid performance optimization.

Halliburton Co. (15-20%)

Expands its presence in enhanced oil recovery and cementing solutions, with a strong focus on well integrity and fluid management.

Schlumberger Limited (12-16%)

Strengthens its position through innovative drilling fluid additives and high-performance stimulation chemicals.

BASF SE (10-14%)

Focuses on sustainable and low-toxicity oilfield chemicals, gaining traction in green energy transition initiatives.

Albemarle Corporation (8-12%)

A key player in completion fluid and chemical catalyst solutions, supporting offshore and deepwater drilling.

Other Key Players

Baker Hughes, a GE Company LLC

The segmentation is into inhibitors (scale inhibitors, corrosion inhibitors, paraffin inhibitors), lubricants, de-emulsifiers, viscosfiers, gas well foamers, biocides, H₂S scavengers, and others.

The segmentation is into drilling & completion, cementing chemicals, stimulation chemicals, oil production chemicals, and enhanced oil recovery chemicals.

The segmentation is into onshore and offshore.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry valuation is estimated to be USD 31.17 billion in 2025.

The industry valuation is projected to grow to USD 48.70 billion by 2035.

China is expected to witness a 5.7% CAGR, reflecting its growing oilfield activity and the need for advanced chemicals in drilling and completion operations.

The drilling and completion segment is a key focus of the industry.

Key players in the industry include Akzo Nobel N.V., DowDuPont Inc., Flotek Industries, Inc., Ashland Inc., Solvay SA, Clariant AG, GEO Drilling Fluids, Inc., Innospec Incorporated, and Chevron Phillips Chemical Company LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Terrain Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Terrain Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Terrain Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Terrain Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Terrain Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Terrain Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Terrain Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Terrain Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Terrain Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Terrain Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Terrain Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Terrain Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Terrain Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Terrain Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Roller Chain Market

Rig and Oilfield Mat Market Size and Share Forecast Outlook 2025 to 2035

Digital Oilfield Solutions Market Growth - Trends & Forecast 2025 to 2035

Digital Oilfield Market Growth – Trends & Forecast 2024-2034

Operational Digital Oilfield Solution Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA