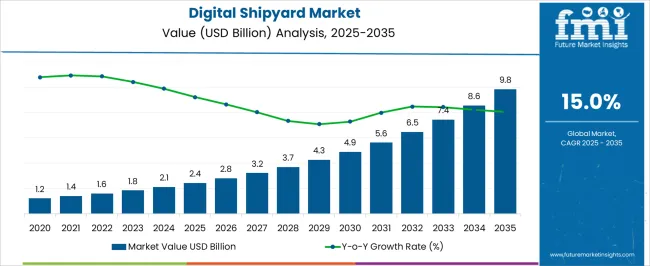

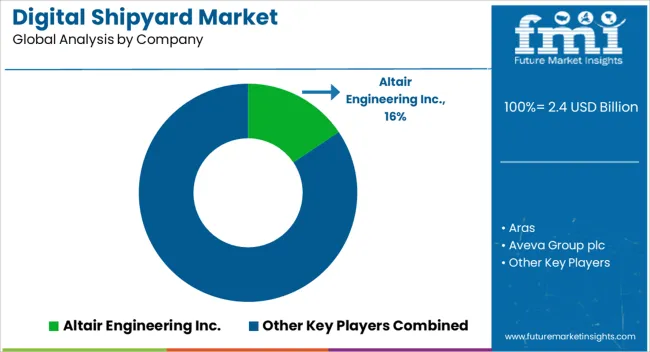

The digital shipyard market is poised for rapid growth, with an impressive compound annual growth rate (CAGR) of 15%, expected to expand from USD 2.4 billion in 2025 to USD 9.8 billion by 2035. The increasing need for automation and digital transformation within the maritime industry largely drives this market’s expansion. As shipbuilding processes become more complex and require higher precision, shipyards are increasingly adopting digital solutions to improve efficiency, reduce operational costs, and streamline their workflow. The growth of this market is a direct result of shipyards embracing new technologies to maintain competitiveness and meet growing demand for more advanced, cost-effective vessels.

From 2025 to 2030, the digital shipyard market is expected to experience significant year-over-year growth, with a strong increase in adoption across key segments like ship design, construction, and maintenance. The incorporation of digital tools such as simulation software, predictive maintenance technologies, and digital twin solutions will continue to drive this growth.

As shipyards strive to optimize production processes and foster collaboration across departments, the digital shipyard approach presents significant operational advantages. This shift is not only reshaping the way ships are built but also contributing to the broader maritime sector’s evolution, signaling a growing trend towards digitalization in the industry.

| Metric | Value |

|---|---|

| Digital Shipyard Market Estimated Value in (2025 E) | USD 2.4 billion |

| Digital Shipyard Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The digital shipyard market is estimated to hold a notable proportion within its parent markets, representing approximately 4-6% of the shipbuilding market, around 5-7% of the industrial automation market, close to 10-12% of the maritime industry market, about 6-8% of the digital transformation market, and roughly 3-5% of the IoT market. Collectively, the cumulative share across these parent segments is observed in the range of 28-38%, highlighting the growing role of digital technologies in transforming traditional shipyard operations. The market has been influenced by the rising need for advanced solutions that streamline shipbuilding processes, enhance operational efficiency, and improve data management.

Adoption is driven by the demand for digital tools that optimize design, construction, and maintenance processes, where real-time monitoring, predictive analytics, and automation play a critical role in reducing costs and improving project timelines. Market participants have focused on integrating digital solutions, including IoT-enabled systems, robotics, and AI, to enhance the performance and efficiency of shipyard operations. As a result, the digital shipyard market has captured a significant share of the industrial automation, digital transformation, and maritime industry markets, reinforcing its role in driving the modernization of shipyards and enhancing their competitiveness globally.

The digital shipyard market is experiencing accelerated growth, driven by the increasing adoption of advanced digitalization solutions to optimize shipbuilding processes, reduce production timelines, and enhance lifecycle management of naval and commercial vessels. Shipyards are integrating cutting-edge technologies to improve design accuracy, operational efficiency, and predictive maintenance capabilities. The rising demand for connected infrastructure, automation, and real-time monitoring in shipbuilding is further boosting the adoption of digital tools.

Governments and defense agencies are prioritizing modernization programs for naval fleets, while commercial operators are investing in smart shipyard capabilities to remain competitive. The use of advanced analytics, IoT-enabled systems, and AI-driven simulations is enabling improved decision-making and cost optimization.

Growing emphasis on sustainability and reduced operational emissions is also influencing design and manufacturing processes As global shipbuilding projects become more complex, digital shipyard platforms are emerging as essential tools for achieving efficiency, compliance, and quality standards, positioning the market for sustained expansion in both military and commercial segments over the next decade.

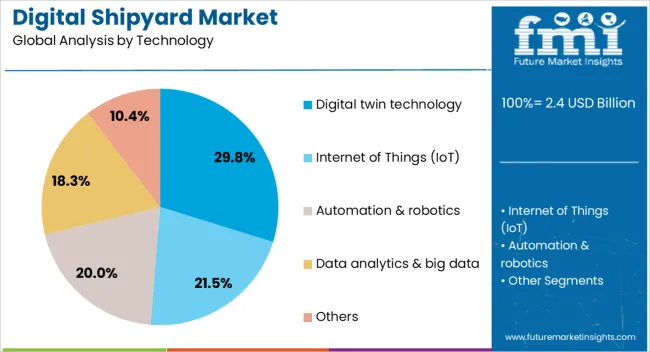

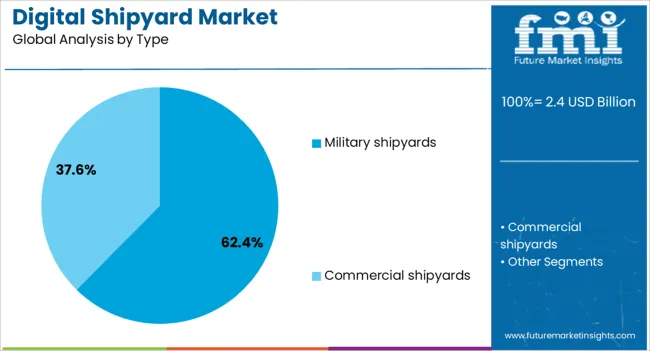

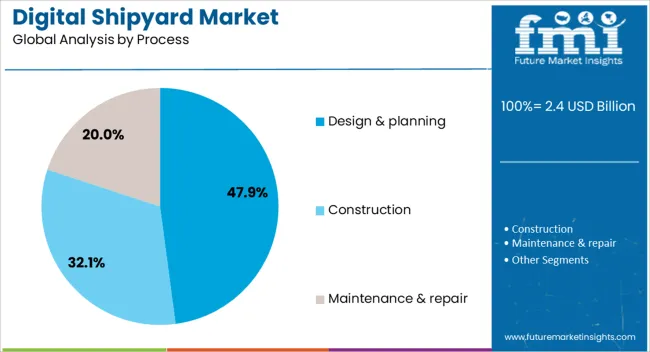

The digital shipyard market is segmented by technology, type, process, capacity, digitalization level, end user, and geographic regions. By technology, digital shipyard market is divided into Digital twin technology, Internet of Things (IoT), Automation & robotics, Data analytics & big data, and Others. In terms of type, digital shipyard market is classified into Military shipyards and Commercial shipyards. Based on process, digital shipyard market is segmented into Design & planning, Construction, and Maintenance & repair. By capacity, digital shipyard market is segmented into Large shipyards, Small shipyards, and Medium shipyards. By digitalization level, digital shipyard market is segmented into Fully digital shipyard and Semi-digital shipyard. By end user, digital shipyard market is segmented into Shipbuilders & shipyards, Ship Owners & operators, and Defense & military. Regionally, the digital shipyard industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The digital twin technology segment is projected to account for 29.8% of the digital shipyard market revenue share in 2025, making it the leading technology segment. Its dominance is being driven by the ability to create real-time virtual replicas of vessels and shipyard operations, enabling enhanced monitoring, predictive maintenance, and process optimization.

The technology facilitates the simulation of design changes and operational scenarios, reducing the need for costly physical prototypes and minimizing errors in production. In shipbuilding, where precision and reliability are critical, digital twins provide the capability to evaluate structural integrity, fuel efficiency, and system performance throughout the vessel’s lifecycle.

Growing adoption of digital twins in both new-build and retrofit projects is being fueled by the increasing demand for operational efficiency and reduced downtime Integration with IoT sensors, cloud platforms, and AI analytics is further enhancing the value proposition of this technology, solidifying its position as a core enabler of transformation in the shipbuilding industry.

The military shipyards segment is anticipated to hold 62.4% of the digital shipyard market revenue share in 2025, making it the leading type category. This leadership is being reinforced by the substantial investments from defense agencies in modernizing naval fleets and shipbuilding infrastructure. Military shipyards require advanced capabilities for designing, building, and maintaining highly complex vessels, including aircraft carriers, destroyers, and submarines, where precision, security, and performance are paramount.

The adoption of digital shipyard technologies in military contexts enables improved project scheduling, reduced maintenance downtime, and enhanced operational readiness of fleets. Governments are increasingly allocating budgets toward smart infrastructure upgrades that integrate real-time monitoring, automated workflows, and secure data management systems.

The segment is further supported by the strategic importance of maintaining a competitive edge in naval capabilities, which drives the continuous adoption of advanced design, simulation, and production tools This combination of technological necessity and strategic priority ensures the ongoing dominance of military shipyards in the market.

The design and planning process segment is expected to represent 47.9% of the digital shipyard market revenue share in 2025, securing its position as the leading process segment. This dominance is attributed to the critical role that advanced design and planning tools play in determining the efficiency, cost, and quality of shipbuilding projects. The integration of 3D modeling, simulation software, and collaborative design platforms allows for greater accuracy in structural layouts, system integration, and resource allocation.

Digitalization in this process stage enables shipbuilders to anticipate challenges, optimize material usage, and ensure compliance with safety and regulatory standards before construction begins. The ability to conduct detailed virtual testing and scenario analysis reduces risks associated with rework, delays, and cost overruns.

Growing complexity in vessel designs, coupled with heightened performance and environmental requirements, is driving shipyards to adopt digital design and planning solutions as a strategic priority This is ensuring the segment’s continued leadership and expanding its relevance in both military and commercial shipbuilding projects.

The digital shipyard market is experiencing rapid growth, driven by the increasing demand for digital solutions that enhance shipbuilding efficiency, reduce operational costs, and improve product quality. Advanced data integration technologies, cloud-based solutions, and remote monitoring systems are becoming central to the industry’s transformation. However, challenges remain in terms of high implementation costs, particularly for smaller or less financially equipped shipyards. As digital tools continue to reshape the landscape of shipbuilding, the market is expected to thrive, providing long-term benefits for operators willing to embrace these technologies.

The digital shipyard market has seen substantial growth driven by the growing demand for digitalization within the shipbuilding industry. As the need for higher efficiency, faster production times, and reduced operational costs rises, shipyards are turning to digital tools for design, maintenance, and manufacturing. The integration of digital platforms, including digital twins, predictive maintenance, and real-time monitoring systems, is transforming traditional shipbuilding practices. These technologies are being adopted to streamline operations, improve quality, and ensure timely delivery, thus boosting demand for digital shipyard solutions.

With the rise of data-driven operations, significant opportunities have emerged in integrating advanced data technologies like artificial intelligence (AI), machine learning (ML), and big data analytics into shipyards. These technologies are being used to optimize operations, from design to production and maintenance. The ability to collect and analyze massive volumes of data allows shipyards to make informed decisions, optimize resource allocation, reduce downtime, and improve safety. As a result, digital shipyard solutions are being increasingly adopted by companies looking to enhance their competitive edge.

Cloud-based solutions and remote monitoring technologies are emerging as dominant trends in the digital shipyard market. Shipyards are transitioning from traditional on-premise software solutions to cloud-based platforms that offer greater scalability, flexibility, and real-time access to operational data. This transition enables real-time collaboration, remote monitoring, and management of shipbuilding operations across multiple locations. As shipyards continue to embrace these trends, they are able to improve productivity, reduce costs, and enhance the overall performance of their operations by utilizing advanced cloud-based technologies.

Despite the promising growth of the digital shipyard market, one of the most significant challenges remains the high cost of implementing these advanced technologies. The integration of digital tools such as AI, IoT, and machine learning into traditional shipbuilding processes requires significant upfront investment in infrastructure and training. Smaller shipyards, particularly in emerging economies, face difficulties in overcoming these financial barriers. While the long-term benefits of digitalization are evident, the initial costs can be a deterrent for many companies, slowing down the adoption rate of these solutions.

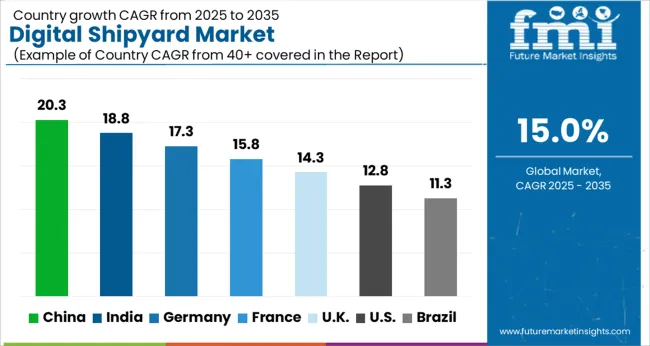

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The global digital shipyard market is projected to grow at a robust CAGR of 15% from 2025 to 2035. China leads with a growth rate of 20.3%, followed by India at 18.8%, and France at 15.8%. The United Kingdom records a growth rate of 14.3%, while the United States shows the slowest growth at 12.8%. Digital transformation in shipbuilding is driving this growth, with technologies such as AI, IoT, robotics, and automation being integrated into shipyard operations to enhance productivity, reduce costs, and improve vessel quality. The market is being propelled by the increasing demand for innovative vessels, sustainability requirements, and the need to streamline operations. The expanding shipbuilding industries in China and India are contributing significantly to the demand for digital shipyard solutions, while developed economies are focusing on upgrading existing facilities for higher efficiency and quality production. This report includes insights on 40+ countries; the top markets are shown here for reference.

The digital shipyard market in China is experiencing significant growth, with a CAGR of 20.3%. As the largest shipbuilding nation globally, China’s shipyards are increasingly adopting digital technologies to streamline operations and improve efficiency. The Chinese government has heavily invested in upgrading shipbuilding infrastructure, and the integration of digital technologies such as AI, robotics, and data analytics has become a key focus. China’s rapid industrialization and the growing demand for both commercial and military vessels are major drivers for the digital transformation of shipyards. Additionally, the push for sustainable maritime solutions and regulatory compliance is accelerating the adoption of digital shipyard technologies to meet environmental and operational standards.

The digital shipyard market in India is growing at a strong rate of 18.8%, driven by the country’s expanding maritime and shipbuilding industries. India’s shipyards are embracing digital solutions to improve operational efficiency and product quality. The adoption of advanced technologies such as AI, IoT, and data analytics is enabling Indian shipyards to optimize design, construction, and maintenance processes. The government’s support for upgrading naval infrastructure and building more modern vessels is further promoting the adoption of digital technologies. India’s focus on becoming a global hub for shipbuilding, with a particular emphasis on eco-friendly vessels, is driving the demand for innovative digital solutions in the shipbuilding process.

The digital shipyard market in France is expanding at a rate of 15.8%. France has a well-established maritime industry, with its shipyards investing in digital technologies to maintain global competitiveness. The use of advanced technologies, such as AI-driven predictive maintenance and digital twins, is increasing in French shipyards to enhance operational efficiency and reduce downtime. France is also focusing on building green vessels, which are pushing the adoption of sustainable digital shipyard technologies. The French government’s emphasis on upgrading infrastructure and meeting stricter environmental regulations is encouraging shipyards to invest in digital solutions that enhance both operational and environmental performance.

The digital shipyard market in the United Kingdom is growing at a rate of 14.3%. The UK has a rich maritime heritage, and its shipbuilding industry is now embracing digital technologies to enhance productivity and stay competitive in the global market. The adoption of digital tools such as automation, robotics, and AI is helping UK shipyards streamline operations, reduce costs, and improve the quality of vessels. Additionally, the demand for sustainable shipbuilding practices is prompting the integration of digital solutions that focus on reducing environmental impact. The UK government is also encouraging digital transformation in the industry as part of its broader plan to boost the economy and improve competitiveness.

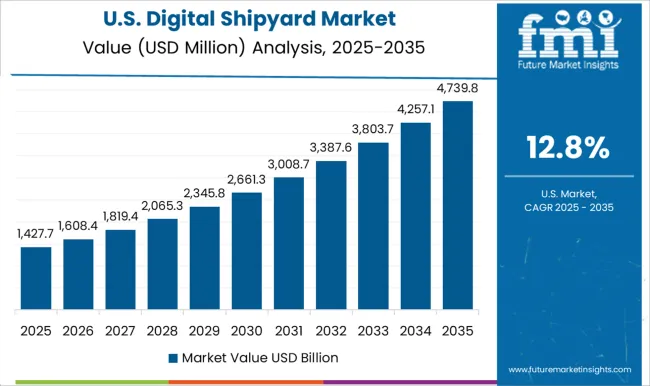

The digital shipyard market in the United States is growing at a rate of 12.8%. The USA has one of the largest and most technologically advanced shipbuilding industries in the world, and it is now shifting towards digitalization to enhance efficiency and competitiveness. USA shipyards are adopting cutting-edge technologies, including digital twins, AI-driven analytics, and robotics, to optimize production timelines and improve vessel quality. The USA government’s focus on modernizing its naval fleet and meeting stricter environmental standards is driving the need for digital solutions in shipbuilding. With increasing demand for both military and commercial vessels, USA shipyards are investing heavily in digital shipyard technologies to stay at the forefront of the global market.

The digital shipyard market is undergoing a substantial transformation as shipbuilders increasingly adopt advanced technologies to optimize operations, enhance efficiency, and lower costs. Altair Engineering Inc. and Aveva Group plc are at the forefront of this change, providing digital design and simulation tools that enable shipyards to optimize product development cycles, improve collaboration, and reduce manufacturing errors. BAE Systems and Wärtsilä have leveraged these technologies to develop state-of-the-art shipbuilding solutions, enhancing the design, construction, and maintenance of vessels through digital twin technology and integrated platforms. Companies like Aras and Siemens have played a significant role in enabling digital transformation through their advanced software solutions, which streamline the management of shipbuilding processes, from conceptual design to final production. These tools support shipyards in enhancing operational productivity and reducing overall lead times, positioning digital technologies as a core aspect of the modern shipbuilding process.

The market’s growth is further fueled by the increasing demand for more advanced and sustainable vessels, prompting shipyards to adopt new technologies such as Hexagon AB’s digital construction solutions and Dassault Systèmes’ comprehensive shipbuilding software. These solutions focus on providing real-time monitoring and simulation to optimize workflows, improving decision-making capabilities. SSI and iBase-t contribute to the market by offering solutions that focus on data management and lifecycle management for shipbuilding. Additionally, SAP’s enterprise resource planning (ERP) systems integrate seamlessly with shipyard operations, providing valuable insights into inventory, scheduling, and project management. The transition to a digital shipyard allows for better collaboration across global teams, reduces manual errors, and increases production flexibility, ultimately driving the adoption of smart manufacturing solutions within the maritime industry. As more shipyards worldwide transition to digital platforms, the market is expected to experience significant growth, with technological advancements continually driving efficiency improvements and cost reductions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Technology | Digital twin technology, Internet of Things (IoT), Automation & robotics, Data analytics & big data, and Others |

| Type | Military shipyards and Commercial shipyards |

| Process | Design & planning, Construction, and Maintenance & repair |

| Capacity | Large shipyards, Small shipyards, and Medium shipyards |

| Digitalization Level | Fully digital shipyard and Semi-digital shipyard |

| End User | Shipbuilders & shipyards, Ship Owners & operators, and Defense & military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Altair Engineering Inc., Aras, Aveva Group plc, BAE Systems, Dassault Systèmes, Hexagon AB, iBase-t, SAP, Siemens, SSI, and Wartsila |

| Additional Attributes | Dollar sales by solution type (design software, production management, automation systems) and application (shipbuilding, repair, maintenance) are key metrics. Trends include rising demand for digital transformation in shipbuilding processes, growth in automation and AI integration, and increasing focus on cost reduction and operational efficiency. Regional adoption, technological advancements, and sustainability goals are driving market growth. |

The global digital shipyard market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the digital shipyard market is projected to reach USD 9.8 billion by 2035.

The digital shipyard market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in digital shipyard market are digital twin technology, internet of things (iot), automation & robotics, data analytics & big data and others.

In terms of type, military shipyards segment to command 62.4% share in the digital shipyard market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA