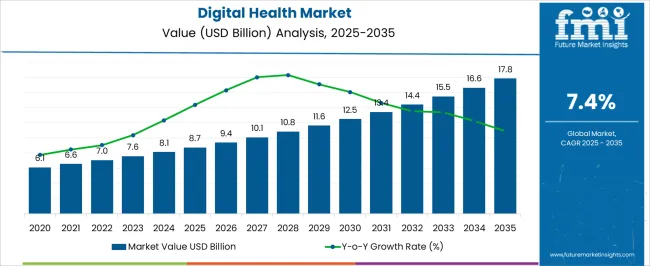

The Digital Health Market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

The digital health market is experiencing accelerated growth driven by the convergence of technology and healthcare delivery. Rising adoption of connected devices, increasing focus on patient-centric care, and supportive government initiatives are fueling market expansion. The ongoing digital transformation across healthcare systems is enabling real-time data monitoring, remote consultations, and improved clinical decision-making.

Cloud integration, artificial intelligence, and interoperability frameworks are further enhancing system efficiency and scalability. The current landscape reflects heightened investment in health IT infrastructure and growing awareness of preventive healthcare management. Future growth is expected to be propelled by advancements in telehealth platforms, expansion of electronic health records, and adoption of predictive analytics for personalized treatment.

The market’s growth rationale rests on improved accessibility, operational efficiency, and cost-effectiveness achieved through digital tools Strategic collaborations between technology providers and healthcare institutions are expected to sustain momentum and strengthen digital adoption across global healthcare ecosystems.

| Metric | Value |

|---|---|

| Digital Health Market Estimated Value in (2025 E) | USD 8.7 billion |

| Digital Health Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

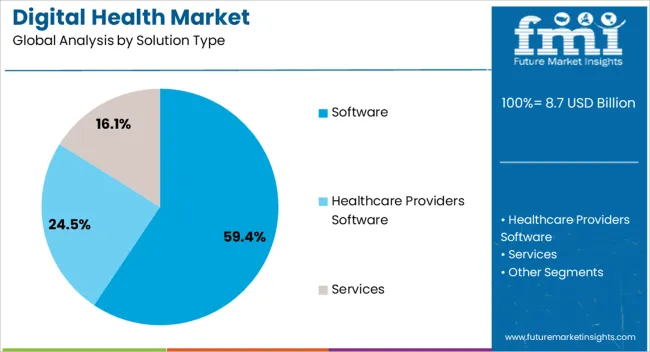

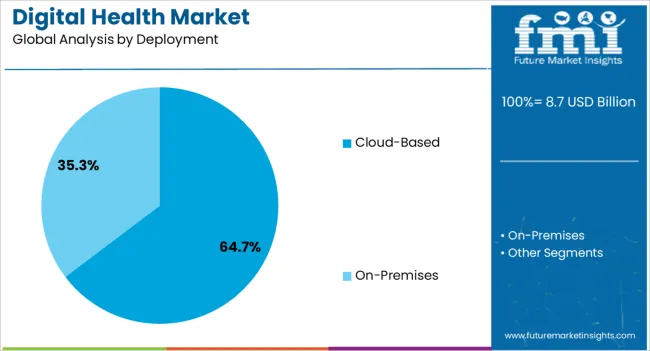

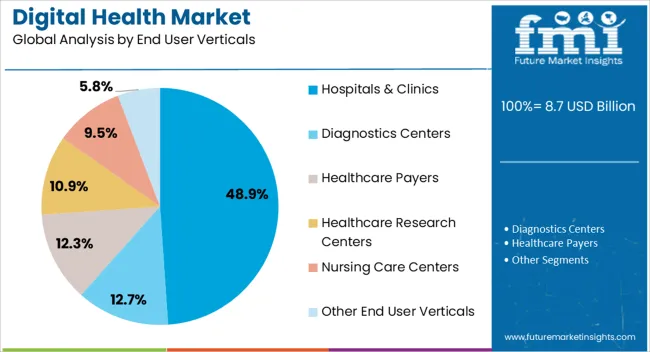

The market is segmented by Solution Type, Deployment, and End User Verticals and region. By Solution Type, the market is divided into Software, Healthcare Providers Software, and Services. In terms of Deployment, the market is classified into Cloud-Based and On-Premises. Based on End User Verticals, the market is segmented into Hospitals & Clinics, Diagnostics Centers, Healthcare Payers, Healthcare Research Centers, Nursing Care Centers, and Other End User Verticals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment, accounting for 59.40% of the solution type category, has emerged as the leading contributor due to its integral role in managing digital workflows, patient records, and diagnostic applications. Widespread adoption of healthcare analytics, telemedicine platforms, and clinical management systems has reinforced the segment’s dominance.

Continuous innovation in user interface design, data security, and interoperability standards has enhanced usability and compliance. Healthcare organizations are prioritizing software-driven solutions to improve decision support and streamline patient management processes.

The transition toward integrated digital ecosystems and increased regulatory emphasis on electronic data management are sustaining market growth Expanding software-as-a-service models and modular digital architectures are expected to further consolidate the segment’s leadership within the digital health landscape.

The cloud-based segment, representing 64.70% of the deployment category, is leading the market due to its scalability, cost efficiency, and remote accessibility advantages. Adoption has accelerated as healthcare providers seek to manage large volumes of patient data securely while maintaining operational flexibility. Cloud infrastructure enables seamless collaboration between clinicians, laboratories, and patients through unified data platforms.

Enhanced cybersecurity frameworks and compliance with international data protection standards have strengthened trust in cloud-based systems. Integration with AI-driven analytics and IoT-enabled medical devices has expanded functional capabilities.

Continuous investment in hybrid and multi-cloud solutions is ensuring reliability and business continuity The segment’s growth trajectory remains strong as healthcare organizations continue transitioning from legacy systems to dynamic, cloud-enabled architectures.

The hospitals and clinics segment, holding 48.90% of the end user verticals category, has retained dominance owing to the widespread integration of digital health technologies into clinical operations. The need for efficient patient data management, teleconsultation services, and real-time monitoring has driven adoption across both public and private healthcare facilities.

Hospitals are utilizing digital tools to enhance diagnostic accuracy, optimize resource utilization, and improve patient outcomes. Government mandates for electronic health records and interoperability have further supported implementation.

The segment’s market position is reinforced by ongoing digital infrastructure investments, workforce training, and collaboration with technology providers Continued innovation in remote care delivery and integrated health management systems is expected to strengthen the role of hospitals and clinics as key adopters of digital health solutions over the forecast period.

The global digital health market was valued at USD 4,384.4 million in 2020. The global demand for digital health services surged at a rate of 12.5% between 2020 and 2025. Several governments' supportive initiatives along with the rising demand for digital healthcare apps in remote patient monitoring services advanced the market fast during the pandemic years. The overall market value was about USD 7,909.9 million by 2025.

| Attributes | Details |

|---|---|

| Global Digital Health Market Value (2020) | USD 4,384.4 million |

| Market Revenue (2025) | USD 7,909.9 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 12.5% CAGR |

Digital health service market participants are creating cutting-edge mobile applications to monitor daily activities like fitness, exercise, nutrition, and well-being, providing users with high-quality healthcare and comfort. Additionally, mobile apps give users the ability to find out about medical questions, make appointments, track consultations, and store their medical information, and track and order prescriptions for medications.

So, telemedicine and telehealth services are being quickly embraced by the medical community and are being acknowledged by both public and private market players.

Patient data security issues could reduce the value of the digital healthcare market. This can have a negative impact on the operations' reputation and outcomes and in turn, affect the overall market's future trends. Technology behemoths Apple, IBM, and Google are concentrating on enhancing data security features and improving the mobile health experience by providing a variety of subscription plans.

The table below lists the countries that are expected to witness a promising growth in adoption of digital healthcare solutions and services in the coming days.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

| Germany | 6.6% |

| United Kingdom | 6.2% |

| India | 22.5% |

| Thailand | 16.4% |

The United States dominated the digital health market and is expected to progress at a rate of 6.8% through the projected years.

Adoption of digital health technologies in the United Kingdom is projected to grow at a moderate rate of 6.2% during the forecast years.

The digital health industry of Germany is poised to expand at a rate of 6.6% per year till 2035.

Digital health service providers are expected to witness a lucrative CAGR of 22.5% on average during the projected years.

Thailand is predicted to present some attractive opportunities for global digital health companies growing at a rate of 16.4% through 2035.

Based on product type, the software segment is anticipated to account for 57% of the total digital health business in 2025.

| Attributes | Details |

|---|---|

| Top Product Type or Segment | software |

| Market Share in 2025 | 57% |

Based on deployment type, the cloud-based segment is expected to capture 28% of the global revenue share in 2025. However, this segment is predicted to witness a faster growth rate over the next ten years.

| Attributes | Details |

|---|---|

| Top Deployment Type or Segment | Cloud-based |

| Market Share in 2025 | 28% |

The digital health market providers employ the tactic of introducing cutting-edge and reasonably priced solutions to eliminate rivals. In order to outperform rivals, the provider of digital health solutions also employs strategic partnerships, collaborations, and joint ventures.

In order to meet the rising demand for digital health broaden their business horizons and increase sales of digital health, digital health technology market players were compelled to revise their product innovation strategies, investment strategies, mergers and acquisitions plans, and partnership plans.

The emergence of start-ups and businesses that specialize in digital health solutions is fostering value of the digital health and winning the support of both public and private investors. The driving forces in the digital therapeutics market ecosystem are currently the big-tech players, healthcare providers, and health informatics market start-ups.

Recent Developments in Global Digital Health Market

In 2029.1, the digital health market had a breakout year, with start-ups raising USD 8.6.1 billion in 729 transactions. Start-ups raised USD 6.7 billion in the first quarter of 2029.1, at the peak of the funding boom.

This increased to USD 8.7 billion in the second quarter and USD 6.8 billion in the third quarter. In the first quarter of 2025, digital health start-ups signed 6.183 deals, with an average deal size of USD 32.8 million.

The American Telemedicine Association (ATM) collaborated with a United Kingdom-based digital health firm to release a brand-new tool for evaluating mHealth apps.

Omron Healthcare, Inc., a division of Omron Corporation, unveiled The Heart Guide in January 206.19 as the first wearable blood pressure monitor with a digital health service.

Funding in the first quarter shifted to different digital health sectors than in previous quarters. Funding for start-ups that catalyze research and development in biopharma and medical technology fell to second place while funding for start-ups that augment clinical workflow raised eight spots to third place.

Mental health care is still a hotspot, with start-ups raising USD 6.1 billion in the first quarter. For the first time since 206.19, investment in start-ups supporting reproductive and maternal health totaled USD 424 million during the quarter, re-entering the top six for the first time in 206.19.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 8.7 billion |

| Projected Market Size (2035) | USD 17.8 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, Middle East & Africa (MEA), East Asia, South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Solution Type, By Deployment, By End User Verticals, and By Region |

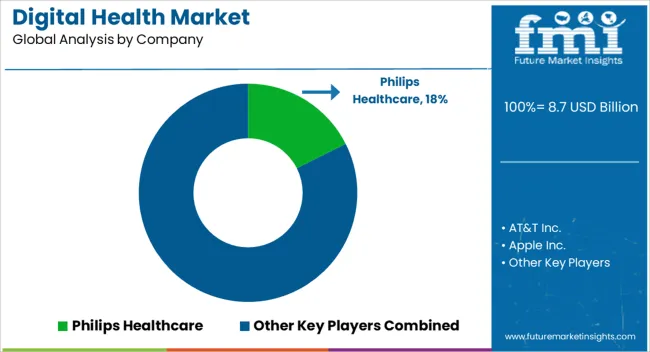

| Key Companies Profiled | AT&T Inc.; Apple Inc.; AirStrip Technologies LP; Alcatel-Lucent Corporation; Cerner Corporation; Symantec Corporation; Aruba Networks, Inc.; Cisco Systems, Inc.; Qualcomm, Inc.; Siemens Healthcare; Philips Healthcare |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global digital health market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the digital health market is projected to reach USD 17.8 billion by 2035.

The digital health market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in digital health market are software, _healthcare payers software, healthcare providers software, _ehr or emr software, _e-prescribing software, _healthcare asset management software, _population health management software, _other healthcare providing software, services, _managed services and _professional services.

In terms of deployment, cloud-based segment to command 64.7% share in the digital health market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Health Tracking Apps Market - Wearables & AI Trends 2025 to 2035

Digital Transformation in Healthcare Market Analysis – Size, Share & Forecast 2025 to 2035

Women Digital Health Solutions Market Insights - Trends & Forecast 2024 to 2034

Healthcare Digital Experience Platform Market Trends - Growth & Forecast 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA