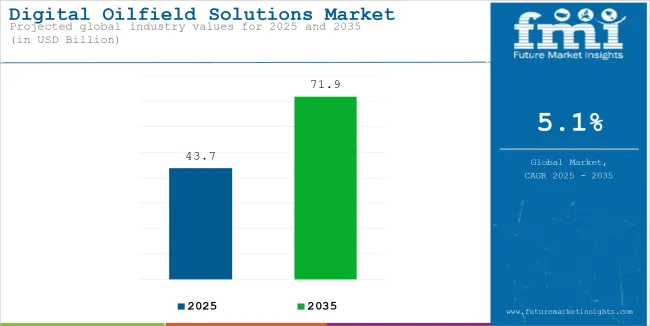

The digital oilfield solutions market has been identified to grow from USD 43.7 billion in 2025 to USD 71.9 billion by the year 2035, around a CAGR of 5.1%. The market is driven by the increase in automation in the oil and gas industry, adoption of advanced data analytics, and the growing need for real-time monitoring for better operational efficiency.

The investments being made by companies in AI, IoT, and cloud-based platforms are focusing on improving production and reducing downtimes while offering a better safety standard. Oilfield operators would be adopting much more data-driven solutions to come to proper decision-making and optimizing asset performance as digital transformation continues growing.

Companies and oilfield services are opting for more digital solutions for productivity, efficiency improvement, and safety compliance with a real-time data analytics approach. Emerging drivers for the adoption of digital oilfield solutions also include augmenting existing production and operational risk mitigation; changes such as predictive analytics, automation by artificial intelligence, and digital twins are facilitating remote overview and even preventive maintenance of oilfield activities.

Furthermore, currently, one can have real-time insights on any operating well and upon the health of equipment integrated with IoT devices, and thereby significantly reducing unplanned downtime while improving utilization on assets globally. Besides increasing investment in the development of digital solutions as necessitated by mandatory regulations on safety and environmental compliance, sustainability targets could be attained while optimizing petroleum resources.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 43.7 billion |

| Industry Value (2035F) | USD 71.9 billion |

| CAGR (2025 to 2035) | 5.1% |

Digital oilfield solutions are expected to continue growing as automation, artificial intelligence, and IoT-based technologies evolve. With a strong focus on operational efficiency, safety compliance, and real-time data analytics, more and more oil and gas operators are using advanced digital techniques to improve output. Cloud input, predictive maintenance, and digital twin modeling are expected to enhance market growth.

As long as the regulatory framework is getting tighter and the sustainability agenda is advancing, cutting-edge digital technologies will further define the shape of future oilfield operations worldwide.

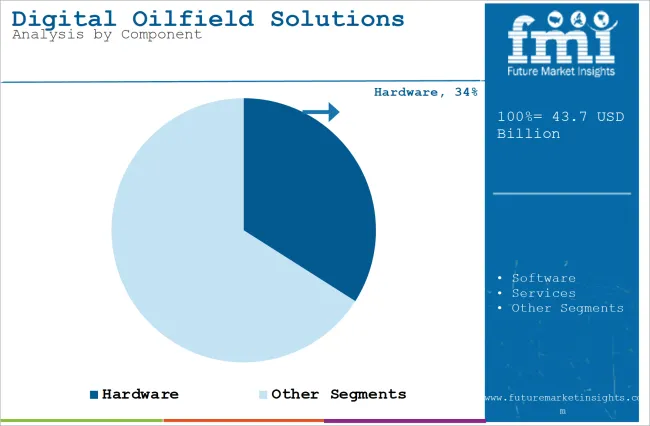

Hardware Segment Leads the Market Due to Increasing Adoption of IoT-Enabled Devices

The hardware segment of the digital oilfield solutions market is very significant and is driven by widespread deployments of IoT-enabled sensors, data-acquisition systems, and ruggedized computing devices. These components are critical for real-time monitoring, predictive maintenance, and asset management during oilfield operations.

The increasing demand for automation and remote monitoring for oil and gas fields is further contributing to the growth of hardware solutions. Along with this, increasing investments in upstream and midstream operations, especially in locations such as North America and the Middle East, are stimulating the growth of this segment. Continuous research and development in edge computing and AI-enabled hardware is predicted to further propel the future growth of the market.

Software Solutions Witness Rapid Growth with the Rise of Advanced Data Analytics

The software segment is growing at a tremendous pace, driven by the increasing need for advanced analytics, AI-led decision-making tools, and digital twin technology in oil and gas operations. Software solutions integrate drilling efficiency, production forecasting, and asset performance management optimization.

The change toward cloud-type oilfield solutions and integrated data platforms hastens acceptance. Companies are adopting various AI and Machine Learning techniques to enhance their reservoir modelling and predictive maintenance capabilities. Growing digital transformation activities in this segment are expected to get further traction by offshore and deepwater projects.

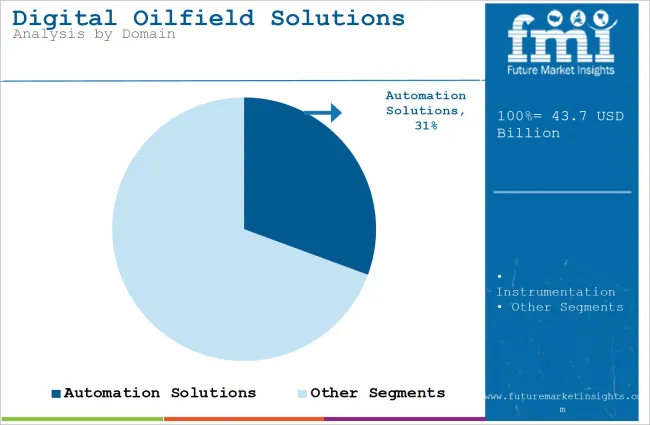

Automation Solutions Dominate the Market with Increased Focus on Operational Efficiency

Automation solutions are at the center of digital oilfield transformation, allowing the companies to optimize the drilling, production, and maintenance activities. Advanced SCADA systems, AI-controlled applications involving process controls, and autonomous drilling technologies principally drive the growth of this segment.

The demand for automation solutions is further driven by the transition to unmanned operations and the integration of digital workflow. The subsequent investments in real-time monitoring and automated control systems are pushing yet further via offshore and high-risk operational environments.

Instrumentation Segment Witnesses Growth with Advancements in Sensing Technologies

Instrumentation solutions are growing faster in the world of oil and gas, supplying real-time data on well productivities, fluid dynamics, and environmental conditions. Advanced sensors, flow meters, and pressure monitoring system integration further improve decision-making and predictive maintenance strategies.

Unconventional oil and gas fields on deepwater demand high precision instrumentation to improve operational efficacy and increase safety. Wireless sensor network and remote telemetry system innovations are thereby boosting digital instrumentation solutions adoption.

North America remains the largest market for digital oilfield solutions with the strong presence of giant oil and gas producers in the USA and Canada. The region has also seen augmented investments in automation, AI-driven predictive maintenance and IoT-enabled well monitoring technologies.

Oil prices are fluctuating, so companies are rapidly changing their mindset from manual applications towards technology-based solutions while looking to minimize costs while increasing operational efficiencies. Regulatory pressures focusing on safety, emissions, and environmental sustainability will end up pushing the adoption of advanced technologies that can comply with these requirements.

This is where the deepwater oil fields of the Gulf of Mexico and the shale production sites move to the direction of digital transformation. Companies apply the latest possible solutions to take significant strides toward improved exploration and production.

By capitalizing on the advantages of AI, IoT, and data analytics, North American oil and gas operators can now efficiently operate while ensuring higher safety and environmental stewardship in their operations. Increased innovation in the energy industry means increased productivity and growth for the future.

In Europe, the scenario of the market is being determined by either tight government-controlled environmental regulations or the extreme seriousness in the energy sector on sustainable energy generation. Norway and the UK direct huge investments in digital technology to optimize exploration and production of the North Sea.

AI-driven asset management and remote monitoring result in efficient compliance with emission targets at the same time as keeping operational effectiveness. Further, such European oilfield service companies have adopted digital twin concepts toward improvement in modeling of the reservoirs and related production forecasting. This integration of automation and analytics into workflows by operators is likely to keep the market flowing with steady growth.

The Asia-Pacific region is fast maturing into a developing region for digital oilfield technologies due to increasing energy needs and the development of offshore exploration, as in China, India, and Australia. Petro China and ONGC, national oil companies, are among the first to embrace the digital transformation route to improve drilling efficiency and optimize reservoir management.

Investments in real-time decision-making and cost-efficient operations across oilfields are in on the rise, especially in cloud-enabled platforms and IoT solutions.

South Korea and Singapore emerge as key hubs in the innovation platform for offshore digital oilfield technology because of significant advancements in automation, greater than that of AI and data analytics. As exploration expands into the deep basins at sea, the number of AI-driven predictive maintenance and digital well optimization requirements will increase. These initiatives help operators to reduce downtime while improving safety and productivity.

This digital technology makes exploration and production capabilities improve and increases the chance of this region emerging as a global frontrunner in energy exploration and production in the near future, specifically in offshore fields..

Emerging markets for digital oilfield solutions include the Middle East, Latin America, and Africa. These markets are motivated by increasing investments in offshore projects combined with the need to boost operational productivity. The Middle East, especially Saudi Arabia, the UAE, and Qatar, focuses on AI-enabled asset monitoring and real-time reservoir analysis for maximal hydrocarbon recovery.

Latin America, especially Brazil, is adopting digital oilfields through offshore pre-salt reserves to optimize production. Digital technologies have proven useful in deepwater projects in Nigeria and Angola, and they continue to impact on digitizing asset operationalization for improving well integrity.

High initial investment costs for digital transformation

The adoption of digital oilfield technologies is characterized by heavy capital investment in acquiring new digital technologies, software platforms, and advanced infrastructure. Funding constraints faced by most oil and gas companies, in particular smaller operators, limit their ability for digital transformation initiatives.

Further, investments with high initial costs for IoT sensors, AI-led analytics, and automation solutions are seen as a financial burden, and companies are facing delays in their wide- scale adoption. Nonetheless, as technology costs fall and returns on investment through efficiency gains are realised, an increased emphasis on operational strategies focusing on digitalization is observed.

Data security concerns in cloud-based oilfield management

The use of cloud computing and IoT-based solutions for oilfield operations raise concerns related to data security and cyber threats. Sensitive operational data such as well performance and production metrics are at risk of being lost to cyber-attacks, data breaches, and unauthorized access.

In order to realize the security of these digital platforms, robust cybersecurity measures must be instituted, including but not limited to encryption, multi-factor authentication, and AI-based threat detection systems. While transitioning to cloud-based data management, oil companies must endeavor to mitigate cybersecurity risks to avoid disruption of operations and maintaining regulatory compliance.

Integration complexities with legacy oilfield infrastructure

Many oil and gas operators work on decades-old infrastructures, most having never implemented thoughts on integrating digital technologies. Integration happened in modern digital oilfield solutions with him technical integration issues, and groundwork must be well done prior to considering a solution. Making things even more complex are the requirements of retrofitting existing equipment with IoT sensors, SCADA systems, and above-mentioned AI-driven analytics, which inflate expenditure and time taken for integration.

Companies have to invest in scalable integration solutions as well as workforce training to ensure a seamless transition to digitally optimized operations while keeping production downtime to an absolute minimum.

Adoption of AI and machine learning for predictive analytics

AI and machine learning are transforming oilfield operations through predictive maintenance, drilling optimization, and reservoir model improvement. Through predictive analytics, operators can detect signs of potential equipment failure, thereby reducing equipment downtime and increasing the asset life.

The algorithms provided through machine learning analyze large volumes of data and then guide operations towards a more efficient process and a cut in operational risks. As AI-based solutions accelerate, more enterprises are using these technologies for automating decision-making and optimizing the processes for maximum hydrocarbon recovery restoration from complicated reservoirs.

Expansion of 5G and edge computing for real-time monitoring

The implementation of 5G and Edge computing technologies is improving real-time data processing capabilities in oilfield operations. High-speed data transfer through 5G networks enables oilfield operators to closely monitor drilling processes, equipment performance, and production metrics with low latency.

Edge computing lessens dependence on centralized cloud processing by allowing for data to be processed and analyzed closer to where it is generated, thereby speeding up response times and increasing operational efficiency. As these technologies become more accessible, continued investment will be made into the digital infrastructure of oil and gas companies for enhanced remote monitoring, safety, and optimization of production in general.

Increasing government support for digitalization in energy sectors

Around the world, governments aim at promoting digitalization in oil and gas, thus enhancing the operational efficiencies of energy generation method, combating CO2 emissions into the atmosphere, and resolving energy security concerns. On the other hand, rules and regulations toward encouraging smart oilfield technologies, AI-driven automation, and IoT-enabled monitoring are spearheading digital transformation across the industry.

Support for technology development in digital oilfield solutions through tax incentives, research funds, and public-private partnerships is also of increasing importance. As the regulatory environment matures to facilitate digital initiatives, investments by oil and gas operators in advanced technology to meet sustainability targets and optimize resource management will keep rising.

The digital oilfield solutions market is poised for continuous growth with advancements in automation, AI, and IoT-based technologies. Oil and gas operators are beginning investments in AI digital oilfield solutions with operational efficiency, safety compliance, and real-time data analytics at the forefront of their strategies for improving production.

The key trends defining the future of this sector include accelerated migration to cloud computing, AI-driven predictive maintenance, and digital twin modeling. As regulations tighten and sustainability initiatives take flight, advanced digital technology integration will influence the future of oilfield operations around the world.

Introduction The digital oilfield solutions market is booming from 2020 to 2024, mainly due to growing adoption of automation, real-time data analytics, and cloud computing in oil and gas. All these would come on the backdrop of the imperative need that industry players have for improving operational efficiency and reducing operational costs, with strong decision capabilities. The introduction of IIoT, real-time predictive analytics, and machine learning will play a significant role in optimizing drilling, production, and reservoir management.

As the shift takes place into the 2025 to 2035 time period, digital oilfield technologies will also evolve further as advanced artificial intelligence will be introduced, enabling blockchain for secure management of data as well as digital twins for real-time visualization of assets. Increased emphasis on sustainability and reduction of carbon footprint, in conjunction with other securities measures such as cybercrime mitigation, will further determine market dynamics.

Companies investing in next-generation digital solutions will experience that competitive advantage in productivity and regulatory compliance.

The market for digital oilfield solutions would be briskly transformed in the near future with prediction by AI-powered predictive maintenance that would reduce downtime and increase productive output. In addition, the concept of a digital twin will pave the way for carrying out real-time simulations of how oilfields operate to make processes quicker and more precise in decision making. Robust data security will incorporate blockchain technology, which will help to eliminate or considerably reduce threats of cyber criminals and data breaches.

Besides, discovery and monitoring of greenhouse gas emissions would eventually lead to the development of real-time digital platforms for the consumption of natural resources. The introduction of high-end technologies that complete the cycle of improving efficiency without straying from emerging regulations will dominate the ultimate future of competition in a decade. Digitalization and energy transition strategies will converge, ensuring sustained growth potential and continued innovation in the digital oilfield solutions market.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with data security and operational efficiency standards. |

| Technological Advancements | Adoption of cloud computing, IIoT, and real-time monitoring. |

| Industry-Specific Demand | High demand for predictive maintenance and enhanced reservoir management. |

| Sustainability & Circular Economy | Initial steps toward digital solutions for energy efficiency. |

| Production & Supply Chain | Challenges in integrating legacy systems with digital platforms. |

| Market Growth Drivers | Increasing need for efficiency, safety, and real-time data analysis. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter cybersecurity protocols and integration with global sustainability initiatives. |

| Technological Advancements | Expansion of AI-driven automation, blockchain-based security, and digital twin technologies. |

| Industry-Specific Demand | Increased focus on real-time asset optimization and emissions monitoring. |

| Sustainability & Circular Economy | Greater emphasis on reducing carbon emissions and optimizing resource utilization through AI. |

| Production & Supply Chain | Widespread deployment of fully integrated and autonomous digital oilfield ecosystems. |

| Market Growth Drivers | Growth in AI adoption, sustainability-driven innovations, and enhanced digital security measures. |

The United States has once again proudly declared itself as a world leader in Digital Oilfield Solutions, keeping a pace of over 5.4% in growth. This growth has been possible mainly due to the powerful oil and gas infrastructure of the country, along with its enormous shale reserves and the prevalent adoption of advanced digital technologies such as Artificial Intelligence (AI), cloud computing, and real-time monitoring.

This strategic convergence allows greatly improving operational efficiencies, availability of real-time decision-making capabilities, predictive maintenance, and thus creates a higher optimization of production.

Among the most prominent drivers of this market expansion has been the current growing commitment to sustainability by the USA energy sector, with all the increasing pressure to reduce environmental footprint making the larger oil and gas companies now committing digital solutions for enabling better resource management and reduction in emissions.

AI analytics, digital twin, and automation have made it possible for the industry to predict failure of equipment and failures before they occur, optimizing their energy consumption and using much less energy, also helping to keep in line with other larger national sustainability goals.

Besides this, cost saving also remains an important element in driving the business towards a digital oilfield solution. The price of oil that would change makes oil companies creative in finding new ways of cutting costs in operations.

Digitalization streams companies' operations in an environment with improved drilling and an increase in data-driven decision-making, all helping reduce expenses of companies. E.g., cloud computing makes it easier to collect, store and analyze massive amounts of data without developing costly infrastructure for this purpose while expanding agility in operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

Cumulatively, the market for Digital Oilfield Solutions in the UK has been growing steadily, boasting a CAGR of 4.9% from 2025 to 2035. While one of the factors driving this development is the focus by the country towards security in energy as well as its carbon footprints decrease, it propels the oil and gas industry to embrace digital technologies for more efficient operations. Significant government backing for offshore oil exploration in the North Sea is speeding up the movement into the digital oilfield.

Continued digital transformation in the North Sea oilfields now associated with value-adding technologies such as predictive analytics, digital twins, and IoT into solutions provide enhanced data analysis, real-time monitoring, and enhanced predictive maintenance, thus bringing production up while costs plummet. Thus, digital solutions will accompany the remaining development and efficiency of the UK oil and gas industry in innovation and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Effective growth for the Digital Oilfield Solutions market is rewarding the European Union (EU) with a 5.1% CAGR. The EU has been stepping up investments in digital technologies towards oil and gas operations, because it has been raising the bar on applications to reduce energy dependency on non-renewables and on future energy needs.

Such advanced solutions-in smart monitoring, data management, and automation-are imperative for improving oil recovery from mature fields and enhancing operational efficiencies. Adding to that are the numerous sustainability regulations and energy transition goals plastered all over the EU, which also drive corporations into adopting more green digital solutions.

By moving further into greener practices, more innovations will be adopted by digital oilfield technologies to emit less while optimizing the use of resources and working toward the EU's longer objectives of sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

Japan is growing at a CAGR of 4.8% in the Digital Oilfield Solutions market, which relies quite much on advanced technologies to improve the efficiency of energy production. The use of digital solutions because of heavy reliance on energy imports even though the domestic oil and gas reserves are limited in the country, have led to improved production and decreased cost as the government most likely will be doing policies with the aid of corporations in investments for automation, data analytics, and energy-efficient systems, which will be central in the growth of this industry.

Innovations such as AI-driven analytics, predictive maintenance, and real-time monitoring are already improving operational performance, safety, and resource management. As Japan keeps a focus on energy security and sustainability, so will the use of digital oilfield solutions remain relevant in maximizing the efficiency within its energy sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The Oilfield Solutions Digital market in South Korea is expanding rapidly with a 5.5% CAGR. The country's advanced technological infrastructure combined with very strong government-initiated initiatives in the oil and gas sector is what makes the difference in deploying digital oilfield in South Korea.

The most important aspect of that deployment is improvement in operational efficiency and reduced downtime caused by incorporating AI-driven predictive maintenance, real-time monitoring, and IoT-based solutions in oilfields. On top that, the growing focus on integrating renewable energy into oilfield operations is expected to drive the Digital Oilfield Solutions market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The Digital Oilfield Solutions Market is rapidly evolving as oil and gas companies harness digital technologies to improve efficiency, reduce operating expenses, and maximize production. Automation, data analytics, artificial intelligence (AI), and the Internet of Things (IoT) have transformed what used to be operational oilfield paradigms into smart, data-oriented ecosystems.

The major players in the market include Schlumberger, Halliburton, Baker Hughes, Weatherford, and Siemens Energy, all of which have found their business opportunities in catching real-time data, predictive analytics, and digital twin technology to advance asset performance, safety, and sustainability. Drivers of market growth include enhanced reservoir management, predictive maintenance, and energy transition initiatives.

Rapidly Changing Digital Oilfield Solutions Market- With the increased application of technologies like AI, IoT, and Cloud Computing, the market transformation for Digital Oilfield Solutions is happening faster. The market space continues to be mostly dominated by existing leaders such as Schlumberger, Halliburton, and Baker Hughes, while budding new entrants are establishing their niche for specifically designed digital solutions.

Automation becomes more emphasized every year, sustainability takes a greater role, and real-time data analytics improves, adding to the growing base for a better and broader scope for new developments in future years.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger | 20-25% |

| Halliburton | 15-20% |

| Baker Hughes | 12-16% |

| Weatherford | 8-12% |

| Siemens Energy | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger | Provides AI-powered digital twin solutions, real-time well monitoring, and cloud-based oilfield analytics. |

| Halliburton | Specializes in digital workflows, predictive maintenance, and integrated asset management solutions. |

| Baker Hughes | Offers IoT-driven remote monitoring, predictive analytics, and AI-enhanced oilfield automation. |

| Weatherford | Focuses on real-time production optimization and advanced digital control systems. |

| Siemens Energy | Develops intelligent oilfield solutions with edge computing, data analytics, and process automation. |

Schlumberger

Schlumberger is a company in the lead when it comes to new and innovative technologies for the digitization of oilfield practices, employing real-time insight through AI analytics, cloud-based solutions, and automation tools. The DELFI cognitive E&P environment, the fact that it provides a collaborative platform for enhancing intelligent decision-making and operational control, makes it the most transformative environment for the oil patch.

It has advanced efficiencies at energy companies in such managing reservoirs and asset performance, cost reductions, and improving productivity, thus marking yet another milestone in the digitization transformation of the energy industry.

Halliburton

Halliburton combines artificial intelligence and machine learning with cloud computing to enhance efficiency in drilling, completions, and production workflows. With the help of its DecisionSpace® suite, real-time data can be analyzed and utilized to manage assets so that operators have tools to improve operational efficiencies and reduce downtime.

Increase performance and speed up decision making; Halliburton helps its customers gain competitive advantage from their work in the energy sector while reducing costs and focusing on maximized production within exploration and production operations.

Baker Hughes

Baker Hughes concentrates on IoT-powered digital solutions for predictive maintenance and asset health monitoring enhance operational reliability. Strategic alliances with Microsoft and C3 AI reinforce the company's capabilities in AI-driven oilfield technology and position it to provide next-generation solutions to optimize performance while reducing emissions.

Baker Hughes' digital solutions help clients achieve sustainability goals, improve asset uptime, and reduce operational costs, creating a defence position for the company in the evolution of smart, sustainable energy solutions.

Weatherford

Production optimization and real-time monitoring are key areas where Weatherford excels through advanced digital solutions. The predictive analytics and remote operations of ForeSite® enhance reservoir performance and reduce operational risk.

Weatherford offers data-driven insights that allow operators to optimize asset performance, reduce downtime, and increase productivity. Effective reservoir management from this holistic approach translates to economical operations while improving safety and reliability in oilfield operations.

Siemens Energy

Siemens Energy has endowed itself not only with a most qualified team of experts in the oil industry but also with a most approved modern means for providing solutions to oilfield problems, that is, through edge computing, artificial intelligence, and massive data analytics. The MindSphere industrial IoT platform will help to keep the connectivity simple, hence allowing process automation and optimized control across oilfield assets.

Like the other solutions Siemens develops, this one enables their customer to enjoy real-time monitoring and predictive maintenance, hence driving efficiency and minimizing downtimes. With advanced digital tools, Siemens can now empower operators to increase their performance, streamline operations, and improve sustainability in the oil and gas industry, thus ensuring a competitive edge in a rapidly evolving sector.

The global Digital Oilfield Solutions market is projected to reach USD 47.3 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the assessment period.

By 2035, the Digital Oilfield Solutions market is expected to reach USD 71.9 billion.

The Hardware segment is expected to hold a significant market share due to its high demand in Digital Oilfield Solutions.

Major companies operating in the Digital Oilfield Solutions market include Emerson Automation Solutions, Honeywell Process Solutions, ABB Ltd., Rockwell Automation, CGG Aveva Group, Schneider Electric, Infosys Oil & Gas Digital Services, Siemens AG, Eaton.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Domain, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Domain, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Domain, 2023 to 2033

Figure 19: Global Market Attractiveness by End Use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Domain, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Domain, 2023 to 2033

Figure 39: North America Market Attractiveness by End Use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Domain, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Domain, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Domain, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Domain, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Domain, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Domain, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Domain, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Domain, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Domain, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Domain, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Domain, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Domain, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Domain, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Domain, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Domain, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA