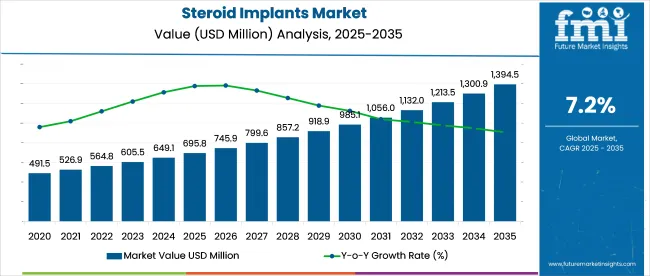

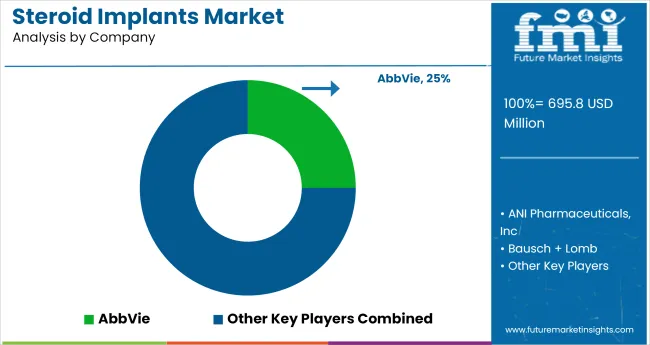

The steroid implants market is set for a valuation of USD 695.8 million in 2025 to USD 1,394.6 million by 2035 at a CAGR of 7.2%. This growth is driven by the increasing prevalence of conditions requiring long-term inflammation control, such as chronic eye diseases, arthritis, and other inflammatory conditions.

The adoption of implants has gained traction due to their efficacy in delivering precise, sustained drug release, minimizing side effects commonly associated with oral steroids.

Scott Cousins, MD, CEO and VP of Research and Development at Eclipse Life Sciences, stated: “Initiating this clinical trial for EC-104 represents an important milestone for Eclipse, as we advance a novel 6-month corticosteroid implant to improve outcomes and enhance quality of life for patients with DME.”

The industry holds a specialized share within its parent markets. In the pharmaceuticals market, it accounts for approximately 2-3%, as steroid implants are a specific type of therapeutic drug delivery system. Within the medical devices market, its share is around 1-2%, since these implants are part of a larger category of implantable devices used in various medical treatments.

In the biotechnology market, the share is about 3-4%, driven by innovations in biologically-derived implants for targeted and controlled drug release. Within the endocrinology market, these implants contribute approximately 5-7%, primarily for hormone replacement therapies and managing hormone imbalances. In the orthopedic market, their share is around 2-3%, as they are used for treating joint inflammation and pain.

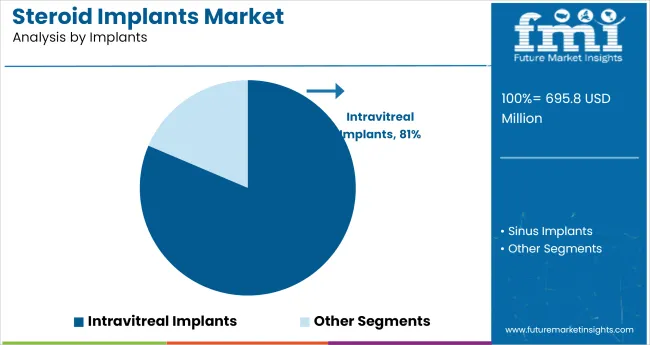

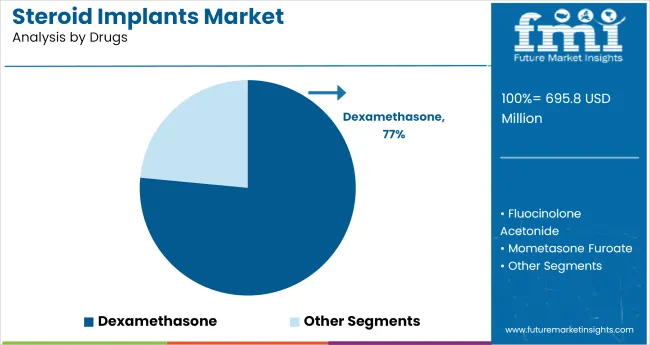

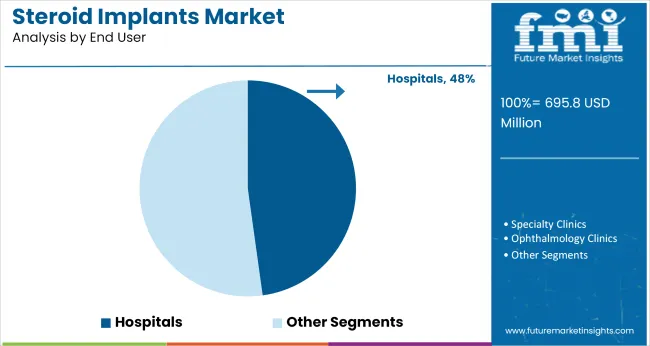

The industry is projected to grow significantly by 2035, with intravitreal implants capturing 81.4% industry share in 2025. Dexamethasone will dominate the drug segment with 76.5% industry share, while hospitals will represent 47.8% of the end-user segment.

The intravitreal implants segment is expected to dominate the industry, accounting for 81.4% of the share in 2025. These implants are primarily used to treat retinal diseases, such as diabetic macular edema and age-related macular degeneration, through the sustained release of steroids.

Leading companies like Allergan and Bausch & Lomb are developing advanced intravitreal implants that offer extended drug release, minimizing the need for frequent injections and improving patient compliance. The ability of these implants to target the posterior segment of the eye while minimizing systemic side effects is driving their popularity in the treatment of ocular diseases.

Dexamethasone is projected to capture 76.5% of the drug segment in 2025, largely due to its effectiveness in treating inflammation and macular edema in ocular conditions. Dexamethasone implants are widely used in conditions such as diabetic retinopathy and uveitis, where they offer long-lasting anti-inflammatory and immunosuppressive effects.

Major players like Merck and Allergan are expanding their dexamethasone-based implant offerings, as the drug provides significant therapeutic benefits with a lower risk of systemic side effects. The increasing prevalence of eye diseases, along with dexamethasone's proven efficacy, solidifies its dominance in industry.

The hospitals segment is expected to account for 47.8% of the industry share in 2025, as they remain the primary setting for administering intravitreal implants, especially for complex treatments. Hospitals are equipped with the necessary diagnostic tools, surgical infrastructure, and specialized care for the implantation process and post-operative management.

The growing adoption of minimally invasive treatments and advancements in surgical techniques ensure that hospitals continue to dominate as the key end-user of intravitreal implants. Their central role in providing comprehensive eye care and treating retinal diseases reinforces their continued industry dominance.

The industry is growing due to the rising prevalence of chronic diseases and the effectiveness of these implants in providing targeted pain relief. However, high production costs, regulatory challenges, and the need for specialized training for healthcare providers are limiting broader adoption, especially in lower-income regions.

Growing Demand for Effective Treatment of Chronic Conditions

The industry is growing due to the increasing prevalence of chronic diseases such as arthritis, diabetes, and inflammatory conditions. Steroid implants offer long-lasting relief by reducing inflammation and providing targeted pain management, especially for conditions that do not respond well to oral medications or injections.

As the global population ages and chronic diseases become more common, healthcare providers and patients are increasingly opting for these implants to manage symptoms, further driving industry growth.

High Costs and Regulatory Challenges Hinder Broader Adoption

Despite their benefits, steroid implants face barriers such as high production and administration costs, making them inaccessible for many patients, particularly in low-income regions. The regulatory environment for the implants is complex, with varying approval processes and stringent safety standards across regions, which can delay product availability and increase development costs. Specialized training for healthcare providers and the risk of complications such as infections limit the widespread use of these implants.

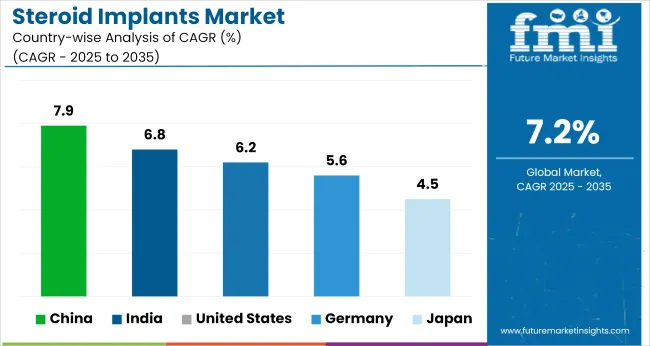

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

| Germany | 5.6% |

| China | 7.9% |

| Japan | 4.5% |

| India | 6.8% |

Global industry demand is projected to rise at a 7.2% CAGR from 2025 to 2035. Of the five profiled industries out of 40 covered, China leads at 7.9%, followed by India at 6.8%, and the United States at 6.2%, while Germany posts 5.6% and Japan records 4.5%. These rates translate to a growth premium of +10% for China, -6% for India, and -14% for Germany versus the baseline, while Japan lags with slower growth.

Divergence reflects local catalysts: increasing adoption of the implants for medical treatments in China and India, steady demand in the United States driven by established healthcare systems, and slower growth in Germany and Japan due to more mature healthcare industries with limited incremental adoption.

The industry in the United States is projected to grow at a CAGR of 6.2% from 2025 to 2035. Demand is fueled by an aging population with osteoarthritis, chronic back pain, and tendon injuries. Clinicians favor depot implants that offer site-specific anti-inflammatory action and lower systemic exposure than oral steroids.

Continuous material innovation-silicone-elastomer reservoirs, bioresorbable polymers, and micro-port designs-supports sustained release over weeks, improving patient adherence. Private insurers now reimburse in-office implantation for select musculoskeletal indications, widening access beyond hospital settings.

The industry in Germany is set to expand at a CAGR of 5.6% between 2025 and 2035. A well-funded statutory insurance system and high outpatient procedure volume favor minimally invasive pain-control solutions. Orthopedic clinics increasingly place steroid micro-reservoirs during arthroscopic joint repairs, reducing postoperative oral-steroid use. Domestic device makers leverage Europe’s MDR compliance expertise to export CE-marked implants.

The industryin China is forecast to grow at a CAGR of 7.9% from 2025 to 2035. Rapid hospital expansion and provincial reimbursement updates have broadened access to interventional pain procedures. Domestic manufacturers scale cost-competitive, prefilled steroid depots for large urban hospitals. Government Healthy China 2030 targets encourage advanced, opioid-sparing pain therapies, positioning implants as a strategic focus.

The industry in Japan is projected to rise at a CAGR of 4.5% during 2025 to 2035. Japan’s super-aged society drives high incidence of arthritis and spinal stenosis, for which clinicians adopt slow-release steroid pellets. National insurance covers implant use after conservative-therapy failure, and manufacturers emphasize miniaturized applicators for outpatient clinics.

The industryin India is expected to grow at a CAGR of 6.8% through 2035. Urban orthopedic hubs and expanding private hospitals adopt implants to offer affordable, long-acting pain relief. Lower-cost domestic production and favorable import duties attract medical tourists seeking joint-pain interventions. Public-sector tenders begin listing steroid implants for district hospitals treating work-related musculoskeletal injuries.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as AbbVie Inc., Medtronic Plc, and Bausch + Lomb lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across ophthalmology, endocrinology, and pain management sectors.

Key players including ANI Pharmaceuticals, Inc., Lyra Therapeutics, and Eclipse Life Sciences, Inc. offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Innovad, Tucker Milling, and Merton Feed Company, LLC, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Value (2025) | USD 695.8 million |

| Projected Industry Value (2035) | USD 1,394.6 million |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| End User | Hospitals, Specialty Clinics, Ophthalmology Clinics, ENT Clinics |

| Implants | Intravitreal Implants, Sinus Implants |

| Drugs | Fluocinolone Acetonide, Dexamethasone, Mometasone Furoate |

| Indication | Diabetic Macular Edema, Macular Edema, Chronic Non-Infectious Uveitis, Chronic Rhinosinusitis |

| Region | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | ANI Pharmaceuticals, Inc, Bausch + Lomb, AbbVie, Medtronic Plc, Lyra Therapeutics, Eclipse Life Sciences, Inc |

| Additional Attributes | Dollar sales rising with diabetic macular edema treatments, growing demand for sustained release implants, increasing adoption in ophthalmology and ENT specialties, rise in patient awareness driving industry growth |

The industry is divided into intravitreal implants and sinus implants.

Drug-based segmentation includes fluocinoloneacetonide, dexamethasone, and mometasonefuroate.

Indications covered include diabetic macular edema, macular edema, chronic non-infectious uveitis, and chronic rhinosinusitis.

End users consist of hospitals, specialty clinics, ophthalmology clinics, and ENT clinics.

The report includes North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, the Middle East and Africa.

The projected industry value is USD 695.8 million in 2025.

The forecast industry value of the industry by 2035 is USD 1,394.6 million.

The expected CAGR for is 7.2% from 2025 to 2035.

Intravitreal implants are expected to lead the industry in 2035, with approximately 81.4% industry share.

China is expected to be the fastest-growing industry, with a projected 7.9% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steroid Induced Glaucoma Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Steroid Releasing Implant Market

Bio-Implants Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Smart Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Cheek Implants Market

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Ocular Implants Market

Facial Implants Market

Struts Implants Market

Medical Implants Precision Machining Service Market Size and Share Forecast Outlook 2025 to 2035

Humeral Implants Market Growth – Trends & Forecast 2025 to 2035

Aniridia Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cervical Implants Market

Contouring Implants Market

Eye Socket Implants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA