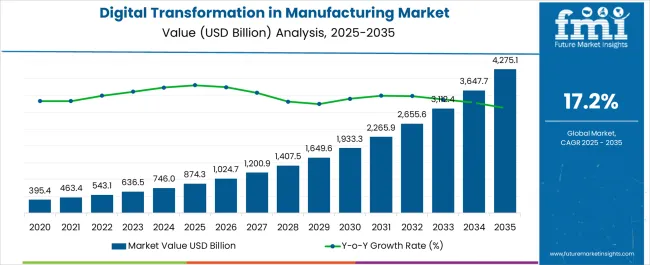

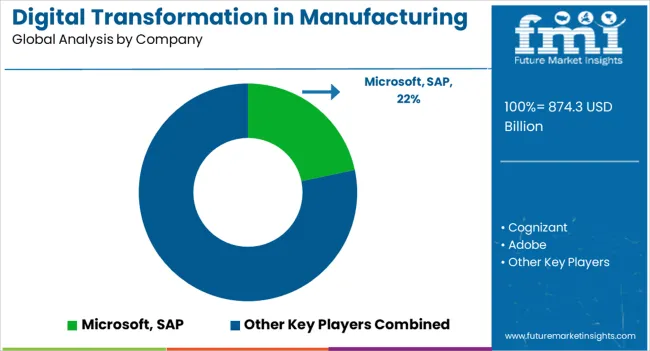

The Digital Transformation in Manufacturing Market is estimated to be valued at USD 874.3 billion in 2025 and is projected to reach USD 4275.1 billion by 2035, registering a compound annual growth rate (CAGR) of 17.2% over the forecast period.

| Metric | Value |

|---|---|

| Digital Transformation in Manufacturing Market Estimated Value in (2025 E) | USD 874.3 billion |

| Digital Transformation in Manufacturing Market Forecast Value in (2035 F) | USD 4275.1 billion |

| Forecast CAGR (2025 to 2035) | 17.2% |

The digital transformation in manufacturing market is expanding rapidly as industries prioritize automation, data-driven decision making, and enhanced operational efficiency. Increasing integration of Industrial Internet of Things, advanced analytics, and artificial intelligence is enabling manufacturers to optimize production workflows and reduce downtime.

Demand for flexible and scalable solutions has been amplified by global supply chain disruptions and the urgent need for resilient production models. Enterprises are increasingly investing in platforms that connect shop floor operations with enterprise-level planning, ensuring real-time visibility across the value chain.

Regulatory standards for quality, safety, and sustainability are further driving digital adoption. The future outlook remains robust as manufacturers across diverse sectors accelerate digital transformation strategies to remain competitive in an evolving global market landscape.

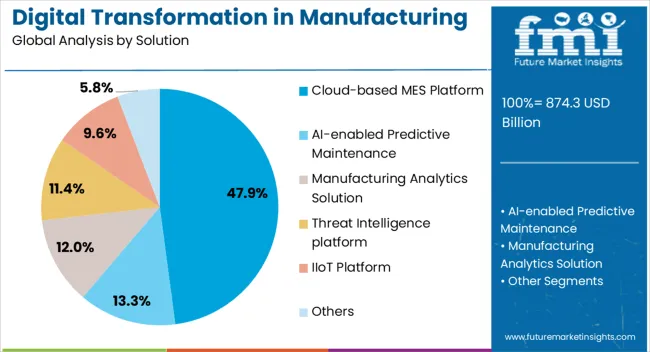

The cloud based MES platform solution segment is expected to hold 47.90% of total revenue by 2025, positioning it as the leading solution type. This dominance is supported by the scalability, cost efficiency, and ease of integration offered by cloud platforms.

The ability to access real-time production data from remote locations has strengthened decision making and operational transparency. Enterprises are adopting cloud MES to streamline upgrades, reduce infrastructure investments, and facilitate collaboration across multiple sites.

As manufacturing processes become more complex, the adaptability and lower upfront cost of cloud deployment have reinforced its market leadership.

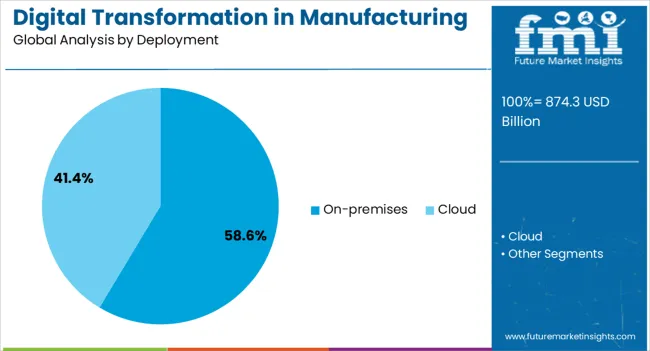

The on premises deployment segment is projected to account for 58.60% of total revenue by 2025, establishing it as the leading deployment model. This preference is driven by the demand for enhanced control over sensitive production data and compliance with strict industry regulations.

Manufacturers operating in sectors such as aerospace, defense, and pharmaceuticals prioritize data security and operational continuity, which are more easily managed through on premises systems.

Integration with legacy infrastructure and the ability to customize solutions according to plant-specific requirements have further contributed to its dominance.

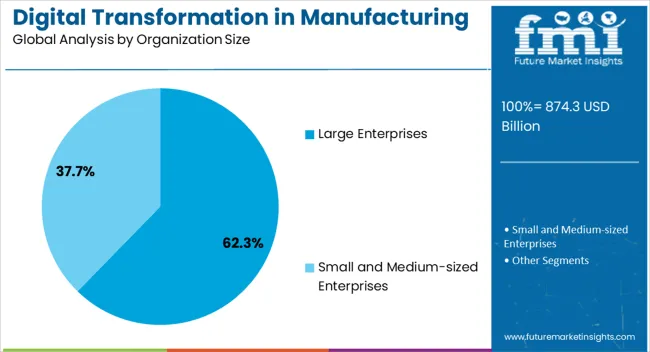

The large enterprises segment is anticipated to represent 62.30% of overall revenue by 2025 within the organization size category, making it the dominant segment. Large enterprises have greater capacity to invest in advanced digital infrastructure and manage complex, multi-site manufacturing operations.

Their scale enables them to achieve significant returns on investment by leveraging automation, predictive analytics, and connected platforms. Furthermore, strategic focus on global competitiveness, sustainability targets, and regulatory compliance has accelerated digital transformation in this segment.

As industry leaders, large enterprises continue to drive market momentum by setting benchmarks in efficiency, innovation, and integrated manufacturing ecosystems.

Some Key Developments in Digital Transformation in Manufacturing

Companies are launching an advanced platform to hasten the adoption of robotics in factories and stores.

The digital transformation in the manufacturing market is projected to grow USD 4275.1 Billion by 2035, at an expected CAGR of more than 17% during the forecast period 2025 to 2035. Due to Covid-19, there is a shift from traditional to new digitalized business models and this has LED to the introduction of more technologically advanced products and services.

Digital transformation in manufacturing can reduce processing costs and enhance cost efficiency. Those days are gone when manufacturing companies used to focus less on the production cost of a product and which LED to high-end product costs. However, with the help of digital transformation, unnecessary costs can be reduced.

Companies across different sectors are working remotely due to the guidelines of Covid-19 for following social distancing. People are using online services for their essential and non-essential needs.

This has resulted in the demand for robust cloud infrastructure. As everyone is working remotely, cloud computing is playing an important role in making manufacturing processes and activities more seamless.

Continuous advancement in technology is adding opportunities for digital transformation in manufacturing. IoT is playing an important role in manufacturing industry for improved efficiency and a reduction in production costs. This has resulted in contributing to the market growth.

Advanced data analytics is one of the major driver, which will also keep the market future robust. There are various components of the Industrial Internet or Industry 4.0 space, which are further driving the digital transformation across the manufacturing sector.

There is an increase in number of industrial robots used by organizations for eliminating the need for human drivers, this too is likely to garner demand in the global digital transformation in manufacturing market.

The demand for more developments in robotics, internet of things has further LED to the rise global digital transformation in manufacturing industry.

Different industries are moving towards the application of robotics for improved efficiency and a reduction in production costs, which leads the way for growth of digital transformation in manufacturing.

Robots can be programmed to operate 24*7 and this is anticipated to be a major trend driving growth of the digital transformation in manufacturing.

Robots can also be customized to perform complex functions. This significant factor is further impelling the need for digital transformation solutions. Industries are using robots for material handling to product packing, this will also keep the market future robust.

There are highly trainable and collaborative robots, which can be remotely controlled by operators. Industries are using them at mining sites and unsafe working environments, as well. This is further impelling many industries for the need of digital transformation.

With the help of robotics technology, industries can help fix mechanical issues and this can minimize the delays. This major trend also contributes to market of digital transformation in manufacturing.

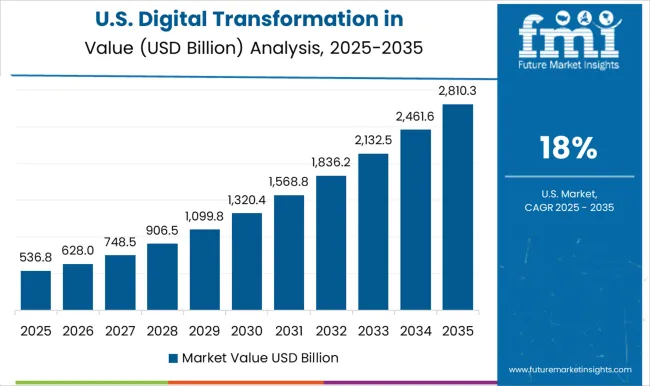

United States has majority of the key vendors of digital transformation in manufacturing sector. All the major industries like government, defense, healthcare and others are moving towards the adoption of digital transformation technologies and services, for improved efficiency.

There is an increase in adoption of robotics technology in the country and there is a large implementation for industrial robotics and process automation. This can impel the expansion of the digital transformation in manufacturing, in the United States. Further,

United Sates is allowing manufacturing companies optimize their business operations with IoT-enabled manufacturing plants, which will again add growth to the market.

A significant rise of digital transformation technologies in the United Kingdom, it will attribute to the availability of more technical solutions in the upcoming years.

The country is dependent on new technologies and innovations to produce higher quality products with lower costs and to achieve this goal, companies in the country are adopting intelligent solutions.

The United Kingdom is expected to hold a major share as there are several initiatives taken by the government to aid the transformation of the traditional manufacturing industry.

The manufacturing plants with IoT technology in the country are allowing manufacturing companies to optimize their product and service innovations, supply chain and logistics management, and business operations.

Key players such as

are actively involved in offering digital transformation solutions and services in the manufacturing sector for different applications.

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global digital transformation in manufacturing market is estimated to be valued at USD 874.3 billion in 2025.

The market size for the digital transformation in manufacturing market is projected to reach USD 4,275.1 billion by 2035.

The digital transformation in manufacturing market is expected to grow at a 17.2% CAGR between 2025 and 2035.

The key product types in digital transformation in manufacturing market are cloud-based mes platform, ai-enabled predictive maintenance, manufacturing analytics solution, threat intelligence platform, iiot platform and others.

In terms of deployment, on-premises segment to command 58.6% share in the digital transformation in manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Trust Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA