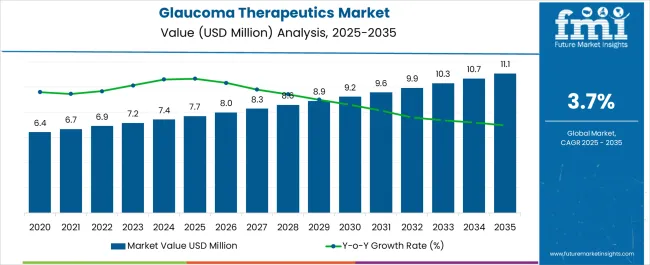

The Glaucoma Therapeutics Market is estimated to be valued at USD 7.7 million in 2025 and is projected to reach USD 11.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Glaucoma Therapeutics Market Estimated Value in (2025 E) | USD 7.7 million |

| Glaucoma Therapeutics Market Forecast Value in (2035 F) | USD 11.1 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The glaucoma therapeutics market is witnessing a steady rise in demand, influenced by the growing global prevalence of age-related eye disorders, expanding geriatric population, and improved early diagnostic practices.

Increasing awareness campaigns led by public health bodies, combined with rising availability of topical and systemic treatment options, are supporting the market’s expansion.

Advancements in drug formulation, such as sustained-release delivery systems and preservative-free options, are improving patient compliance and clinical outcomes.

Insights into the Eye Drops Glaucoma Therapeutics Treatment Type Segment

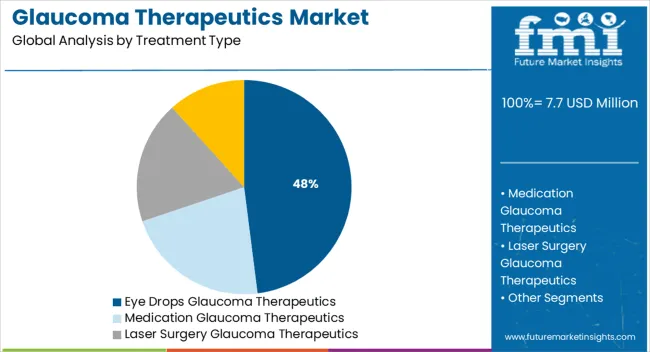

Eye drops are expected to account for 48.0% of the glaucoma therapeutics market revenue in 2025, making them the leading treatment type segment. This leadership is being driven by the non-invasive nature of topical treatments, patient familiarity, and ease of administration.

Furthermore, advancements in preservative-free and sustained-delivery eye drop formulations are improving tolerability and reducing the risk of long-term ocular surface damage.

The ability to provide targeted therapy with minimal systemic absorption continues to reinforce the widespread preference for eye drops in managing chronic glaucoma.

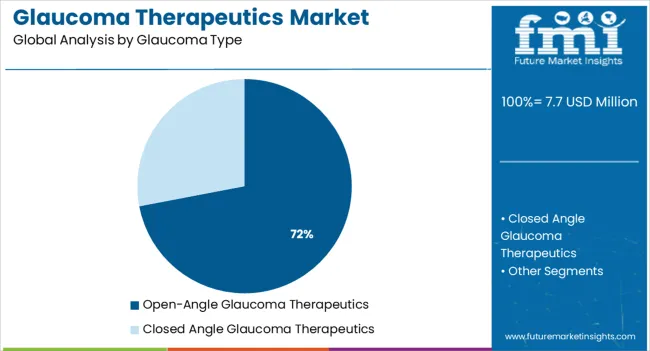

Open-angle glaucoma is projected to represent 72.0% of the total market share in 2025, positioning it as the dominant glaucoma type segment. This prominence is being attributed to the high prevalence of this form globally, particularly among aging populations and individuals with genetic predispositions.

The typically asymptomatic and progressive nature of open-angle glaucoma has led to increased routine screenings and early detection, driving treatment volume.

Management protocols for open-angle glaucoma are well-established, with clinical guidelines favoring pharmacologic intervention as the initial therapeutic step.

Healthcare infrastructure improvements and national blindness prevention programs have further contributed to timely diagnosis and therapy initiation.

Continuous technological advancements in the field of ophthalmology are one of the major factors driving the glaucoma treatment market. Increased demand for advanced surgical procedures may propel industry growth potential.

Advances in optometric care such as medical imaging, selective laser trabeculoplasty (SLT), optical coherence tomography (OCT), visual fields, micro-invasive glaucoma surgery (MIGS), and progression analysis software may increase patient preference. The incorporation of laser treatments as first-line therapy alongside medication to treat glaucoma may expand the market size.

The general public's growing awareness of health issues, as well as their preference for laser glaucoma surgery, is driving the glaucoma therapeutics market growth. The development of novel drugs is making a significant contribution to the market's expansion.

It is expected that diagnostic techniques for glaucoma may advance in the coming years, along with an improved healthcare infrastructure, propelling the market to new heights. A surge in eye disorder awareness and education programs is expected to propel the market during the forecast period.

In addition to the rising geriatric population around the world, the market is expected to expand rapidly. But since doctors prefer laser surgery to treat glaucoma, the market is expected to expand in the future. The goal of developing sustained delivery technologies is to improve adherence to therapeutic regimens and therapeutic potential.

Furthermore, advances in biological and gene therapies are indeed being evolved to reconfigure diseases, potentially leading to permanent treatments.

Due to the market's strong healthcare infrastructure, glaucoma therapeutics is expected to thrive in North America. In 2025, the North American market is predicted to account for 30% of the total. North America is expected to dominate the market due to a strong interest in drug development across the healthcare industry.

The market in these regions is expected to expand substantially over the next few years as the prevalence of diabetes, ocular disorders, and the number of visually impaired people rises. The region's market share may be leveraged as a consequence of increased attention to therapeutic drug research and development.

Increased population awareness of glaucoma and access to reimbursements have all aided in the expansion of the market in these regions.

Glaucoma is the leading cause of childhood glaucoma in the United States. With over one million cases of glaucoma diagnosed each year, blacks and Hispanics are the most influenced in the United States. All of these factors contribute to the expansion of the glaucoma therapeutics market in these regions.

Several new medications and treatment options are reshaping the glaucoma therapeutics market landscape. To meet the needs of patients, several new start-up companies are researching and developing first-line treatments in the market. The advancement of high-tech healthcare infrastructure and treatments is opening up new avenues for study and research.

Launch:

Teva Pharmaceuticals launched the first generic version of AZOPT (brinzolamide ophthalmic suspension) 1% in the United States in March 2024 to treat open-angle glaucoma and ocular hypertension. This has increased the company's product portfolio.

Collaboration:

Aerie Pharmaceuticals, Inc. and Santen Pharmaceuticals will collaborate in December 2024 to develop and commercialize Rhopressa/Rhokiinsa and Rocklatan/Roclanda for glaucoma treatment in Europe, India, China, Oceania countries, and parts of Latin America. These will strengthen both companies' market positions in these regions.

The global demand for glaucoma therapeutics is projected to increase at a CAGR of 3.7% during the forecast period between 2025 and 2035, reaching a total of USD 11.1 Million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales increased significantly, registering at a CAGR of 6.6%.

Diabetics and non-diabetics are both at risk of glaucoma. Glaucoma is also more likely to develop in people who suffer from diabetic retinopathy. In the past few decades, there has been an increase in demand for research and development of drugs for various eye diseases. As the healthcare industry continues to grow, government support is expected to increase as more funds are allocated for clinical trials for the discovery of novel drugs, and advanced surgical procedures.

A proliferation of healthcare institutions and drug development organizations will further boost glaucoma therapeutics' market share. Technology for minimally invasive surgeries is expected to significantly increase the market in the future.

Another area being explored for therapeutic options is neuroprotection, which includes preserving retinal ganglion cells (RGCs) and the optic nerve. The therapeutic potential of neuro-protectants is close to being realized with advances in imaging technologies and new surrogate clinical endpoints. As a result, the market is expected to grow in the future.

Glaucoma Prevalence is expected to Boost Market Growth in the Coming Years

The change in lifestyle has led to an increase in glaucoma cases around the world. As glaucoma's prevalence increases worldwide, the market for glaucoma therapeutics is expected to grow in the market. A higher percentage of people over 60 suffer from glaucoma all over the world.

Further, the increasing awareness of health issues among the general population and the increasing preference for laser glaucoma surgery are also contributing to the growth of the market.

The development of innovative drugs is also contributing to the growth of the market. In the coming years, it is anticipated that diagnostic techniques for glaucoma will become more advanced, along with an enhanced healthcare infrastructure that will drive the market to new heights. A surge in awareness and education programs regarding eye disorders is likely to drive the global glaucoma therapeutics market during the forecast period.

In addition to the growing geriatric population across the globe, the glaucoma therapeutics market is also expected to grow at a robust rate over the forecast period. With doctors preferring laser surgery for treating glaucoma, the glaucoma therapeutics market is set to grow in the future.

The development of sustained delivery technologies aims to increase compliance with treatment regimens and therapeutic benefits. In addition, innovations from biological therapies and gene therapies are being developed to modify diseases, which may result in permanent treatments.

Recalls of Major Pharma Drugs will hinder Growth of Glaucoma Therapeutics in the Market

The lack of awareness about glaucoma treatment may limit the growth of the glaucoma therapeutics market. Furthermore, underdeveloped economies and limited access to skilled professionals for laser surgery will hinder the growth of glaucoma therapeutics. There would be a significant impact on market growth if major players recalled their drugs for glaucoma treatment.

As a result of regulatory constraints and approvals associated with glaucoma medications, the glaucoma therapeutics market is expected to remain stagnant in the near future. In the near future, inappropriate glaucoma treatments, adverse drug reactions, and the growth of generic drugs are expected to restrain the global glaucoma market.

Glaucoma therapeutics are expected to flourish in North America due to its high healthcare infrastructure in the market. The North American glaucoma therapeutics market is expected to accumulate a market share of 30% in 2025. Due to a profound interest in drug development across healthcare industries, North America is anticipated to be the largest glaucoma therapeutics market.

As the prevalence of diabetes, ocular disorders, and the number of visually impaired people increases, the glaucoma therapeutics market in these regions is expected to grow significantly over the next few years. As a result of increased attention to therapeutic drug research and development, the region's market share will be leveraged. Increasing awareness of glaucoma among the population, and access to reimbursements, have all contributed to the growth of the glaucoma therapeutics market in these regions.

The majority of childhood glaucoma cases in the United States are caused by glaucoma. Approximately one infant out of every 10,000 suffers from this condition. Thus, there is a high demand for glaucoma therapeutics in the USA According to estimates, 2.7% of American adults over 40 have open-angle glaucoma, causing a high demand for therapies.

The number of Americans suffering from blindness or low vision is estimated to be 3.3 million or more people over the age of 40. Around 80 million people, or over 111 million by 2040, are estimated to suffer from glaucoma worldwide. Approximately USD 2.86 billion is lost to the USA economy every year due to direct costs and productivity losses associated with glaucoma.

Blacks and Hispanics are the most affected in the United States with over one million cases of glaucoma a year. These factors all contribute to the growth of the market for glaucoma therapeutics in these region.

Europe is expected to hold a market share of 28% in 2025 in the glaucoma therapeutics market. Due to the rise in technology development in drug tools in Europe, there are also potential growth opportunities in glaucoma therapeutics in the market.

The leading cause of irreversible blindness in Western Europe appears to be glaucoma, followed by age-related macular degeneration. Globally, 2.93% of people between the ages of 40 and 80 have glaucoma. People in their 40s to 80s are also more likely to suffer from open-angle glaucoma, which has a prevalence rate of 2.51%.

Furthermore, the presence of significant key players would drive the growth of the region's glaucoma therapeutics market throughout the projection period. A growing pharmaceutical industry in Europe will also generate opportunities for the market during the forecast period.

Glaucoma Therapeutics Medication to beat the competition in unending markets

The use of medication for treating glaucoma is expected to drive the market in 2025. There is a high potential for growth in the market in the near future, attracting investments from companies manufacturing therapeutics for glaucoma in the market.

To combat glaucoma, researchers have developed a method involving twice-yearly injections to maintain the pressure in the eye that will replace daily eye drops and surgery as a method of combating this condition. A non-profit organization, the Glaucoma Research Foundation, received a donation of USD 1.5 million for a project aimed at restoring vision. To support interdisciplinary research projects, additional funds will be provided to organizations like the National Eye Institute.

The development of medicines and delivery methods to aid in the market development of glaucoma medications. As part of glaucoma treatments, multiple professionals prescribe combination therapies such as polymer-based contact lenses, implantable devices with longer release times, drug-eluting punctal plugs, and micro-injections. Injectable medications will grow at a rapid pace in the market for glaucoma therapeutics as a result of these factors.

Based on glaucoma type the market is segmented into open-angle glaucoma and closed-angle glaucoma type. According to Future Market Insights, the market for open-angle glaucoma therapeutics is expected to grow at a projected period in the market. In comparison to other types of glaucoma, this disorder has a high prevalence. Additionally, most medications for treating open-angle glaucoma are currently available for angle glaucoma, which represents the category as a dominant segment in the market.

A variety of sociodemographic factors influence the prevalence of primary open-angle glaucoma (POAG). Researchers are investigating variations in POAG prevalence by age, gender, and location among the general adult population worldwide over the last 20 years. A substantial amount of funding has been directed to drug development, clinical trials, and awareness campaigns by key healthcare and pharmaceutical stakeholders. Laser surgery, incisional surgery, as well as oral medication is currently being sold as alternative treatment approaches in the market.

Several new medications as well as treatment alternatives are transforming the landscape of glaucoma therapeutics in the market. In order to address the needs of the patients, several new start-up companies are researching and developing first-line treatments in the market. The development of high-end healthcare infrastructure and treatments is creating new opportunities for studies and research in this sector.

A strategic collaboration lets manufacturers increase production and meet consumer demand, which means more revenue and market share. Using new products and technologies, end users will be able to benefit from eco-friendly products that are designed by nature in order to preserve the environment.

Some of the key participants present in the global gaming hardware market include Competition Deep Dive, Allergan, Merck & Co., Inc, Akorn, Inc, Bausch & Lomb Incorporated, Oculis S.A., Teva Pharmaceuticals, Alcon, Pfizer, Santen, Nanodropper, Inc., Novai, NeuBase Therapeutics, Ocular Therapeutix, Aerie Pharmaceuticals Inc, and Inotek Pharmaceuticals Corp.

Key developments in the market are as follows:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.7% from 2025 to 2035 |

| Market Value in 2025 | USD 7.7 million |

| Market Value in 2035 | USD 11.1 million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Treatment Type, Glaucoma Type, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, Spain, France, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Competition Deep Dive; Allergan; Merck & Co., Inc.; Akorn, Inc; Bausch & Lomb Incorporated; Oculis S.A.; Teva Pharmaceuticals; Alcon; Pfizer; Santen; Nanodropper, Inc.; Novai; NeuBase Therapeutics; Ocular Therapeutix; Aerie Pharmaceuticals Inc.; Inotek Pharmaceuticals Corp. |

The global glaucoma therapeutics market is estimated to be valued at USD 7.7 million in 2025.

The market size for the glaucoma therapeutics market is projected to reach USD 11.1 million by 2035.

The glaucoma therapeutics market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in glaucoma therapeutics market are eye drops glaucoma therapeutics, medication glaucoma therapeutics, laser surgery glaucoma therapeutics and traditional surgery glaucoma therapeutics.

In terms of glaucoma type, open-angle glaucoma therapeutics segment to command 72.0% share in the glaucoma therapeutics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glaucoma Treatment Market Overview - Trends & Forecast 2025 to 2035

Steroid Induced Glaucoma Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fucosidosis Therapeutics Market - Growth & Innovations 2025 to 2035

Market Leaders & Share in Alzheimer’s Therapeutics

Alzheimer’s Therapeutics Market Analysis by Disease Class into Cholinesterase Inhibitors, NMDA Receptor Antagonists and Combinations Through 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA