The Digital X-ray Market is estimated to be valued at USD 15.7 billion in 2025 and is projected to reach USD 36.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The digital X-ray market is advancing rapidly, driven by technological innovations, increasing diagnostic accuracy demands, and the global shift toward digital healthcare infrastructure. Rising healthcare investments, coupled with an expanding patient base requiring advanced imaging solutions, have accelerated adoption across hospitals and diagnostic centers.

Digital X-ray systems offer faster image acquisition, reduced radiation exposure, and enhanced storage capabilities, improving overall workflow efficiency. The market also benefits from the integration of artificial intelligence for image enhancement and disease detection, further strengthening diagnostic precision.

Ongoing transitions from analog to digital imaging, supported by favorable reimbursement policies and government initiatives, continue to propel market expansion. With cost reductions and enhanced mobility in portable systems, the digital X-ray market is expected to maintain robust growth globally.

| Metric | Value |

|---|---|

| Digital X-ray Market Estimated Value in (2025 E) | USD 15.7 billion |

| Digital X-ray Market Forecast Value in (2035 F) | USD 36.0 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

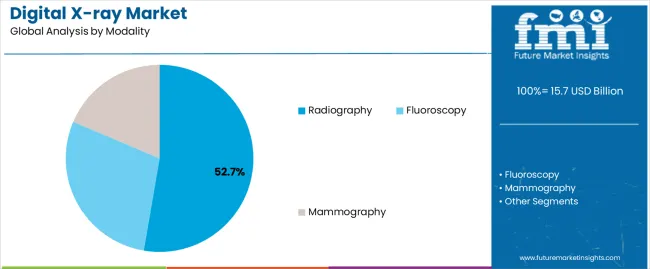

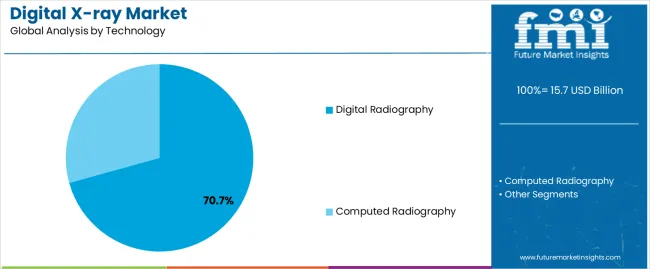

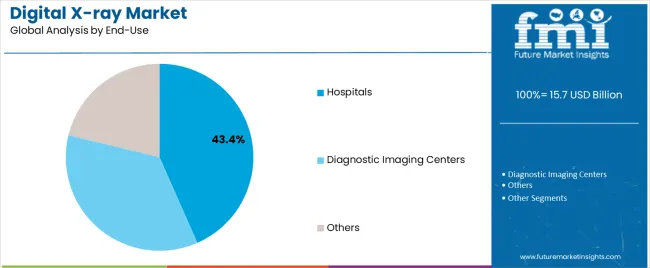

The market is segmented by Modality, Technology, and End-Use and region. By Modality, the market is divided into Radiography, Fluoroscopy, and Mammography. In terms of Technology, the market is classified into Digital Radiography and Computed Radiography. Based on End-Use, the market is segmented into Hospitals, Diagnostic Imaging Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The radiography segment leads the modality category with approximately 52.70% share, attributed to its widespread application in general diagnostic imaging and preventive healthcare. Radiography provides efficient imaging for a broad range of conditions, enabling rapid screening and diagnosis in both outpatient and emergency settings.

The segment’s prominence is supported by technological advancements that enhance image resolution and reduce scan times. Integration with digital storage and transmission systems has improved accessibility and data management in healthcare facilities.

With increased focus on preventive healthcare and growing utilization in orthopedics and chest imaging, radiography is expected to retain its dominant role within the digital X-ray market.

The digital radiography segment accounts for approximately 70.70% share in the technology category, representing the core technological transition driving market modernization. This segment’s expansion is fueled by reduced image processing time, enhanced diagnostic accuracy, and the elimination of chemical film processing.

Hospitals and imaging centers are rapidly adopting digital radiography due to its lower long-term operational costs and superior workflow integration. The technology also supports real-time image sharing, facilitating remote diagnosis and tele-radiology applications.

Continuous advancements in detector materials and wireless system design have further optimized image quality and portability. As healthcare providers prioritize efficiency and digital transformation, digital radiography is projected to remain the leading technology throughout the forecast period.

The hospitals segment holds approximately 43.40% share in the end-use category, underscoring its dominant role in digital X-ray adoption. Hospitals possess the infrastructure, patient volume, and capital capacity necessary to implement large-scale imaging systems.

The segment benefits from the increasing prevalence of chronic diseases requiring regular diagnostic imaging and the emphasis on accurate, real-time diagnostics. Integration of digital X-ray systems within hospital information systems has improved workflow efficiency and patient management.

Ongoing expansion of healthcare facilities, particularly in emerging markets, continues to drive equipment procurement. With sustained government investments in healthcare modernization and infrastructure, the hospitals segment is expected to retain its leading share in the global digital X-ray market.

The digital X-ray market is anticipated to surpass a global valuation of USD 360 billion by 2035, expanding at a growth rate of 9.10%. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

| Attributes | Details |

|---|---|

| Top Modality | Radiography |

| CAGR (2025 to 2035) | 8.90% |

Depending on the modality, the digital X-ray market is bifurcated into radiography, fluoroscopy, and mammography. The radiography segment is anticipated to grow at a remarkable rate of 8.90% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top Technology Type | Digital Radiography |

| CAGR (2025 to 2035) | 8.60% |

The digital X-ray market is categorized by technology type into digital and computed radiography. The former dominates the market and is anticipated to grow at a remarkable rate of 8.60% through 2035.

The section provides an analysis of the digital X-ray market by country, including Japan, China, the United States, the United Kingdom, and South Korea. The table presents the CAGRs for each country, indicating the expected growth of the market in that country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.90% |

| United Kingdom | 10.80% |

| Japan | 10.40% |

| China | 9.90% |

| United States | 8.70% |

South Korea is one of the leading countries in this market. The South Korean digital X-ray market is anticipated to retain its dominance by progressing at an annual growth rate of 12.90% until 2035.

Japan is another Asian country that leads the digital X-ray market. The Japanese market is anticipated to retain its dominance by progressing at a CAGR of 10.40% till 2035.

The United Kingdom dominates the digital X-ray market in the European region. The United Kingdom's digital X-ray market is anticipated to exhibit an annual growth rate of 10.80% through 2035.

China, too, is one of the leading countries in the global digital X-ray market, which is anticipated to register a CAGR of 9.90% through 2035.

The United States leads the digital X-ray market in the North American region. Over the next ten years, the demand for digital X-rays is projected to rise at an 8.70% CAGR.

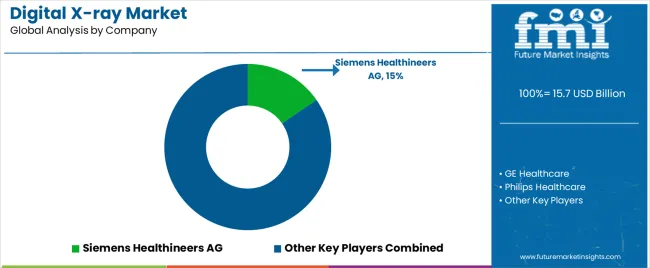

The market for digital X-rays is filled with numerous companies, such as Siemens, Healthineers AG, GE Healthcare, Philips Healthcare, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, etc.

These companies have a strong foothold in the international healthcare sector as hospitals, clinics, ambulatory surgical centers, etc., depend on them for their radiography needs.

Key players in the market are also investing in developing affordable devices so that smaller clinics with limited financial resources can also implement them.

Recent Developments

The global digital X-ray market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the digital X-ray market is projected to reach USD 36.0 billion by 2035.

The digital X-ray market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in digital X-ray market are radiography, fluoroscopy and mammography.

In terms of technology, digital radiography segment to command 70.7% share in the digital X-ray market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA