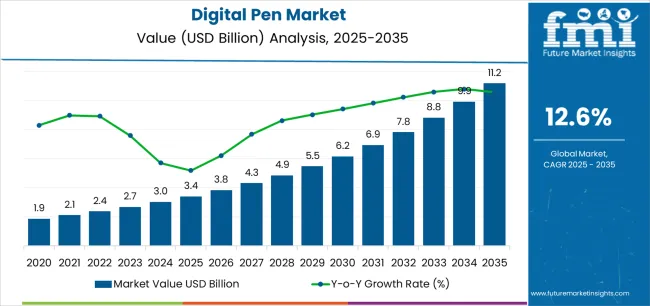

The Digital Pen Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.6% over the forecast period.

The Digital Pen market is experiencing strong growth, driven by the increasing adoption of digital devices for professional, educational, and creative applications. Rising demand for efficient note-taking, precise drawing, and seamless device interaction has accelerated the use of digital pens across multiple sectors. Technological advancements, including pressure-sensitive sensors, palm rejection features, and high-resolution digitizers, are enhancing user experience and functionality, driving market adoption.

Integration with smart devices, tablets, and interactive displays allows for improved productivity and workflow efficiency. Compatibility with operating systems and enterprise platforms further supports adoption by professionals, students, and creative users. The increasing prevalence of hybrid work models and e-learning solutions has heightened the need for interactive tools that facilitate remote collaboration and digital engagement.

As manufacturers continue to innovate, offering ergonomic designs, multi-function capabilities, and software-enabled enhancements, the market is expected to witness sustained growth Investment in research and development and rising awareness about the benefits of digital pens in enhancing productivity are anticipated to create further opportunities, positioning the market for long-term expansion.

| Metric | Value |

|---|---|

| Digital Pen Market Estimated Value in (2025 E) | USD 3.4 billion |

| Digital Pen Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 12.6% |

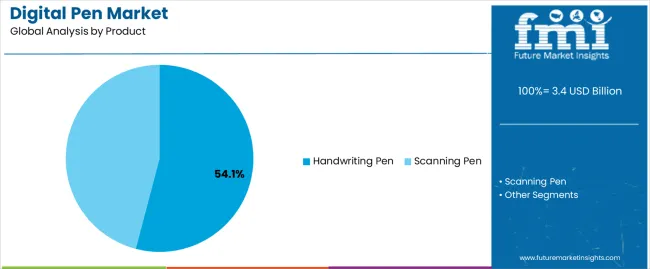

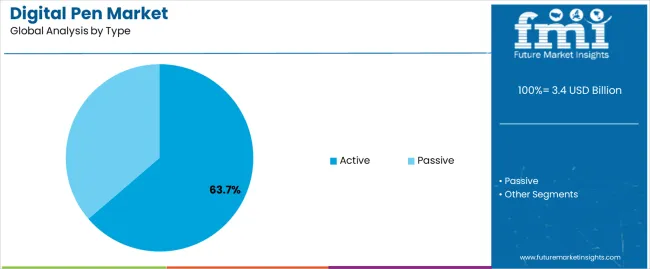

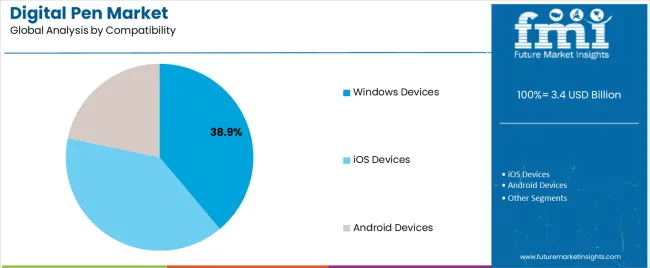

The market is segmented by Product, Type, Compatibility, Usage, and End User and region. By Product, the market is divided into Handwriting Pen and Scanning Pen. In terms of Type, the market is classified into Active and Passive. Based on Compatibility, the market is segmented into Windows Devices, iOS Devices, and Android Devices. By Usage, the market is divided into Tablet, PC, and Smartphone. By End User, the market is segmented into Education, BFSI, Healthcare, Government, Media & Entertainment, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handwriting pen product segment is projected to hold 54.1% of the market revenue in 2025, establishing it as the leading product category. Growth in this segment is being driven by the increasing preference for pens that replicate natural writing experiences, enabling precise note-taking and drawing on digital devices. Advanced features, such as pressure sensitivity, tilt recognition, and customizable tip settings, allow for enhanced control and accuracy, appealing to professionals, educators, and creative users.

Compatibility with various software applications and integration with tablet and touchscreen devices further enhance adoption. Ergonomic designs and lightweight construction contribute to user comfort during prolonged use, supporting widespread acceptance.

Handwriting pens are increasingly being adopted in digital classrooms, offices, and creative studios to replace traditional writing instruments, driven by the need for efficiency and digitization As the demand for interactive and high-performance tools grows, the handwriting pen segment is expected to maintain its market leadership, supported by technological innovation, ease of use, and enhanced compatibility with evolving digital ecosystems.

The active type digital pen segment is anticipated to account for 63.7% of the market revenue in 2025, making it the leading type category. Its growth is driven by the incorporation of advanced electronics, sensors, and rechargeable battery systems that enhance performance, responsiveness, and precision. Active pens enable features such as pressure-sensitive input, programmable buttons, and real-time interaction with digital screens, providing superior user experience compared to passive alternatives.

Their ability to integrate with specialized software and support multiple functionalities, including annotation, drawing, and navigation, has strengthened their adoption across professional, educational, and creative sectors. Ongoing advancements in battery life, connectivity, and compatibility with operating systems further reinforce their market position.

The growing trend of digital transformation, remote collaboration, and e-learning is accelerating demand for high-performance digital pens As user expectations for precision, versatility, and interactivity continue to rise, active digital pens are expected to maintain their dominant position, supported by continuous technological innovation and increasing adoption across multiple device platforms.

The Windows devices compatibility segment is projected to hold 38.9% of the market revenue in 2025, establishing it as the leading compatibility category. Growth in this segment is being driven by the widespread use of Windows-based laptops, tablets, and hybrid devices across enterprise, education, and personal computing environments. Digital pens compatible with Windows devices provide seamless integration with software applications, productivity tools, and creative suites, enabling precise input and improved workflow efficiency.

Enhanced features, such as customizable shortcuts, pressure sensitivity, and gesture support, allow users to fully leverage the capabilities of Windows devices. Enterprise adoption is supported by compatibility with Microsoft Office, OneNote, and other productivity software, facilitating note-taking, collaboration, and content creation.

The increasing prevalence of hybrid work, online learning, and digital creativity has further accelerated demand for Windows-compatible digital pens As technology continues to advance, and device manufacturers prioritize stylus integration, the Windows devices compatibility segment is expected to maintain its leadership position, driven by user convenience, productivity gains, and seamless software interaction.

The historical period suggests that the digital pen market growth occurred at a staggering CAGR of 16.7%. This elevated the market size from USD 1.9 billion in 2020 to USD 3.4 billion in 2025.

Demand-side trends of digital pens suggest that the demand for digital pens suddenly surged during the pandemic. Digital transformation was the key reason behind this. Consequently, digital pen market growth was substantial during the historical period.

The creative industry was also booming in the historical period. Digital pens were required to be supplied frequently. Hence, this is another key digital pen market trend.

Supply-side trends of digital pens suggest that reduced manufacturing costs enhanced the profit margins. Also, the demand for digital pens was rising due to the inevitability of substituting traditional methods. Therefore, this has fuelled the digital pen market growth.

| Historical CAGR from 2020 to 2025 | 16.7% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 13.3% |

The growing e-learning market will govern the forecasted period, creating lucrative digital pen market opportunities. The rising demand for digital support to enhance educational quality will likely bring constructive innovation in digital pen technology to meet the need. Hence, this will fuel the digital pen market growth.

Additionally, the healthcare sector will fetch the attention of leading digital pen manufacturers to meet the demand for reduced paperwork. Thus, it generates demand and will likely drive the subject market significantly.

The electronics market and the digital pen market are growing in North America. Based on supply-side trends of digital pens, large-scale businesses are fuelled by the efficient supply of relevant goods and services. Hence, this forecasts a great leap for the region in the market.

Europe secures a respectable market share due to the rising number of leading digital pen manufacturers. The increasing number of competitors gives ample product options for customers, supporting their demand-side trends of digital pens.

Asia-Pacific is the combination of emerging marketers and existing players. They foster innovation in digital pen technology through various initiatives. Hence, it is a promising market for key players.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| The United States of America | 13.5% |

| The United Kingdom | 14.4% |

| China | 13.9% |

| Japan | 14.9% |

| South Korea | 15.5% |

| Category | Top Product- Handwriting Pen |

|---|---|

| CAGR % 2025 to End of Forecast (2035) | 13.1% |

| Market Segment Drivers |

|

| Category | Top End-User- Healthcare |

|---|---|

| CAGR % 2025 to End of Forecast (2035) | 12.9% |

| Market Segment Drivers |

|

Leading digital pen manufacturers clutter the competitive landscape of the global digital pen market. The cluttered digital pen market competition results in different market expansion strategies, including partnerships, collaborations, mergers and acquisitions, and product innovation.

The market might get threatened due to new entrants cluttering the market competition. Restricted resources control the costs levitated by the entry of new players. New entrants can reduce the profit margins.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 3.4 billion |

| Projected Market Valuation in 2035 | USD 11.2 billion |

| Value-based CAGR 2025 to 2035 | 12.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered |

Product, Type, Compatibility, Usage, End-User, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled |

IRIS S.A.; Lucidia Inc.; Kent Displays; Wacom Co., Ltd.; ACECAD Digital Corp.; NeoLAB Convergence Lab; Livescribe Inc.; Moleskine S.p.A.; Apple Inc.; Microsoft Inc. |

The global digital pen market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the digital pen market is projected to reach USD 11.2 billion by 2035.

The digital pen market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in digital pen market are handwriting pen and scanning pen.

In terms of type, active segment to command 63.7% share in the digital pen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Digital Pen Providers

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA