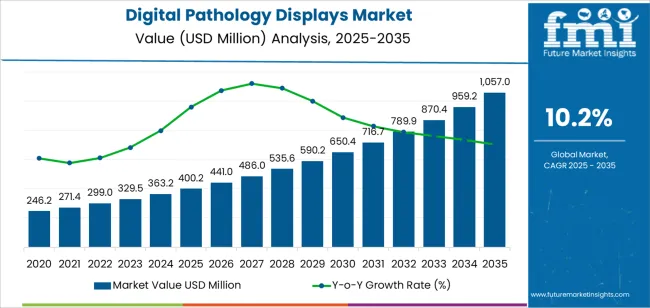

The digital pathology displays market is projected to expand from USD 400.2 million in 2025 to USD 1,057.1 million by 2035, growing at a 10.2% CAGR as clinical laboratories transition from glass-slide microscopy to fully digital diagnostic workflows. The period from 2025 to 2030 contributes USD 250.2 million in growth as hospitals, reference labs, and academic medical centers accelerate adoption of 27–32 inch medical-grade calibrated displays that provide consistent color accuracy, high-resolution image rendering, and DICOM-compliant grayscale performance for primary diagnosis. This is the phase where digitization moves from pilot evaluation to standard procurement.

Between 2030 and 2035, the digital pathology displays market adds a further USD 406.7 million, driven by enterprise-scale digital pathology rollouts, deployment of large-format multi-viewer diagnostic stations, and integration of displays into whole slide imaging platforms, LIS/PACS environments, and telepathology collaboration systems. The workflow model shifts from isolated workstation displays to networked diagnostic review environments, where display performance becomes a core component of case throughput, AI-assisted triage, remote review, and multi-disciplinary tumor board collaboration. Medium-size displays (27–32 inches) remain the dominant segment due to ergonomics, diagnostic accuracy, and compatibility across pathologist workspaces. Regional growth is led by East Asia and South Asia Pacific, driven by hospital expansion and investment in digital pathology infrastructure, while Western Europe shows steady adoption supported by structured national digital health programs. Key players shaping product standards include Barco, Eizo, LG Display, Sony Medical Systems, and Jusha Medical, each competing on image calibration technology, display uniformity algorithms, and clinical workflow integration capabilities.

Where revenue comes from - now vs next (industry-level view)

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New display sales (small, medium, large) | 52% | Hardware-led, diagnostic infrastructure purchases |

| Display calibration & quality assurance | 18% | Color accuracy, compliance validation | |

| Maintenance & service contracts | 15% | Preventive maintenance, technical support | |

| Accessories & mounting systems | 10% | Display stands, viewing stations | |

| Software & integration services | 5% | PACS connectivity, workflow integration | |

| Future (3-5 yrs) | High-resolution large displays | 45-50% | 4K/8K systems, multi-monitor configurations |

| AI-integrated display systems | 15-20% | Decision support, image enhancement | |

| Calibration-as-a-service | 12-15% | Remote monitoring, automated QA | |

| Display & software bundles | 10-12% | Complete viewing workstations | |

| Training & validation services | 8-10% | Pathologist training, compliance certification | |

| Data services (image quality, diagnostic accuracy metrics) | 5-8% | Performance analytics for pathology labs |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 400.2 million |

| Market Forecast (2035) | USD 1,057.1 million |

| Growth Rate | 10.2% CAGR |

| Leading Technology | Medium Size Displays (27-32 inches) |

| Primary Application | Hospital Segment |

The market demonstrates strong fundamentals with medium size displays capturing a dominant share through optimal viewing balance and clinical versatility for diverse pathology applications. Hospital applications drive primary demand, supported by increasing digital pathology adoption and diagnostic workflow requirements. Geographic expansion remains concentrated in developed markets with established pathology infrastructure, while emerging economies show accelerating adoption rates driven by laboratory modernization initiatives and rising diagnostic standards.

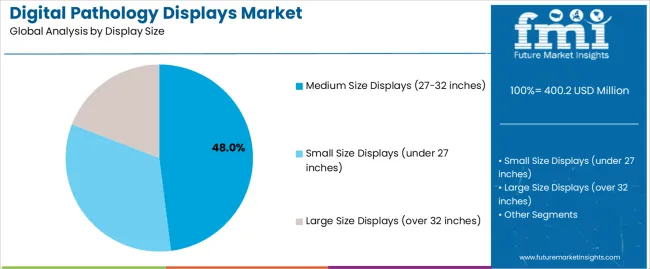

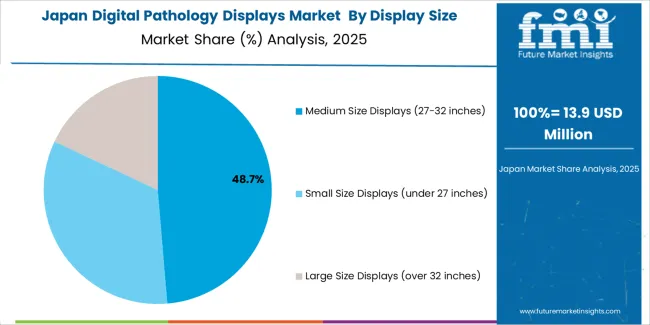

Primary Classification: The market segments by display size into Small Size Displays (under 27 inches), Medium Size Displays (27-32 inches), and Large Size Displays (over 32 inches), representing the evolution from compact viewing solutions to sophisticated diagnostic workstation displays for comprehensive pathology visualization optimization.

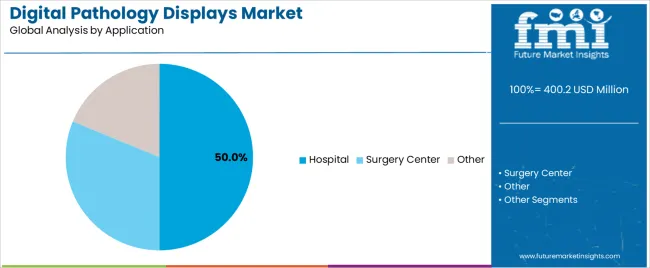

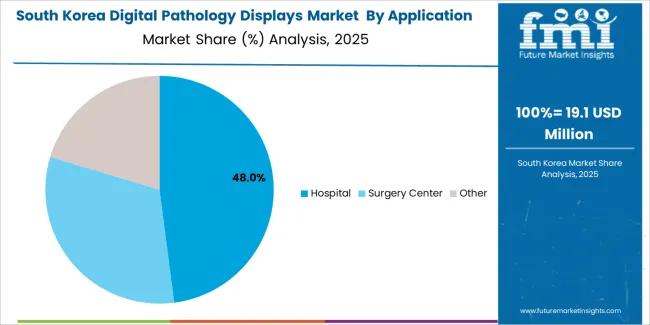

Secondary Classification: Application segmentation divides the market into Hospital, Surgery Center, and Other sectors, reflecting distinct requirements for diagnostic volume, clinical workflow, and facility integration standards.

Regional Classification: Geographic distribution covers major markets including China, India, Germany, Brazil, United States, United Kingdom, and Japan, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by digital pathology expansion programs.

The segmentation structure reveals technology progression from standard diagnostic displays toward sophisticated visualization systems with enhanced color accuracy and resolution capabilities, while application diversity spans from hospital pathology departments to surgery centers requiring precise diagnostic imaging solutions.

Market Position: Medium Size Displays (27-32 inches) command the leading position in the digital pathology displays market with 48% market share through optimal viewing balance, including superior screen real estate, ergonomic viewing comfort, and diagnostic workflow optimization that enable pathology laboratories to achieve optimal visualization performance across diverse clinical and research environments.

Value Drivers: The segment benefits from pathologist preference for balanced display systems that provide adequate viewing area, comfortable diagnostic sessions, and workflow efficiency without requiring excessive desk space. Advanced design features enable high-resolution imaging, accurate color reproduction, and integration with existing pathology workstations, where diagnostic precision and user comfort represent critical laboratory requirements.

Competitive Advantages: Medium Size Displays differentiate through proven diagnostic reliability, optimal viewing characteristics, and integration with digital pathology platforms that enhance laboratory effectiveness while maintaining optimal image quality suitable for diverse diagnostic applications.

Key market characteristics:

Small Size Displays (under 27 inches) maintain a 32% market position in the digital pathology displays market due to space-constrained environments and portable review applications. These displays appeal to facilities requiring compact diagnostic solutions with competitive pricing for satellite laboratories and consultation scenarios. Market growth is driven by telemedicine expansion, emphasizing portable visualization solutions and operational flexibility through optimized compact designs.

Large Size Displays (over 32 inches) capture 20% market share through advanced visualization requirements in research facilities, academic centers, and multi-head review stations. These applications demand expansive screen real estate capable of displaying multiple slides simultaneously while providing effective diagnostic capabilities and enhanced detail visualization.

Market Context: Hospital applications demonstrate the highest growth in the digital pathology displays market, with 50% market share due to widespread adoption of digital pathology systems and increasing focus on diagnostic workflow optimization, laboratory efficiency, and comprehensive pathology services that maximize diagnostic throughput while maintaining quality standards.

Appeal Factors: Hospital pathology departments prioritize display reliability, diagnostic accuracy, and integration with existing laboratory infrastructure that enables coordinated pathology operations across multiple workstations. The segment benefits from substantial healthcare investment and digital transformation programs that emphasize the acquisition of medical-grade displays for diagnostic optimization and workflow efficiency applications.

Growth Drivers: Hospital expansion programs incorporate digital pathology displays as standard equipment for diagnostic operations, while laboratory consolidation increases demand for high-performance visualization capabilities that comply with clinical standards and minimize diagnostic complexity.

Market Challenges: Varying case volumes and multi-departmental requirements may limit display standardization across different facilities or diagnostic scenarios.

Application dynamics include:

Surgery Center applications capture 35% market share through intraoperative consultation requirements, frozen section analysis, and rapid diagnostic support. These facilities demand reliable display systems capable of providing immediate visualization access while maintaining effective diagnostic accuracy and operational efficiency.

Other applications account for 15% market share, including research laboratories, veterinary pathology, pharmaceutical development, and educational institutions requiring specialized visualization capabilities for teaching and analysis applications.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Digital pathology adoption & whole slide imaging growth | ★★★★★ | Transition from microscopes to digital workflow requires medical-grade displays; vendors offering integrated solutions gain advantage. |

| Driver | Regulatory requirements & diagnostic accuracy standards (FDA, CAP) | ★★★★★ | Mandates medical-grade displays with calibration verification; compliance support becomes competitive differentiator. |

| Driver | Telepathology & remote consultation expansion | ★★★★☆ | Distributed diagnostic models need consistent visualization; demand for standardized displays across multiple locations. |

| Restraint | High display costs & budget constraints | ★★★★☆ | Medical-grade displays significantly more expensive than consumer displays; price sensitivity in smaller laboratories. |

| Restraint | Calibration maintenance & quality assurance complexity | ★★★☆☆ | Regular calibration required for diagnostic accuracy; ongoing maintenance costs and technical expertise requirements. |

| Trend | 4K/8K resolution & enhanced color gamut | ★★★★★ | Ultra-high resolution enables detailed tissue examination; color accuracy improvements enhance diagnostic confidence. |

| Trend | AI integration & image enhancement | ★★★★☆ | Display systems incorporating AI-assisted visualization; real-time image optimization and diagnostic decision support features. |

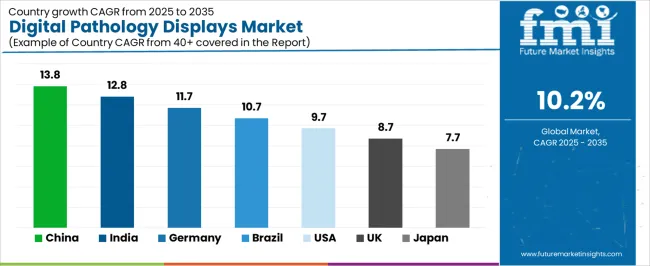

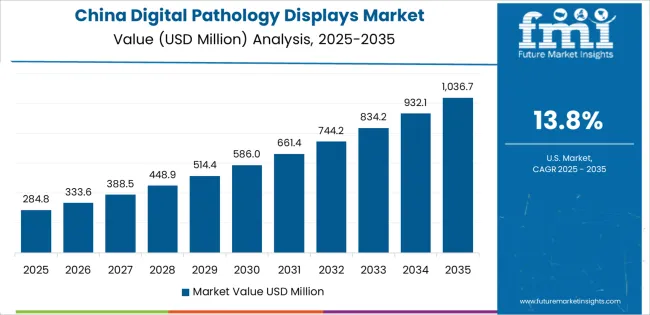

The digital pathology displays market demonstrates varied regional dynamics with Growth Leaders including China (13.8% growth rate) and India (12.8% growth rate) driving expansion through digital pathology initiatives and laboratory modernization programs. Steady Performers encompass Germany (11.7% growth rate), United States (9.7% growth rate), and developed regions, benefiting from established pathology infrastructure and advanced diagnostic technology adoption. Emerging Markets feature Brazil (10.7% growth rate) and developing regions, where healthcare initiatives and laboratory digitalization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through healthcare infrastructure expansion and diagnostic modernization development, while Western European countries maintain strong expansion supported by digital pathology standardization and regulatory compliance requirements. North American markets show steady growth driven by laboratory consolidation and telepathology applications.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 13.8% | Lead with cost-effective solutions and local partnerships | Regulatory complexity; local competition |

| India | 12.8% | Focus on training and service support | Infrastructure gaps; budget constraints |

| Germany | 11.7% | Offer premium calibrated systems with compliance | Over-specification; lengthy procurement |

| Brazil | 10.7% | Provide value-oriented bundles | Economic volatility; import duties |

| United States | 9.7% | Push telepathology and AI integration | Market saturation; reimbursement challenges |

| United Kingdom | 8.7% | Digital pathology networks and standardization | NHS budget pressures; centralization impacts |

| Japan | 7.7% | Emphasize precision and quality assurance | Conservative adoption; aging infrastructure |

China establishes fastest market growth through aggressive digital pathology programs and comprehensive laboratory modernization initiatives, integrating advanced medical-grade displays as standard equipment in tertiary hospitals and pathology centers. The country's 13.8% growth rate reflects government initiatives promoting healthcare digitalization and diagnostic accuracy improvement that mandate the use of calibrated display systems in pathology departments. Growth concentrates in major healthcare hubs, including Beijing, Shanghai, and Guangzhou, where pathology technology development showcases integrated display systems that appeal to laboratory directors seeking advanced diagnostic visualization and workflow optimization capabilities.

Chinese manufacturers are developing competitive display solutions that combine domestic production advantages with medical-grade specifications, including color accuracy and calibration features. Distribution channels through medical equipment suppliers and healthcare technology distributors expand market access, while government support for digital pathology infrastructure supports adoption across diverse hospital and diagnostic center segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, hospital pathology departments and diagnostic centers are implementing medical-grade displays as standard equipment for digital pathology operations and diagnostic workflow applications, driven by increasing private healthcare investment and laboratory modernization programs that emphasize the importance of visualization accuracy. The market holds a 12.8% growth rate, supported by government healthcare initiatives and expanding diagnostic service demand that promotes advanced display systems for pathology departments. Indian laboratories are adopting display systems that provide consistent color accuracy and calibration features, particularly appealing in urban regions where diagnostic quality and efficiency represent critical healthcare requirements.

Market expansion benefits from growing pathology service networks and international technology partnerships that enable adoption of medical-grade displays for diagnostic applications. Technology adoption follows patterns established in medical imaging equipment, where diagnostic accuracy and regulatory compliance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany's advanced healthcare technology market demonstrates sophisticated digital pathology display deployment with documented diagnostic effectiveness in university hospitals and reference laboratories through integration with existing pathology information systems and quality management platforms. The country leverages engineering expertise in medical display technology and calibration systems to maintain an 11.7% growth rate. Academic medical centers, including university hospitals in Munich, Berlin, and Heidelberg, showcase premium installations where displays integrate with comprehensive digital pathology platforms and diagnostic workflow systems to optimize visualization operations and clinical effectiveness.

German manufacturers prioritize color accuracy and regulatory compliance in display development, creating demand for premium systems with advanced features, including automated calibration and quality assurance integration. The market benefits from established pathology technology infrastructure and willingness to invest in medical-grade equipment that provides long-term diagnostic benefits and compliance with international pathology standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse healthcare modernization demand, including digital pathology implementation in São Paulo and Rio de Janeiro, laboratory upgrades, and government healthcare programs that increasingly incorporate medical displays for diagnostic optimization applications. The country maintains a 10.7% growth rate, driven by rising diagnostic service utilization and increasing recognition of digital pathology benefits, including improved consultation access and diagnostic efficiency.

Market dynamics focus on accessible display solutions that balance medical-grade performance with affordability considerations important to Brazilian healthcare providers. Growing laboratory consolidation creates continued demand for standardized display systems in new diagnostic infrastructure and pathology modernization projects.

Strategic Market Considerations:

United States establishes market leadership through comprehensive digital pathology programs and advanced pathology infrastructure development, integrating medical-grade displays across hospital laboratories and reference pathology centers. The country's 9.7% growth rate reflects established pathology relationships and mature digital pathology adoption that supports widespread use of calibrated display systems in diagnostic and consultation applications. Growth concentrates in major academic medical centers and commercial pathology laboratories, including facilities in Boston, New York, and California, where pathology technology showcases mature digital display deployment that appeals to pathologists seeking proven visualization accuracy and diagnostic workflow optimization.

American pathology laboratories leverage established vendor relationships and comprehensive service networks, including calibration programs and technical support that create operational advantages. The market benefits from mature regulatory standards and CAP accreditation requirements that mandate medical-grade display use while supporting technology advancement and diagnostic optimization.

Market Intelligence Brief:

United Kingdom's pathology modernization programs demonstrate extensive medical-grade display deployment with documented integration in NHS pathology networks and private diagnostic centers through compatibility with national digital pathology initiatives. The country maintains an 8.7% growth rate through centralized procurement programs and pathology network consolidation. Major pathology hubs, including London, Leeds, and Glasgow, showcase integrated installations where displays connect with comprehensive pathology information systems and remote consultation platforms to optimize diagnostic operations and service delivery.

British pathology services balance clinical effectiveness with cost efficiency in display procurement, influenced by NHS budget constraints and network standardization requirements. The market benefits from national digital pathology strategy and coordinated technology implementation that drives adoption of validated display systems.

Market Intelligence Brief:

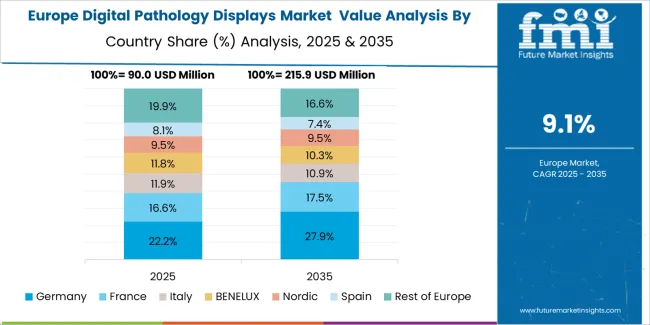

The digital pathology displays market in Europe is projected to grow from USD 141.9 million in 2025 to USD 378.2 million by 2035, registering a CAGR of 10.3% over the forecast period. Germany is expected to maintain its leadership position with a 33.6% market share in 2025, supported by its advanced pathology infrastructure and comprehensive digital pathology programs.

United Kingdom follows with a 24.2% share in 2025, driven by NHS digital pathology initiatives and laboratory network consolidation. France holds a 18.8% share through academic pathology centers and healthcare modernization programs. Italy commands a 12.4% share, while Spain accounts for 7.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.1% to 4.2% by 2035, attributed to increasing medical display adoption in Nordic countries and emerging Eastern European pathology laboratories implementing digital workflow programs.

Japan's digital pathology displays market reflects established diagnostic infrastructure with sophisticated medical-grade display deployment across university hospitals and commercial pathology laboratories. The country maintains a 7.7% growth rate, supported by aging population demographics and comprehensive healthcare coverage that sustains pathology service volumes. Japanese pathology facilities emphasize precision engineering and color accuracy in display selection, with preference for established manufacturers offering validated diagnostic performance and comprehensive calibration support.

Market dynamics focus on replacement cycles and premium display adoption, with moderate penetration growth due to existing digital pathology infrastructure. Professional society guidelines and hospital accreditation standards influence procurement decisions, while demographic trends support sustained diagnostic volumes despite slower technology refresh rates. Distribution networks through established medical equipment suppliers maintain market access, with opportunities concentrated in display technology upgrades and multi-monitor workstation implementations.

South Korea's healthcare technology market demonstrates rapid digital pathology display integration with active implementation of advanced visualization systems in tertiary hospitals and specialized pathology centers. The market exhibits 9.4% growth driven by strong healthcare digitalization initiatives, comprehensive insurance coverage, and institutional willingness to adopt advanced diagnostic technologies. Seoul, Busan, and other major cities showcase modern pathology facilities where medical-grade displays represent standard diagnostic equipment, supported by comprehensive vendor technical support and calibration service programs.

Korean pathology laboratories prioritize diagnostic accuracy and workflow efficiency, driving demand for high-resolution displays with automated calibration capabilities and pathology information system integration. Market expansion benefits from robust medical education infrastructure and international clinical practice adoption, with pathology departments actively implementing latest visualization technologies. Distribution channels combine direct manufacturer relationships with specialized medical equipment suppliers, while professional education programs and vendor certification initiatives facilitate technology adoption and quality standardization across the pathology community.

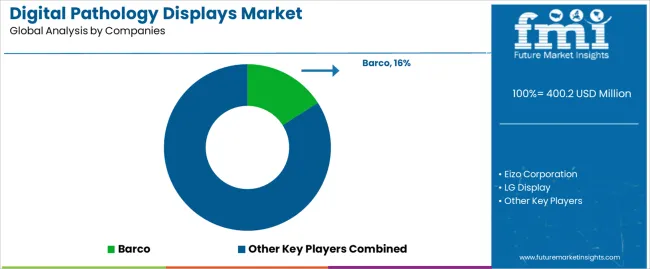

The competitive structure features 15-18 established players with the top 5 manufacturers holding approximately 62% market share by revenue. Leadership is maintained through extensive service networks, comprehensive calibration support programs, and continuous innovation focused on resolution enhancement and color accuracy optimization. Market dynamics reflect consolidation trends with medical imaging companies expanding into pathology displays while specialized manufacturers defend positions through superior calibration technology and diagnostic workflow integration.

Basic display hardware and standard calibration tools are commoditizing, while margin opportunities exist in automated quality assurance systems, telepathology integration services, and comprehensive validation programs. Successful manufacturers differentiate through regulatory compliance documentation, pathologist training initiatives, and technical support that builds laboratory confidence and long-term customer relationships. Market entry barriers include medical device regulatory requirements, established laboratory procurement relationships, and extensive validation protocols across multiple jurisdictions.

Competition intensifies around ultra-high resolution systems for detailed tissue examination, AI-enhanced visualization features, and cloud-connected quality monitoring that integrates displays with laboratory information systems. Manufacturers increasingly offer complete digital pathology workstations combining displays, image management software, and calibration systems to capture larger share of laboratory technology budgets while ensuring system compatibility and simplified procurement processes. Service-based business models gain traction with calibration-as-a-service and performance guarantee contracts that shift from capital expenditure to operational expense models.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, comprehensive product lines, service networks | Broad laboratory access, proven reliability, multi-region compliance | Innovation speed; emerging market pricing pressure |

| Technology innovators | Advanced display technology, proprietary calibration, resolution leadership | Latest features first; superior diagnostic performance | Service density outside core markets; price competitiveness |

| Regional specialists | Local compliance expertise, rapid technical support, country-specific service | Close laboratory relationships; responsive support; local standards | Technology development resources; global scale limitations |

| Service-focused ecosystems | Calibration networks, maintenance programs, validation support | Lowest operational downtime; comprehensive quality assurance | Technology refresh cycles if legacy-dependent |

| Medical imaging specialists | Radiology relationships, PACS integration, imaging expertise | Cross-modality synergies; established hospital presence | Pathology-specific workflow understanding |

| Item | Value |

|---|---|

| Quantitative Units | USD 400.2 million |

| Display Size | Small Size Displays (under 27 inches), Medium Size Displays (27-32 inches), Large Size Displays (over 32 inches) |

| Application | Hospital, Surgery Center, Other |

| Regions Covered | East Asia, South Asia Pacific, Western Europe, North America, Latin America, Eastern Europe, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, France, Italy, Spain, Canada, Australia, and 20+ additional countries |

| Key Companies Profiled | Barco, Eizo Corporation, LG Display, Sony Medical Systems, Jusha Medical, Advantech Co., Ltd., Double Black Imaging, Konica Minolta, Dell Technologies, Totoku Electric Co., Ltd., Philips Healthcare, Siemens Healthineers, ViewSonic, Novanta Inc., BenQ Corporation |

| Additional Attributes | Dollar sales by display size and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with medical display manufacturers and digital pathology platform providers, pathologist preferences for color accuracy and calibration reliability, integration with pathology information systems and image management platforms, innovations in resolution technology and calibration automation, and development of AI-enhanced display systems with improved diagnostic performance and workflow optimization capabilities. |

The global digital pathology displays market is estimated to be valued at USD 400.2 million in 2025.

The market size for the digital pathology displays market is projected to reach USD 1,057.0 million by 2035.

The digital pathology displays market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in digital pathology displays market are medium size displays (27-32 inches) , small size displays (under 27 inches) and large size displays (over 32 inches).

In terms of application, hospital segment to command 50.0% share in the digital pathology displays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA