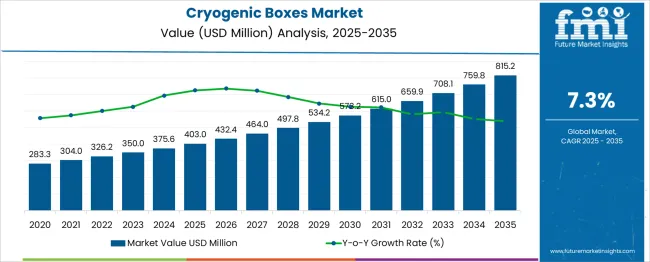

The Cryogenic Boxes Market is estimated to be valued at USD 403.0 million in 2025 and is projected to reach USD 815.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Cryogenic Boxes Market Estimated Value in (2025 E) | USD 403.0 million |

| Cryogenic Boxes Market Forecast Value in (2035 F) | USD 815.2 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

During the historic period (2020 to 2024), the cryogenic boxes market grew at a CAGR of 5.5% and valued at USD 375.6 Million in 2024. However, with the increase in manufacturing of vaccine and cosmetic products, the global market is estimated to increase 2.2x over the next decade.

Cryogenic boxes are used to store and transport organic material at ultra-low temperatures for short or long period of time. It is designed to keep cryogenic vials and tubes safe, utilizing modern technologies and products to give a boost to the cryogenic box market. Various market participants and product innovations helped to increase market penetration during this time period.

The market for cryogenic boxes observed exponential growth following the outbreak of COVID-19. Growth is also due to increasing research into better vaccine development, introduction of antiviral medications, and immunity-boosting shots.

Furthermore, increasing demand owing to non-fragile lab applications is another driving the cryogenic boxes market. Application of cryogenic boxes in healthcare sector is expected to create significant revenue creating opportunities for the manufacturers.

The biopharmaceutical sector is gaining immense traction in the pharmaceutical industry, and it has the potential to grow rapidly in the next years. Disruptive technologies, digitization, and a comprehensive approach to the treatment of incurable diseases are some of the factors boosting the market.

With the expansion of biopharmaceutical industry, cryogenic box applications are expected to surge. Cryovials could be utilized to store cancer, HIV, and Alzheimer's disease medications. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), the biopharmaceutical business in the United States accounted for 3.2 percent of total GDP in 2020, with a value of USD 625 billion. This is further expected to increase the sales of cryogenic boxes in upcoming decade.

The cryogenic boxes demand is increasing for storing and transporting vaccines, chemicals, and various other ingredients in different packaging formats such as vials, ampoules, and tubes. The demand for cryogenic boxes for storing powder or liquid ingredient in vials is surging across the globe.

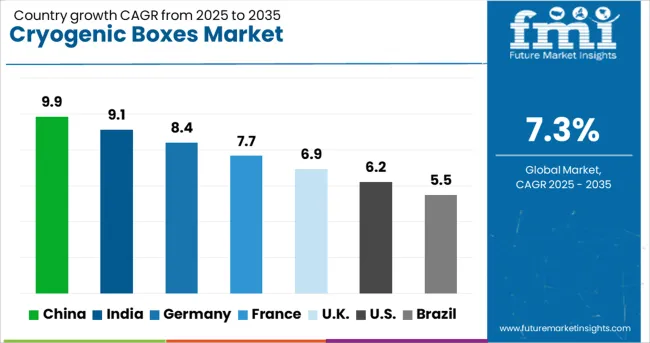

However, due to increasing clinical research and drug research in India, the demand for cryogenic boxes for storing tubes is expected to rise in South Asia. As per FMI, South Asia market is expected to hold a market share of 44% during the forecast period.

Consumption and sales of cryogenic boxes in ampoules segment is estimated to hold a varying market share between 10-15% in all regions. Although this consist of low market share in Europe, it is expected to increase with the significant pace in 2025 to 2035.

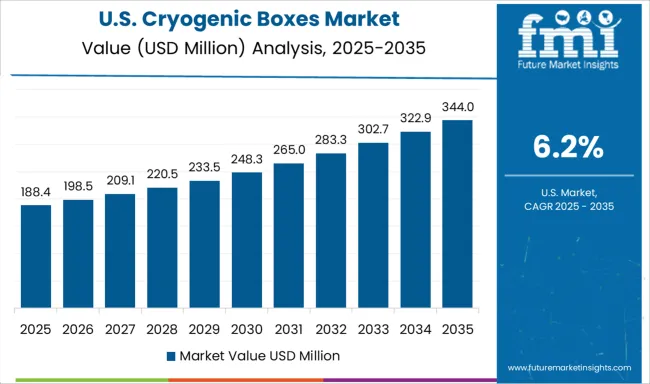

Presence of Leading Cryogenic Boxes Manufacturers in the USA to Push the Sales

The USA is considered to have the lowest market barriers to new market entrants in the pharmaceutical industry. It also has the most favorable business climate for the research and sale of pharmaceutical equipment and medications.

According to FMI, the USA will reach a valuation of USD 403 Million in 2025, accounting for about 23% of the worldwide cryogenic box market.

As per the annual report published by Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers, Government of India, India pharmaceutical industry is the world’s third largest by volume and 14th largest by value.

India is the largest provider of generic drugs globally. India supplies affordable and low-cost generic drugs to millions of people across the globe and operates a significant number of United States Food and Drug Administration (USFDA) and World Health Organization (WHO) Good Manufacturing Practices (GMP)-compliant plants.

India accounts for 60% of global vaccine production, contributing 40 to 70% of the WHO demand for Diphtheria, Tetanus and Pertussis (DPT) and Bacillus Calmette–Guérin (BCG) vaccines, and 90 percent of the WHO demand for the measles vaccine.

FMI team predicts that increasing exports and imports of vaccines and many other ingredients expected to create USD 28.3 Million revenue opportunity in next decade.

Growing Sustainability Concerns to Spur the Sales of Paper & Paperboard Cryogenic Boxes

Plastic cryogenic box accounts for over 50% of the whole cryogenic box market, according to FMI. Demand for plastic cryogenic boxes in humid areas for protection against rain, dampness, as well as other liquid contents, is increasing.

However, paper & paperboard cryogenic boxes are gaining traction due to the easy biodegradable property of paper & paperboard cryogenic box and government restrictions also prohibit the use of plastic cryogenic box in various countries.

Cryogenic Boxes Market to Benefit from Rising Application in Healthcare Industry

Among the end-use, healthcare accounted for the largest share in 2024 and is poised to maintain its reign during the forecast period. Healthcare is expected to accelerate with a CAGR of 8% in the global market is expected to attract investors.

As per the report published by World Health Organization, global spending on health more than doubled in real terms over the past two decades, reaching USD 8.5 trillion in 2020, or 9.8% of global GDP.

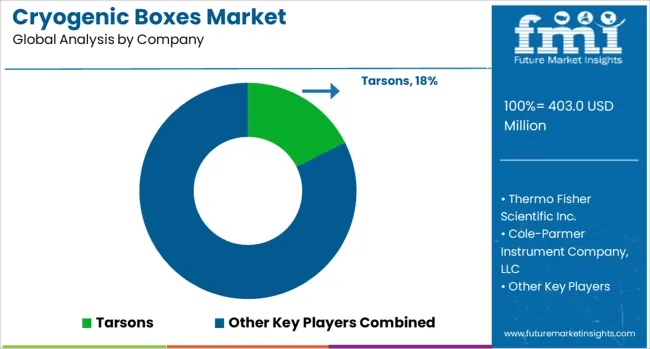

With big global and local competitors, the cryogenic box market is fiercely competitive. Customers can choose their sizes thanks to the market's leading companies. Cryogenic box lids are also being innovated by several manufacturers in order to gain market share.

Market shares are projected to change as a result of overall innovation in material, size, and appearance. Some of the market's major companies are Tarsons, Thermo Fisher Scientific Inc., Cole-Parmer Instrument Company, LLC, Merck KGaA, ratiolab, BIOLOGIX GROUP LTD, Heathrow Scientific, Bioline Technologies, TENAK A/S, Deluxe Scientific Surgico Private Limited, CAPP, GENAXXON bioscience, Glassco, AHN BIoTechnologie GmbH

Some of the key developments:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, UK, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Material, Application, End Use Industry, Region |

| Key Companies Profiled | Tarsons; Thermo Fisher Scientific Inc.; Cole-Parmer Instrument Company; LLC, Merck KGaA, ratiolab; BIOLOGIX GROUP LTD; Heathrow Scientific; Bioline Technologies; TENAK A/S; Deluxe Scientific Surgico Private Limited; CAPP; GENAXXON bioscience; Glassco; AHN BIoTechnologie GmbH |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global cryogenic boxes market is estimated to be valued at USD 403.0 million in 2025.

The market size for the cryogenic boxes market is projected to reach USD 815.2 million by 2035.

The cryogenic boxes market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in cryogenic boxes market are paper & paperboard, plastic and metal.

In terms of application, vials segment to command 46.2% share in the cryogenic boxes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Helium Cycling System Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vial Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Technology Market

Cryogenic vial rack Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA