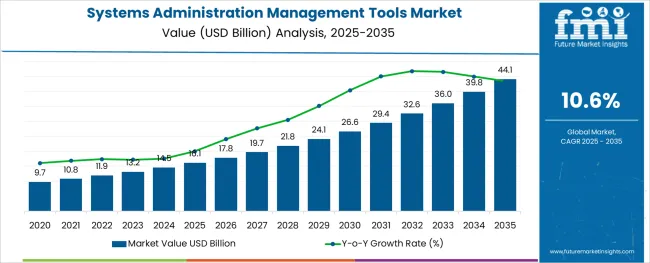

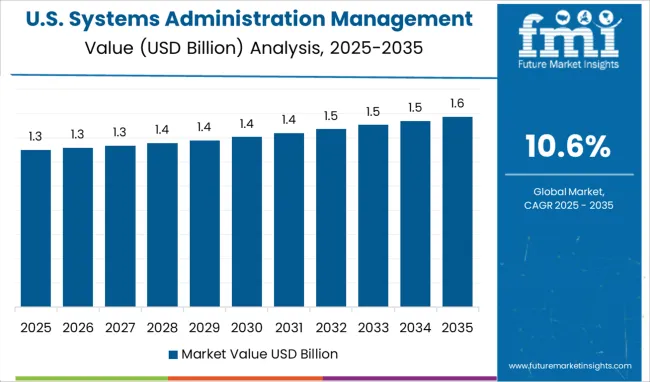

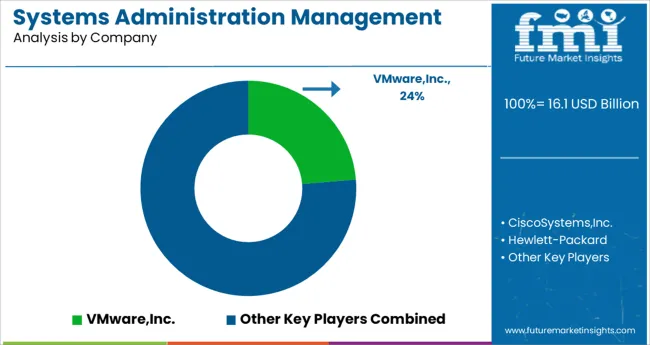

The Systems Administration Management Tools Market is estimated to be valued at USD 16.1 billion in 2025 and is projected to reach USD 44.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

The systems administration management tools market is undergoing a phase of rapid modernization as organizations shift toward agile IT frameworks and distributed infrastructure models. The increasing complexity of hybrid and multi-cloud environments has intensified demand for centralized tools that can provide visibility, control, and automation across servers, applications, and network components.

Enterprises are investing in platforms that offer unified dashboards, AI-based anomaly detection, and real-time configuration management to reduce downtime and operational risk. Additionally, the growing focus on cybersecurity, regulatory compliance, and SLA adherence is compelling IT leaders to deploy solutions that ensure proactive incident handling and streamlined change control.

Vendors are enhancing their offerings through modular architecture, API integrations, and self-service capabilities, enabling easier customization and faster deployments. As remote and edge computing expand globally, systems administration tools are expected to evolve toward predictive intelligence and zero-touch management, positioning the market for sustained long-term growth.

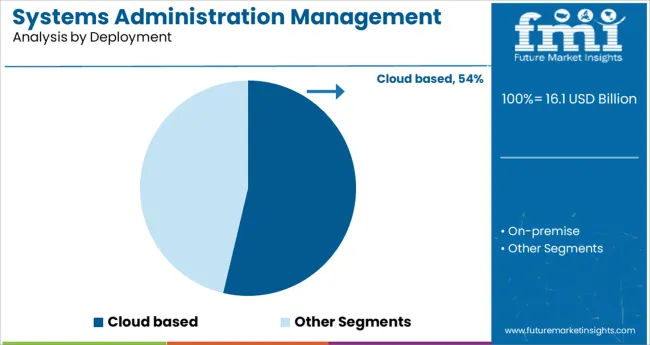

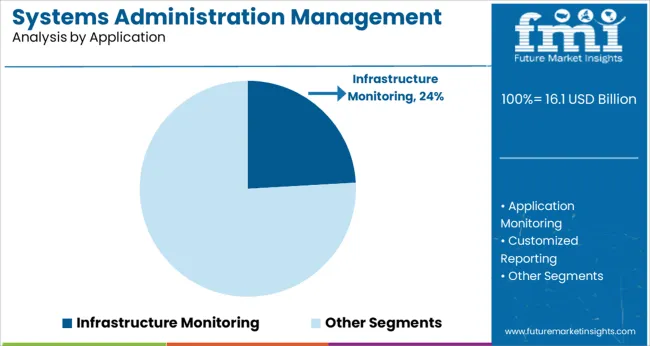

The market is segmented by Deployment and Application and region. By Deployment, the market is divided into Cloud based and On-premise. In terms of Application, the market is classified into Infrastructure Monitoring, Application Monitoring, Customized Reporting, Capacity Planning, System Performance Monitoring, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud based deployment segment is expected to account for 53.7% of total revenue in 2025, making it the leading deployment model. Its dominance is driven by the ability to offer scalable, on-demand infrastructure management without the capital and maintenance burden associated with on-premise solutions.

Organizations have increasingly favored cloud based platforms to support remote administration, continuous updates, and integration with third-party cloud services. Cloud based tools facilitate faster onboarding, centralized patching, and cross-platform compatibility which is critical in modern IT environments.

The rise of subscription-based licensing and modular pay-as-you-go models has further strengthened adoption, especially among mid-sized enterprises and managed service providers. As IT teams prioritize agility and global accessibility, cloud based deployment is set to remain the preferred model across the systems administration tools landscape.

The infrastructure monitoring segment is projected to capture 24.1% of market revenue in 2025 within the application category, establishing it as the leading application area. This segment’s growth is being propelled by the increasing need for continuous performance tracking across diverse and complex IT infrastructures.

Businesses are seeking tools that provide real-time insights into server health, storage capacity, network latency, and system availability to ensure business continuity. The integration of AI-driven alerting, historical analytics, and root cause diagnostics has made infrastructure monitoring a strategic priority.

With growing dependence on uninterrupted digital services, infrastructure monitoring has become central to risk mitigation, performance optimization, and capacity planning efforts. Enterprises are investing in tools that offer comprehensive infrastructure visibility across on-premise, cloud, and hybrid environments, driving sustained demand for advanced monitoring capabilities.

The need to efficiently manage, monitor, and preserve data assets is anticipated to boost the systems administration management tools market, as industries become more and more reliant on IT.

The demand for systems administration management tools and software is anticipated to rise as a result of system failure, power outages, human error, and other man-made and natural catastrophes.

Furthermore, hundreds of devices are added to the internet, and as services like R&D & testing, IT, telecom, and the internet undergo digital transformation, the adoption of systems administration management tools is expected to experience considerable development over the forecast period.

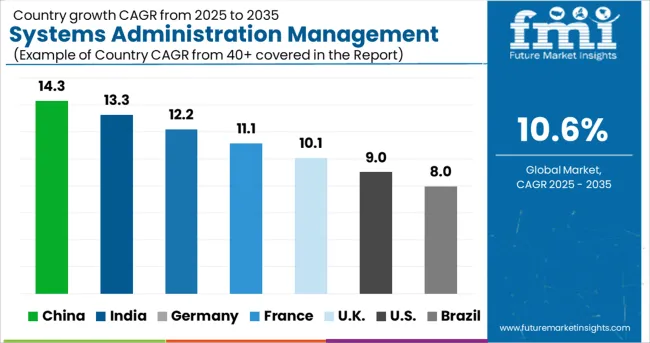

Europe is expected to have a systems administration management tools market share of 22.6% in 2025. The APEJ region is anticipated to have a growing demand for system administration management tools, owing to the help of rising IT player presence in nations like China and India, as well as rising call centre penetration.

By cutting trade taxes and duties, governments in developing nations like India, China, Taiwan, Indonesia, etc., are encouraging foreign investors to invest in their individual manufacturing sectors and creating more jobs.

The system administration management tools market in North America is anticipated to lead with a share of 39% in 2025.

Owing to the region's robust IT industry, rising IT spending across all industries, and the presence of significant system administration management tool suppliers in the region. Western Europe, then APEJ, are predicted to come after the North American region.

In order to increase the respective customer bases, a number of major market participants and start-ups in the global systems administration management tools market are now concentrating more on forming successful software updates, joint ventures, acquisitions, and/or collaborations.

| Companies | Leading Solutions |

|---|---|

| Cisco | A potent network controller, Cisco DNA Center runs on physical equipment and eventually supports virtual appliances. It uses facilitated processes created for the NetOps, AIOps, SecOps, and DevOps job categories. |

| Syxsense | Other OS and third-party deployments are handled separately by Syxsense from Windows 10 Feature Updates. It introduced its own ISOs to maintain devices with supported Windows 10 versions, lessening the administrative strain of managing semi-annual releases, and guaranteeing you don't miss crucial upgrades that may leave Windows 10 devices susceptible. |

| ProofHub | The creation, management, and tracking of tasks within a project are handled by the task management portion of ProofHub. Gantt charts and a visual-friendly Kanban format make it easy to plan and organize the team's tasks. ProofHub's active collaboration features enable the team to work together, whether they are based locally or remotely. |

| Scoro | A comprehensive business management tool called Scoro brings several teams, projects, sales, and reports all under one roof. The update focuses on managing your work more effectively and staying organized in all facets of your organization. |

Key players involved in the systems administration management tools sector are increasingly more engaged with launching strategies like targeted marketing, CSR programs, etc., as a way to increase their global significance.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.6% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Deployment, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC, South Africa |

| Key Companies Profiled | VMware, Inc. (USA); Cisco Systems, Inc. (USA); Hewlett-Packard (USA); Microsoft(USA); IBM (International Business Machines Corporation) (USA) |

| Customization | Available Upon Request |

The global systems administration management tools market is estimated to be valued at USD 16.1 billion in 2025.

It is projected to reach USD 44.1 billion by 2035.

The market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types are cloud based and on-premise.

infrastructure monitoring segment is expected to dominate with a 24.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Excitation Systems Market Analysis – Growth, Demand & Forecast 2025 to 2035

Fire Alarm Systems Market by Solution by Application & Region Forecast till 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA