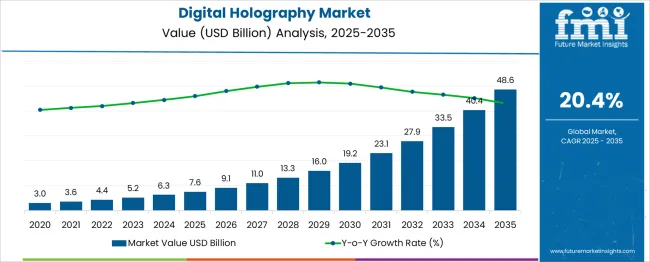

The Digital Holography Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 48.6 billion by 2035, registering a compound annual growth rate (CAGR) of 20.4% over the forecast period. This significant growth is supported by a robust CAGR of 20.4%, driven by the increasing applications of digital holography in fields such as medical imaging, industrial inspection, and 3D visualization.

In the first five-year phase (2025 to 2030), the market is expected to expand from USD 7.6 billion to USD 18.7 billion, adding USD 11.1 billion, which accounts for 27.1% of total incremental growth. The second phase (2030 to 2035) contributes USD 29.9 billion, representing 72.9% of incremental growth, reflecting strong momentum as digital holography technologies mature and expand into new applications like augmented reality, telecommunications, and defense.

Annual increments will increase from USD 2.3 billion in early years to USD 7.3 billion by 2035, indicating the accelerating adoption of holographic imaging systems and 3D data capture. Companies focusing on higher precision, real-time processing, and applications in diagnostics and industrial monitoring will capture the largest share of this USD 41 billion growth opportunity.

| Metric | Value |

|---|---|

| Digital Holography Market Estimated Value in (2025 E) | USD 7.6 billion |

| Digital Holography Market Forecast Value in (2035 F) | USD 48.6 billion |

| Forecast CAGR (2025 to 2035) | 20.4% |

The Digital Holography market is undergoing significant advancement, influenced by the integration of high-speed computing, advanced sensors, and precision optics that enable real-time three-dimensional visualization. Increased adoption across biomedical imaging, industrial inspection, and defense applications is contributing to robust market expansion.

The growing need for non-invasive, label-free imaging solutions has positioned digital holography as a preferred choice in life sciences, while industrial sectors are increasingly utilizing it for surface inspection and quality control. Continuous innovation in resolution enhancement and recording techniques is opening new avenues for precision diagnostics and automated processes.

As data acquisition and processing speed improve, digital holography systems are being incorporated into broader digital twin ecosystems and next-generation imaging platforms. Future growth is expected to be driven by miniaturization of optical components, AI-based reconstruction algorithms, and the rising demand for compact, high-resolution holographic systems in both research and commercial domains..

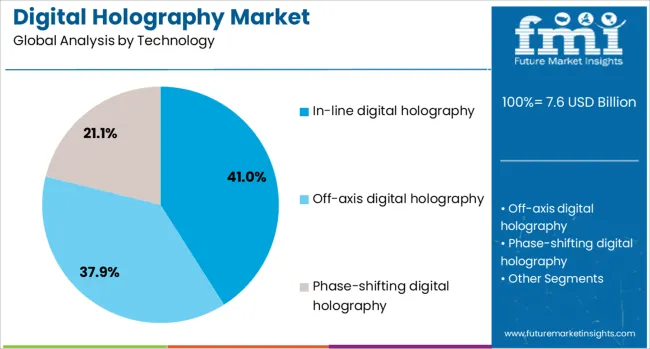

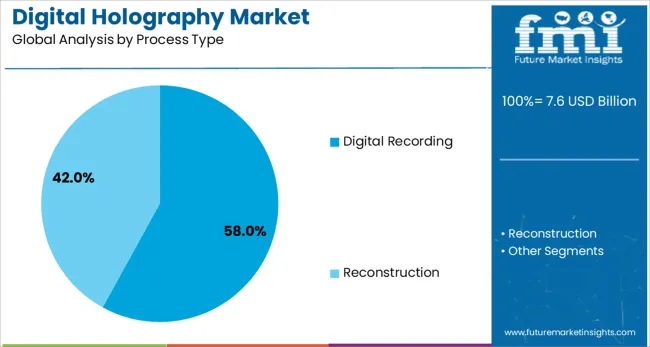

The digital holography market is segmented by technology, process type, resolution, component, application, end-use industry, and geographic regions. The technology of the digital holography market is divided into In-line digital holography, Off-axis digital holography, and Phase-shifting digital holography. The digital holography market is classified into Digital Recording Reconstruction.

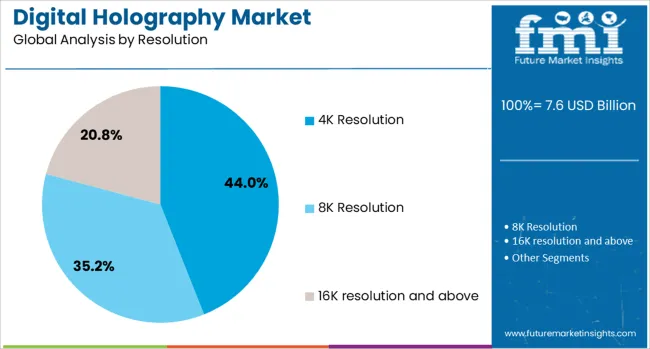

Based on the resolution, the digital holography market is segmented into 4K Resolution, 8K Resolution, 16 K Resolution, and above. The digital holography market is segmented into Hardware, Software, and Services. The digital holography market is segmented into Digital holography microscopy, Digital holographic displays, and Holographic telepresence.

The end-use industry of the digital holography market is segmented into Healthcare and life sciences, Aerospace & defence, Automotive, Commercial, Consumer electronics, Research and education, and others. Regionally, the digital holography industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in-line digital holography subsegment is projected to account for 41% of the Digital Holography market revenue share in 2025, emerging as the leading technology. Its dominance has been attributed to the simplified optical setup that allows direct recording of interference patterns without the need for beam-splitting or complex reference arms.

This configuration has enabled faster image acquisition and reduced system complexity, making it particularly suited for real-time applications. The compact and cost-efficient nature of in-line systems has been favored by industries requiring portable and scalable holographic solutions.

Additionally, the alignment stability and reduced calibration needs associated with this method have led to broader adoption in applications where rapid deployment and operational reliability are critical. As sectors such as medical diagnostics and microelectronics inspection prioritize efficiency and precision, the advantages offered by in-line digital holography continue to reinforce its leadership in the technology segment..

The digital recording subsegment is expected to capture 58% of the Digital Holography market revenue share in 2025, establishing it as the dominant process type. This growth has been driven by the increased demand for flexible, software-controlled imaging processes that enable easy storage, transmission, and post-processing of holographic data.

Unlike analog methods, digital recording facilitates rapid manipulation of captured holograms using advanced computational algorithms, resulting in higher accuracy and reproducibility. Its compatibility with modern sensors and integration with AI-powered reconstruction tools has expanded its application scope across academic, industrial, and defense sectors.

Moreover, the ability to enhance resolution and suppress noise through digital filters has been crucial in improving image quality. As holography shifts toward data-rich imaging for real-time analysis and remote accessibility, the digital recording process has gained preference due to its adaptability, processing power, and seamless integration with emerging imaging architectures..

The 4K resolution subsegment is projected to lead the Digital Holography market by holding 44% of the revenue share in 2025, reflecting the growing emphasis on ultra-high-definition imaging standards. The shift toward 4K has been driven by demand for highly detailed and precise visualizations in applications such as semiconductor inspection, biological tissue analysis, and precision manufacturing.

Superior pixel density and clarity offered by 4K systems have enabled researchers and professionals to capture intricate surface features and microstructural variations with greater accuracy. The increasing availability of 4K-compatible sensors and displays has also made this resolution more accessible across industrial and research applications.

In addition, the integration of 4K imaging with digital processing techniques allows for improved depth resolution and spatial detail, enhancing analytical capabilities. As high-fidelity visualization becomes a key requirement in quality control and diagnostics, 4K resolution continues to set the benchmark for performance in the digital holography market..

The digital holography market is experiencing growth, driven by increased demand for high-quality imaging solutions in various industries. Major growth drivers include advancements in medical imaging and the increasing use of holography in security applications. Opportunities exist in the integration of holography with augmented reality (AR) and virtual reality (VR) technologies. Emerging trends focus on miniaturization and real-time holographic displays. However, market restraints include high equipment costs and the complexity of processing large datasets, which hinder widespread adoption.

The major growth driver in the digital holography market is the rising demand for high-quality imaging in industries such as medical diagnostics and security. In 2024, the use of digital holography in medical imaging, particularly for non-invasive procedures, increased due to its ability to provide high-resolution images with minimal distortion. These advancements are expected to fuel growth in healthcare applications and expand the market’s reach into other industries requiring detailed imaging solutions.

Opportunities in the digital holography market are emerging through the integration of holography with augmented reality (AR) and virtual reality (VR). By 2025, there was a significant rise in the use of holography in AR and VR applications for gaming, education, and remote collaboration. The ability to generate realistic, 3D holographic images for immersive experiences has opened new avenues for market growth. This integration is expected to drive future demand, particularly in entertainment and corporate sectors.

Emerging trends in the digital holography market include miniaturization and the development of real-time holographic displays. In 2024, manufacturers focused on reducing the size of holographic devices while maintaining or improving image quality. This shift has allowed for broader application in consumer electronics, such as smartphones and wearables. Additionally, real-time holographic displays are gaining attention in sectors like advertising and live events, as they offer more interactive and engaging visual experiences.

The major market restraints in the digital holography market include the high costs of holography equipment and the complexity of processing large datasets. In 2025, many potential users were discouraged by the high initial investment required for holographic systems. Additionally, the complex nature of processing the vast amounts of data required for high-quality holograms posed technical challenges. These factors could limit widespread adoption, especially in smaller businesses and developing markets.

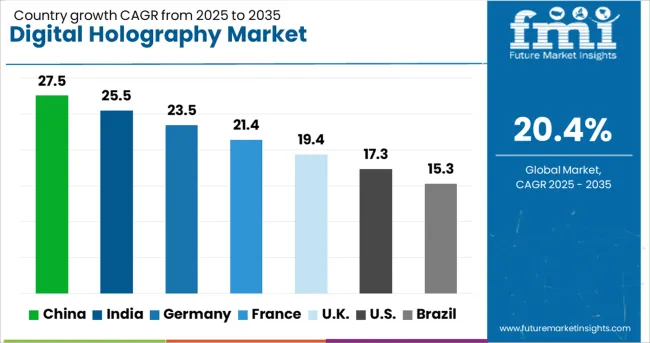

| Country | CAGR |

|---|---|

| China | 27.5% |

| India | 25.5% |

| Germany | 23.5% |

| France | 21.4% |

| UK | 19.4% |

| USA | 17.3% |

| Brazil | 15.3% |

The global robot sensor market is projected to grow at 5% CAGR from 2025 to 2035. China leads with 6.8% CAGR, driven by the country's expanding robotics industry, increasing industrial automation, and growing demand for advanced sensor technologies. India follows at 6.3%, fueled by the rising demand for automation solutions across manufacturing, logistics, and healthcare sectors. France records 5.3% CAGR, supported by a strong focus on industrial robotics, precision sensors, and smart automation technologies. The United Kingdom grows at 4.8%, while the United States posts 4.3%, reflecting steady demand in mature markets with a focus on improving operational efficiency, safety, and productivity in robotic applications. Asia-Pacific leads the market growth, while Europe and North America focus on innovation and integration with Industry 4.0 technologies.

The digital holography market in China is growing rapidly, with a projected CAGR of 27.5%. The country’s technological advancements, particularly in optics and imaging systems, are driving the demand for digital holography solutions. China’s expanding healthcare, electronics, and manufacturing industries are key factors contributing to the adoption of digital holography for applications such as medical imaging, quality control, and material inspection. Government investments in high-tech research and development and a growing focus on artificial intelligence and advanced manufacturing are further accelerating the growth of digital holography technologies.

The digital holography market in India is projected to grow at a CAGR of 25.5%. The country’s expanding healthcare sector, coupled with increasing adoption of digital holography in education and research, is propelling market growth. The demand for digital holography solutions in industrial applications such as quality control, material testing, and precision measurements is also rising. India’s growing focus on technological innovations and increasing investments in R&D are further fueling the adoption of digital holography technologies, making it a key market in the Asia-Pacific region.

The digital holography market in Germany is projected to grow at a CAGR of 23.5%. As a leader in industrial manufacturing and research, Germany is witnessing increasing adoption of digital holography for applications in precision measurement, quality control, and material analysis. The country’s strong focus on automation, smart manufacturing, and advanced optical systems supports the growth of digital holography technologies. Furthermore, Germany’s advancements in healthcare, particularly in medical imaging and diagnostics, are contributing to the demand for digital holography solutions. Germany’s high investment in R&D and technological innovation continues to drive the market forward.

The digital holography market in the United Kingdom is projected to grow at a CAGR of 19.4%. The UK’s strong healthcare sector and ongoing advancements in imaging technology are major contributors to market growth. As demand for high-resolution medical imaging and diagnostic tools increases, the adoption of digital holography for medical applications is rising. Additionally, the growing emphasis on precision manufacturing and quality control in industrial applications, such as material testing and inspection, further fuels the demand for digital holography solutions. Despite slower growth compared to emerging markets, steady investments in innovation continue to support market expansion.

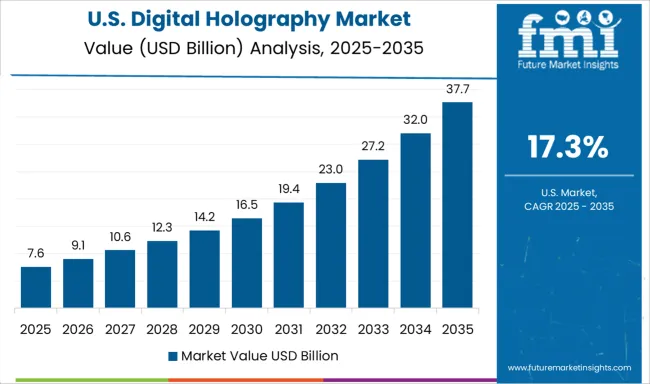

The digital holography market in the United States is expected to grow at a CAGR of 17.3%. The country’s strong focus on technological innovation, particularly in healthcare and industrial applications, drives the demand for digital holography solutions. The adoption of digital holography for medical imaging, material inspection, and quality control is increasing as industries look for more efficient and precise technologies. However, the USA market is more mature compared to emerging markets, with slower growth expected due to the saturation of existing technologies. Despite this, continued investments in R&D and advances in optical technologies are expected to sustain steady growth.

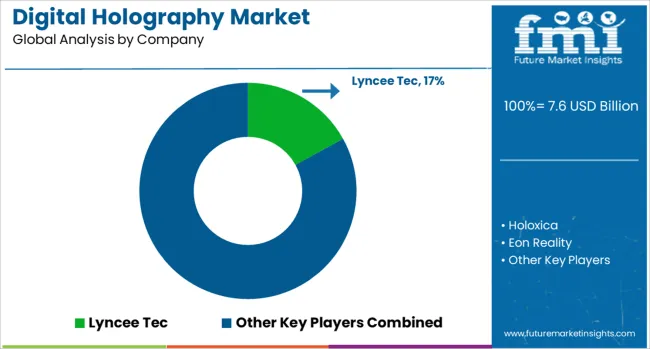

The digital holography market is dominated by Lyncee Tec, which leads with its cutting-edge holographic imaging solutions used across industries such as healthcare, defense, and research. Lyncee Tec’s dominance is reinforced by its advanced 3D visualization technologies, providing high-quality, precise holographic images for medical diagnostics, educational tools, and product development.

Key players such as Holoxica, Eon Reality, and RealView Imaging maintain significant market shares by offering innovative digital holography solutions that enhance imaging capabilities, including real-time 3D visualization and interactive holograms for medical and scientific applications.

These companies focus on advancing holographic displays and improving user interfaces for immersive, realistic experiences. Emerging players like Leia Inc. are expanding their presence by offering digital holography technology for consumer devices, including smartphones and tablets, providing 3D holographic experiences without the need for special glasses.

Their strategies include making holographic technologies more accessible and compatible with existing digital platforms. Market growth is driven by increasing demand for interactive 3D displays, advancements in augmented reality (AR) and virtual reality (VR) applications, and the need for high-quality imaging in fields such as healthcare, entertainment, and education. Ongoing innovations in light field displays, processing power, and image clarity are expected to continue shaping the digital holography market’s competitive dynamics.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 Billion |

| Technology | In-line digital holography, Off-axis digital holography, and Phase-shifting digital holography |

| Process Type | Digital Recording and Reconstruction |

| Resolution | 4K Resolution, 8K Resolution, and 16K resolution and above |

| Component | Hardware, Software, and Services |

| Application | Digital holography microscopy, Digital holographic displays, and Holographic telepresence |

| End-use Industry | Healthcare and life sciences, Aerospace & defence, Automotive, Commercial, Consumer electronics, Research and education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lyncee Tec, Holoxica, Eon Reality, RealView Imaging, and Leia Inc. |

| Additional Attributes | Dollar sales by application type and industry, demand dynamics across healthcare, defense, and entertainment sectors, regional trends in digital holography adoption, innovation in imaging technologies and 3D visualization, impact of regulatory standards on data security and quality, and emerging use cases in virtual reality and medical diagnostics. |

The global digital holography market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the digital holography market is projected to reach USD 48.6 billion by 2035.

The digital holography market is expected to grow at a 20.4% CAGR between 2025 and 2035.

The key product types in digital holography market are in-line digital holography, off-axis digital holography and phase-shifting digital holography.

In terms of process type, digital recording segment to command 58.0% share in the digital holography market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA