The steroid induced glaucoma market is set to experience steady growth, projected to increase from USD 1.2 billion in 2025 to USD 2.1 billion by 2035 at a CAGR of 6.1%. The industry holds a specialized but small share within its parent markets.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1.2 billion |

| Projected Global Value (2035F) | USD 2.1 billion |

| Value-based CAGR (2025 to 2035) | 6.1% |

Within the ophthalmology market, it accounts for approximately 2-4%, as it is a specific type of glaucoma among various other eye diseases and conditions. In the broader glaucoma market, its share is around 5-7%, reflecting the fact that steroid-induced glaucoma is just one of the many types of glaucoma treated.

Within the pharmaceuticals market, its share is about 0.5-1%, as steroid-induced glaucoma treatments are just one segment within the larger field of eye care pharmaceuticals. In the biopharmaceutical market, the share is approximately 1-2%, due to the involvement of specialized biopharmaceuticals in managing side effects of steroids. In the chronic disease management market, its share is around 2-3%, as it requires ongoing treatment and monitoring.

This growth is largely attributed to the increasing awareness and treatment of steroid-induced glaucoma, which is a common side effect of long-term steroid use in individuals with conditions such as ocular inflammation or post-surgical recovery.

In a recent statement, Dr. Rebecca Chen, MD, emphasized the importance of early diagnosis in managing steroid-induced glaucoma, stating, “Elevated eye pressure does not always lead to steroid-induced glaucoma (defined as optic nerve damage) if it is diagnosed and treated in time.” This highlights the critical role of timely intervention in preventing the progression of the condition, underscoring the need for proactive eye care in patients using steroids.

Several developments and collaborations are under progress in the industry. AbbVie entered a collaboration and option-to-license agreement with Ripple Therapeutics to develop RTC-620, a fully biodegradable, sustained-release intracameral implant designed to reduce intraocular pressure in patients with open-angle glaucoma or ocular hypertension. This partnership aims to advance next-generation glaucoma therapies.

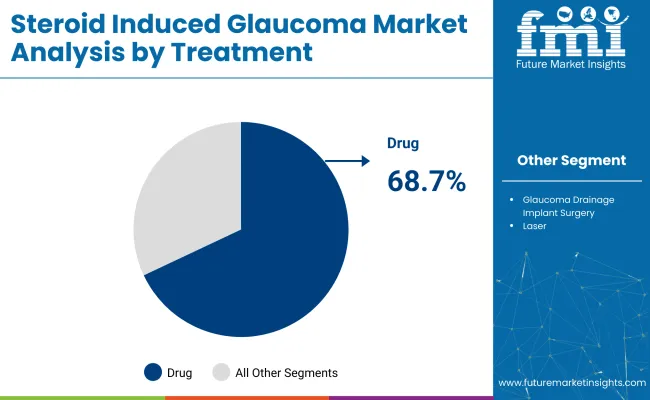

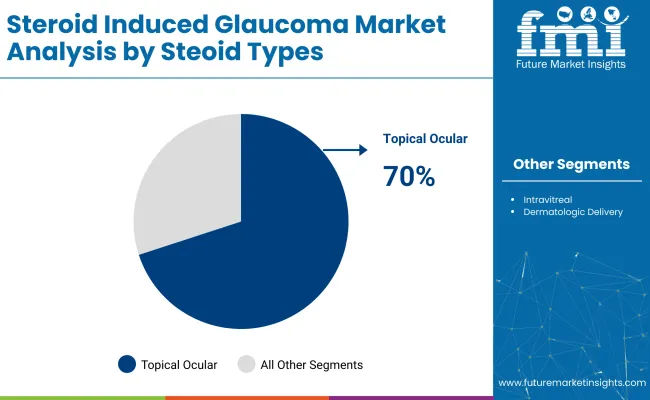

The industry is set to grow steadily through 2035. By 2025, drug treatments will capture 68.7%, topical ocular steroids will hold 70%, and hospitals will dominate the sales channel with 46.3%. Key players in the industry include Allergan, Novartis, and Santen Pharmaceutical.

The drug treatment segment is expected to dominate the industry, capturing 68.7% of the industry share in 2025. Medications like prostaglandin analogs, beta-blockers, and carbonic anhydrase inhibitors are primarily prescribed to manage intraocular pressure (IOP) and prevent optic nerve damage.

Leading pharmaceutical companies like Allergan and Novartis are continuously developing glaucoma-specific drugs to improve efficacy and minimize side effects. As the prevalence of steroid-induced glaucoma rises with the increasing use of corticosteroids for inflammatory conditions, drug treatments will remain the primary approach for managing this condition, driving the industry’s growth.

Topical ocular steroids are projected to hold 70% of the steroid types industry share in 2025. These steroids are widely used to treat inflammation and reduce swelling in eye conditions, but they also contribute to elevated intraocular pressure (IOP), leading to steroid-induced glaucoma.

Commonly prescribed topical steroids, such as prednisolone and dexamethasone, are essential in eye care but require careful monitoring due to their potential to raise IOP. Ongoing advancements in steroid formulations and delivery systems aim to reduce IOP-lowering effects, ensuring a balance between treatment efficacy and minimizing the risk of glaucoma.

The hospitals segment is expected to dominate the sales channel segment with 46.3% industry share in 2025. Hospitals are the primary setting for the diagnosis and treatment of steroid-induced glaucoma, especially in severe cases.

Due to the complexity of managing glaucoma, hospitals offer specialized care, including diagnostic testing, medication management, and surgical options when necessary. Ophthalmologists and other specialists provide tailored treatment plans and long-term follow-up care in hospitals, further contributing to their dominance. As awareness of steroid-induced glaucoma rises, hospitals will remain a critical hub for effective management and treatment.

The industry is growing due to increasing awareness of the side effects of steroid use on ocular health. However, challenges related to effective treatment options and managing the condition limit industry growth, particularly with long-term steroid use.

Increasing Awareness and Diagnosis of Steroid-Induced Glaucoma

The growing recognition of the link between steroid use and elevated intraocular pressure (IOP) is driving demand for treatments targeting steroid-induced glaucoma. Patients receiving long-term corticosteroid treatments for conditions like asthma, arthritis, and autoimmune diseases are particularly vulnerable.

As more healthcare professionals identify this connection, early diagnosis and intervention are becoming more common, allowing for timely management to prevent optic nerve damage and preserve vision. The increasing prevalence of chronic conditions requiring steroid treatment is contributing to a higher incidence of steroid-induced glaucoma.

Challenges in Treatment Options and Condition Management

Despite the rising demand for solutions, managing steroid-induced glaucoma remains difficult due to the limited number of effective treatments that specifically address steroid-induced IOP elevation. Current treatments, including beta-blockers, prostaglandin analogs, and carbonic anhydrase inhibitors, primarily lower IOP but may not be effective in all cases, especially with prolonged steroid use. Additionally, patients may be hesitant to discontinue steroid use for managing their primary condition, complicating the treatment of glaucoma.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

| Germany | 6.2% |

| China | 8.2% |

| Japan | 3.8% |

| India | 9.1% |

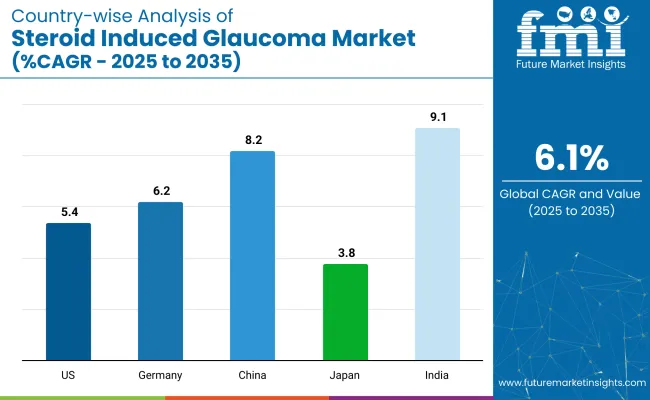

The global industry is projected to grow at a CAGR of 6.1% from 2025 to 2035. The United States, with a CAGR of 5.4%, shows steady growth, supported by advancements in ophthalmology treatments, increasing awareness of steroid-induced glaucoma, and the rising incidence of the condition due to steroid use.

Germany, at 6.2%, demonstrates moderate growth, driven by a strong healthcare system and ongoing research in ophthalmic treatments. China, with a CAGR of 8.2%, reflects faster growth, fueled by its growing aging population, improving healthcare infrastructure, and increasing awareness of steroid-induced glaucoma.

Japan, at 3.8%, shows slower growth, attributed to its more mature healthcare system and a lower increase in the incidence of the condition. India, with the highest CAGR of 9.1%, leads the industry’s growth, driven by a rapidly expanding healthcare sector, rising healthcare access, and increased focus on eye care and ophthalmic treatments.

While OECD countries show moderate growth, India and China stand out as the fastest-growing industries, signaling the shift towards emerging economies as key drivers of the industry’s future expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The USA industry is expected to grow at a CAGR of 5.4% from 2025 to 2035. The rise in long-term use of corticosteroids for treating conditions such as asthma, arthritis, and autoimmune disorders is leading to an increased incidence of steroid-induced glaucoma.

Advances in diagnostic technologies are enabling early detection, resulting in better management and treatment options for glaucoma. Companies like Allergan and Bausch Health are working on new therapies, including innovative intraocular pressure-lowering treatments, which further contribute to industry growth.

The industry in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035. Increased corticosteroid use in the long-term treatment of conditions like allergies, organ transplants, and rheumatoid arthritis is leading to a rise in steroid-induced glaucoma cases. The German healthcare system is focusing on early diagnosis and regular eye check-ups to better manage glaucoma risk.

Treatments such as prostaglandin analogs and selective laser trabeculoplasty are being widely adopted, further contributing to the industry’s growth. The pharmaceutical sector is advancing drug formulations to minimize glaucoma risks.

The industry in China is expected to grow at a CAGR of 8.2% from 2025 to 2035, driven by the rising adoption of corticosteroids for treating chronic conditions like asthma, allergic rhinitis, and dermatologic disorders. With the expansion of healthcare infrastructure, there is increased access to steroid treatments, which raises the risk of glaucoma.

The Chinese government’s focus on improving eye care services and raising awareness about steroid-induced glaucoma is helping drive industry growth. Additionally, Chinese pharmaceutical companies are working on developing treatments for intraocular pressure management.

The industry in Japan is projected to grow at a CAGR of 3.8% from 2025 to 2035. Growth in this industry is attributed to the aging population and increased use of corticosteroids for chronic conditions such as arthritis, autoimmune diseases, and eye inflammations.

Advanced diagnostic tools and therapies like selective laser trabeculoplasty are helping to manage intraocular pressure in patients. Japan’s healthcare system emphasizes early detection and personalized treatments to reduce the incidence of steroid-induced glaucoma, contributing to the industry’s steady growth trajectory.

The industry India is projected to grow at a CAGR of 9.1% from 2025 to 2035, driven by the increasing use of steroids and the rising prevalence of chronic conditions like asthma, allergies, and autoimmune diseases. India’s expanding healthcare infrastructure is improving access to eye care services and glaucoma treatments, boosting industry growth.

As the middle class grows and healthcare awareness rises, more patients are seeking advanced treatments for steroid-induced glaucoma, including topical medications and surgical interventions to manage intraocular pressure.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Novartis AG, AbbVie Inc., and Bausch & Lomb, Inc. lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across ophthalmology and healthcare sectors.

Key players including Pfizer, Thea Pharma Inc., and Sun Pharmaceutical Industries offer specialized formulations tailored to specific applications and regional industries. Emerging players, such as Ocular Therapeutix, Inc. and Glaukos, focus on innovative drug delivery technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Value (2025) | USD 1.2 billion |

| Projected Industry Value (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Treatment | Drug Treatment, Laser Treatment, Glaucoma Drainage Implant Surgery |

| Steroid Types | Topical Ocular Steroids, Intravitreal, Dermatologic Delivery |

| Sales Channel | Hospitals, Ophthalmology Clinics, Retail Pharmacy Chains, Mail Order Pharmacies |

| Region | North America, Latin America, Asia Pacific, Middle East and Africa (MEA), Europe |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Novartis, AbbVie Inc., Bausch & Lomb, Inc., Pfizer, Thea Pharma Inc., Sun Pharmaceutical Industries, Ocular Therapeutix, Inc, Glaukos |

| Additional Attributes | Dollar sales, CAGR trends, product type segmentation, Type-based demand, industry-specific adoption trends, competitor dollar sales & industry share, regional growth patterns |

Drug treatment (topical ocular steroids, prostaglandin analogs, beta blockers, carbonic anhydrase inhibitors, rock inhibitors), laser treatment, and glaucoma drainage implant surgery.

Topical ocular steroids, intravitreal, and dermatologic delivery.

Hospitals, ophthalmology clinics, retail pharmacy chains, and mail order pharmacies.

The regions covered in the report include North America, Latin America, Asia Pacific, Middle East and Africa(MEA), and Europe.

The projected value of the industry in 2025 is USD 1.2 billion.

The forecast value of the industry by 2035 is USD 2.1 billion.

The expected CAGR for the industry from 2025 to 2035 is 6.1%.

Drug treatment is expected to lead the industry in 2035, with approximately 68.7% industry share.

India is expected to be the fastest-growing in the market, with a projected 9.1% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steroid Implants Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Steroid Releasing Implant Market

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Induced Pluripotent Stem Cells Production Market Size and Share Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Opioid-Induced Respiratory Depression Market

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Dialysis Induced Anemia Treatment Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Chemotherapy-Induced Oral Mucositis Market – Growth & Forecast 2025 to 2035

Chemotherapy-Induced Myelosuppression Treatment Market Growth - Forecast 2025 to 2035

Radiotherapy-Induced Oral Mucositis Treatment Market Analysis – Growth & Forecast 2024-2034

Pelvic Cancer Induced Hemorrhegic Cystitis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA