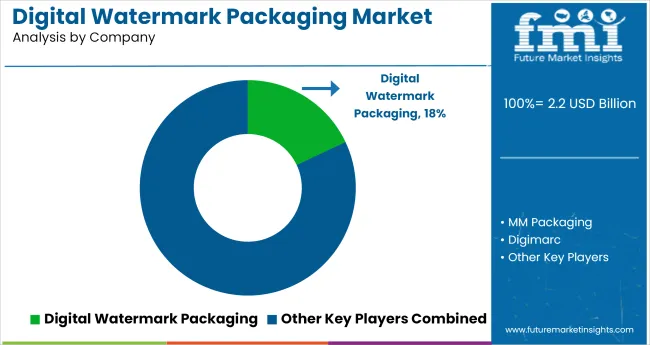

In 2025, the digital watermark packaging market is valued at USD 2.2 billion and is forecasted to reach USD 3.9 billion by 2035, growing at a CAGR of 5.9%.

| Attribute | Value |

|---|---|

| Market Size (2025) | USD 2.2 billion |

| Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 5.9% |

This growth is being driven by the deployment of imperceptible codes on packaging surfaces to support automated sorting technologies in recycling facilities, particularly under initiatives like HolyGrail 2.0 in Europe. Brands in the food, personal care, and household product segments are implementing digital watermarks to comply with upcoming EPR (Extended Producer Responsibility) requirements and to enhance pack-level traceability without changing package aesthetics.

Scalability is being enabled through cloud-based data infrastructure and the ability to apply these watermarks across both flexible films and rigid plastic formats. Companies are embedding these codes to unlock SKU-level authentication, improve post-consumer recycling rates, and deliver digital content such as usage guides and authenticity certificates. With increasing regulatory and consumer demands for packaging transparency, digital watermarks emerge as a cost-effective solution that aligns with both sustainability goals and connected packaging strategies.

The digital watermark packaging market represents a niche but rapidly growing segment, accounting for approximately 1.5% to 3% of its five parent markets collectively. Within the smart packaging market, it holds a slightly higher share-around 5%, driven by growing adoption in green initiatives and brand protection.

In the brand protection and anti-counterfeiting market, it contributes about 2%, as digital watermarks offer invisible, secure tracking. In larger segments like the overall packaging industry and supply chain technology, its share is under 1%, due to its emerging adoption status. The advancements in AI-driven detection and growing retail demands for traceability are expected to increase this share.

Riley McCormack, CEO of Digimarc, characterizes digital watermarks as a transformative advancement in packaging intelligence, enabling a secure and persistent link between physical packaging and digital data. He highlights Digimarc’s leadership in developing watermarking solutions that align with the White House’s rigorous standards for content provenance, positioning the technology as a cornerstone for trusted information systems. Beyond traceability, McCormack emphasizes the impact of digital watermarks on recycling accuracy, anti-counterfeiting, and consumer interaction

Packaging conversion to digital watermarking is gaining ground, especially in retail where traceability and recycling are critical. Digital inkjet printing enables flexible runs, while watermark types support applications from sorting to brand security. Adoption is shaped by print resolution, substrate compatibility, and sorting-line recognition rates.

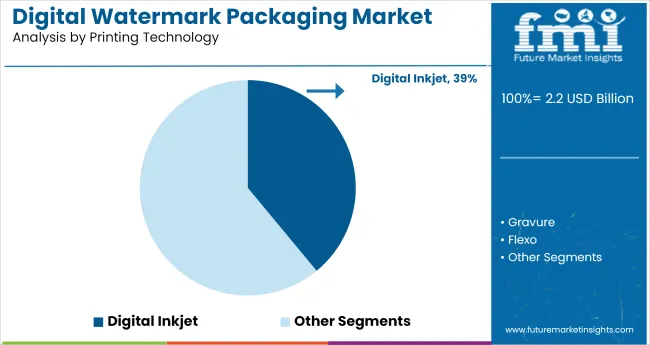

Digital printing holds a 39% market share, emerging as the preferred technology for embedding watermark codes into primary packaging layers. The ability to vary print data at 600-1200 dpi resolution enables precise watermark placement, critical for object recognition in DWS (Digital Watermark Sorting) systems. Suppliers such as HP Indigo, Durst, and Xeikon offer high-speed digital presses with inline verification modules. Digital allows batch-level or SKU-specific watermarks across substrates like cartons, films, and tubes, with substrate throughput between 50-120 m/min.

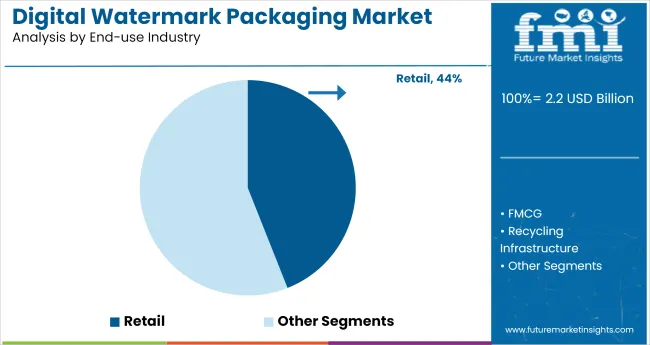

Retail packaging, especially for FMCG products, accounts for 44% of end-use adoption. Digital watermarking is embedded into product labels and cartons to enhance product identification, shelf-level engagement, and end-of-life recyclability. Brands like Nestlé, Unilever, and P&G have tested over 200+ SKUs using invisible barcodes and smart logo integration on folding cartons and shrink sleeves. Retailers deploying smart shelves and AR/QR-linked promotions demand packaging that supports dual-function watermarks for sorting and consumer activation.

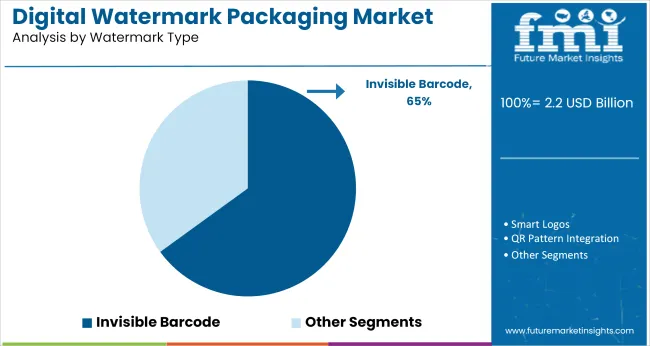

Invisible barcodes dominate among watermark types due to their multi-layered data encoding and compatibility with existing packaging artwork. These barcodes embed binary or matrix data through pixel variation patterns, designed not to disrupt aesthetic elements. Firms like Digimarc, GS1, and Systech offer standard protocols for barcode encoding in CMYK layers, with verification using industrial-grade scanners or NIR sensors. These barcodes maintain functionality even after minor creasing or distortion, provided pixel integrity exceeds 85% continuity.

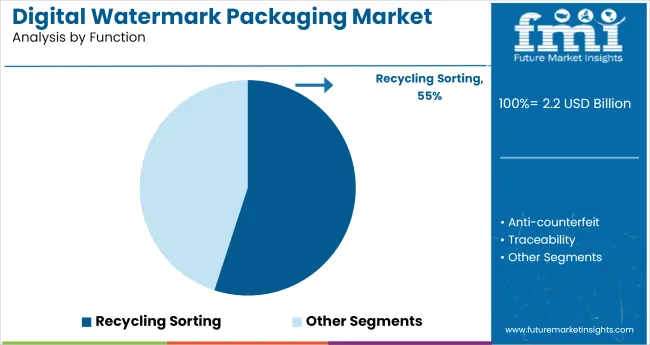

Recycling sorting is the most technically validated use-case for digital watermarking, enabling object-level packaging identification. Sorting efficiency with watermark-embedded packs reaches >95% purity for materials like PP, PET, and HDPE using NIR-equipped robotic sorters. Pilots under the HolyGrail 2.0 initiative demonstrated a throughput of 3 tons/hour in live MRFs (Material Recovery Facilities) when watermarked materials are present in sufficient density. Companies like PepsiCo, TOMRA, and Avery Dennison are actively testing sort recognition performance across regional waste systems.

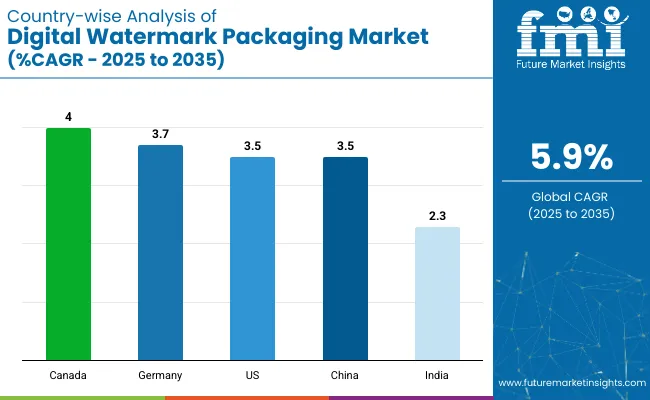

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 2.3% |

| China | 3.5% |

| United States | 3.5% |

| Germany | 3.7% |

| Canada | 4.0% |

Global demand for digital watermark packaging is expected to grow at a 6.0% CAGR from 2025 to 2035. Among the profiled countries, OECD members such as the United States (3.5%), Canada (4.0%), and Germany (3.7%) remain below the global average. Similarly, BRICS economies like China (3.5%) and India (2.3%) trail the benchmark, with India posting the widest gap at -62% relative to the global rate. This divergence reflects uneven integration of digitized packaging systems, delays in automated sorting infrastructure, and slow uptake of traceability solutions.

While ASEAN nations have begun aligning packaging technologies with modern identification tools, most OECD and BRICS countries continue to face structural bottlenecks. The lower growth momentum may be attributed to fragmented regulatory support, cost limitations for smaller manufacturers, and limited awareness of the value chain benefits of digitally traceable packaging formats. These conditions are tempering progress across both advanced and developing markets.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The digital watermark packaging market in the USA is projected to expand at a CAGR of 3.5% between 2025 and 2035, with demand expected to reach 46,000 metric tons by the end of the forecast period. Progress is concentrated in FMCG and retail brands experimenting with detection at material recovery facilities (MRFs). While large-scale deployment remains limited, pilot outputs have influenced procurement strategies across packaging design teams.

Canada's digital watermark packaging market is expected to grow at a CAGR of 4.0% through 2035, with anticipated demand reaching 17,000 metric tons. Technology is increasingly viewed as a data-layering solution for regional waste traceability and packaging lifecycle mapping. Adoption has been strongest in the personal care and dairy segments, with manufacturers integrating invisible codes into multilayer films. Regulatory bodies in provinces such as Ontario are exploring the integration of watermark-based automation in their waste auditing systems.

Germany is forecasted to see a CAGR of 3.7% in the digital watermark packaging market between 2025 and 2035, with demand projected to surpass 39,000 metric tons. As part of Europe's advanced waste-sorting ecosystem, Germany has positioned watermark packaging at the core of next-gen identification systems. The country has implemented robust digital watermark pilots across food-grade PET and PP trays, supported by machine vision-enabled recovery systems. Demand is being fueled by both packaging converters and retail private labels embracing the technology for traceability and compliance.

China’s digital watermark packaging market is set to grow at a CAGR of 3.5% from 2025 to 2035, with projected demand reaching 58,000 metric tons by the close of the forecast period. Market traction is largely driven by logistics and e-commerce giants implementing invisible identifiers for counterfeit protection and packaging traceability. High-speed consumer goods producers are integrating watermarking into flexible pouches and outer corrugated layers, often embedded in the design print stream. Innovation zones in Shenzhen and Hangzhou are actively scaling up in-line watermark scanners.

India's digital watermark packaging market is projected to grow at a CAGR of 2.3% from 2025 to 2035, with demand likely to reach 41,000 metric tons during the forecast horizon. Adoption is currently centered around smart labels in organized retail and pilot efforts by FMCG conglomerates exploring track-and-trace in packaging. The infrastructure limitations at recycling facilities have slowed implementation of watermark sorting technologies. Efforts are underway in Tamil Nadu and Maharashtra to set up scanning units within extended waste recovery programs.

Digital watermark packaging suppliers such as Digimarc, MM Packaging, and ProAmpac maintain market strength through targeted product launches and refinement of print processes. Digimarc collaborates with retailers to improve packaging functionality through invisible codes, while MM Packaging adapts designs for folding cartons across sectors. ProAmpac focuses on integrating digital markers into flexible packaging for enhanced logistics and inventory control. Winpak and Wipak continue to align packaging formats with specific brand requirements.

Entry into this space requires specialized equipment, technical knowledge of digital coding, and close coordination with packaging converters. Companies like AeroFlexx and INKOPACK Co., Ltd. are entering by offering cost-efficient solutions for short-run applications. Korpack and Spies concentrate on agile production models, enabling them to meet custom orders and support regional packaging needs effectively.

Recent Digital Watermark Packaging Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.2 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Watermark Types Analyzed (Segment 1) | Invisible Barcode, Smart Logos, QR Pattern Integration |

| Functions Analyzed (Segment 2) | Recycling Sorting, Anti-counterfeit, Traceability, Customer Engagement |

| Printing Technologies (Segment 3) | Flexo, Gravure, Digital Inkjet, Offset |

| Applications Analyzed (Segment 4) | Beverage Labels, Food Cartons, Cosmetic Tubes, Folding Cartons |

| End-Use Industries (Segment 5) | FMCG, Retail, Recycling Infrastructure, Brand Protection |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, China, Japan, South Korea, India, Brazil, Australia |

| Key Players Profiled | MM Packaging, Digimarc, ProAmpac, Polychem, AeroFlexx, Wipak, Spies, Korpack Corporation, INKOPACK Co., Ltd., Winpak |

| Additional Attributes | Dollar sales segmented by watermark type and application area, growing integration in recycling and smart retail systems, increasing demand for traceability and counterfeit prevention across FMC |

Invisible Barcode, Smart Logos, QR Pattern Integration.

Recycling Sorting, Anti-counterfeit, Traceability, Customer Engagement.

Flexo, Gravure, Digital Inkjet, Offset.

Beverage Labels, Food Cartons, Cosmetic Tubes, Folding Cartons.

FMCG, Retail, Recycling Infrastructure, Brand Protection.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The industry is expected to grow from USD 2.2 billion in 2025 to USD 3.9 billion by 2035, expanding at a CAGR of 5.9%.

Digital inkjet printing holds a 39% market share in 2025.

The retail sector accounts for 44% of total end-use demand.

Digimarc leads the industry with an 18% market share.

Canada is forecasted to grow at the highest CAGR (4.0%) through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Twin Packaging Line Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Packaging Market Trends, Growth, Forecast 2025 to 2035

Market Share Breakdown of Digital Printing Packaging Providers

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA