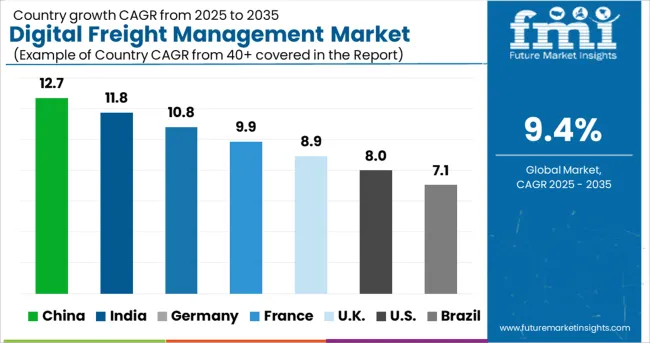

The Digital Freight Management Market is estimated to be valued at USD 18.4 billion in 2025 and is projected to reach USD 45.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

The digital freight management market is experiencing strong momentum due to increased pressure on logistics operators to deliver real-time tracking, cost optimization, and automation across freight networks. The need for enhanced route planning, carrier collaboration, and freight auditing has elevated the adoption of digital solutions that unify transportation data into actionable insights. Regulatory initiatives focused on decarbonization, customs compliance, and electronic documentation have further accelerated investment in advanced freight technologies.

The widespread use of IoT sensors, AI-powered decision-making, and cloud-based platforms is transforming traditional freight management into agile, transparent systems. As global trade complexity rises and supply chains become more digitized, market participants are focusing on modular platforms that allow scalability, interoperability, and integration with legacy infrastructure.

The future outlook remains optimistic, particularly as logistics providers prioritize end-to-end visibility, predictive analytics, and seamless system integration to strengthen performance across multimodal networks.

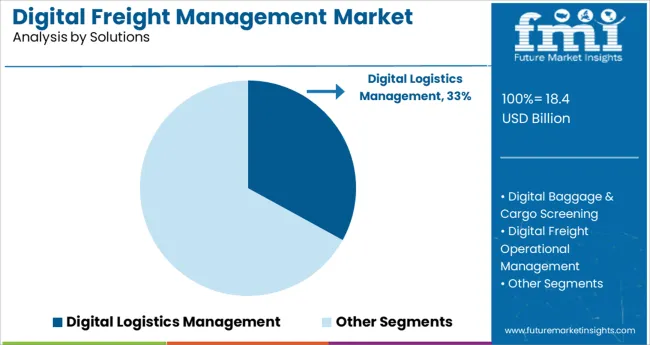

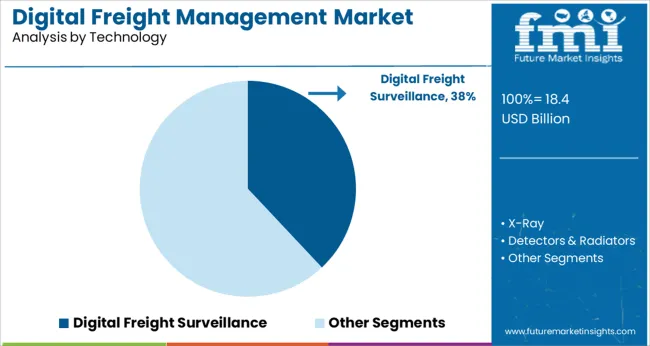

The market is segmented by Solutions, Technology, and Services and region. By Solutions, the market is divided into Digital Logistics Management, Digital Baggage & Cargo Screening, Digital Freight Operational Management, and Digital Freight Security Monitoring. In terms of Technology, the market is classified into Digital Freight Surveillance, X-Ray, and Detectors & Radiators.

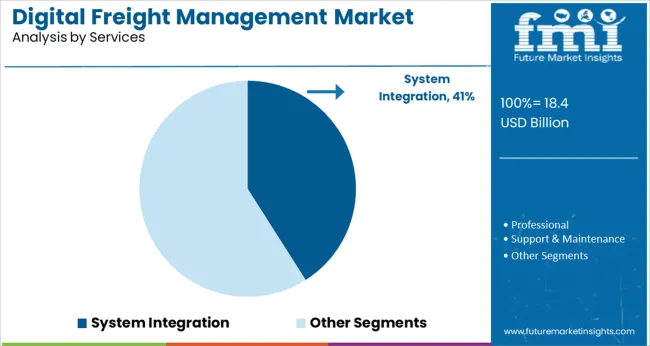

Based on Services, the market is segmented into System Integration, Professional, and Support & Maintenance. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Digital logistics management solutions are expected to account for 33.0% of the total revenue in the digital freight management market by 2025, making it a key growth-driving segment. This dominance is being driven by their ability to centralize freight scheduling, dispatch, carrier communication, and document management into a single automated platform.

These solutions enhance efficiency by reducing manual tasks, minimizing freight errors, and providing real-time visibility across shipment lifecycles. The integration of AI and machine learning further supports dynamic route optimization and demand forecasting, enabling logistics providers to adapt rapidly to changing market conditions.

Additionally, the interoperability of digital logistics platforms with warehouse and inventory systems supports a more synchronized supply chain ecosystem. As companies seek to reduce overhead costs and improve freight transparency, digital logistics management has emerged as a strategic investment area across both enterprise and mid-sized fleets.

Digital freight surveillance technologies are projected to contribute 38.0% of the market revenue by 2025, positioning them as the leading technology segment. This segment’s growth is being supported by increased focus on cargo security, regulatory compliance, and insurance liability reduction. Technologies such as GPS tracking, environmental monitoring sensors, and tamper detection systems have been widely adopted to ensure the integrity and traceability of freight in transit.

Enhanced capabilities in AI-driven video analytics and automated alert systems are providing carriers and shippers with real-time insights into asset location, condition, and handling. The rise in high-value and temperature-sensitive shipments has intensified the need for continuous freight monitoring, especially in sectors such as pharmaceuticals, food, and electronics.

As digital surveillance becomes integral to operational risk management and service-level assurance, its integration into broader freight management systems is expected to further accelerate.

System integration services are anticipated to hold 41.0% of the total market revenue in the digital freight management space by 2025, making it the most prominent service category. The segment’s leadership is being driven by the complexity of integrating freight solutions with enterprise systems such as ERP, TMS, WMS, and customer portals. Logistics providers and shippers increasingly require customized, interoperable platforms that align with legacy processes while enabling digital transformation.

System integrators play a crucial role in ensuring seamless data flow, security compliance, and user interface standardization across devices and software ecosystems. As freight platforms evolve to support predictive analytics, blockchain-based documentation, and real-time collaboration tools, specialized integration services are being sought to accelerate deployment and maximize ROI.

Additionally, the increasing use of API-based architecture and modular freight applications has made system integration central to long-term digital strategy and scalability for freight operators globally.

The growth of free trade policy in different countries is surging the business of imports and exports across the globe, which is likely to secure the adoption of digital freight management. Moreover, delivery capabilities can be improved through the deployment of this software by several transport enterprises.

Digital freight management offers a lesser time frame, flexibility, and accuracy in delivery services which aids in optimizing the efficiency of commercial freight operations. In addition, this software can be operated by leveraging technologies which becomes an asset for proficient operations.

The introduction of various enterprise management suites (ERP) and big data analysis reduces human exertion to handle numerous complex operations. Improved cash flow and transportation & logistics are increasing the usage of blockchain technology, likely bolstering the demand for digital freight management.

There has been increasing difficulty in the on-time delivery of products and raw materials owing to the expansion of the e-commerce sector, which is likely to surge the fleet owners to administer an efficient freight management system. Additionally, the e-commerce sector is exploring ways to reduce operational costs and delivery times by creating new business solutions and models by automating material handling systems, digitalizing logistics operations, and distribution and warehouse management systems.

Trained and expensive human resource is required to operate such sophisticated equipment and software. Hence, this is likely to increase the overall cost for end users. The lack of such operational effectiveness may be a significant challenge for the digital freight management market share.

On the contrary, several innovations in the field of data analytics, AI, and ERP are anticipated to assist industries in operating across borders. Therefore, by creating novel technologies, key players are focusing on research and development activities to improve the IT infrastructure.

Trucks and last-mile robots unlock new levels of quality, safety, and efficiency through the deployment of self-driving vehicles, which ultimately aims to transform freight management solutions. Furthermore, the enhancement of management systems combined with the upgradation of tracking, monitoring, and integrated systems are anticipated to promote several growth opportunities got the digital freight management market share.

The USA is conventionally the global leader in international trade, which makes North America the largest digital freight management market, with a remarkable revenue of 31.8%.

The presence of large IT companies, as well as freight management services and solutions in this region, are attributed to the global market growth. Digitalization and other technological developments, along with the growth of the e-commerce sector, are further estimated to contribute to the digital freight management market growth.

Europe is the second leading digital freight management market, with a profit of 25.3%. This is attributed to the presence of several IT companies, increased technological advancements, and the high adoption of freight management system tools.

Start-up companies in the digital freight management market are creating unique strategies such as tracking of freight shipments, goods consolidation, AI-enabled freight forwarding services, etc., to cater to the transport, FMCG, construction, etc. sectors.

Zencargo - It is a provider of AI-enabled freight forwarding services. Its platform enables instant quotes, booking, and tracking of freight shipments, warehousing and fulfillment, analytics, multi-modal freight forwarding, and supply chain optimization. It caters to FMCG, fashion, construction, and packaging industries. Its clients include Ribble and Catapult.

Forto - It is a provider of tech-enabled freight forwarding services. Its platform enables multi-modal cargo transport and freight forwarding. It includes features like fulfillment and warehousing through its logistics partners, contract management and negotiation, online shipment booking and tracking, real-time quotations, documentation, customs clearance, and goods consolidation. Its clients include Miweba, Zero, and Viessmann.

Convelio - It is a tech-enabled freight forwarder focused on logistics services of fine art, antiques, design pieces, and other bulky/fragile/valuable/sensitive items. Users can provide relevant load & shipping details to book door-to-door shipping services (including pick-up, last-mile delivery, packing, customs clearance, insurance, etc.). The platform also offers additional features for document management, real-time tracking, claims management, and more.

Freightwalla - It is a provider of tech-enabled freight forwarding services. The company offers cargo tracking, booking & searching services, automated documentation, reporting, etc. It also enables businesses to digitalize their workflows.

Nowports - It is an AI and tech-enabled freight forwarding service provider. It is a digital platform that allows users to book their multi-modal freight forwarding services. Its features include live shipment tracking, shipment history reports, transparent rates prior to shipping, communication between clients and suppliers, optimized routing, and visibility into cargo handling. It caters to the automotive, cleaning, furniture, refrigeration, and dairy products industries. Its clients include Grin Scooters.

Cargo.one - It is an online marketplace for air freight forwarding services. The platform enables users to search, compare and book air freight services from multiple carriers (such as Dachser, Lufthansa Cargo, JAS, and Leisure Cargo, among others) after providing relevant details. Features include real-time pricing, real-time tracking of cargo/shipments, and more.

Owing to the presence of a large number of players in the digital freight management market share, the market itself is fragmented and competitive. The increasing penetration and growing reliance on technology for negotiating rates, contacting carriers, scheduling, and controlling fleet operations are further leading to global market growth.

The latest developments in the digital freight management market are:

Start-up companies in the digital freight management market are creating unique strategies such as tracking of freight shipments, goods consolidation, AI-enabled freight forwarding services, etc., to cater to the transport, FMCG, construction, etc. sectors.

Zencargo - It is a provider of AI-enabled freight forwarding services. Its platform enables instant quotes, booking, and tracking of freight shipments, warehousing and fulfillment, analytics, multi-modal freight forwarding, and supply chain optimization. It caters to FMCG, fashion, construction, and packaging industries. Its clients include Ribble and Catapult.

Forto - It is a provider of tech-enabled freight forwarding services. Its platform enables multi-modal cargo transport and freight forwarding. It includes features like fulfillment and warehousing through its logistics partners, contract management and negotiation, online shipment booking and tracking, real-time quotations, documentation, customs clearance, and goods consolidation. Its clients include Miweba, Zero, and Viessmann.

Convelio - It is a tech-enabled freight forwarder focused on logistics services of fine art, antiques, design pieces, and other bulky/fragile/valuable/sensitive items. Users can provide relevant load & shipping details to book door-to-door shipping services (including pick-up, last-mile delivery, packing, customs clearance, insurance, etc.). The platform also offers additional features for document management, real-time tracking, claims management, and more.

Freightwalla - It is a provider of tech-enabled freight forwarding services. The company offers cargo tracking, booking & searching services, automated documentation, reporting, etc. It also enables businesses to digitalize their workflows.

Nowports - It is an AI and tech-enabled freight forwarding service provider. It is a digital platform that allows users to book their multi-modal freight forwarding services. Its features include live shipment tracking, shipment history reports, transparent rates prior to shipping, communication between clients and suppliers, optimized routing, and visibility into cargo handling. It caters to the automotive, cleaning, furniture, refrigeration, and dairy products industries. Its clients include Grin Scooters.

Cargo.one - It is an online marketplace for air freight forwarding services. The platform enables users to search, compare and book air freight services from multiple carriers (such as Dachser, Lufthansa Cargo, JAS, and Leisure Cargo, among others) after providing relevant details. Features include real-time pricing, real-time tracking of cargo/shipments, and more.

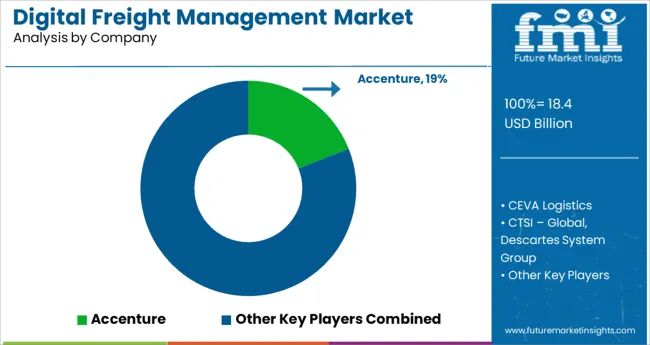

Accenture plc - It is an Irish-American professional services company based in Dublin, specializing in information technology services and consulting. A Fortune Global 500 company, it reported revenues of 16.9 billion in 2024.

CEVA Logistics - It is a global logistics and supply chain company in both freight management and contract logistics with USD 12 billion in revenues. Its head office is in Marseille, France, and it was founded in 2007 as a merger of TNT Logistics and EGL Eagle Global Logistics.

CTSI-Global - It is a Memphis-based firm that provides freight-invoice processing and related supply chain management technology and consulting services. CEO J. Kenneth Hazen acquired the company in 1982.

The Descartes System Group Inc. - It is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses.

DSV A/S - It is a Danish transport and logistics company offering transport services globally by road, air, sea, and train.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.4% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Solutions, Technology, Services, and Region. |

| Regional scope | North America, Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Accenture plc, CEVA Logistics, CTSI-Global, The Descartes System Group Inc., DSV A/S, High Jump Software, JDA Software Group Inc., Manhattan Associates, United Parcel Service of North America Inc., C.H. Robinson, Cargocentric Inc., J.B. Hunt Transport Inc., Kintetsu World Express, Kuehne + Nagel International AG, Loadsmart Inc., Panalpina World Transport (Holding) Ltd., etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts', working days) with purchase. Addition or alteration to country, regional &, segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global digital freight management market is estimated to be valued at USD 18.4 billion in 2025.

It is projected to reach USD 45.3 billion by 2035.

The market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types are digital logistics management, digital baggage & cargo screening, digital freight operational management and digital freight security monitoring.

digital freight surveillance segment is expected to dominate with a 38.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freight Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Experience Management Software Market

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA