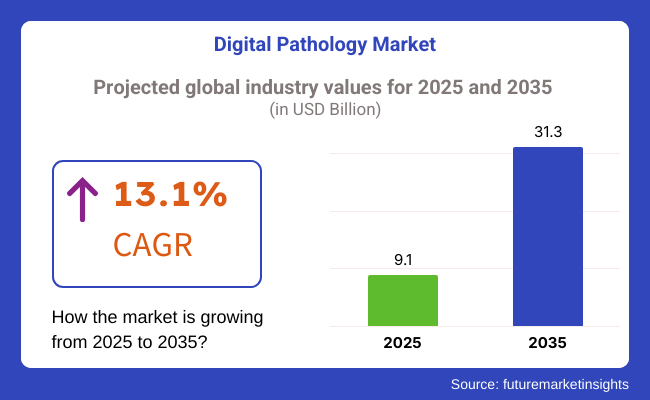

The global digital pathology market is valued at approximately USD 9.1 billion in 2025. It is projected to grow at a CAGR of 13.1% between 2025 and 2035. By 2035, the market size is expected to reach around USD 31.3 billion. This growth is driven by the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, which necessitate accurate and timely diagnostics.

Digital pathology enhances diagnostic precision and workflow efficiency, enabling pathologists to process more information effectively. The integration of artificial intelligence (AI) and machine learning (ML) further augments the capabilities of digital pathology systems, facilitating improved diagnostic outcomes.

Leading manufacturers such as Roche, Proscia, and Gestalt Diagnostics are at the forefront of digital pathology innovation and enhance diagnostic precision and efficiency. In April 2025, Roche received FDA Breakthrough Device Designation for its VENTANA TROP2 (EPR20043) RxDx Device, marking the first AI-driven companion diagnostic for non-small cell lung cancer.

Matt Sause, CEO of Roche Diagnostics, stated, "This FDA breakthrough device designation is another example of our commitment to deliver innovation that enables more precise diagnosis in oncology". ProsciaConcentriq® AP-Dx* was honored with the 2025 MedTech Breakthrough Award for its innovation in digital pathology.

“Being honored by MedTech Breakthrough alongside some of the most prominent names in healthcare, as digital pathology quickly becomes the standard of care”- stated by David West, Proscia’s CEO. These developments underscore the industry's focus on integrating AI and digital solutions to advance pathology diagnostics and patient care.

Between 2024 and 2025, significant technological advancements have been made in digital pathology. The integration of AI and ML algorithms into digital pathology systems has improved diagnostic precision and workflows, allowing pathologists to process more information efficiently.

North America holds a significant share of the digital pathology market, driven by advanced healthcare infrastructure and high adoption rates of innovative technologies. In 2024, North America accounted for 41% of the global market share. The region's growth is further supported by increasing investments in healthcare and a strong focus on improving diagnostic efficiency. The United States, in particular, has witnessed substantial growth due to favorable reimbursement policies and the presence of key market players.

The integration of AI and telepathology services has also contributed to the market's expansion in North America. Europe's digital pathology market is characterized by growing demand for advanced diagnostic solutions and supportive government initiatives promoting healthcare IT infrastructure.

Countries like Germany, France, and the UK are leading in the adoption of digital pathology technologies, driven by rising incidences of chronic diseases and increasing awareness among healthcare professionals.

In the digital pathology market, equipment components are projected to dominate with a 56.3% revenue share in 2025, driven by technological innovations in imaging systems and AI-powered slide analysis. Clinical pathology is expected to lead by application, holding 29.9% share, due to rising demand for accurate and rapid diagnostic services in chronic disease management.

The equipment component segment is projected to capture 56.3% of the digital pathology market revenue in 2025, driven by its pivotal role in enabling high-resolution digitization of pathology samples. Devices such as whole-slide scanners, digital microscopes, and automated imaging systems allow for enhanced visualization, faster turnaround, and improved diagnostic precision.

Technological innovations-especially in AI-assisted pattern recognition and image enhancement-have streamlined tissue analysis workflows. These tools reduce diagnostic variability, detect abnormalities earlier, and support large-scale slide processing. AI integration has further enabled the automation of routine tasks, freeing up pathologists to focus on complex cases.

Leading manufacturers, including Philips and Leica Biosystems, are investing heavily in next-generation imaging platforms that feature faster scanning speeds, cloud-based storage, and integrated AI decision support tools. In a 2024 investor call, Leica’s CTO stated that speed and fidelity in slide digitization are now matched by intelligent interpretation-this convergence defines the future of pathology diagnostics. The growing reliance on equipment in both centralized labs and point-of-care settings underscores its continued dominance, especially as remote diagnostics and digital consultations expand globally.

By 2025, clinical pathology is projected to hold over 29.9% of the market by application. This leadership stems from its essential role in diagnosing chronic conditions such as cancer, diabetes, and cardiovascular diseases. Digital pathology supports high-throughput slide analysis, improving diagnostic speed and reliability across large clinical networks. The integration of machine learning algorithms and automated image quantification enhances accuracy in histological assessments. These systems allow for real-time digital slide sharing, facilitating remote collaboration and second opinions in underserved regions.

The rise of personalized medicine and molecular diagnostics has amplified the need for precise and timely pathology results. Digital workflows also reduce manual errors, cut specimen handling times, and support data archiving and compliance. Global adoption is being fueled by the shift toward value-based care models, where diagnostic efficiency is critical to treatment success. As healthcare systems scale digital infrastructure, clinical pathology’s alignment with AI-driven efficiency and outcome optimization ensures its continued market leadership through 2035.

The digital pathology market is expanding due to advancements in imaging technologies, AI integration, and rising demand for remote diagnostics. However, adoption is hindered by high initial equipment costs, workflow integration challenges, and regulatory variability. Despite these, the market remains on a strong upward trajectory driven by innovation and global digitization trends.

Ongoing Innovation in Imaging and AI is Fueling Market Expansion

The digital pathology market continues to grow due to advancements in imaging resolution, AI-driven diagnostics, and the growing demand for remote consultation capabilities. Adoption of whole slide imaging (WSI), cloud-based storage, and AI-powered image interpretation is enabling faster, more accurate diagnoses across clinical and research settings.

Healthcare systems worldwide are digitizing pathology workflows to improve efficiency, enable multidisciplinary collaboration, and support precision medicine initiatives. The integration of digital pathology into hospital IT ecosystems is accelerating, driven by the rising burden of chronic diseases and a global shift toward data-driven diagnostics.

High Equipment Costs and Workflow Transition Slow Adoption

Despite positive momentum, the adoption of digital pathology systems is hampered by high initial capital investments. Purchasing slide scanners, establishing secure data storage, and deploying AI software require significant resources, which remain prohibitive for many mid-sized labs.

Transitioning from manual to digital workflows often demands staff retraining, workflow redesign, and short-term operational disruptions, especially in settings with limited technical support. Until costs become more manageable and workflows become more turnkey, adoption may remain skewed toward larger institutions with robust IT and diagnostic budgets.

Regulatory Gaps and Interoperability Remain Key Challenges

Lack of standardized regulatory frameworks across regions continues to restrict global deployment of digital pathology, especially when it involves AI in clinical decision-making. Differing rules for validation, data security, and device classification make cross-border adoption difficult. Cloud storage of pathology slides raises additional concerns about data privacy, especially under GDPR and HIPAA guidelines.

In a 2024 HIMSS roundtable, stakeholders emphasized that interoperability and cost control are essential for scaling digital pathology. Until these structural challenges are addressed through harmonized standards and affordable platforms, digital pathology implementation may remain fragmented across healthcare ecosystems.

The digital pathology market is witnessing accelerated adoption globally, led by the integration of artificial intelligence, whole slide imaging (WSI), and cloud-based platforms. The United States, European Union, and Japan are capitalizing on technological maturity and infrastructure, while the United Kingdom and South Korea are experiencing rapid growth through government-funded digitization initiatives and AI-driven diagnostics.

The United States digital pathology market is expected to grow at a CAGR of 12% from 2025 to 2035. Growth is being fueled by the increasing burden of cancer cases, with over 2 million new diagnoses expected in 2024 alone, and the urgent demand for faster, more accurate diagnostics. This has accelerated the deployment of whole slide imaging (WSI) platforms and AI-based analysis tools in pathology labs. Companies such as Philips, Roche Diagnostics, and Leica Biosystems are investing in automated image interpretation systems, enhancing both diagnostic speed and precision.

Integration with electronic health records (EHRs) and expanding use of cloud-based pathology platforms have contributed to market scalability. Federal programs such as the Cancer Moonshot Initiative have further supported investment in digital infrastructure and precision oncology solutions. With regulatory support and rising telemedicine adoption, digital pathology is playing a vital role in reshaping diagnostics in hospitals, cancer centers, and academic research institutions.

The United Kingdom digital pathology market is projected to grow at a CAGR of 11.8% between 2025 and 2035. Expansion is being led by NHS digital initiatives, particularly the Digital Pathology and Imaging AI Centre of Excellence, which is advancing the deployment of WSI technologies and AI-enhanced diagnostics across hospital networks. Remote consultations via telepathology are becoming mainstream in clinical workflows, particularly in oncology and infectious diseases.

Startups like Paige AI and PathAI are contributing to the development of deep learning algorithms that enable high-precision slide analysis. Research collaboration between academic pathology departments, biotech firms, and the NHS is accelerating AI validation and adoption. With continued government backing and an emphasis on health system digitization, the UK market is expected to witness sustained investment and implementation of digital pathology tools over the next decade.

The European Union digital pathology market is forecast to expand at a CAGR of 12.4% through 2035. Strong momentum is being driven by the Horizon Europe program and the EU Cancer Plan, both of which have earmarked significant funding for the modernization of diagnostic infrastructure and AI research in healthcare. Countries such as Germany, France, and Italy are leading regional growth through adoption of machine learning-based pathology platforms, cloud-connected WSI systems, and collaborative cancer research projects.

EU data protection standards and interoperability mandates are encouraging cross-border image sharing and integration of digital diagnostics into national health systems. A surge in automated pathology labs and AI-enabled startups is also advancing adoption across tertiary care hospitals. With robust infrastructure and strong public-private collaboration, Europe remains at the forefront of digital pathology transformation.

The Japan digital pathology market is expected to grow at a CAGR of 12.1% from 2025 to 2035. Expansion is being fueled by advancements in AI-driven diagnostic systems, supported by industry leaders such as Olympus, Nikon, and Fujifilm, who are introducing next-gen WSI scanners and integrated AI software. Japan’s aging population and rising incidence of chronic diseases are increasing the need for efficient, high-throughput pathology workflows.

Government investment in telemedicine and digital diagnostics has prompted healthcare institutions to adopt remote slide reading capabilities and precision diagnostics. Wider adoption in drug discovery and clinical trials is also being supported by Japan’s robust biotechnology ecosystem. With growing application in research, diagnostics, and AI-enabled medical imaging, digital pathology is playing a key role in Japan’s precision medicine evolution.

The South Korea digital pathology market is projected to grow at a CAGR of 12.2% between 2025 and 2035. Expansion is being propelled by national investments in healthcare IT, AI-integrated imaging, and the rapid adoption of telemedicine services. Leading tech firms such as LG and Samsung are actively developing medical imaging systems and diagnostic platforms, facilitating real-time AI interpretation of pathology slides.

Hospitals are transitioning from traditional labs to digital diagnostic workflows, improving speed and reducing human error. Government-backed digital health initiatives are allocating funding for cloud-based WSI infrastructure and cancer detection tools, accelerating public and private sector collaboration. With increased focus on cross-disciplinary research and export-ready medical technologies, South Korea is quickly emerging as a key player in the global digital pathology ecosystem.

The digital pathology market displays moderate consolidation, with Tier 1 players holding substantial global presence across hospital diagnostics, research labs, and AI-driven pathology solutions. Market entry is limited by the need for FDA clearance, CE-IVD marking, HIPAA-compliant cloud infrastructure, and the high capital costs associated with whole slide imaging (WSI) scanners, enterprise software, and data integration systems.

Tier 1 players such as Philips Healthcare, Leica Biosystems (Danaher Corporation), and Roche Diagnostics lead through integrated offerings that combine high-resolution WSI scanners, AI-powered image interpretation, and cloud-based pathology platforms. According to Future Market Insights, these firms are driving adoption through AI-augmented diagnosis, remote consultations, and digital archiving aligned with evolving hospital IT ecosystems.

Tier 2 players, including Hamamatsu Photonics, 3DHISTECH, and Visiopharm, provide mid-market and specialty solutions focused on academic research, oncology diagnostics, and AI-driven analytics. These companies emphasize modular deployments, software-as-a-service (SaaS) models, and high-volume slide digitization tailored to regional markets.

Tier 3 firms, such as OptraSCAN, Proscia, and PathAI, are emerging as innovators in cloud-native platforms, low-cost slide scanners, and AI training datasets for rare pathology subtypes. These firms are often involved in pilot programs or precision medicine partnerships with life sciences companies and hospital chains.

Strategic imperatives across all tiers include algorithm validation, regulatory scaling, and AI-human collaboration models for pathology workflows. Future Market Insights notes an increase in multi-vendor system integrations, partnerships with cloud providers like AWS and Microsoft Azure, and incorporation of clinical decision support tools (CDSTs) to elevate platform usability in clinical settings.

Recent Digital Pathology Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.1 billion |

| Projected Market Size (2035) | USD 31.3 billion |

| CAGR (2025 to 2035) | 13.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Segments Analyzed (Segment 1) | By Product Type: Digital Pathology Equipment, Digital Pathology Software, Digital Pathology Information Systems, Digital Pathology Services |

| Segments Analyzed (Segment 2) | By Application: Clinical Pathology, Molecular Diagnostics, Basic & Applied Research, Drug Development, Others |

| Segments Analyzed (Segment 3) | By End User: Hospitals, Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Forensic Laboratories, Research Institutes, Contract Research Organizations (CROs), Clinics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Companies Profiled | Danaher Corporation, F. Hoffmann-La Roche AG, Huron Technologies International Inc., Koninklijke Philips N.V., Olympus Corporation, Hamamatsu Photonics K.K., Carl Zeiss AG, Nikon Corporation, 3DHISTECH Ltd., Hologic Inc. |

| Additional Attributes | Market share by equipment and application, AI integration and workflow automation trends, cloud-based WSI platforms, region-wise technology adoption, pricing models, and vendor benchmarking |

USD 9.1 Billion, the overall market size for Digital Pathology Market in 2025.

Digital Pathology Market Revenue will reach USD 31.3 Billion by 2035.

Increasing adoption AI-driven diagnostics, growing prevalence of chronic diseases, advancements in telepathology and the need for efficient workflow solutions in pathology labs will create demand for the digital pathology market and push the transition to digital imaging and analysis.

USA, UK, Europe Union, Japan and South Korea are the Leading 5 countries which drives the development of Digital Pathology Market.

Whole slide scanners and cloud-based digital pathology software drive market to dominate substantial portion during the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Veterinary Digital Pathology Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA