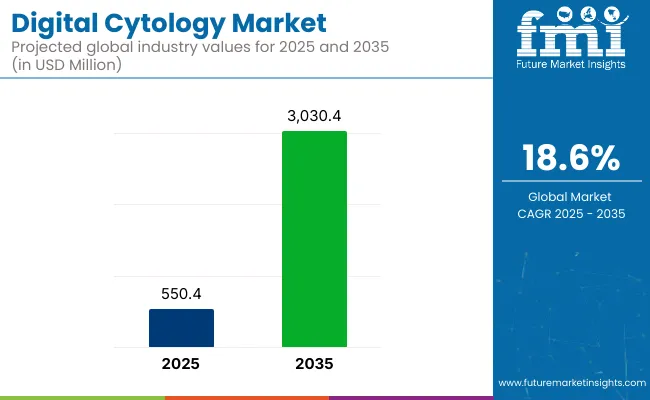

The digital cytology market is set to grow from USD 550.4 million in 2025 to USD 3,030.4 million by 2035. This significant growth reflects a CAGR of 18.6% between 2025 and 2035, driven by increasing demand for advanced diagnostic solutions in clinical and research settings. As healthcare systems around the world continue to digitize and adopt precision medicine approaches, digital cytology is emerging as a key component of modern pathology workflows.

As of 2025, the digital cytology market occupies a small but rapidly expanding share within its parent markets. In the global diagnostic imaging market, it holds an estimated 1-2%, as it complements radiology through microscopic image analysis. Within the global pathology market, digital cytology accounts for about 4-6%, driven by the shift from conventional to digital workflows.

In the digital health market, its share is around 0.5-1%, reflecting its emerging role in AI-assisted diagnostics. In the in vitro diagnostics (IVD) market, digital cytology represents approximately 2-3%, particularly in areas like automated Pap smear analysis. In the cancer diagnostics market, its contribution is about 3-5%, given its growing use in early cancer detection, especially cervical and lung cancers.

In February 2024, Hologic announced USA FDA clearance for its Genius™ Digital Diagnostics System. The first and only FDA-cleared digital cytology system integrating AI with volumetric imaging for cervical cancer screening. This system, including scanners, AI software, and image management platform, is already commercial in Europe, Australia, and New Zealand, with planned USA rollout in early 2024

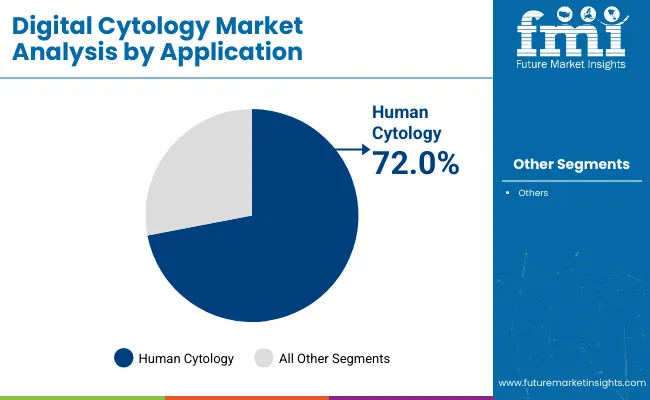

Digital cytology scanners are set to lead the market due to their ability to digitize slides efficiently and support remote diagnostics. Human cytology dominates application areas, driven by rising cancer cases and the need for early, accurate screening.

Digital cytology scanners are projected to dominate the market in 2025, accounting for 35.2% of the market share. They are the dominating segment in the market due to their critical role in transforming traditional microscopic examination into a streamlined, high-resolution digital process.

Human cytology is projected to account for 72.0% of the digital cytology market share in 2025.It is the dominating segment in the market primarily due to the rising global burden of cancer and other chronic diseases that require regular cytological screening, such as cervical, lung, and bladder cancers.

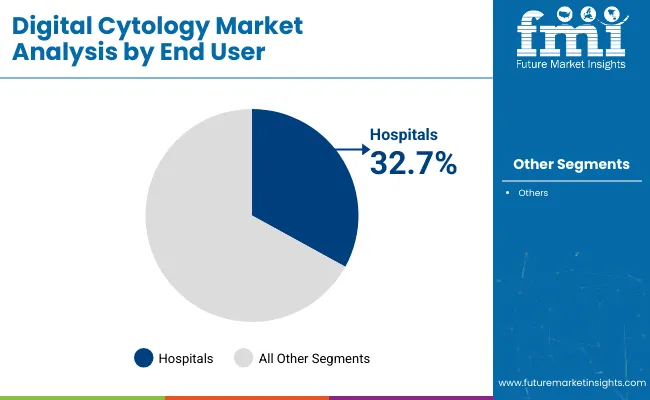

The hospitals sales channel is projected to hold a 32.7% share of the digital cytology market in 2025.Hospitals are the dominating segment in the industry due to their central role in providing comprehensive diagnostic and treatment services to a broad patient population.

Technological advancements and AI integration are enhancing diagnostic accuracy and enabling remote cytology analysis, addressing workforce shortages. Rising cancer prevalence and the push for early detection are driving demand for fast, reliable, and non-invasive digital cytology solutions globally.

Technological Advancements and AI Integration

One of the key dynamics driving the market is the rapid advancement in imaging technologies and the integration of artificial intelligence (AI). Modern digital cytology systems now offer high-resolution image capture, real-time analysis, and automated slide scanning, which significantly enhance diagnostic speed and accuracy. AI-powered algorithms are being increasingly used to detect abnormal cells with greater precision, reducing diagnostic errors and supporting early disease detection, particularly in cancer screening.

These technologies are also making remote diagnosis more accessible, enabling telepathology and facilitating consultations across geographical boundaries. The continuous evolution of AI in digital cytology not only improves diagnostic efficiency but also addresses the global shortage of skilled cytotechnologists and pathologists.

Rising Cancer Prevalence and Demand for Early Diagnosis

Another major market dynamic is the growing global burden of cancer and the corresponding need for early and accurate diagnostic tools. Digital cytology plays a critical role in screening for various cancers, including cervical, lung, and bladder cancer. The demand for non-invasive, fast, and reliable diagnostic methods has surged as healthcare systems emphasize early intervention to improve patient outcomes.

Additionally, awareness campaigns, government screening initiatives, and rising healthcare expenditures in both developed and emerging economies have further boosted the adoption of digital cytology. This increasing focus on preventive healthcare and timely diagnosis is pushing laboratories and hospitals to transition from traditional microscopy to more advanced, digital solutions.

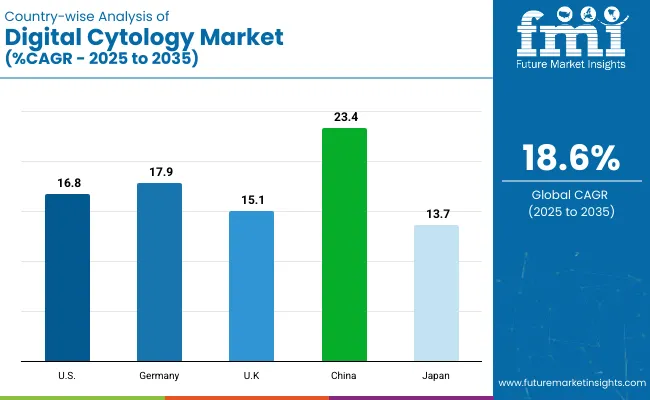

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| USA | 16.8% |

| Germany | 17.9% |

| UK | 15.1% |

| China | 23.4% |

| Japan | 13.7% |

The global market is witnessing double-digit growth driven by AI-based diagnostic automation, increasing cancer screening coverage, and the digitization of pathology labs. China is emerging as a hyper-growth market, expanding at 23.4% CAGR, fueled by centralized health infrastructure and aggressive AI adoption.

Germany (17.9%) leads in the EUs push for digital pathology regulation, while the USA (16.8%) anchors the market through early FDA clearances and reimbursement backing. The UK (15.1%) leverages NHS-funded pilots, and Japan (13.7%) demonstrates steady growth via its aging population and robotic lab integration.

Developed markets in the OECD bloc like the USA, Germany, and Japan emphasize high diagnostic accuracy, quality compliance, and patient-centric innovation. China, part of the BRICS group, is scaling through national health reforms and AI investments, reshaping cytology access for underserved regions.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The USA market is growing at a 16.8% CAGR, anchored in regulatory innovation, insurance-driven adoption, and an advanced med-tech ecosystem. The country’s integration of digital cytology into cancer screening programs is backed by FDA-cleared AI solutions, reimbursement alignment through CMS, and private-sector lab digitization. As a leader among OECD nations and Agri-food Tech Pioneers, the USA benefits from a robust clinical trial ecosystem and global supplier partnerships.

The digital cytology industry in Germany is expanding at 17.9% CAGR, driven by EU-backed digital health strategies, national cancer screening mandates, and growing AI trust within clinical workflows. As part of both the EU27 and Sustainability-Focused Nations, Germany is aligning pathology digitization with data privacy and diagnostic accuracy goals. Public and private insurers are jointly funding pilot programs across major hospital networks.

The UK is advancing at a 15.1% CAGR, focusing on digitizing its national cervical cancer screening program under NHS guidance. Government investments in telepathology hubs and AI pathology partnerships (especially in England and Scotland) support structured adoption. As an OECD member with high public health expenditure, the UK emphasizes outcome-based funding and data transparency, making it a policy leader in digital diagnostics.

China leads global growth with a 23.4% CAGR, enabled by government-driven healthcare digitization, domestic AI innovation, and regional screening initiatives in oncology. As a key BRICS country and Protein-Transition Market, China is reshaping cytology workflows in both urban and tier-2/3 hospitals through telemedicine and AI-based cytology tools. National mandates are accelerating digitization, particularly in cervical and lung cancer programs.

Japan is expanding at a 13.7% CAGR, reflecting stable but measured adoption of digital cytology in aging-population diagnostics. As part of the OECD and known for precision-led healthcare, Japan focuses on integrating cytology with robotics, AI algorithms, and automated lab hardware. Uptake is highest in major oncology centers and university hospitals, with private-sector innovation filling workflow gaps in rural and satellite facilities.

Key players like Hologic, Inc. and Antech Diagnostics, Inc. dominate the digital cytology market due to their advanced imaging and diagnostic technologies. Hologic, Inc. is renowned for its innovative cytology solutions and AI-powered screening tools, enhancing accuracy in cancer detection. Antech Diagnostics, Inc. provides comprehensive veterinary diagnostic services, contributing to market growth through its extensive laboratory network. Other significant players, including Techcyte, Inc. and OptraScan, focus on AI-driven image analysis and high-resolution digital scanning, improving diagnostic efficiency.

Emerging companies such as Wuhan Landing Intelligence Medical Co., Ltd. and 3DHISTECH are expanding their footprint by developing cutting-edge digital pathology platforms, while established firms like Leica Biosystems, Becton, Dickinson and Company, IDEXX Laboratories, Inc., Zoetis Services LLC, and Glenbio Ltd. continue to innovate with specialized cytology products and integrated solutions for clinical and veterinary applications.

Recent Digital Cytology Industry News

In September 2024, the Institute of Biomedical Science (UK) collaborated with Hologic to publish a digital cytology roadmap aimed at addressing workforce shortages and backlogs in cervical screening. The report highlighted digital cytology as a transformative tool in the UK's screening programs.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 550.4 million |

| Projected Market Size (2035) | USD 3,030.4 million |

| CAGR (2025 to 2035) | 18.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Component Analyzed (Segment 1) | Digital Cytology Scanners, Slide Preparation Systems, Image Analysis Software, And Services. |

| Applications Covered (Segment 2) | Human Cytology, Cervical Cancer Screening, HPV-Associated Screening, Bladder Cancer Screening, Urothelial Carcinoma Detection, Fine Needle Aspiration Cytology (FNAC) For Breast Lumps, FNAC For Thyroid Nodules, Sputum Cytology For Lung Carcinoma, Serous Fluid Cytology, Salivary Gland Cytology, Others Such As Ascitic , Pleural, Or CSF Fluid Cytology, Veterinary Cytology, Dermatologic Cytology, Oncologic Cytology, Effusion And Fluid Cytology, Hematologic Cytology, And Other Applications. |

| End User Covered (Segment 3) | Hospitals, Diagnostic Laboratories, Cancer Research Institutes, Telepathology Providers, And Others. |

| Regions Covered | North America , Western Europe , East Asia , South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Hologic , Inc., Antech Diagnostics, Inc., Techcyte , Inc., OptraScan , Wuhan Landing Intelligence Medical Co., Ltd., IDEXX Laboratories, Inc., Zoetis Services LLC, Leica Biosystems , Becton, Dickinson and Company, 3DHISTECH, and Glenbio Ltd. |

| Additional Attributes | Dollar sales, market share, growth trends, key segments, competitive landscape, technological advancements, regional demand, customer needs, regulatory impact, and future opportunities to strategize product development and expand market presence effectively. |

The market is segmented into digital cytology scanners, slide preparation systems, image analysis software, and services.

The market covers human cytology, cervical cancer screening, HPV-associated screening, bladder cancer screening, urothelial carcinoma detection, fine needle aspiration cytology (FNAC) for breast lumps, FNAC for thyroid nodules, sputum cytology for lung carcinoma, serous fluid cytology, salivary gland cytology, others such as ascitic, pleural, or CSF fluid cytology, veterinary cytology, dermatologic cytology, oncologic cytology, effusion and fluid cytology, hematologic cytology, and other applications.

The market is categorized into hospitals, diagnostic laboratories, cancer research institutes, telepathology providers, and others.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 3,030.4 million by 2035.

The market size is projected to be USD 550.4 million in 2025.

The market is expected to grow at a CAGR of 18.6% from 2025 to 2035.

China is expected to be the fastest growing with a CAGR of 23.4%.

Human cytology, accounting for over 72.0% of the market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Pen Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA