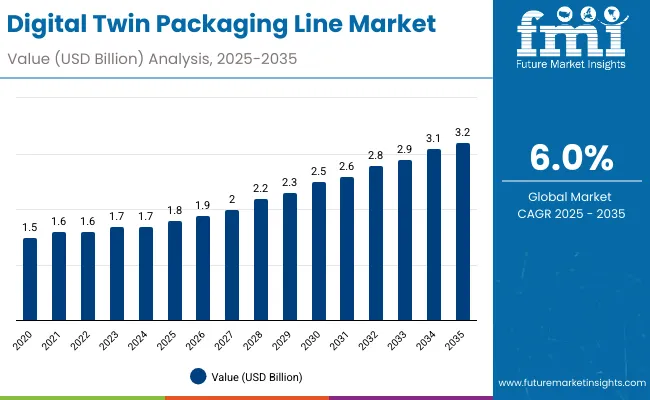

The digital twin packaging line market is expected to grow from USD 1.8 billion in 2025 to USD 3.2 billion by 2035, resulting in a total increase of USD 1.4 billion over the forecast decade. This represents a 77.8% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 6.0%. Over ten years, the market grows by a 1.8 multiple.

| Metric | Value |

|---|---|

| Digital Twin Packaging Line Market Estimated Value in (2025 E) | USD 1.8 billion |

| Digital Twin Packaging Line Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

In the first five years (2025 to 2030), the market progresses from USD 1.8 billion to USD 2.4 billion, contributing USD 0.6 billion, or 42.9% of total decade growth. This phase is shaped by rising adoption of simulation-based design, predictive maintenance, and efficiency optimization in packaging lines. Food and beverage players lead early adoption due to high throughput needs.

In the second half (2030 to 2035), the market grows from USD 2.4 billion to USD 3.2 billion, adding USD 0.8 billion, or 57.1% of the total growth. This acceleration is supported by deeper integration of IoT, AI-enabled monitoring, and real-time virtual replicas of entire facilities. Expansion in pharmaceuticals and logistics strengthens adoption, making digital twin systems a vital enabler of smart packaging automation.

From 2020 to 2024, the digital twin packaging line market expanded from USD 1.4 billion to USD 1.7 billion, driven by the need for virtual modeling in packaging system design, predictive maintenance, and process optimization. Nearly 70% of revenue was led by OEMs embedding digital twin modules within automated lines. Companies such as Siemens, DassaultSystèmes, and Rockwell Automation emphasized throughput accuracy, lifecycle management, and real-time line simulation. Differentiation centered on interoperability, precision analytics, and integration with IoT-enabled equipment, while AI-led autonomous adjustments remained secondary. Service-driven offerings like operator training and simulation audits accounted for under 20% of revenue, as capital-focused investments dominated.

By 2035, the digital twin packaging line market will reach USD 3.2 billion, growing at a CAGR of 6.00%, with software ecosystems and predictive maintenance solutions contributing more than 40% of total value. Competitive intensity will heighten as providers roll out AI-driven diagnostics, cloud-based collaboration tools, and immersive AR/VR-enabled training. Established leaders are pivoting to hybrid offerings pairing digital twin platforms with subscription-based performance optimization. Emerging companies such as ANSYS, Altair, and Autodesk are gaining share through modular digital twin solutions, low-code integration frameworks, and sector-specific adoption, meeting rising demand for sustainable and cost-efficient packaging operations worldwide.

The rising adoption of Industry 4.0 technologies and demand for predictive maintenance are driving growth in the digital twin packaging line market. These solutions create virtual replicas of physical systems, enabling real-time monitoring, process optimization, and reduced downtime. Growing need for flexible and cost-efficient packaging operations further accelerates adoption.

Digital twin systems integrated with IoT sensors, AI analytics, and cloud platforms are gaining popularity for improving decision-making and operational transparency. Their ability to simulate packaging line performance, detect anomalies, and optimize energy usage enhances productivity. Alignment with smart manufacturing and sustainability initiatives reinforces strong growth across multiple packaging industries.

The market is segmented by component, technology, application, packaging line type, end-use industry, and region. Component segmentation includes software platforms, hardware such as sensors, IoT devices, and controllers, and services including consulting, integration, and maintenance, enabling complete digital twin ecosystems. Technology covers system simulation and modeling, virtual reality and augmented reality integration, artificial intelligence and machine learning, industrial internet of things (IIoT), and cloud and edge computing, driving innovation.

Applications include design and simulation, process optimization, predictive maintenance, production monitoring, and supply chain management, streamlining performance across packaging operations. Packaging line type segmentation covers bottling lines, canning lines, cartoning lines, flexible packaging lines, and blister and tray packaging lines. End-use industries include food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, consumer electronics, industrial goods, and logistics and e-commerce. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

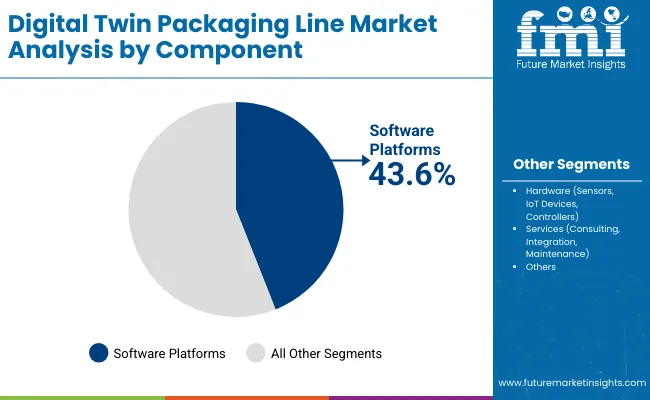

Software platforms are forecast to account for 43.6% of the market in 2025, driven by their role in enabling visualization, simulation, and coordination of packaging lines. These platforms create virtual replicas of real-world operations, allowing predictive modeling and continuous optimization of processes. Their adaptability across industries supports scalability from pilot projects to large-scale facilities.

Adoption is reinforced by the need for real-time insights that improve decision-making and reduce downtime. Software also enables integration with AI, IoT, and cloud technologies, making it the foundation for digital twin ecosystems. As demand for flexible and intelligent packaging grows, software platforms remain the dominant market component.

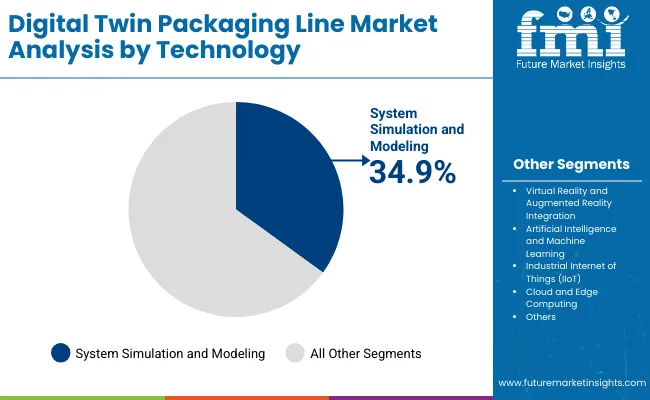

System simulation and modeling is projected to represent 34.9% of the market in 2025, enabling companies to replicate packaging workflows digitally before physical implementation. This reduces trial-and-error costs, enhances machine layout planning, and ensures accurate performance testing under varying conditions.

Its growing adoption is tied to rising complexity in packaging formats and sustainability requirements. By allowing rapid scenario testing, system simulation helps identify energy-saving opportunities and optimize material use. The segment’s ability to minimize waste while improving production efficiency strengthens its market leadership.

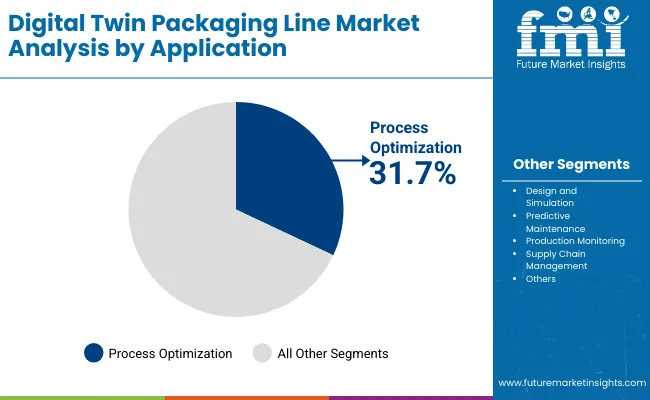

Process optimization is expected to capture 31.7% of the market in 2025, as digital twins help maximize throughput and minimize inefficiencies. By leveraging real-time operational data, companies can fine-tune line speeds, adjust equipment synchronization, and optimize resource utilization.

Manufacturers benefit from predictive adjustments that prevent bottlenecks and ensure consistent output quality. The technology also supports compliance by maintaining traceability across packaging operations. As consumer demands drive SKU diversification, process optimization remains the most valued digital twin application.

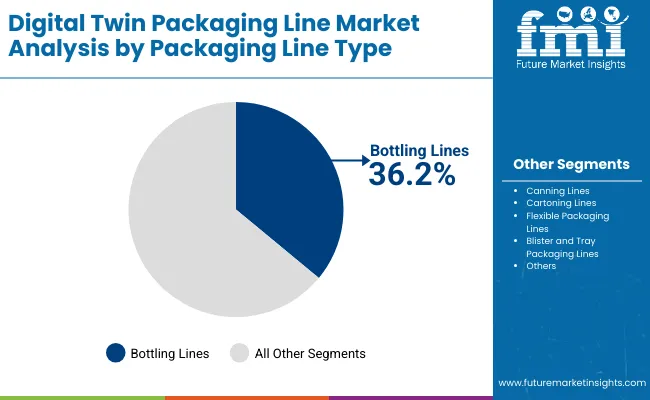

Bottling lines are projected to hold 36.2% of the market in 2025, supported by their extensive use in food, beverage, and pharmaceutical industries. Digital twin integration enables monitoring of filling accuracy, capping, labeling, and overall line synchronization.

Adoption is driven by high-speed operations where downtime or defects result in significant cost impacts. Bottling lines benefit from predictive maintenance and real-time quality checks enabled by digital twins, ensuring efficiency. Their dominance reflects global demand for bottled beverages and healthcare products requiring secure, consistent packaging.

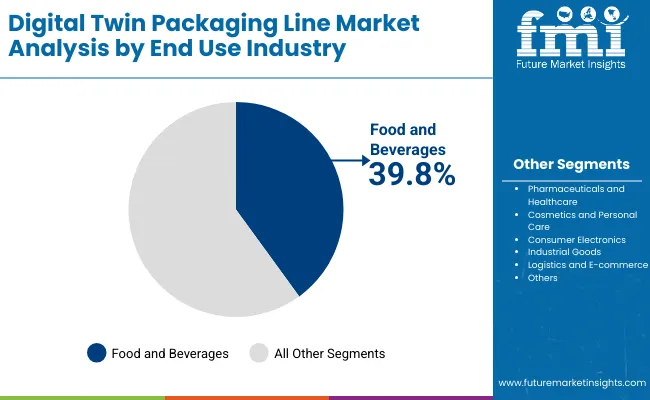

The food and beverages sector is expected to represent 39.8% of the market in 2025, as it involves diverse product categories, packaging formats, and regulatory standards. Digital twins help manufacturers manage multi-SKU production, optimize batch scheduling, and reduce waste.

This segment also benefits from enhanced traceability and compliance features critical in food safety. Real-time insights allow companies to adapt to shifting consumer demands while maintaining cost efficiency. With growing global consumption of packaged foods and drinks, this sector anchors demand for digital twin packaging lines.

The digital twin packaging line market is expanding as manufacturers embrace virtual simulation to improve efficiency, reduce downtime, and optimize production processes. Growing adoption in food, beverage, and pharmaceutical sectors is driven by Industry 4.0 initiatives and predictive maintenance needs. However, high implementation costs and data integration challenges act as restraints. Advances in AI, IoT connectivity, and cloud-based simulation platforms are shaping the future of this market.

Operational Efficiency, Predictive Maintenance, and Process Optimization Driving Adoption

Digital twins enable manufacturers to create virtual replicas of packaging lines, allowing real-time monitoring, troubleshooting, and predictive maintenance. By simulating packaging processes, companies can identify bottlenecks, optimize layouts, and enhance line flexibility without disrupting operations. Food and pharmaceutical companies benefit from improved compliance, reduced waste, and faster product changeovers. The ability to forecast equipment failures and reduce unplanned downtime strengthens ROI, making digital twin systems critical in highly competitive, efficiency-driven industries.

High Costs, Data Complexity, and Workforce Skill Gaps Restraining Growth

Despite the benefits, adoption is restrained by the high upfront investment in sensors, IoT platforms, and advanced software. Integration with existing legacy equipment can be technically complex, requiring significant data harmonization across multiple systems. Cybersecurity risks also arise due to the constant exchange of sensitive operational data. Additionally, manufacturers face skill gaps as their workforce requires training in simulation technologies and data analytics. These challenges slow adoption, especially among small to mid-sized enterprises.

AI Integration, Cloud Platforms, and Smart Analytics Trends Emerging

Key trends include AI-driven analytics that enhance predictive capabilities and enable autonomous decision-making within packaging lines. Cloud-based platforms are expanding accessibility, allowing real-time collaboration and monitoring across multiple facilities. Integration with IoT sensors is enabling granular data capture, driving higher accuracy in simulations. Companies are also adopting hybrid digital twins that combine physical and virtual systems for continuous optimization. These innovations are positioning digital twin packaging lines as foundational to future smart factories, sustainability goals, and competitive manufacturing strategies.

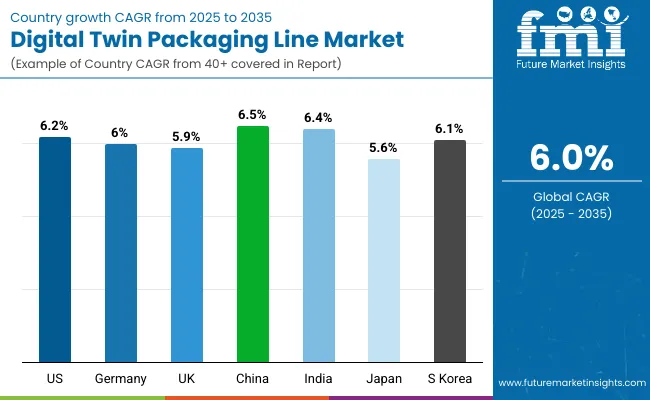

The global digital twin packaging line market is expanding steadily, fuelled by the need for predictive maintenance, process optimization, and sustainability in packaging operations. Asia-Pacific is emerging as a major growth hub, with China and India leading adoption through smart manufacturing initiatives and Industry 4.0 programs. Developed markets such as the USA, Germany, and Japan are driving innovation in AI-powered simulations, cloud-based monitoring, and real-time analytics to enhance efficiency, reduce downtime, and ensure regulatory compliance in packaging facilities.

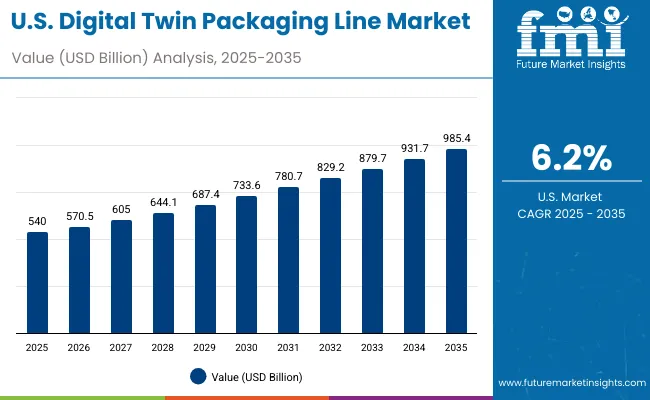

The USA market is projected to grow at a CAGR of 6.2% from 2025 to 2035, supported by strong adoption in food, beverage, and pharmaceutical industries. Companies are leveraging digital twin technology to simulate packaging line performance, enabling predictive maintenance and reducing energy usage. Growth is also being driven by integration with IoT sensors and AI-based analytics. USA firms are prioritizing sustainability by using digital twins to optimize resource consumption and minimize packaging material waste.

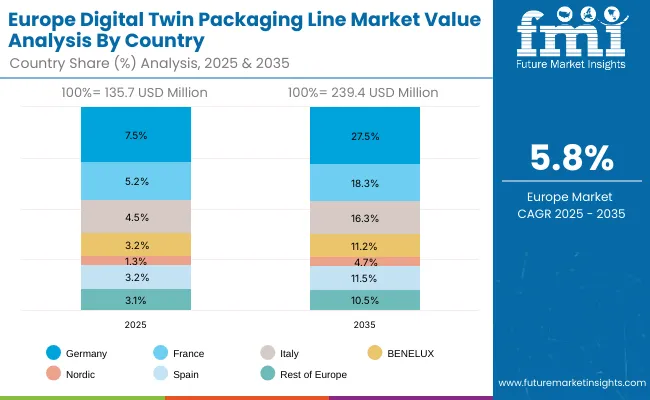

Germany’s market is expected to grow at a CAGR of 6.0%, driven by its advanced engineering ecosystem and Industry 4.0 leadership. Packaging firms are using digital twins to model production lines for flexibility and efficiency. Strict EU sustainability regulations are pushing adoption of twins to minimize material waste and energy use. German OEMs are also introducing modular digital twin solutions tailored to mid-sized enterprises, ensuring broader industry integration across food, beverages, and specialty packaging.

The UK market is forecast to grow at a CAGR of 5.9%, supported by demand in e-commerce packaging, FMCG, and premium beverages. Companies are adopting digital twins to improve traceability, reduce downtime, and support sustainable packaging designs. Growth is further reinforced by startups providing cloud-enabled twin platforms with affordable subscription models. Regulations around packaging waste are also driving adoption, as digital twins enable businesses to optimize production and compliance simultaneously.

China’s market is projected to grow at a CAGR of 6.5%, fuelled by large-scale manufacturing, government-backed smart factory initiatives, and rising e-commerce packaging volumes. Local OEMs are scaling cost-effective digital twin platforms integrated with AI and cloud systems. Demand is strong in food processing, electronics, and logistics. The ability of digital twins to simulate large production lines and improve real-time efficiency makes them integral to China’s rapid digital transformation in packaging industries.

India is forecast to grow at a CAGR of 6.4%, supported by rapid industrial automation, expansion in FMCG, and growth in pharmaceutical exports. SMEs are adopting digital twin platforms for cost-efficient packaging optimization. Government initiatives like "Make in India" and smart factory programs are boosting adoption. Local players are developing affordable, cloud-integrated twins that allow scalability for mid-sized plants, supporting demand across domestic and export-focused packaging industries.

Japan’s market is projected to grow at a CAGR of 5.6%, driven by its focus on precision manufacturing, electronics, and premium food packaging. Companies are adopting digital twin systems to ensure reliability, efficiency, and sustainability in operations. Compact, automation-ready twins are being developed for small-scale facilities, while larger firms emphasize real-time analytics. Japan’s strong focus on innovation and regulatory compliance makes digital twins an essential tool for packaging industries seeking high precision and traceability.

aSouth Korea’s market is expected to grow at a CAGR of 6.1%, supported by demand from semiconductors, cosmetics, and food industries. Strong export-oriented manufacturing and advanced IT infrastructure are reinforcing adoption. Companies are combining AI and IoT with digital twin systems to optimize efficiency and ensure packaging compliance. Growth is further supported by e-commerce demand for faster and smarter packaging solutions, positioning digital twins as a strategic tool in South Korea’s industrial packaging ecosystem.

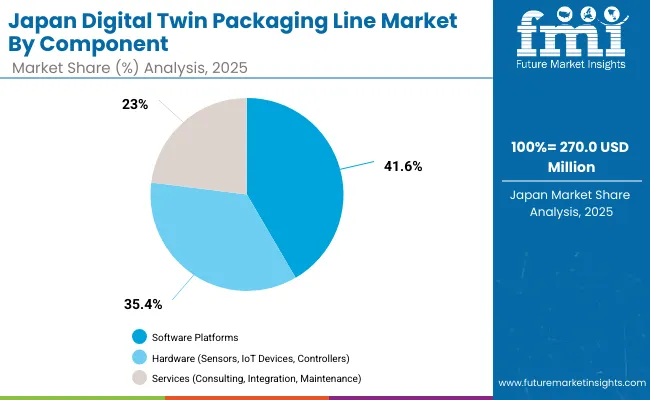

Japan’s digital twin packaging line market, valued at USD 270 million in 2025, is led by software platforms, which account for 41.6% of share due to their central role in simulation, design, and real-time analytics. Hardware, including sensors, IoT devices, and controllers, follows with 35.4%, reflecting the importance of physical connectivity. Services such as consulting, integration, and maintenance contribute 23.0%. The dominance of software reflects Japan’s focus on digitalization, automation, and predictive modeling, while investments in hardware and services demonstrate the country’s commitment to building robust, integrated packaging ecosystems that balance innovation, efficiency, and long-term operational performance.

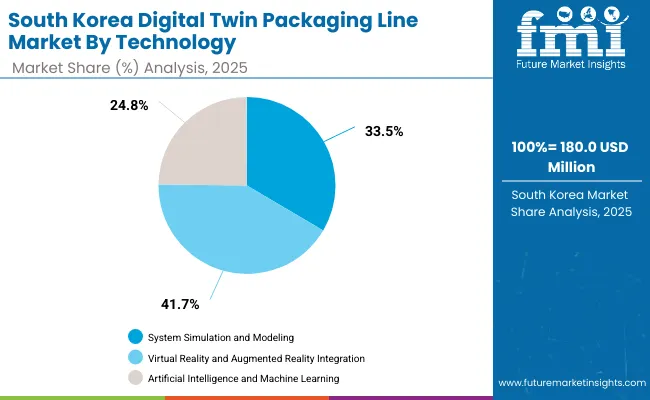

South Korea’s digital twin packaging line market, worth USD 180 million in 2025, is dominated by virtual and augmented reality (VR/AR) integration, capturing 41.7% share. System simulation and modeling follows with 33.5%, while artificial intelligence and machine learning hold 24.8%. Industrial Internet of Things (IIoT) and cloud/edge computing currently show negligible adoption. The leadership of VR/AR reflects its widespread use in operator training, maintenance, and process optimization. Simulation and modeling remain essential for design and efficiency testing. South Korea’s strong embrace of immersive technologies demonstrates its drive toward innovative packaging solutions that improve productivity, safety, and operational precision.

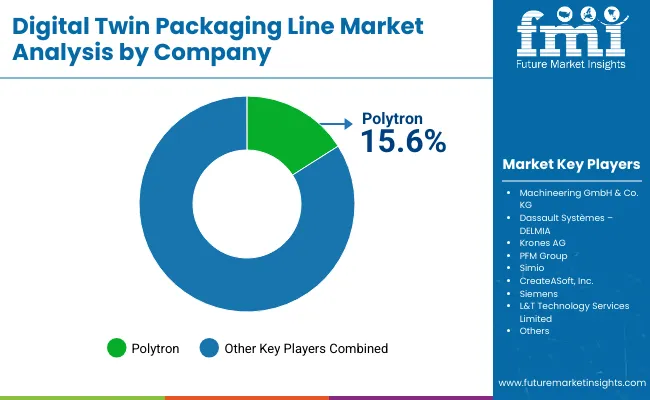

The digital twin packaging line market is moderately fragmented, with industrial software leaders, automation providers, and engineering consultancies competing across food, beverage, and pharmaceutical manufacturing sectors. Global leaders such as Polytron, Machineering GmbH & Co. KG, and DassaultSystèmes - DELMIA hold notable market share, driven by simulation accuracy, predictive analytics, and compliance with Industry 4.0 standards. Their strategies increasingly emphasize real-time optimization, reduced downtime, and cloud-based lifecycle management.

Established mid-sized players including Krones AG, PFM Group, and Simio are supporting adoption of packaging line digital twins featuring integrated robotics, production scheduling, and sensor-driven data models. These companies are especially active in bottling, flexible packaging, and confectionery lines, offering modular solutions that improve throughput, enhance operator training, and optimize resource utilization within highly competitive manufacturing environments.

Specialized technology firms such as CreateASoft, Inc., Siemens, and L&T Technology Services Limited focus on tailored digital twin solutions for regional markets and niche industries. Their strengths lie in multi-domain integration, customized software platforms, and deployment of AI-driven analytics, enabling packaging companies to accelerate product development, streamline maintenance, and ensure sustainable, agile operations across complex packaging ecosystems.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| By Component | Software Platforms, Hardware (Sensors, IoT Devices, Controllers), Services (Consulting, Integration, Maintenance) |

| By Technology | System Simulation and Modeling , Virtual Reality and Augmented Reality Integration, Artificial Intelligence and Machine Learning, Industrial Internet of Things ( IIoT ), Cloud and Edge Computing |

| By Application | Design and Simulation, Process Optimization, Predictive Maintenance, Production Monitoring, Supply Chain Management |

| By Packaging Line Type | Bottling Lines, Canning Lines, Cartoning Lines, Flexible Packaging Lines, Blister and Tray Packaging Lines |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Consumer Electronics, Industrial Goods, Logistics and E-commerce |

| Key Companies Profiled | Polytron , Machineering GmbH & Co. KG, Dassault Systèmes – DELMIA, Krones AG, PFM Group, Simio , CreateASoft , Inc., Siemens, L&T Technology Services Limited |

| Additional Attributes | Rising adoption of digital twin technology for predictive maintenance and downtime reduction, increasing use of AI and IIoT integration to optimize packaging efficiency, demand for VR/AR-enabled simulations in packaging line design, growing cloud and edge-based deployments for scalability, and strong uptake in food, pharmaceuticals, and e-commerce sectors seeking higher precision, flexibility, and reduced operational costs. |

The global digital twin packaging line market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the digital twin packaging line market is projected to reach USD 3.2 billion by 2035.

The digital twin packaging line market is expected to grow at a CAGR of 6.0% between 2025 and 2035.

The key components in the digital twin packaging line market include software platforms, hardware (sensors, IoT devices, controllers), and services (consulting, integration, and maintenance).

The software platforms segment is expected to account for the highest share of 43.6% in the digital twin packaging line market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA