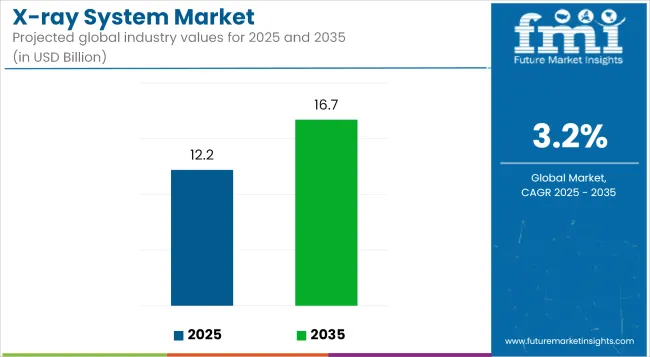

The global X-ray System Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 16.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.2 billion |

| Industry Value (2035F) | USD 16.7 billion |

| CAGR (2025 to 2035) | 3.2% |

The X-ray system market is undergoing steady transformation driven by increased healthcare digitization, rising imaging volumes, and sustained investments in radiology infrastructure. The market is constant witnessing a consistent shift toward digital radiography and flat-panel detector technologies to improve workflow efficiency and image quality.

Healthcare providers are prioritizing equipment upgrades to reduce radiation exposure and enable advanced imaging protocols supporting early disease detection. Regulatory initiatives incentivizing the replacement of legacy analog systems with digital solutions have contributed to modernization across public and private health systems.

Additionally, integration of artificial intelligence for image enhancement and workflow automation has been recognized as a critical factor supporting future growth. As demographic trends accelerate chronic disease incidence, the X-ray system market is expected to benefit from sustained capital spending and broader access to diagnostic services.

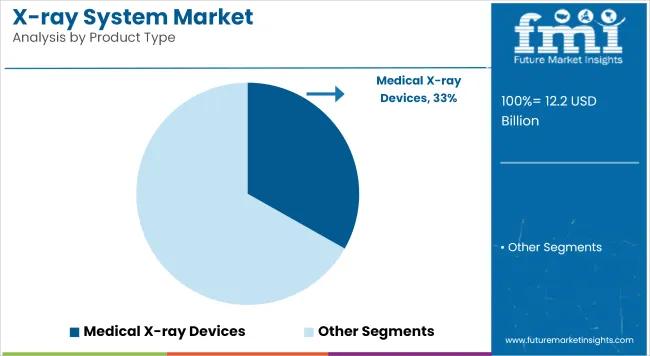

In 2025, medical X-ray devices are anticipated to account for 33.2% of total revenue within the X-ray system market. This segment has been reinforced by widespread adoption in hospitals, outpatient centers, and specialty clinics where diagnostic imaging is a critical workflow component.

Transition to digital radiography platforms has been observed to drive efficiency gains and reduce operational costs over analog systems, prompting replacement investments. Regulatory emphasis on radiation dose optimization and quality standards has further supported procurement of advanced medical X-ray devices with enhanced safety and automation features.

Additionally, increasing imaging utilization linked to chronic disease management and emergency care has strengthened recurring demand. Collectively, these factors have established medical X-ray devices as a leading product category with sustained growth prospects.

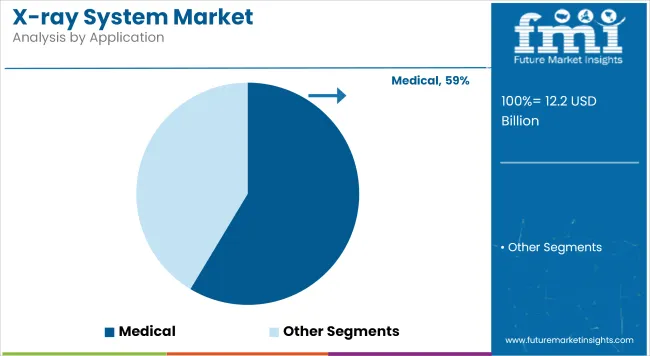

Medical applications are projected to capture 58.6% revenue share in 2025, supported by their central role in diagnostic and treatment workflows across healthcare facilities. The segment has been driven by increased imaging volumes related to trauma, cancer screening, and musculoskeletal evaluations. Clinical evidence has underscored the importance of timely radiographic assessments for accurate diagnosis and treatment planning, reinforcing the reliance on X-ray systems.

Reimbursement policies and government funding initiatives have been observed to encourage investments in digital imaging infrastructure, particularly in public health systems. Furthermore, technological advancements such as portable and point-of-care X-ray solutions have broadened access and accelerated procedural throughput. These dynamics are expected to maintain the prominence of medical applications as the largest contributor to market revenue.

High Equipment Costs and Radiation Safety Regulations

The X-ray system market is mainly subject to high capital costs, which limits the adoption of X-ray systems in many small healthcare facilities and rural diagnostic centers. They can also require substantial financial investment in hardware and operator training; advanced digital radiography systems are efficient yet capital-intensive. Simultaneously, regulatory compliance associated with radiation exposure especially in the USA, EU, and Japan requires stringent safety protocols, shielding infrastructure and regular system audits.

These are complex and costly requirements. In Emerging markets, absence of reimbursement support and technical knowhow further limits the adoption of next-gen X-ray systems, impeding advancements in early diagnosis and patient throughput.

Rising Demand for Digital Imaging and AI-Enhanced Diagnostics

The world X-ray system market is growing at a fast pace owing to increasing demand for quick, precise and less invasive diagnostic imaging. Comparison of analog and digital radiography demonstrates that the transition of commercial radiography to digital media allows for better resolution, storage efficiency, and greater diagnostic accuracy.

Today, AI integration is paving the way for real-time anomaly finding and workflow automation, enhancing the productivity of radiologists. Growing burden of chronic diseases, increased geriatric population, and improved hospital infrastructure, especially across Asia-Pacific and Latin America are major factors driving installation of mobile, portable, and multi-function X-ray units. Modern X-ray systems with AI, cloud connectivity, and integrated PACS support are redefining diagnostic speed, scalability, and clinical value.

The USA market for X-ray systems is growing steadily, driven by their use in diagnostics, dental procedures, orthopedic and emergency medicine. The ever-increasing elderly population and high healthcare spending in the country support advanced digital radiography and portable X-ray unit’s demand.

To improve imaging quality, minimize radiation exposure and get results faster, USA hospitals and diagnostic centers are upgrading analog systems to digital platforms. AI for image analysis and workflow automation is also being integrated across large healthcare networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

In the UK, the X-ray system market is experiencing moderate growth, spurred by government expenditure to update National Health Service (NHS) infrastructure and increasing demand for quicker diagnostics. Digital X-ray systems have gained widespread adoption in regional hospitals and clinics for musculoskeletal as well as pulmonary examinations.

Mobile and portable X-ray systems are under scrutiny in emergency response and senior care. UK imaging providers are also adopting a cloud-based PACS (Picture Archiving and Communication System) to eliminate silos of image data and drive clinical collaboration.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.1% |

Europe continues to be one of the largest markets for the X-ray system, there is a higher growth rate of digital radiography in the countries such as Germany, France, Italy, and Spain. Outdated equipment is being replaced with low-dose, high-resolution imaging systems as EU healthcare systems digitally transform.

This, combined with regulatory efforts toward standardization and improved diagnostic accuracy of radiation safety, is driving investment in advanced X-ray modalities, including dual-energy and flat-panel detector systems. AI integration in imaging diagnostics across hospitals and research centers are also supported by public-private partnerships.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

Diagnoses requiring diagnostics have also increased the growth of Japan's X-ray generation systems market, and Japan is a technology leader in imaging solutions. In hospitals, mobile vans, and for home healthcare, the country emphasizes compact, high-performance X-ray systems with little radiation.

“Real time 3-D imaging and hybrid diagnostic platforms are developed primarily by Japanese manufacturers. Demand is also on the rise for dental and orthopedic X-ray units designed for an aging population suffering from chronic skeletal and joint conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

Healthy growth is being recorded in the X-ray system market for South Korea, thanks to the presence of a solid I'm and growing export demand. Digital X-ray technologies are gaining traction in emergency medicine, intensive care, and outpatient settings domestically for faster diagnostic throughput.

Some South Korean manufacturers are developing AI-based X-ray systems with some added features, such as image enhancement, anomaly detection and smart workflow. Its growth keeps being bolstered through government incentives for digitization in healthcare and support for local innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

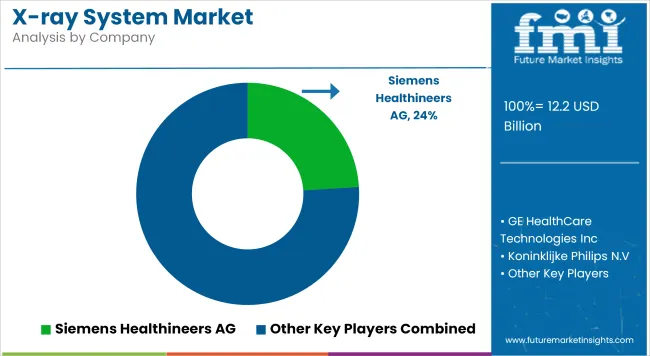

The X-ray system market is dominated by a mix of global diagnostic imaging giants and regional manufacturers, with competition driven by technological innovation, integration of AI-based diagnostics, mobility, and hybrid imaging capabilities. The focus has shifted from conventional X-ray systems to digital radiography (DR) and portable/mobile systems that enable point-of-care diagnostics.

Companies are prioritizing low-dose imaging, improved throughput, and interoperability with PACS/RIS platforms to gain market share. Demand from emerging economies is boosting sales of cost-effective digital X-ray units, while developed markets are investing in AI-enhanced systems and real-time image analytics. Competitive positioning is reinforced through strategic partnerships with hospitals and teleradiology providers, OEM collaborations, and government tenders for public health imaging programs.

In 2024, Siemens Healthineers is expanding its "Make in India" initiative by locally manufacturing the Multix Impact E Digital Radiography X-ray System at its Bengaluru factory. This move aims to enhance secondary care provision and improve access to healthcare in India. The Multix Impact E offers intuitive operation, low-dose imaging, and confident reading, joining mobile C-Arms, CT, and MRI systems already produced at the facility.

In 2024, Carestream Health has launched its new, enhanced DRX-Excel Plus X-ray System, a two-in-one solution for both fluoroscopy and general radiology. This system offers increased productivity, efficiency, and higher image quality, designed to improve the experience for users and patients while delivering real-time, high-quality images for diverse exams.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 12.2 billion |

| Projected Market Size (2035) | USD 16.7 billion |

| CAGR (2025 to 2035) | 3.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value; Thousand units for volume |

| Product Types Analyzed (Segment 1) | Medical X-ray Devices (Fixed/Floor Mounted, Mobile and Portable Devices), X-ray Diffraction (Powder Diffraction, High-Resolution XRD, Custom XRD), X-ray Fluorescence (XRF), Security X-ray Devices (Closed Systems, Full Body Scanner, Single View, Dual View, SAXS/WAXS) |

| Applications Analyzed (Segment 2) | Medical, Research and Development, Security |

| End Uses Analyzed (Segment 3) | Hospitals, Diagnostic Imaging Centers, Airports, Malls, Railway & Metro Stations, Government Facilities & Homeland Security |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Siemens Healthineers AG, GE Healthcare, Canon Medical Systems, Shimadzu Corporation, FUJIFILM SonoSite Inc., Carestream, Mindray Medical International Limited, Hologic Inc., New Medical Imaging, AGFA |

| Additional Attributes | Rising demand for mobile diagnostics, Growth in chronic disease imaging, Increased investment in security screening infrastructure |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the x-ray system market was USD 12.2 billion in 2025.

The x-ray system market is expected to reach USD 16.7 billion in 2035.

The increasing prevalence of chronic diseases, rising need for advanced diagnostic tools, and growing adoption of mobile and portable x-ray devices in medical applications fuel the x-ray system market during the forecast period.

The top 5 countries driving the development of the x-ray system market are the USA, UK, European Union, Japan, and South Korea.

Mobile and portable x-ray devices and medical applications lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diagnostic X-Ray System Market – Trends & Forecast 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA