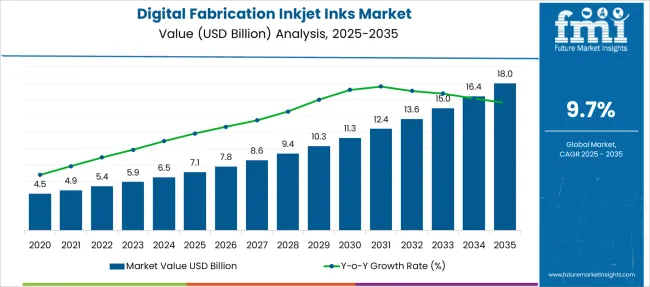

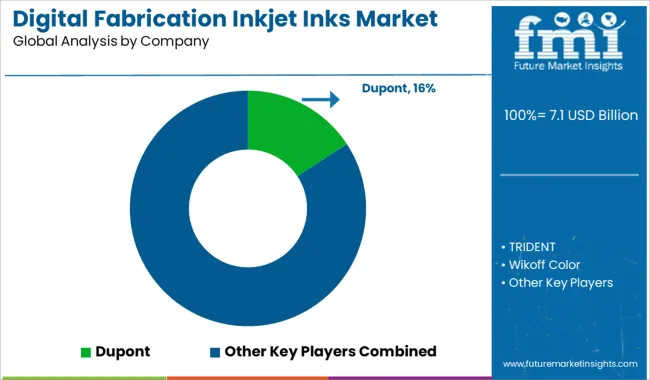

The Digital Fabrication Inkjet Inks Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 18.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Digital Fabrication Inkjet Inks Market Estimated Value in (2025 E) | USD 7.1 billion |

| Digital Fabrication Inkjet Inks Market Forecast Value in (2035 F) | USD 18.0 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The digital fabrication inkjet inks market is evolving steadily, driven by the growing demand for high-resolution, on-demand printing solutions across various industries. These inks are gaining traction for their ability to enable precise and customizable print applications with minimal waste, supporting trends toward digital transformation and sustainability.

Industries such as textiles, packaging, and interior décor are increasingly adopting digital fabrication technologies to enhance design flexibility and reduce production time. The integration of environmentally friendly formulations and compatibility with diverse substrates is further strengthening market adoption.

Innovations in ink chemistry, along with advancements in printhead technologies and substrate treatment methods, are expected to propel market growth. As businesses seek efficient, scalable, and cost-effective printing alternatives, the digital fabrication inkjet inks market is positioned for continued expansion across both industrial and commercial sectors.

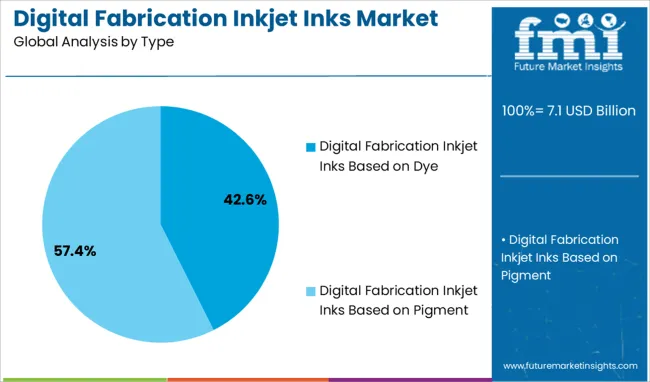

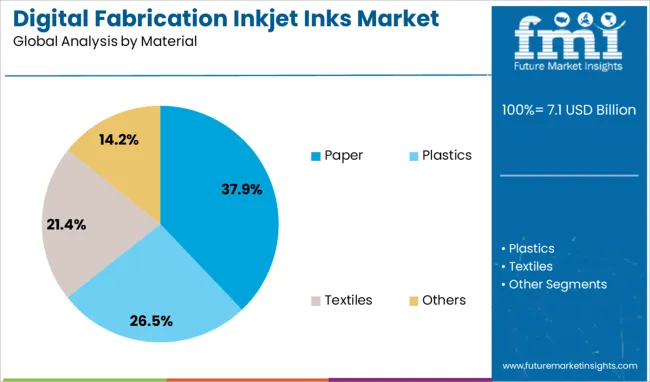

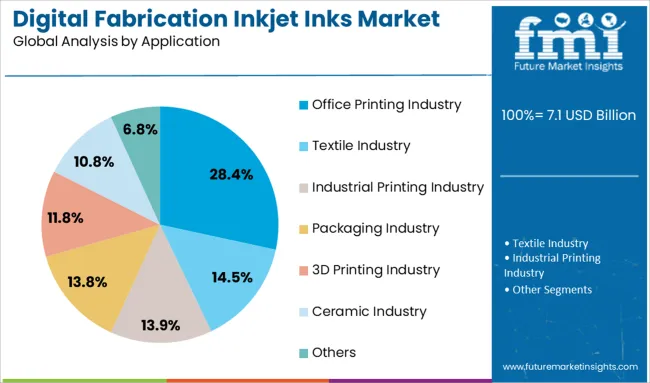

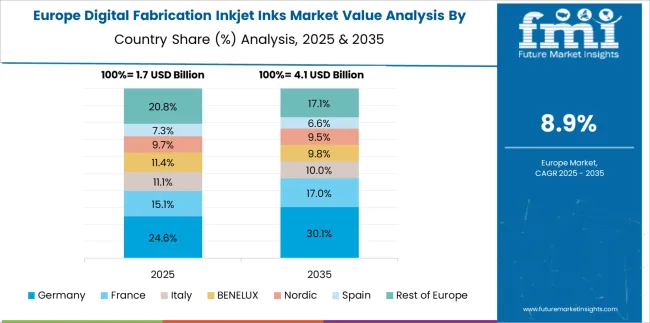

The digital fabrication inkjet inks market is segmented by type, material, application and geographic regions. The digital fabrication inkjet inks market is divided into Digital Fabrication Inkjet Inks Based on Dye and Digital Fabrication Inkjet Inks Based on Pigment. The digital fabrication inkjet inks market is classified into Paper, Plastics, Textiles, and Others. Based on the application of digital fabrication inkjet inks, the market is segmented into Office Printing Industry, Textile Industry, Industrial Printing Industry, Packaging Industry, 3D Printing Industry, Ceramic Industry, and Others. Regionally, the digital fabrication inkjet inks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dye-based ink segment leads the type category with a 42.6% share, attributed to its vibrant color output, lower cost, and wide applicability in general-purpose and indoor printing tasks. These inks are widely utilized for applications that do not require high levels of water or UV resistance, making them suitable for posters, office prints, and graphics with short-term exposure.

The segment benefits from the growing demand for vivid and high-resolution prints at competitive pricing, particularly in the home and small-office user base. Ease of formulation and compatibility with standard inkjet printers contribute to its broad market penetration.

While pigment-based inks are gaining momentum for industrial and archival applications, dye-based inks remain dominant in cost-sensitive segments where aesthetics and print vibrancy are prioritized. Ongoing improvements in fade resistance and formulation stability are expected to reinforce this segment’s relevance in the evolving inkjet ecosystem.

The paper segment holds a commanding 37.9% market share in the material category, driven by its longstanding role as the most common and cost-effective substrate for inkjet printing. Paper’s compatibility with various ink formulations, ease of handling, and affordability make it a preferred choice across office, educational, and advertising environments.

The rise in short-run and personalized printing has further bolstered the demand for coated and specialty papers designed to optimize ink absorption and image quality. Despite the increasing use of synthetic and textile substrates in industrial applications, paper continues to dominate due to its accessibility and lower environmental impact.

Technological advancements in paper coatings and treatments are enhancing print durability and resolution, ensuring that paper remains a staple substrate for a wide array of digital fabrication tasks. As demand for sustainable and recyclable materials intensifies, the paper segment is expected to maintain a strong foothold in the market.

The office printing industry accounts for 28.4% of the application segment, reflecting the sustained use of inkjet technology in business environments for document creation, reports, and presentation materials. Despite the digitization of workflows, physical printing remains integral to many organizational processes, especially within administrative, educational, and legal sectors.

The widespread use of inkjet printers in offices is supported by their affordability, ease of use, and ability to produce high-quality color outputs on demand. The segment has adapted well to the hybrid work model, with continued sales of compact inkjet units for home offices further driving ink consumption.

The shift toward energy-efficient and lower-emission printing solutions aligns with environmental policies in corporate settings. The office printing segment is expected to remain stable, supported by consistent replacement cycles, maintenance contracts, and the development of ink formulations tailored to high-speed, multifunction devices.

The digital fabrication inkjet inks market is expanding rapidly as industries such as textiles, packaging, industrial printing and 3D fabrication adopt precision inkjet solutions. Key ink formats include aqueous dye, pigment, UV‑curable and sublimation chemistries tailored to substrates like textiles, plastics and ceramics. Demand growth is supported by interest in functional inks for printed electronics and customized production workflows.

Increasing adoption of industrial drop‑on‑demand and hybrid inkjet systems enables high-resolution, multi-material printing. Regional strength emerges in manufacturing hubs such as North America, Europe and Asia‑Pacific.

Ink formulations must ensure strong adhesion and durability across diverse substrates such as plastics, ceramics, textiles, glass and composite surfaces. Some aqueous dye or pigment inks experience delamination or migration on non‑porous plastics without specialized primers or surface treatments.

UV‑curable inks require precise curing control to avoid curing defects or substrate damage. Formulators must tailor ink viscosity, surface tension, and curing profiles for each intended substrate. This increases development cost and prolongs testing cycles. As new materials enter digital fabrication platforms, compatibility testing must scale rapidly.

Adoption delays occur when ink behavior is inconsistent, prompting requalification or substitution. Manufacturers that invest in substrate‑specific ink portfolios and validation workflows gain credibility. Suppliers that can partner with printer and substrate providers to ensure seamless performance across combinations reduce integration risk and support faster deployment of digital fabrication platforms in end‑use industries.

Growth in digital fabrication and 3D printing technologies is creating new demand for specialized inkjet inks. These inks enable layer‑by‑layer deposition of polymers, ceramics, or biocompatible materials at micro‑scale resolution. Industries such as aerospace, automotive, healthcare and consumer goods benefit from precise customization and rapid prototyping enabled by inkjet ink innovation. Inks must support high resolution, precise placement, and multi‑material integration while maintaining consistency across build layers. Demand increases for formulations that support complex geometries and functional features such as embedded circuits or microstructures.

Suppliers that collaborate with digital fabrication equipment makers and material science teams can co‑develop ink systems tuned to specific fabrication platforms. As fabrication platforms diversify, ink complexity grows. Companies able to rapidly adapt chemistry for emerging fabrication technologies position themselves well for long‑term growth in highly specialized applications.

A pronounced trend in this market is the emergence of conductive and functional inkjet formulations for printed electronics, flexible circuitry, sensors and smart textiles. These inks incorporate materials such as silver nanoparticles, graphene, or carbon nanotubes to enable printed conductive traces directly on substrates. Functional inks support creation of IoT components, wearable devices and integrated sensors using additive fabrication processes. Precision formulation ensures conductivity, flexibility, and adhesion while maintaining ink stability. Multi‑layer printing and sintering compatibility are critical in electronics fabrication.

As demand grows for flexible and wearable electronic devices, ink developers invest in optimized formulations for stretch, wash durability and low curing temperature compatibility. This trend expands beyond color printing into functional material printing that adds value in smart manufacturing. Suppliers pioneering functional ink portfolios and validation in printed electronics applications differentiate themselves as ecosystem partners in advanced additive fabrication environments.

Feedstock variability and supply disruptions affect ink precursors such as pigments, specialty monomers, or nanoparticle conductive materials. Availability of key pigment chemistries and metal-based conductive particles can vary due to raw material sourcing issues. Some biobased or waterborne formulations rely on agricultural feedstocks whose chemical consistency may fluctuate seasonally. These variations affect ink performance attributes such as color stability, viscosity, curing rate, and electrical conductivity. Formulators must implement tight quality control and batch testing to maintain product consistency.

Unexpected raw input shortages or price volatility force suppliers to reformulate or qualify alternate sources, leading to extended development cycles. Small producers face greater vulnerability as they lack scale purchasing power or secured supply contracts. Buyers seeking consistent quality and long-term reliability may hesitate to commit without proven supply chains. Until material sourcing stabilizes and contingency protocols are in place, supply unpredictability will restrain confidence in digital fabrication ink deployment for mission‑critical applications.

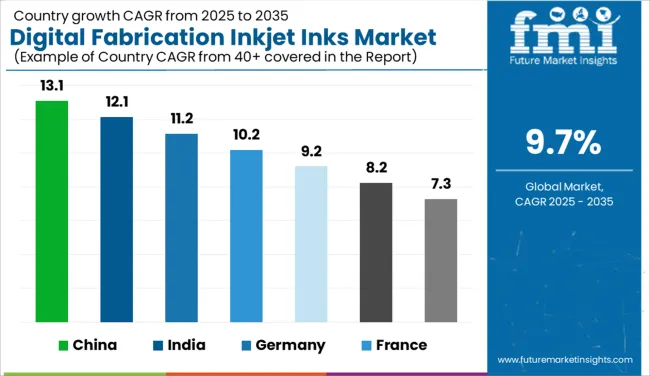

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

The global digital fabrication inkjet inks market is projected to grow steadily, with China leading at 13.1%, supported by large-scale printing and packaging industries adapting digital methods. India follows at 12.1%, driven by increasing demand in textile printing and commercial graphics. Germany reports 11.2% growth, sustained by precision ink formulations used in industrial and prototyping applications. The United Kingdom, at 9.2%, has maintained demand, particularly in specialty coatings and decorative printing. The United States, at 8.2%, remains an established market with developments guided by regulatory compliance and quality standards for print durability. Ink formulation guidelines, printhead compatibility protocols, and environmental safety regulations influence market dynamics. This report includes insights on 40+ countries; the top markets are shown here for reference.

China has seen rapid expansion with a 13.1% CAGR, driven by increased use in industrial printing, packaging, and textile decoration. Demand has focused on inks with quick drying times and strong adhesion on varied substrates such as plastics, paper, and metal foils. Large-scale manufacturers have scaled production of UV-curable and solvent-based inkjet inks to meet rising orders from commercial print service providers. Specialty formulations tailored for high-resolution textile printing and flexible electronics fabrication are gaining traction. Local R&D efforts have concentrated on improving ink consistency and color vibrancy to meet evolving market requirements.

India has shown notable progress in the nonwoven flanging market, growing at a CAGR of 7.8%, driven by increased use in HVAC filters, household appliances, and transport air modules. Regional air purifier brands have incorporated flanged edges in their cartridge-style filters for better sealing during operation. Domestic filter converters have adapted rotary die-cut stations to produce round and oval formats with flanged linings. Train ventilation systems and bus cabin filters have deployed nonwoven flanges to ensure leak-free airflow. Contract manufacturers have modified heat sealing lines for faster flange reinforcement on spunbond and meltblown substrates. Consumer appliance brands have moved toward modular filter units using precision-cut flanged nonwovens for easy installation. Roll suppliers have introduced custom-width materials for localized trimming and bonding.

In Germany, the market for digital fabrication inkjet inks has grown at a CAGR of 11.2%, driven primarily by industrial printing applications, automotive interior decoration, and electronics labeling. Demand for solvent-free and low-odor inks has increased due to strict workplace safety and environmental standards. UV-curable inks, offering flexibility and durability on various substrates, are extensively used in automotive components and smart device manufacturing. Considerable research has been invested in improving abrasion resistance and colorfastness to meet premium quality expectations. The German market has focused on developing ink formulations compatible with a wide range of inkjet technologies and surface textures. Moreover, chemical companies have expanded offerings to include specialty inks that comply with evolving regulatory requirements and ensure minimal environmental impact. High demand for inks supporting industrial automation and precision printing has also driven continuous product development.

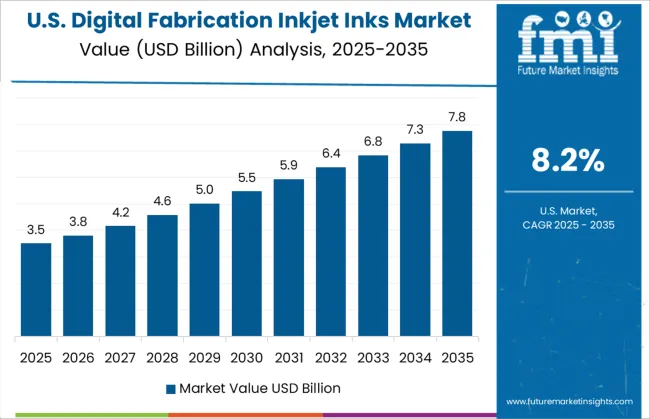

The United States market for digital fabrication inkjet inks is expanding at a CAGR of 8.2 percent, with growth driven by commercial printing, textile decoration, and flexible packaging industries. Increased adoption of high-speed industrial inkjet printers and variable data printing systems has fueled demand for compatible ink formulations. Low-odor and solvent-free inks have become the preferred choice for indoor printing applications due to health and safety considerations. UV-curable inks are widely used for flexible packaging and product labeling, providing durability and color vibrancy. Ink manufacturers have concentrated on improving print resolution, adhesion, and resistance to environmental factors. Regulatory compliance with volatile organic compound (VOC) standards has influenced the development of several new ink formulations. Additionally, the growing e-commerce sector has increased demand for packaging inks that can withstand handling and transportation without compromising print quality. Regional warehouses and distributors have expanded inventories to support diverse production needs.

The United Kingdom digital fabrication inkjet inks market is growing at a CAGR of 9.2 percent, underpinned by demand from packaging, signage, and textile printing sectors. Fast-drying inkjet inks with strong adhesion across diverse materials have been increasingly adopted by print service providers and textile manufacturers. UV and LED-curable inks have gained traction as they reduce production cycles and enhance output efficiency. Custom printing for retail packaging and promotional materials has led to increased consumption of vibrant, stable ink formulations. Regional distributors have expanded their product portfolios to include inks optimized for flexible films, coated paper, and synthetic substrates. Growing demand for specialty inks tailored to complex surfaces and print finishes has further driven market growth. Additionally, manufacturers have focused on producing inks with low environmental impact while maintaining high performance to meet evolving industry standards and client expectations.

The digital fabrication inkjet inks market is led by manufacturers specializing in advanced ink formulations designed for high-performance printing across industrial, commercial, and creative applications. DuPont is a prominent player, known for its innovative and durable ink solutions tailored to various substrates, delivering superior color vibrancy and adhesion in 3D printing and digital textile printing. TRIDENT offers a broad portfolio of specialty inks, emphasizing eco-friendly and solvent-based technologies that provide consistent output quality in flexible packaging and graphics printing sectors.

Wikoff Color is recognized for its extensive range of solvent, UV-curable, and aqueous inks, catering to packaging and label printing markets, with a strong focus on regulatory compliance and sustainability. Fujifilm Sericol International provides technologically advanced inkjet inks optimized for industrial digital printers, supporting high-speed, high-resolution outputs in packaging, signage, and textile markets. HP brings cutting-edge inkjet solutions leveraging their proprietary pigment and dye chemistry, focusing on precision and durability for both commercial and industrial digital printing applications. Sensient Imaging Technologies is known for its comprehensive ink systems designed to meet demanding environmental and performance standards in packaging and product decoration. Collins offers specialty ink formulations that cater to niche digital fabrication needs, including UV-curable and solvent inks with excellent adhesion and flexibility.

Nippon Kayaku delivers high-quality inkjet inks that emphasize stability and color consistency, widely used in packaging, signage, and industrial printing. EPSON specializes in eco-solvent and dye-based inks engineered for superior print quality and longevity, favored in signage, fine art, and textile digital printing. Nazdar is a leading supplier of UV, solvent, and aqueous inks known for broad compatibility with numerous digital printers and substrates, serving commercial and industrial print markets. InkTec offers a variety of inkjet inks focusing on wide color gamut and fast curing times, widely used in signage and label printing industries. Roland DG develops inks tailored to their integrated printing hardware, focusing on durability and color vibrancy, popular in large-format and specialty digital printing sectors.

Van Son Holland Ink delivers premium inks with high pigment concentration and resistance properties, commonly used in packaging and industrial applications. Hitachi provides high-quality inkjet inks designed for precision digital fabrication processes, emphasizing stable performance and strong adhesion across various substrates, with growing applications in 3D printing and electronics. Collectively, these suppliers drive the digital fabrication inkjet inks market through continuous innovation in ink chemistry and formulation, meeting evolving demands for sustainability, print quality, and industrial-grade durability across a wide range of digital printing applications.

According to Canon’s Annual Report 2024, the company emphasizes technology integration by combining proprietary ink formulations with advanced printhead technology to enhance precision and durability in digital fabrication. Additionally, Canon is investing in local manufacturing expansions to serve emerging markets more efficiently. These strategies align with Canon's commitment to innovation and global market responsiveness.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Type | Digital Fabrication Inkjet Inks Based on Dye and Digital Fabrication Inkjet Inks Based on Pigment |

| Material | Paper, Plastics, Textiles, and Others |

| Application | Office Printing Industry, Textile Industry, Industrial Printing Industry, Packaging Industry, 3D Printing Industry, Ceramic Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dupont, TRIDENT, Wikoff Color, Fujifilm Sericol International, HP, Sensient Imaging Technologies, Collins, Nippon Kayaku, EPSON, Nazdar, InkTec, Roland DG, Van Son Holland Ink, and Hitachi |

| Additional Attributes | Dollar sales by digital fabrication inkjet ink type including dye-based, pigment-based, and UV-curable inks; by application in packaging, textiles, 3D printing, and electronics; by geographic region including North America, Europe, and Asia-Pacific; demand driven by customization, sustainability, and Industry 4.0 adoption; innovation in eco-friendly formulations, high-speed curing, and multifunctional inks; costs influenced by raw materials, regulatory compliance, and production scalability. |

The global digital fabrication inkjet inks market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the digital fabrication inkjet inks market is projected to reach USD 18.0 billion by 2035.

The digital fabrication inkjet inks market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in digital fabrication inkjet inks market are digital fabrication inkjet inks based on dye and digital fabrication inkjet inks based on pigment.

In terms of material, paper segment to command 37.9% share in the digital fabrication inkjet inks market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA