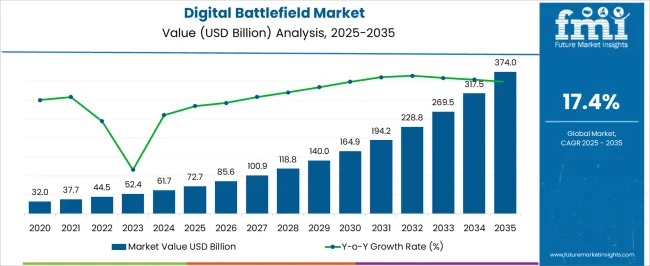

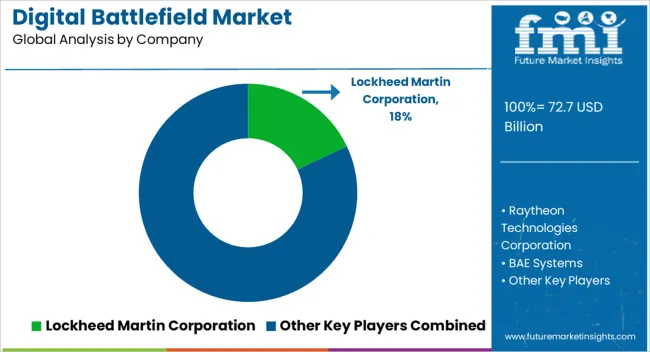

The Digital Battlefield Market is estimated to be valued at USD 72.7 billion in 2025 and is projected to reach USD 374.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

| Metric | Value |

|---|---|

| Digital Battlefield Market Estimated Value in (2025 E) | USD 72.7 billion |

| Digital Battlefield Market Forecast Value in (2035 F) | USD 374.0 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

The digital battlefield market is undergoing robust expansion, driven by rising defense modernization initiatives and the adoption of next-generation technologies to enhance situational awareness, operational efficiency, and decision-making speed. The integration of digital communication systems, AI-driven analytics, and IoT-enabled devices is transforming traditional defense operations into connected ecosystems.

Current market growth is supported by increasing geopolitical tensions and the need for advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) capabilities. Hardware innovations, combined with software and service-based intelligence solutions, are improving interoperability among defense forces.

Future outlook is strengthened by investment in artificial intelligence, cloud computing, and cyber defense systems, ensuring more adaptive and resilient military operations. With strong government budgets allocated to defense technology upgrades and private sector collaboration, the digital battlefield market is positioned to expand significantly in the coming years.

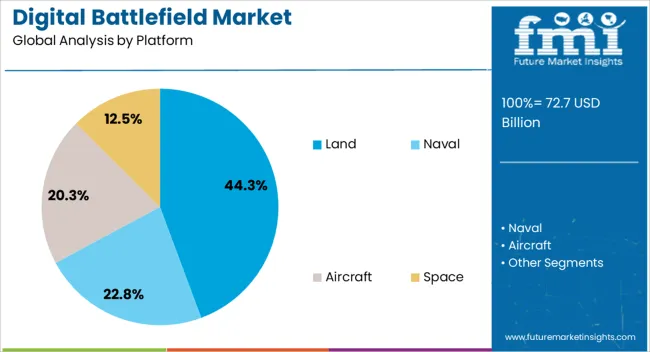

The land segment dominates the platform category in the digital battlefield market, accounting for approximately 44.34% share. This leadership is attributed to the critical role of ground-based systems in defense operations, where armored vehicles, command centers, and tactical units require advanced digital connectivity.

The integration of real-time surveillance, geospatial mapping, and communication systems has reinforced land platform capabilities. Growth in this segment is supported by ongoing upgrades to land-based defense systems, particularly in response to asymmetric warfare and border security requirements.

The deployment of AI-driven decision-support systems and unmanned ground vehicles further enhances its significance. With rising government investment in modernizing ground forces, the land segment is expected to retain its dominant share across global defense programs.

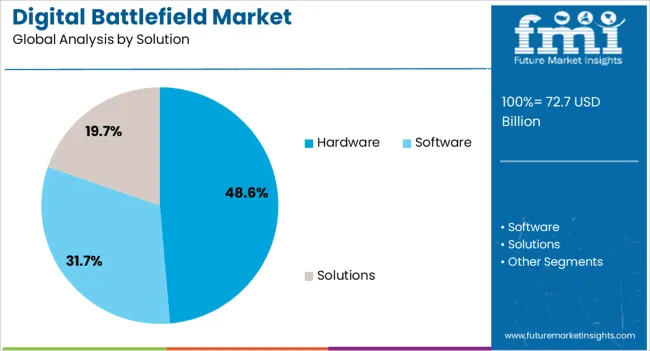

The hardware segment leads the solution category with approximately 48.63% share, reflecting its central role in equipping defense systems with robust physical infrastructure. Hardware components such as sensors, displays, communication systems, and ruggedized devices are essential for digital battlefield operations.

The demand is driven by increasing procurement of advanced military equipment and modernization of existing platforms. Hardware solutions provide the foundation for software integration and AI-enabled analytics, ensuring mission-critical reliability.

With ongoing innovation in miniaturization and enhanced durability of devices, the segment continues to be a cornerstone of defense transformation programs. Strong investment in radar, surveillance, and tactical communication devices is expected to sustain the hardware segment’s leadership position.

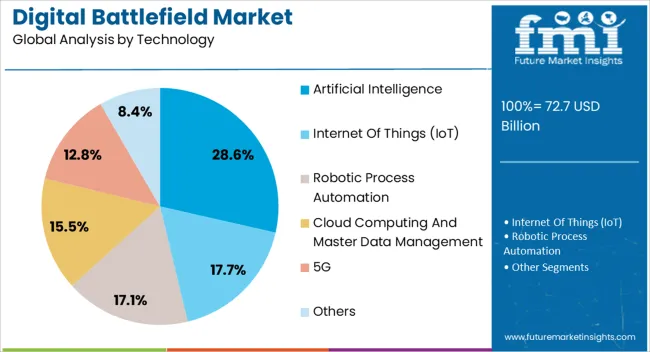

The artificial intelligence segment accounts for approximately 28.56% share of the technology category, underscoring its pivotal role in transforming defense operations. AI-driven applications enable real-time data processing, predictive analytics, and autonomous decision-making capabilities, significantly enhancing battlefield efficiency.

Adoption of AI spans threat detection, surveillance, logistics optimization, and autonomous vehicle operations. Governments and defense contractors are prioritizing AI integration to ensure faster responses and improved mission outcomes.

The segment’s growth is further fueled by AI’s adaptability to cyber defense, counter-terrorism, and unmanned systems. With continuous advancements in machine learning algorithms and defense-specific AI applications, the segment is projected to expand rapidly, driving innovation in the digital battlefield landscape.

Recognizing the varied nature of warfare, digital battlefields offer platforms for naval and air warfare, but it is land that is the platform that is widely concentrated upon. In line with the vast amount of hardware used by militaries, it is hardware that is a sought-after solution in the digital battlefield industry, too.

Land as a platform for warfare is predicted to capture a CAGR of 17.6% over the forecast period. Factors driving the growth of land in the market are:

| Attributes | Details |

|---|---|

| Top Platform | Land |

| CAGR (2025 to 2035) | 17.6% |

Hardware solutions are forecast to progress at a CAGR of 17.4% over the period from 2025 to 2035. Some of the factors for the growth of hardware are:

| Attributes | Details |

|---|---|

| Top Solution | Hardware |

| CAGR (2025 to 2035) | 17.4% |

North America is the traditional powerhouse for military technology. Digital battlefield, too, is seeing increasing adoption across the region. Europe is another traditional base where the market is expected to continue going strong.

The Asia Pacific has emerged as one of the lucrative regions for the market. Increasing geopolitical tensions around the region are leading armies to adopt digital battlefields as a precautionary tactic.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 18.2% |

| United Kingdom | 19.0% |

| South Korea | 20.1% |

| Japan | 19.6% |

| China | 18.7% |

The market is anticipated to register a CAGR of 20.1% in South Korea for the forecast period. Some of the factors driving the incredible growth of the market in the country are:

Japan is set to see the market expand at a CAGR of 19.6% over the forecast period. Prominent factors driving the growth of the market are:

The demand for digital battlefields is expected to register a CAGR of 18.7% in China. Some of the factors driving the growth of the market in China are:

The market is set to progress at a CAGR of 19.0% in the United Kingdom. Factors influencing the growth of the industry in Germany include:

The market is expected to register a CAGR of 18.2% in the United States. Some of the reasons for the growth of digital battlefield in the country are:

Players in the market are focusing on securing sizable contracts from governments. The development of new technologies is also being concentrated upon to attract the eyes of the militaries.

Market players are collaborating, intending to merge the technological capabilities of two different organizations. They are also concentrating on enhancing new technologies and frameworks for faster communication and effective data analysis and collection.

Recent Developments in the Digital Battlefield Market

The global digital battlefield market is estimated to be valued at USD 72.7 billion in 2025.

The market size for the digital battlefield market is projected to reach USD 374.0 billion by 2035.

The digital battlefield market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in digital battlefield market are land, naval, aircraft and space.

In terms of solution, hardware segment to command 48.6% share in the digital battlefield market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA