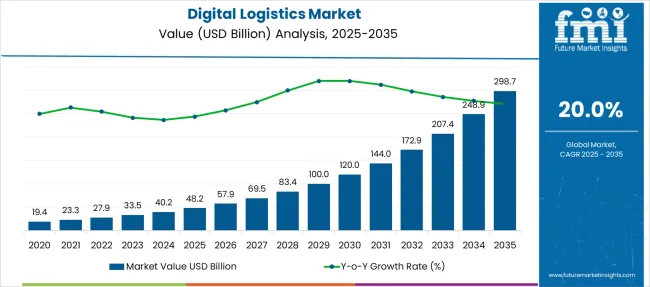

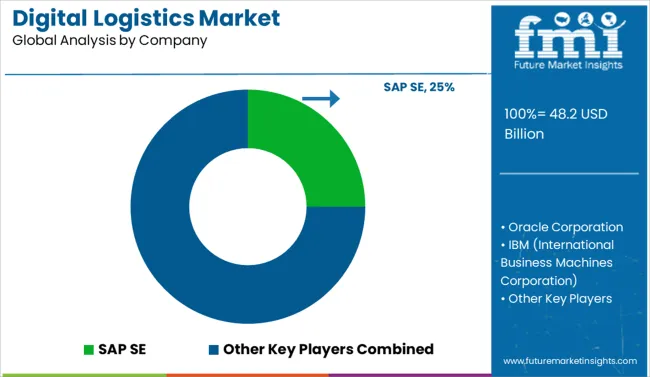

The Digital Logistics Market is estimated to be valued at USD 48.2 billion in 2025 and is projected to reach USD 298.7 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

| Metric | Value |

|---|---|

| Digital Logistics Market Estimated Value in (2025 E) | USD 48.2 billion |

| Digital Logistics Market Forecast Value in (2035 F) | USD 298.7 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The digital logistics market is undergoing significant transformation as enterprises increasingly adopt technology-driven solutions to optimize supply chain operations and enhance visibility. This evolution is being fueled by the growing complexity of global trade, rising customer expectations for faster deliveries, and the need to reduce operational costs.

Organizations are embracing cloud-based platforms, AI-driven analytics, and real-time tracking to streamline processes and improve decision-making. Future growth is anticipated to be supported by advancements in IoT, 5G connectivity, and automation technologies, which are expected to enable more efficient and responsive logistics networks.

The increasing emphasis on sustainability and regulatory compliance is also shaping adoption patterns, encouraging investments in digital tools that minimize environmental impact and improve transparency. Collaborative initiatives among logistics providers, technology vendors, and enterprises are paving the way for more scalable and resilient digital logistics ecosystems.

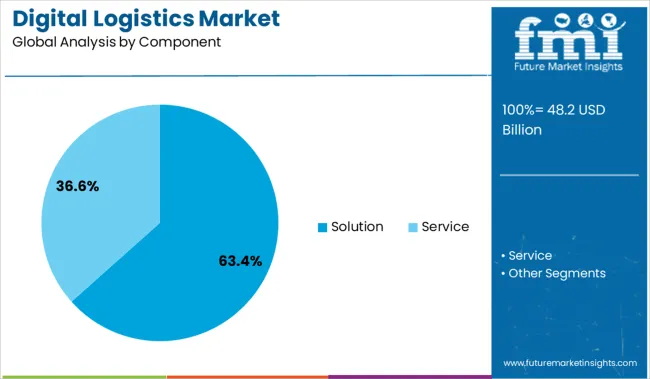

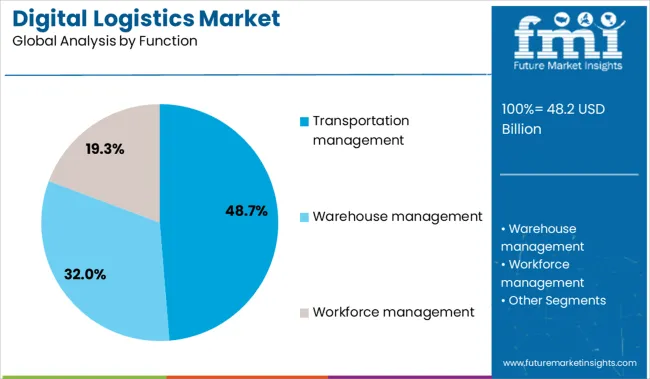

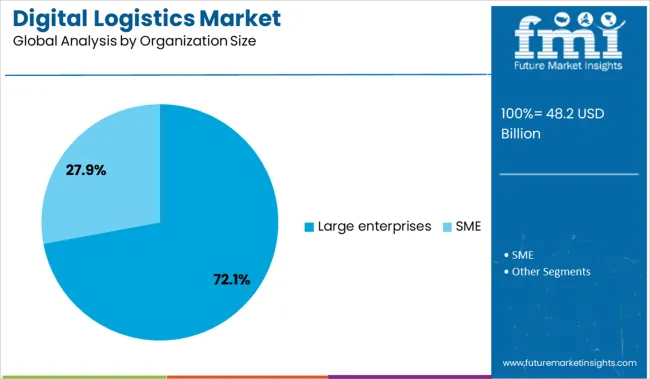

The digital logistics market is segmented by component, function, organization size, deployment mode, and vertical and geographic regions. The digital logistics market is divided into Solution and Service components. The digital logistics market is classified into Transportation management, Warehouse management, and Workforce management. Based on the organization size, the digital logistics market is segmented into Large enterprises and SME. The deployment mode of the digital logistics market is segmented into Cloud and On-premises. The digital logistics market is segmented vertically into Retail and eCommerce, Manufacturing, Pharmaceuticals and healthcare, Aerospace and defense, Automotive, and Others. Regionally, the digital logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the solution segment is projected to account for 63.4% of the total market revenue in 2025, making it the dominant segment. This leadership is being driven by growing enterprise demand for integrated platforms that offer end-to-end supply chain visibility, predictive analytics, and automation capabilities.

Digital solutions have enabled organizations to manage complex logistics operations efficiently, reduce manual intervention, and improve responsiveness to market changes. Their ability to deliver actionable insights, enhance customer service, and optimize resource allocation has reinforced their adoption over traditional services.

Furthermore, scalable cloud-based deployment models and customizable features have made solutions more accessible to enterprises of varying sizes, consolidating their leadership within the market.

In terms of function, transportation management is expected to hold 48.7% of the market revenue share in 2025, ranking as the leading function segment. This dominance is being driven by the critical role transportation plays in the overall logistics process and the pressing need to optimize routing, capacity utilization, and cost efficiency.

Digital transportation management systems have provided real-time visibility into shipments, predictive delay alerts, and dynamic route planning, which have significantly enhanced operational performance. The integration of AI and machine learning capabilities into transportation platforms has further enabled proactive decision-making and reduced inefficiencies.

These capabilities have positioned transportation management as the focal point of digital investments, ensuring its continued leadership in the market.

Segmenting by organization size shows that large enterprises are forecast to capture 72.1% of the market revenue in 2025, maintaining their leadership position. This prominence is being driven by their ability to invest in sophisticated digital logistics solutions and their need to manage extensive, multi-regional supply chains.

Large enterprises have capitalized on advanced analytics, automation, and real-time monitoring to achieve cost savings, improve service levels, and meet compliance requirements. Their substantial resources and established partnerships with technology providers have enabled faster implementation and integration of digital platforms.

Additionally, their focus on scalability and resilience in supply chain operations has reinforced their preference for comprehensive digital logistics solutions, sustaining their dominant share of the market.

Digital logistics platforms are experiencing rapid expansion thanks to growing demand for real-time shipment visibility, last-mile optimization, and integrated supply-chain orchestration across modes.

Supply chain stakeholders from shippers to carriers and warehouses are adopting digital logistics tools to monitor shipments in real time, track inventory, and automate dispatch. GPS-based tracking, NFC tagging, and connected fleet telematics give visibility into load status, route progress, and delivery accuracy. Digital platforms integrate with warehouse management and order fulfillment systems to reduce manual entry, enhance order accuracy, and optimize pick‑pack‑ship workflows. Demand for faster deliveries and tighter schedules has increased reliance on software-based route optimization and load planning. The result is leaner operations, reduced idle time, fewer errors, and improved customer satisfaction. Digital logistics is positioned as a key enabler of agile, data-driven fulfillment across industries handling complex B2B and B2C transportation flows.

Opportunities include developing logistics platforms that offer tiered services basic tracking, performance analytics, predictive ETAs, and exception management across traffic modes (road, rail, sea, air). Integration with ecommerce marketplaces, ERP systems, and retail order flows can create seamless end-to-end visibility and control. Building APIs and modular SaaS offerings tailored for SMEs can unlock adoption among smaller shippers who lack bespoke TMS systems. Regional rollouts in frontier and emerging logistics markets such as Southeast Asia, Africa, and Latin America present major opportunity as supply chain digitization accelerates. Partnerships with local trucking firms, fulfillment houses, and payment providers allow platforms to deliver broader coverage and localized support. Value-added capabilities like predictive delay alerts, real‑time exception handling, and integrated invoice reconciliation help platforms stand out in a crowded landscape.

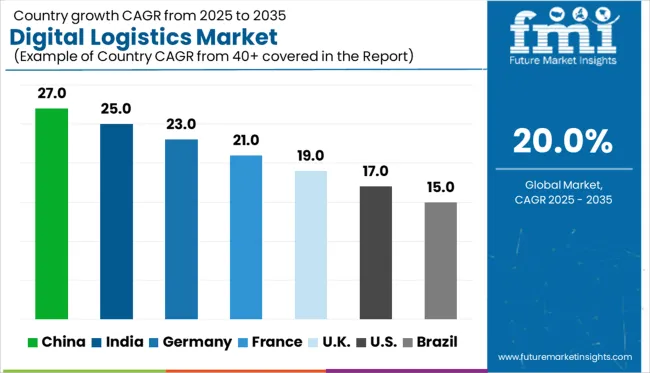

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The global digital logistics market is forecast to grow at a robust CAGR of 20.0% from 2025 to 2035, driven by rapid adoption of AI, IoT, and cloud-based supply chain platforms. BRICS economies lead this transformation, with China registering a high 27.0% CAGR, propelled by smart port development, autonomous freight corridors, and strong state support for logistics tech. India follows at 25.0%, driven by national logistics policy implementation, digitized warehousing, and last-mile innovation. Germany, a key OECD logistics hub, is growing at 23.0% backed by Industry 4.0 alignment and predictive analytics in manufacturing supply chains. In contrast, the United Kingdom (19.0%) and the United States (17.0%) show steady growth shaped by digital twin integration, e-commerce scaling, and legacy infrastructure modernization. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is on track to lead the digital logistics market with a CAGR of 27%, outpacing India and Germany in both infrastructure investment and AI adoption. National logistics hubs are rapidly integrating autonomous delivery, IoT enabled fleet management, and 5G warehouse orchestration. In contrast to the United States, where legacy systems create upgrade friction, China’s relatively newer infrastructure allows quicker tech implementation. The logistics cloud ecosystem in tier 1 cities enables real-time monitoring, with minimal human input. Expansion of smart bonded zones gives China a scale advantage, while B2B e-commerce platforms ensure bulk logistics efficiency.

Digital logistics sector in India is expanding at a CAGR of 25%, trailing only China, but surpassing Germany and the UK. While India still faces infrastructural bottlenecks, its fast-moving adoption of logistics platforms and warehouse automation offers strong catch-up potential. In contrast with Germany’s precision-led systems, Indian logistics favor scalability over immediate perfection. The rise of hyperlocal delivery models in cities like Bengaluru and Delhi mirrors China’s approach but without the same level of automation. India’s fragmented freight sector is being digitally consolidated through APIs and transport exchanges, strengthening visibility.

In Germany, Digital logistics market is projected to grow at a CAGR of 23%, making it Europe’s most aggressive adopter, ahead of the UK and the US but behind India and China. Efficiency-driven upgrades to warehousing and freight management dominate investment flows. Unlike India’s emphasis on scale, Germany prioritizes systems integration and carbon footprint tracking. Government regulations encourage sustainability-linked digitization, with platforms offering predictive analytics for both demand planning and emissions control. Germany’s digital twin deployment in warehouse modeling is contrasting with the mobile-first models in Asian markets.

The UK digital logistics sector is forecast to grow at a CAGR of 19%, trailing behind Germany and far below China’s rapid ascent. Post-Brexit trade complexities have amplified the need for intelligent customs routing and blockchain documentation. Unlike India, which is scaling delivery networks, the UK focuses on traceability and cross-border compliance tools. Retailers and 3PLs are investing in AI-backed control towers for parcel visibility, especially during peak seasons. While infrastructure is advanced, fragmented warehousing limits unified digitization.

The United States market is expanding at a CAGR of 17%, slower than all major global counterparts including China, India, and Germany. Though rich in technology providers, fragmented ownership in supply chains and legacy infrastructure create friction in large-scale digital rollout. In contrast, China’s newer infrastructure and India’s mobile-first approach offer faster system resets. US logistics players are investing in control tower software and real-time freight visibility but adoption varies significantly by region. E-commerce players are leading the charge, with middle-mile innovation focusing on route intelligence and fleet electrification.

The digital logistics market is moderately consolidated, with SAP SE leading at a significant share due to its comprehensive supply chain management (SCM) and logistics execution platforms. Oracle and IBM follow closely, offering integrated AI, IoT, and cloud-based logistics solutions that enhance real-time visibility and predictive analytics. Honeywell and Blue Yonder specialize in automation and warehouse management systems, while Infosys and AT&T provide digital transformation services and connectivity infrastructure, respectively. The market is driven by increasing demand for end-to-end supply chain transparency, last-mile delivery optimization, and cost reduction. Strategic partnerships, platform interoperability, and advanced analytics are key differentiators shaping competitive positioning in this evolving landscape.

Recent Industry Developments On May 26, 2025, WiseTech Global confirmed via Reuters it would acquire e2open for USD 2.1 billion in a deal fully financed by a USD 3 billion syndicated loan, expanding its global logistics platform and enterprise capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.2 Billion |

| Component | Solution and Service |

| Function | Transportation management, Warehouse management, and Workforce management |

| Organization Size | Large enterprises and SME |

| Deployment Mode | Cloud and On-premises |

| Vertical | Retail and eCommerce, Manufacturing, Pharmaceuticals and healthcare, Aerospace and defense, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SAP SE, Oracle Corporation, IBM (International Business Machines Corporation), Honeywell International Inc., Blue Yonder (formerly JDA Software), AT&T Inc., and Infosys Limited |

| Additional Attributes | Dollar sales by solution type, deployment model, and industry vertical; regional demand driven by e-commerce growth, supply chain disruptions, and smart infrastructure investments; innovation in AI-driven route optimization, real-time tracking, and blockchain for transparency; cost dynamics influenced by integration complexity and cloud adoption; environmental impact through fuel efficiency and reduced waste; and emerging use cases in cold chain logistics, reverse logistics, and autonomous freight management. |

The global digital logistics market is estimated to be valued at USD 48.2 billion in 2025.

The market size for the digital logistics market is projected to reach USD 298.7 billion by 2035.

The digital logistics market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in digital logistics market are solution, _asset management, _warehouse management, _data management and analytics, _security, _network managemen, service, _planning and consulting services, _deployment and integration services and _support and maintenance.

In terms of function, transportation management segment to command 48.7% share in the digital logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA