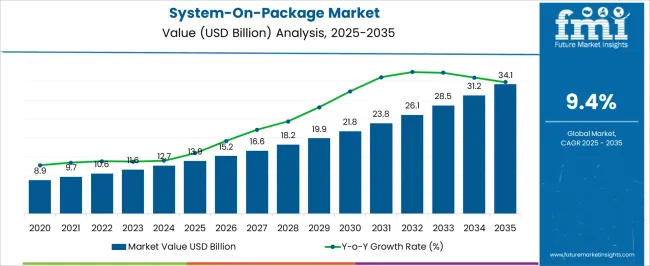

The System-On-Package Market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 34.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| System-On-Package Market Estimated Value in (2025 E) | USD 13.9 billion |

| System-On-Package Market Forecast Value in (2035 F) | USD 34.1 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The system-on-package market is gaining strong traction as industries increasingly adopt advanced semiconductor packaging technologies to meet growing performance and miniaturization demands. Rising adoption of 5G devices, artificial intelligence workloads, and advanced consumer electronics is fueling the need for packaging solutions that provide higher input and output density, improved thermal management, and reduced form factors. The ability of system-on-package technology to integrate multiple heterogeneous functions within a compact footprint is driving its preference across diverse applications.

Significant investments in research and development, alongside strategic collaborations between semiconductor manufacturers and foundries, are accelerating innovation in packaging architectures. The growing importance of power efficiency and faster signal transmission in electronic devices is further shaping demand.

As scaling limitations in traditional semiconductor designs intensify, the market is witnessing a shift toward advanced packaging as a pathway to sustain Moore’s Law With consumer and industrial markets requiring more powerful yet compact devices, the system-on-package market is expected to expand rapidly, offering opportunities for long-term adoption across multiple industries worldwide.

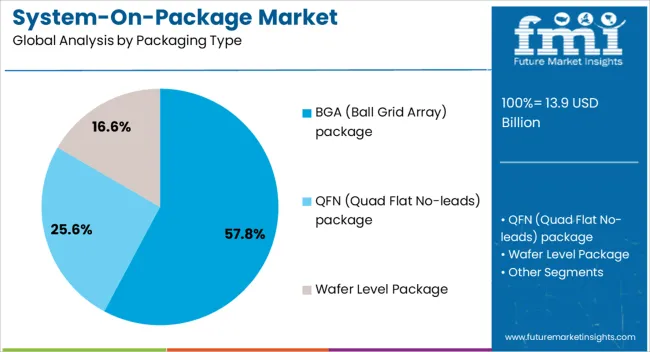

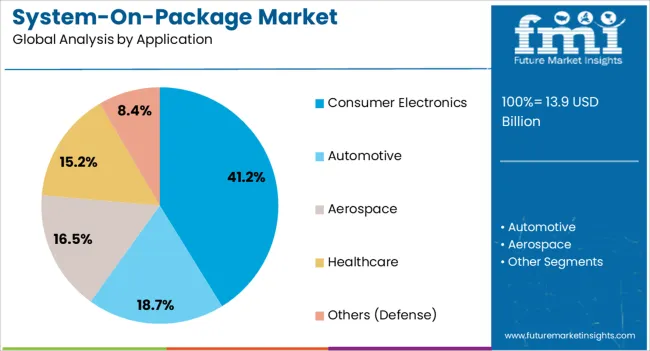

The system-on-package market is segmented by packaging type, application, and geographic regions. By packaging type, system-on-package market is divided into BGA (Ball Grid Array) package, QFN (Quad Flat No-leads) package, and Wafer Level Package. In terms of application, system-on-package market is classified into Consumer Electronics, Automotive, Aerospace, Healthcare, and Others (Defense). Regionally, the system-on-package industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The BGA package segment is projected to account for 57.8% of the system-on-package market revenue share in 2025, making it the dominant packaging type. Its leadership is attributed to the superior ability of ball grid array structures to provide high interconnection density, efficient heat dissipation, and enhanced electrical performance. BGA packaging supports complex system integration while maintaining a compact footprint, which is essential for high-performance applications in computing, networking, and consumer devices.

This packaging type is also valued for its reliability under thermal and mechanical stress, making it suitable for intensive electronic workloads. Manufacturing scalability and cost-effectiveness are additional advantages driving adoption, as BGA packages can be produced efficiently while meeting stringent performance standards.

The segment’s growth is further reinforced by the rising demand for miniaturized and power-efficient devices, where robust packaging is critical to functionality With the continuous scaling of semiconductor nodes and growing integration needs, BGA packages are expected to retain their leadership position in system-on-package designs.

The consumer electronics segment is expected to hold 41.2% of the system-on-package market revenue share in 2025, positioning it as the leading application area. This dominance is being driven by the increasing complexity of smartphones, wearables, gaming consoles, and connected devices, all of which require compact, power-efficient, and high-performance semiconductor solutions. System-on-package technology enables the integration of processors, memory, sensors, and communication modules into smaller footprints without sacrificing efficiency, making it particularly suited for consumer applications.

Growing consumer expectations for enhanced processing power, longer battery life, and multifunctionality in electronic products are accelerating the shift toward advanced packaging. The adoption of 5G-enabled devices, artificial intelligence-based features, and augmented reality applications is further boosting demand for compact integration solutions.

The segment is also benefiting from rapid product refresh cycles in consumer markets, where manufacturers seek packaging innovations to differentiate products and improve performance As consumer devices continue to evolve toward greater functionality and efficiency, system-on-package adoption is expected to remain strongest in this segment.

System-on-package is the latest technology in packaging of microelectronic components in a single chip.

The integration of these microelectronic components into one chip enhances the performance as well as reduces the cost. With the increasing demand for technologically advanced mobile devices among the consumers that are capable of performing an array of functions in a single small product is boosting the system-on-package technology compared to the conventional mode of packaging for semiconductors, thus boosting the market for system-on-package market.

Moreover, the system-on-package enables efficient integration of RF (Radio Frequency) front-end functional building blocks. The development of thin RF materials makes it easy to integrate into the system-on-package thus fulfilling the need of efficient wireless communication systems. With the aforementioned advantages, the global market for system-on-package is expected to register a healthy CAGR by the end of forecast period.

The global system-on-package market is primarily driven by the rising demand among the semiconductor packaging industry for compact electronic devices with high performance and cost effective packaging.

The conventional packaging cost of ICs like, die level packaging with the variation of sizes of the ICs the cost of packaging cost becomes more compared to production cost of the ICs.

Whereas, the system-on-package, is cost efficient compared to the production cost of the ICs. The technological advancements in RF materials, IC design & production is also to an extent propelling the growth of global system-on-package market.

Some of the new trends in the system-on-package market such as the 3D packaging, which provides improved electrical performance and packaging density, is also expected to boost the market for global system-on-packages market.

The fluctuations in some of the physical properties like the coefficient of thermal expansion of the materials of used for packaging with respect to the material of ICs, which is considered as a drawback of system-on-package technology which might restraint the market for system-on-package.

Based on the geographic regions, global automotive seating systems marketing market is segmented into seven key market segments namely North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and Middle East & Africa. Among the aforementioned regions, the Asia-pacific market for system-on-package market is projected to grow with a promising growth rate, which is due to the increase in demand for consumer electronics in the region.

Moreover, the presence of leading semiconductor manufacturers like Taiwan Semiconductor Manufacturing among others will have positive effect on the system-on-package market in APEJ.

The North America and Western Europe market for system-on-package is followed by the Asia-Pacific market and is expected to show stagnant growth over the forecast period.

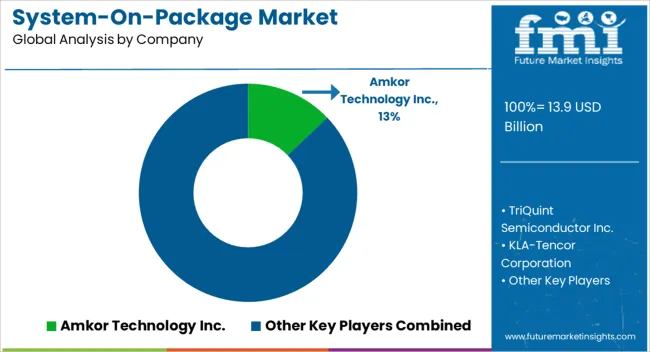

Some of the major players identified in the global system-on-package market includes, ChipMOS TECHNOLOGIES INC., STATS ChipPAC Ltd., IQE PLC, Amkor Technology Inc., TriQuint Semiconductor Inc., Deca Technologies, KLA-Tencor Corporation, Siliconware Precision Industries Co. Ltd., China Wafer Level CSP Co. Ltd., Jiangsu Changjiang Electronics Technology Co. Ltd among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

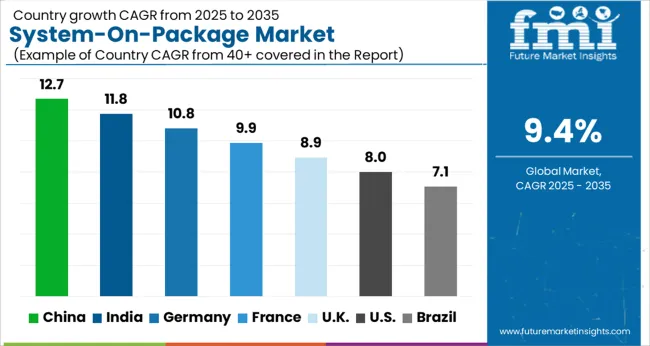

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

The System-On-Package Market is expected to register a CAGR of 9.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.7%, followed by India at 11.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.1%, yet still underscores a broadly positive trajectory for the global System-On-Package Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.8%. The USA System-On-Package Market is estimated to be valued at USD 4.7 billion in 2025 and is anticipated to reach a valuation of USD 10.2 billion by 2035. Sales are projected to rise at a CAGR of 8.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 759.2 million and USD 409.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.9 Billion |

| Packaging Type | BGA (Ball Grid Array) package, QFN (Quad Flat No-leads) package, and Wafer Level Package |

| Application | Consumer Electronics, Automotive, Aerospace, Healthcare, and Others (Defense) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amkor Technology Inc., TriQuint Semiconductor Inc., KLA-Tencor Corporation, China Wafer Level CSP Co. Ltd, ChipMOS Technologies Inc, STATS ChipPAC Ltd., IQE PLC, Deca Technologies, Siliconware Precision, AOI Electronics, Tongfu Microelectronics, Intel, Samsung, Texas Instruments, Carsem, Hana-Micron, and ASE Group |

The global system-on-package market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the system-on-package market is projected to reach USD 34.1 billion by 2035.

The system-on-package market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in system-on-package market are bga (ball grid array) package, qfn (quad flat no-leads) package and wafer level package.

In terms of application, consumer electronics segment to command 41.2% share in the system-on-package market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA