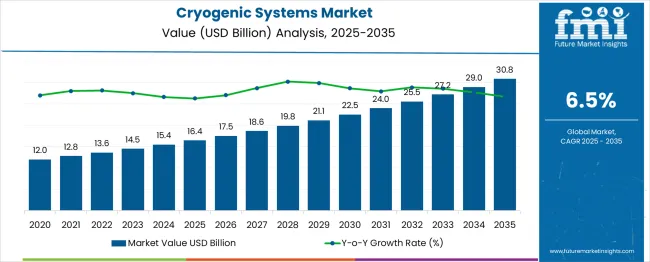

The Cryogenic Systems Market is estimated to be valued at USD 16.4 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Cryogenic Systems Market Estimated Value in (2025 E) | USD 16.4 billion |

| Cryogenic Systems Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

As per the Cryogenic Systems Market research by Future Market Insights - market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Cryogenic Systems Market increased at around 5.8% CAGR.

Cryogenic tanks are used to store and transport liquefied industrial gases such as oxygen, hydrogen, nitrogen, helium, and argon. It is often designed to store liquid gases at temperatures less than -150°C. It is available in a number of forms and sizes, including horizontal, vertical, double-walled, and insulated options.

It may be mobile or portable, as well as static or permanent. It is employed across several industries, including medical technology, food processing, electronics, and metal processing. It is extensively used to store LNG in LNG liquefaction facilities and tanker ships.

Natural gas use is growing as a result of its abundance, environmental friendliness, applications in a variety of sectors, and an ever-increasing energy need. Natural gas is high in demand in the power generating business.

The carbon footprint of contemporary fossil-fuel power plants, such as coal plants, is causing concern among the general population. As part of their environmental protection and climate change commitments, governments throughout the world are adopting various policies and agreements to reduce their countries' carbon footprints.

As the need for power rises, so does the need for sustainable energy production techniques, and LNG is one of the potential winners in this race.

The spike in demand for Cryogenic Systems across a variety of sectors, including electronics, healthcare, and power generation, has led to a rapid growth rate in the Cryogenic Systems market. Furthermore, use of Cryogenic Systems is expected to surge in the coming years owing to rising LNG production and strong demand for gases in the healthcare sector.

The growing demand for cryogenic gases for medical applications will drive market expansion in the coming years. Oxygen gas, for example, is in high demand in the medical business owing to the diagnosis of respiratory illnesses.

Growing medical infrastructure and extensive application across a variety of sectors are projected to drive market growth in the next years.

Furthermore, industries such as aircraft, transportation, and railroads have a high demand for Cryogenic Systems, and this trend is expected to continue in the coming years. Improvements in Cryogenic Systems insulation methods are actively contributing to market growth.

Many governments throughout the world have planned to phase out coal-based electricity by 2024 in order to reduce greenhouse gas emissions. For the reasons stated above, several nations have begun to reduce their reliance on coal and increase their use on natural gas for energy and power generation.

Liquefied natural gas (LNG), which contains various segments of Cryogenic Systems such as tanks, is more pleasant to transport and is expected to boost the market throughout the projection period.

In 2024, revenue through energy and power accounted for more than 25% of the global market. The increased requirement to augment oil production through methods such as enhanced oil recovery and hydraulic fracturing will drive up demand for these commodities across the sector.

Furthermore, technological advancements in the finding of unconventional oil and gas resources such as tight gas, tight oil, shale gas, and coal bed methane will propel the industry ahead.

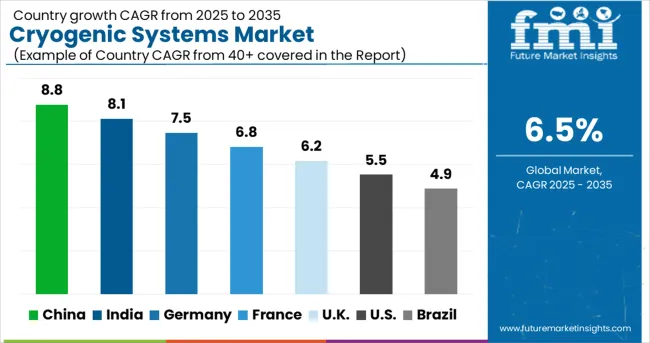

Asia Pacific will be a significant market by 2024, accounting for more than 30% of overall sales. In the absence of pipelines, LNG is stored in tanks and delivered as required.

Demand has increased as a consequence of an increased investment in LNG transportation as an energy and fuel source in Asian nations. Asian healthcare institutions store and maintain rare blood types that need temperatures as low as 165°C.

Europe is likely to take a considerable market share during the forecast period due to its broad application in the food and beverage, healthcare, and electronics industries to preserve materials at low temperatures.

LNG is preferred by the European government since it is a low-emission fuel that addresses environmental concerns. A massive volume of LNG is shipped to major European nations, generating demand for storage tanks for these gases.

The United States is expected to account for the largest Cryogenic Systems market accounting for USD 30.8 Billion by the end of 2035. The US market will increase rapidly due to the country's swelling capacity of natural gas liquefaction and huge expenditures on new exploration and production projects.

The five additional projects announced by the government are Cameron, Cove Point, Corpus Christi, Freeport, and Elba Island, which increased the total US liquefaction capacity from 1.16.4 Bcf/d in 2020 to 9.5 Bcf/d by 2020.

The Chinese market is estimated to hit USD 16.4 Billion by 20246.4. The rising manufacturing sector, helped by ongoing investments in expanding existing units, will promote corporate growth. In 2024, manufacturing value-added will contribute to around 29% of the country's GDP.

Furthermore, in 2024, China announced a long-awaited relaxation of foreign investment restrictions in a variety of sectors, including heavy industries, power grids, automotive, banking, and agricultural.

The demand for Cryogenic Systems in LNG segment is forecasted to grow at the highest CAGR of over 7.8% during 2025 to 2035. This increase is attributable to the increasing need for improved studies based on past patterns and datasets in order to create data-enriched insight that would assist enterprises in better understanding the present situation.

LNG demand is growing all around the globe. According to the International Gas Union, LNG trading climbed by 9.8% year on year in 2020. To meet increased LNG demand, governments are investing heavily in LNG storage and regasification infrastructure.

In 2020, two new regasification plants were launched in Bangladesh and Panama. Tanks, vaporizers, valves, and heat exchangers are among the tools required for such infrastructure projects. As a consequence of these reasons, Cryogenic Systems for LNG is predicted to grow at the highest CAGR of 7.8% throughout the forecast period.

The power & energy sector accounted for more than 20% of overall Cryogenic Systems sales in 2024. Increased investment in the energy business, especially in developing markets, provides the potential for growth.

The power and energy sector uses Cryogenic Systems for increased fuel efficiency, lowering operating costs. They enable the storage, distribution, and handling of LNG at sea as well as on land.

With the COVID-19, power costs in some locations, notably Europe reached all-time lows in the first half of 2024. Furthermore, due to the severity of the epidemic, businesses are focused primarily on key activities, leading industrial component installation to come to a halt.

Due to the global shutdown, makers of these components are experiencing a variety of difficulties with order fulfillment. Cryogenic Systems installation has been impacted by the slowing of operations in various sectors, including rail transportation, healthcare, food and beverage, shipping, electronics, chemicals, metallurgy, and energy and power.

In order to solve the issue, most manufacturing units in India, as well as other countries in the Asia Pacific, are trying to manufacture a range of healthcare goods, including personal protective equipment (PPE) kits for emergency services.

VRA Asia Pacific, for example, a company that develops and manufactures Cryogenic Systems, produces high-quality liquid cylinders and storage tanks for liquid oxygen storage.

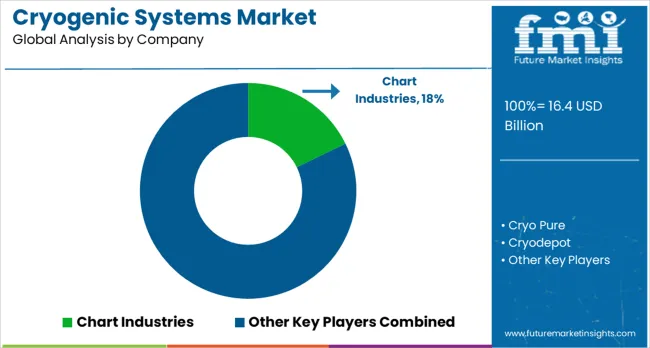

The industry is characterized by high competition due to the presence of a few well-established rivals. The market considers performance, price, technical experience, and the ability to design and manufacture Cryogenic Systems.

Existing companies like as Charts Industries, Linde Group, and Herose GmbH have made significant investments in R&D to decrease the dangers associated with this type of equipment.

Furthermore, the growing demand for on-site gas supply in a wide range of sectors is compelling manufacturers to improve technology and apply aggressive management in all areas of production and distribution.

A key business strategy utilized by notable purveyors is the acquisition of enterprises that complement a purveyor's current goods and services.

Some of the recent developments of key Cryogenic Systems providers are as follows:

Similarly, recent developments related to companies’ Cryogenic Systems services have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK., France, Spain, Italy, Russia, China, Japan, South Korea, India, Australia, South Africa, Saudi Arabia, UAE and Israel. |

| Key Market Segments Covered | Cryogen , End Use, Region |

| Key Companies Profiled | Chart Industries; Cryo Pure; Cryodepot; Cryofab; Cryogenic Systems Equipment, Inc.; Cryoquip; FIBA; HEROSE GmbH; Packo Industry; Shell-N-Tube; The Linde Group; Wessington Cryogenics |

| Pricing | Available upon Request |

The global cryogenic systems market is estimated to be valued at USD 16.4 billion in 2025.

The market size for the cryogenic systems market is projected to reach USD 30.8 billion by 2035.

The cryogenic systems market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cryogenic systems market are nitrogen, oxygen, argon, lng and other cryogen.

In terms of end use, energy & power segment to command 38.9% share in the cryogenic systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Helium Cycling System Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vial Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Technology Market

Cryogenic vial rack Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA