Global Alzheimer's therapeutics market is estimated to be USD 4,288.8 million in 2025 and is also expected to grow to reach USD 10,433.9 million by 2035. In addition to this, it is also projected to grow at a CAGR of 9.3% during the forecast period of 2025 to 2035. In the year 2024, it has generated revenue of USD 3,873.1 million from Alzheimer's therapeutics.

The demand for Alzheimer’s drugs will change intensely over the next decade, primarily driven by breakthrough drug approvals for many novel therapies, advancements in disease-modifying therapies and increased investments in precision medicine.

Researchers are shifting from symptomatic treatments to targeted therapies that modify disease progression, particularly in areas like beta-amyloid, tau proteins, and neuroinflammation. In coming years, monoclonal antibodies, small-molecule inhibitors and gene therapies will come to represent treatments in enhancement of efficacy.

The diagnostics sector will be driven by biomarkers and defining personalized treatment strategies which will further improved patient outcomes. Governments and private organizations are pumping more funds into Alzheimer research, thereby speeding up the drug discovery.

Regulatory agencies will also expedite approvals for innovative therapies, and time-to-market for novel drugs will be shortened. With increasing demand for non-invasive and long-acting therapies, nanotechnology and drug delivery innovations will improve the effectiveness of treatments.

By 2035, the market is expected to adopt combination therapies at a higher scale, AI-driven drug discovery, and improved access to novel treatments for patients. The aging population and rising Alzheimer's cases all over the globe are driving a higher demand for therapeutics; therefore, the market will face strong, steady growth.

Global Alzheimer’s Therapeutics Industry Assessment

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4,288.8 million |

| Industry Value (2035F) | USD 10,433.9 million |

| CAGR (2025 to 2035) | 9.3% |

Higher life expectancy among the developed and developing nations has meant that the cases of neurodegenerative diseases are on an increase, creating a higher need for advanced drug therapies.

Pharmaceutical companies and research centers are pushing the pace to develop drugs further as cases have been increasing steadily in countries with high percentages of the population at or above the age of 65, like Japan, the United States, and Germany.

It is also leading to increased costs of healthcare. The cost for Alzheimer's-related spending is estimated to be USD 1 trillion per annum in the coming decades, and this is creating an immediate need for novel treatment strategies.

Additionally, the incurable nature and progressive course of the disease emphasize the necessity for DMTs and symptomatic therapies. Governments and institutions worldwide have recently introduced programs that focus on spreading awareness and financing and establishing incentives to enforce regulation to bring research-based innovation to the marketplace with novel drugs against Alzheimer's.

These increasing cases, costs, and new initiatives for better health continue driving the Alzheimer's therapeutics market as one of the most vibrant and dynamic as well as a fast-changing fields of neurodegenerative drug development.

The table provided below reflects the expected CAGR for the market of Alzheimer's therapeutics all over the globe across multiple periods semi-annual from 2025 up to 2035.

The company is going to face the rate of growth based on the given CAGR to be 9.2%, which will become lower than what the expected value for growth at the same time during the half period in this decade from H1 spanning across 2024 and 2035 will post 9.7%.

| Particular | Value CAGR |

|---|---|

| H1 | 9.2% (2024 to 2034) |

| H2 | 9.7% (2024 to 2034) |

| H1 | 9.3% (2025 to 2035) |

| H2 | 9.9% (2025 to 2035) |

Moving into the next period, from H1 2025 to H2 2035, the CAGR is expected to decline slightly to 9.3% in the first half and rise moderately at 9.9% in the second half. In the first half (H1) the market experienced a decline of 10.00 BPS while in the second half (H2), the market experienced a rise of 18.72 BPS.

Breakthroughs in Disease-Modifying Therapies Accelerating the Future of Alzheimer’s Treatment

Recent breakthroughs in the DMT space are expected to form the future directions for curbing the progression of the disease. New drug classes, such as monoclonal antibodies, small-molecule inhibitors, and anti-amyloid therapies, emerge since they offer a chance at attacking disease processes rather than the symptoms.

FDA Approvals of New Alzheimer's Medications, Aducanumab (Aduhelm) and Lecanemab (Leqembi), Gave New Hope to Patients and Their Caregivers - Beta-amyloid Plaque Reducers - This time, the change in course from targeting only cognitive decline to modifying the pathology of Alzheimer's disease had finally arrived in the United States.

The approval of these treatments by regulatory authorities has initiated significant investment by the big pharmaceutical firms as major companies, including Biogen, Eisai, and Eli Lilly, accelerate research on next-generation therapeutics.

More significantly, the speedy FDA fast track and breakthrough designations for Alzheimers drugs have positioned the regulatory backdrop favorably so that biopharmaceutical firms are now venturing to enrich their R&D pipelines.

More clinical trials began targeting tau proteins, neuroinflammation, and synaptic dysfunction, which helps to strengthen innovative growth in this market. Those developments put Alzheimers therapeutics ready for strong, long-term expansion.

National Alzheimer’s Plans and Research Grants Boosting Drug Development and Market Expansion

There is increased funding by governments and research institutions as well as private entities interested in the discovery of new drug therapies, hence contributing to the growth of the Alzheimer's therapeutics market. Positive impacts on the economic and social spheres resulting from the prevalence of Alzheimer's disease have led global healthcare agencies to invest heavily in discovering drugs, biomarkers, and early diagnostic technologies.

The NIA has, for example been used by the USA government to capture vast amounts of money by giving research grants aimed at the discovery of novel therapeutics such as disease-modifying treatments and precision medicine strategies. In this case, ADDF is financing innovative biotech projects, thereby facilitating drug development in the quickest time possible.

More recent initiatives around the world - one example would be the DDF, facilitating interaction between the world's most biotechnology-friendly companies, cutting-edge academic research leaders, and even pharmaceutical industries-to accelerate therapy invention.

More about funding those types of innovation toward new targets and neuroprotection strategies to drive advanced trials are ensured as faster candidates along the regulatory pipeline move forward.

National Alzheimer's plans in place by governments could help support research and improve care for patients. As interest builds among both public and private sectors, the Alzheimer's therapeutics market will see a growing pace of expansion and provide more effective treatments in the near future.

Advancements in Stem Cell Therapy Driving a Paradigm Shift in Alzheimer’s Treatment

Mesenchymal stem cells and induced pluripotent stem cells are being seriously explored in an extensive degree with respect to their therapeutic potential in repairing damaged neurons, enhancing synaptic function, and modulating neuroinflammation on the fundamental level of the disease.

Unlike the existing monoclonal antibodies or cholinesterase inhibitors, which generally target slowing disease progression or merely alleviating the symptoms, this stem cell therapy is more inclined toward cell regeneration and neuroprotection, a disease-modifying approach.

Investigations have shown that MSCs could differentiate into neural cells, release neurotrophic factors, reduce oxidative stress, and restore some of the lost cognitive functions. Moreover, the iPSC holds the promise for personalized treatment potential by generating patient-specific neurons with reduced risk of immune rejection and improved long-term therapeutic outcomes.

Regulatory agencies also have growing interest in quick-tracking novel cell-based therapies. Neuroprotective stem cell therapy shall eventually emerge as a pioneering treatment with fully opened streams of revenue and fundamentally changing the competitive structure of the Alzheimer's therapeutics market.

Failures in Late-Stage Clinical Trials Weakening Confidence in Tau-Based Alzheimer’s Treatments

Tau protein aggregation is a hallmark characteristic of Alzheimer's disease, and it becomes an obvious target for drug discovery in neurodegenerative diseases. However, tau-targeting drugs that failed in late-stage clinical trials remain an important challenge and restraint for the market of Alzheimer's therapeutics.

Although much has been invested, therapies blocking tau aggregation, tau antibodies, and even tau vaccines have not shown much clinical efficacy to gain traction in this treatment approach.

One of the main reasons for this failure is the fact that there is no clear mechanistic understanding regarding tau pathology. Although tau tangles have become widely associated with Alzheimer's, it still remains unclear how tau aggregation drives cognitive impairment and when it becomes a therapeutic target.

Such a lack of clarity has rendered researchers efforts to devise successful treatments that could possibly reverse or halt tau pathology an invitation to failure.

Tau-targeting therapies face a number of drug delivery challenges. Drug delivery can become increasingly problematic since tau proteins are located much deeper in the neuron than traditional drugs used in treatment. The BBB reduces the ability of numerous drugs to get into the brain and has hence limited the effectiveness of tau-targeting therapies.

This in turn has delayed the disease-modifying drugs, hence the venture has become uncertain and risky for pharmaceutical companies. This has, in addition, led to a slump in investor confidence that limits the funds allocated to tau-targeting research and therefore slows the growth of the overall Alzheimer's market.

The global market for Alzheimer's therapeutics registered a growth rate of 10.5% during the historical period from 2020 to 2024. The Alzheimer's therapeutics industry grew at a positive growth rate, with the value of the industry growing from USD 2,601.0 million in 2020 to USD 3,873.1 million in 2024.

Historically, symptomatic treatments have dominated the market of Alzheimer's therapeutics. This started with cholinesterase inhibitors, coupled with NMDA receptor antagonists, which manage symptoms only but do not affect the progression of the disease. In the last decade, little was much different, and growth is small and slow, in part due to the challenge of developing effective DMTs.

Indeed, in fact, recent breakthroughs in the area occurred after the approval of amyloid-targeting monoclonal antibodies, Aducanumab and Lecanemab, that have been showing some hope to be able to slow the progression of the disease.

There is an increasing attention being laid on more radical treatments, starting from tau-targeting therapies to gene therapies or stem cell approaches.

Gene-editing tools CRISPR technology are being tried for targeting risk genes for the development of Alzheimer's, as well as offering repair of destroyed neurons and thus regenerating memory functions through this type of treatment. These types of emerging therapy treatments are setting up a future for disease-altering solutions providing long-term remedies rather than purely symptomatic medications.

Future market trends will concentrate on precision medicine through genetic biomarkers and AI-driven diagnostics for early diagnosis and personalized treatment plans.

Combination therapies are also gaining importance, as employing the effect of many disease pathways at once can improve treatment efficacy. As the market emerges, regulatory progress and increasing government and private investments in research will come to dictate the future face of Alzheimer's therapeutics.

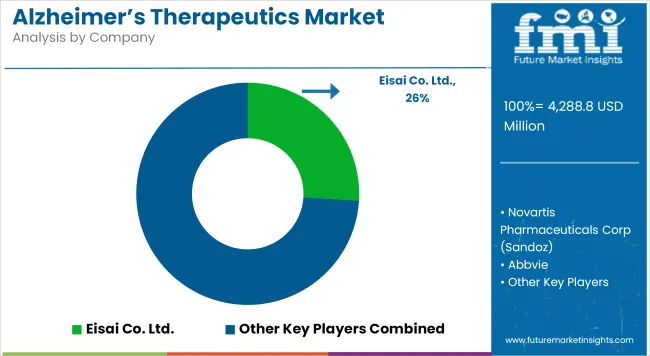

Tier 1 Companies are the market leaders that hold a significant market share of alzheimer’s therapeutics market, which stands at about 49.7% in 2024. These drug developers are focused on developing new therapies, strategic partnerships and mergers and acquisitions to increase their product offerings and gain access to state of the art technologies.

These drug developers also concentrate on aggressive clinical trials in order to prove the safety and efficacy of their products. Major players in this space includes Eisai Co. Ltd., Novartis AG, AbbVie, Aurobindo Pharma Ltd. and Viatris.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 33.3% market share.

They typically pursue partnerships with multispecialty hospitals and research organizations to leverage emerging technologies and expedite product development. These companies often emphasize agility and adaptability, allowing them to quickly bring new products to market, additionally targeting specific types medical needs.

Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include Johnson & Johnson, DR REDDYS LABS LTD, MACLEODS PHARMS LTD and others.

Finally, Tier 3 companies, such as Sun Pharmaceutical Industries Ltd., Unichem, Lannett co Inc. and Others. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the Alzheimer’s therapeutics sales remains dynamic and competitive.

The section below covers the industry analysis for the Alzheimer’s therapeutics market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided.

The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 11.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 9.0% |

| Germany | 11.0% |

| UK | 9.7% |

| Japan | 12.0% |

| India | 11.6% |

| South Korea | 9.5% |

| Australia & New Zealand | 3.0% |

| South Korea | 9.3% |

United States Alzheimer’s therapeutics market is poised to exhibit a CAGR of 9.0% between 2025 and 2035. Currently, it holds the highest share in the North American market.

Such advancement in clinical infrastructure makes the United States a giant in Alzheimer's clinical trials. The country provides an extensive set of research hospitals, academic institutes, and clinically excellent centers particularly for Alzheimer's disease. Facilitating such leading-edge expertise in technology and diversified patient populations have greatly accelerated this development of novel drug candidates in the country.

This strong infrastructure allows for faster recruitment and high-quality data collection, thereby ensuring efficient clinical testing. United States-based companies can go through the drug development process faster by enrolling a greater number of patients in clinical trials, as required. This reduces the timelines for approval from the FDA.

Since most large-scale clinical trials for Alzheimer's prefer conducting them in the United States, it acts as a competitive advantage for pharmaceutical companies, thereby fueling the growth of the market. It ensures that new Alzheimer's drugs come to market more quickly for patients and health providers.

Germany is currently the largest, with a major share in Western Europe, while it is growing at a very high CAGR of 11.0% between 2025 and 2035 in the Alzheimer's therapeutics market.

Germany also contributes to advancements in Alzheimer's therapeutics by spending a large sum of money in research and development. The country's funding body, which is the Federal Ministry of Education and Research, makes significant allocation of funds for the research, where public and private biotech firms can pool efforts to find novel therapeutic purposes.

Such an approach of the German model of synergies between university, research institution, and clinic ensures public-private partnerships in pushing forward novel disease-modifying drugs, biomarker discovery, and drug development.

The emphasis on innovation and collaboration strengthens Germany's chances of translating simple research into actual clinical applications in the Alzheimer's therapeutics market. Public investment increases the allure of the nation for clinical studies, thus supporting the development schedule of new therapy adoption. That strong government backing for healthcare benefits advances the potential for Germany's place in this industry.

India Alzheimer’s therapeutics market is poised to exhibit a CAGR of 4.3% between 2025 and 2035. Currently, it holds the highest share in the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

Significant growth in the areas of both public and private investment in India regarding neurodegenerative disease research, more particularly Alzheimer's disease, can be seen today.

The institutions in the leadership ranks include Indian Institute of Technology, Indian Council of Medical Research, and many other private pharmaceutical companies that have initiated efforts towards innovation in Alzheimer's disease treatments. These programs aims at targeting the early disease diagnosis, discovery of disease modifying agents, and also biomarker detection.

There is a significant influx of funds which is helping the progress of Alzheimer's research, fueling the discovery of new drug candidates and therapeutic interventions.

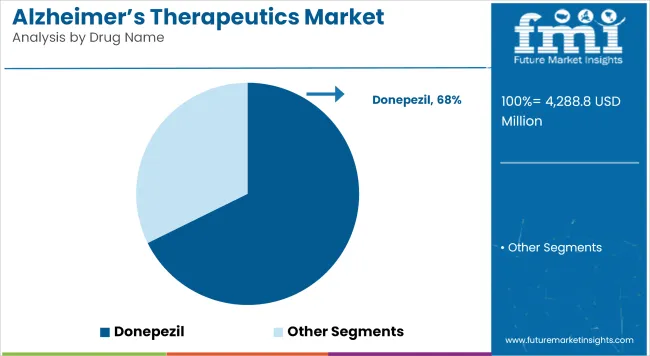

The section contains information about the leading segments in the industry. By drug name, the Donepezil segment holds the highest market share of 67.7% in 2025.

| By Drug Name | Value Share (2025) |

|---|---|

| Donepezil | 67.7% |

Donepezil has been the largest-selling Alzheimer's drugs in the market due to its proven efficacy and versatility in use. This is a cholinesterase inhibitor that raises the brain's acetylcholine levels necessary for memory, as well as the cognitive mechanism. It works by alleviating the symptoms of mild or moderate Alzheimer's disease.

Over two decades, the drug has become a mainstay in the treatment of Alzheimer's disease, with its well-established clinical track record and good safety profile, which makes it the first-line treatment for many patients. Donepezil is also widely available in generic formulations, enhancing accessibility and affordability for both developed and emerging markets.

Even though newer and advanced therapies exist, Donepezil is still there, having been retained for the reasons of cost-effectiveness, proven results, and long-standing clinical approval. The drug is a significant treatment and greatly contributes to global market share in terms of Alzheimer's therapeutics.

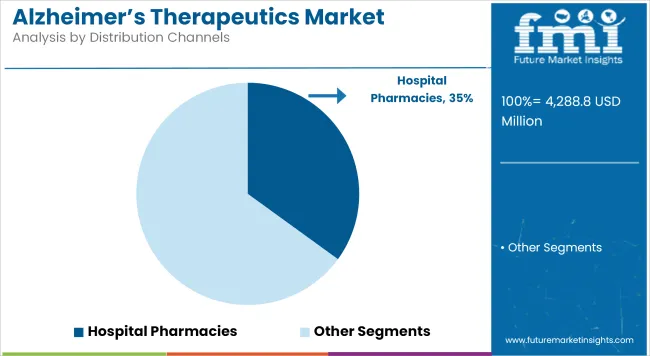

| By Distribution Channels | Value Share (2025) |

|---|---|

| Hospital Pharmacies | 35.0% |

Hospital pharmacies dominate the Alzheimer's therapeutics market because of the strategic role of these pharmacies in patient care, especially for the moderate to severe stages of Alzheimer's disease.

Hospital pharmacies tend to be the primary distribution channels for prescription medicines for Alzheimer's because patients that require special treatment usually go to hospitals or specialty clinics. These conditions guarantee full control over the disease; medicines like Donepezil, Memantine, and other treatments for Alzheimer's are taken under the guidance of doctors.

Hospital pharmacies have qualified medical professionals who can prescribe the proper therapies based on the needs of the patients. Moreover, there is a direct relationship between pharmaceutical companies and the hospitals, thus ensuring a regular supply of newly developed Alzheimer's drugs.

A hospital pharmacy puts emphasis on individualized care of patients and also provides critical care support in treatment, which boosts the market greatly. Therefore, the largest distribution channel is a hospital pharmacy with reliable access to Alzheimer's therapeutics.

Market players use product differentiation, through innovative formulation and strategic partnership with health-care providers for distribution. The key strategic focus for these companies would be to aggressively search for strategic partners that could further their portfolio and extend the market globally.

Recent Industry Developments in Alzheimer's Therapeutics Market

In terms of drug name, the industry is divided into- Donepezil, Rivastigmine, Memantine, Galantamine and Manufactured Combination.

In terms of drug class, the industry is segregated into- cholinesterase inhibitors, NMDA receptor antagonists and manufactured combination.

In terms of distribution channels, the industry is segregated into- hospital pharmacies, retail pharmacies, drug stores and online pharmacies.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global Alzheimer’s therapeutics market is projected to witness CAGR of 9.3% between 2025 and 2035.

The global Alzheimer’s therapeutics industry stood at USD 3,873.1 million in 2024.

The global Alzheimer’s therapeutics market is anticipated to reach USD 10,433.9 million by 2035 end.

Japan is set to record the highest CAGR of 12.0% in the assessment period.

The key players operating in the global Alzheimer’s therapeutics market include Eisai Co. Ltd., Novartis Pharmaceuticals Corp (Sandoz), Abbvie, AUROBINDO PHARMA LTD, Viatris, Johnson & Johnson, DR REDDYS LABS LTD, MACLEODS PHARMS LTD and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 14: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 29: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fucosidosis Therapeutics Market - Growth & Innovations 2025 to 2035

Market Leaders & Share in Alzheimer’s Therapeutics

Sarcoidosis Therapeutics Market

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA