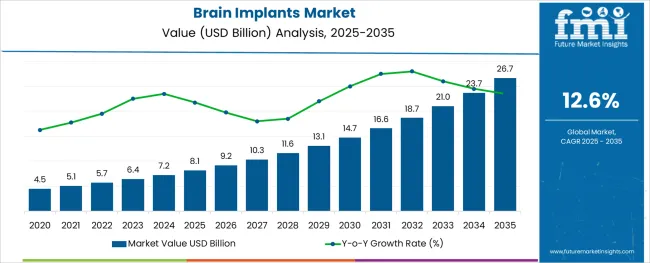

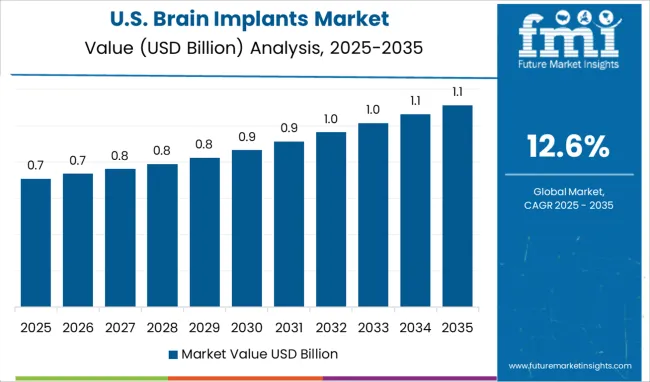

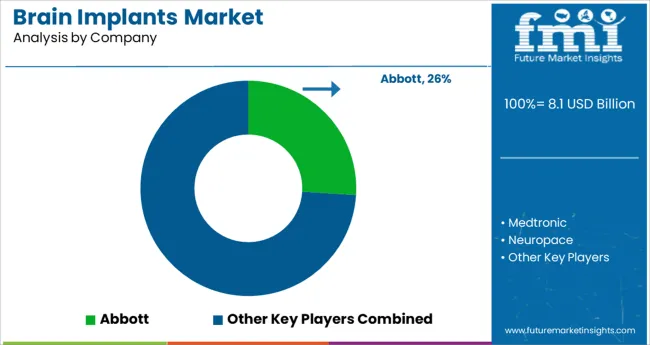

The Brain Implants Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 12.6% over the forecast period.

The brain implants market is progressing steadily, influenced by increased investment in neurotechnology, rising prevalence of neurological disorders, and expanding clinical applications for invasive neuromodulation. Advances in electrode design, signal processing, and miniaturization have enhanced both safety and efficacy, enabling more precise brain stimulation across complex conditions.

Regulatory support for breakthrough devices, along with long-term data supporting clinical outcomes, is accelerating physician adoption in targeted applications. Favorable reimbursement frameworks in select countries are further reducing the financial barrier for patients requiring long-term neurological interventions.

Additionally, collaboration between med-tech companies and academic research institutions is fostering innovation pipelines focused on improving implant longevity, wireless connectivity, and brain-computer interface integration. Looking ahead, demand is anticipated to be reinforced by aging population dynamics, expanded indication approvals, and increasing procedural success rates in Parkinson’s and epilepsy-related interventions.

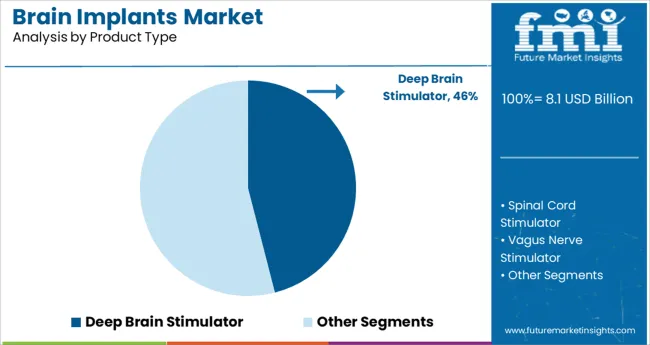

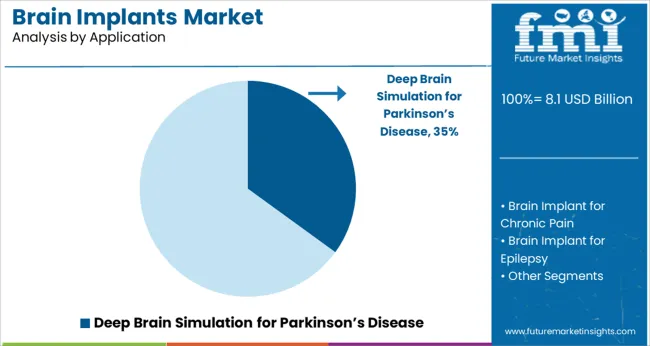

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Deep Brain Stimulator, Spinal Cord Stimulator, and Vagus Nerve Stimulator. In terms of Application, the market is classified into Deep Brain Simulation for Parkinson’s Disease, Brain Implant for Chronic Pain, Brain Implant for Epilepsy, Brain Implant for Depression, Brain Implant for Essential tremor, and Brain Implant for Alzheimer’s Disease. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Deep Brain Stimulator, Spinal Cord Stimulator, and Vagus Nerve Stimulator. In terms of Application, the market is classified into Deep Brain Simulation for Parkinson’s Disease, Brain Implant for Chronic Pain, Brain Implant for Epilepsy, Brain Implant for Depression, Brain Implant for Essential tremor, and Brain Implant for Alzheimer’s Disease. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Deep brain stimulators are projected to hold 46.0% of the total revenue share in the brain implants market by 2025, making them the dominant product type. This lead is being supported by proven therapeutic outcomes in managing motor-related neurological disorders and the device’s ability to deliver adjustable stimulation without permanently altering brain structures.

Growing demand for minimally invasive treatment options and the long-term reduction of medication dependency have also driven adoption. Advances in battery life, closed-loop stimulation systems, and bilateral stimulation capability have significantly improved patient compliance and outcomes.

Additionally, the expanding use of telemedicine and remote programming for deep brain stimulators is increasing access in underserved regions, contributing to continued market growth.

Deep brain stimulation for Parkinson’s disease is expected to account for 35.0% of the total market revenue in 2025, making it the leading application segment. This is due to the consistently high global incidence of Parkinson’s and the therapy’s demonstrated effectiveness in controlling tremors, rigidity, and motor fluctuations in advanced-stage patients.

As pharmaceutical interventions plateau in efficacy over time, deep brain stimulation offers a viable, evidence-based second-line treatment. Clinical endorsements and updated treatment guidelines from neurological associations have encouraged earlier intervention with implants.

Furthermore, increased awareness among both clinicians and patients, along with technological refinement in targeting subthalamic and globus pallidus regions, continues to reinforce its position as a preferred intervention for Parkinson’s management.

Key players are focussing on marketing the implants that can be customized according to the patient's anatomy and have benefits, including offering exactly restored shapes, which produce superior cosmetic outcomes. This is crucial for addressing the major flaws in particular and is anticipated to generate higher demand for brain implants in the coming years. Secondly, because insertion of the implant takes less time with tailored implants, operating room time is reduced and is expected to provide some better brain implant market opportunities.

The very first human brain-computer interface (BCI) implantation in the United States was announced by Synchron in July 2025. This method, which is the first to use an endovascular BCI approach and does not necessitate invasive open-brain surgery, marks a key technological milestone for scalable BCI devices.

As the United States is the country with the most demand for brain implants any advancement in this sector is expected to be a major success in this region and become a lucrative opportunity for the market participants in the following years.

Clinical studies of implanting brain chips in people to enable thought-to-thought communication with computers were launched by Elon Musk's Neuralink in January 2025. This development is poised to be a watershed movement for all the brain implants market players, as a substantial amount of money has already been invested for this purpose. However, this technology is yet to be marketed, giving some leeway for smaller players involved in the brain implants business to promote the conventional technology.

Until now, the massive prices of implantation and procedures involved in it have restricted the growth of the market in third-world economies. Moreover, the danger involved with surgical operations and the lack of the necessary healthcare infrastructure and qualified experts in emerging nations may, however, prove to be major growth barriers for the market for brain or cranial implants.

Also, after sensing the necessity for regular maintenance of implanted chips and recognizing any side-effects arising therein, many prominent brain implants market players have come up with new models of business by integrating services for it. And the new start-ups that have entered the market recently are also vying to capitalize on this particular front of the global brain implants market.

As per the Global Brain Implants Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, market value of the Brain Implants Market increased at around 10.1% CAGR.

The key revenue drivers which affected the Brain Implants Market are increase in the awareness among individuals regarding mental health, lifestyle, rise in the number of various neurological ailments like depression, anxiety, chronic pain, epilepsy, Alzheimer’s, Parkinson’s, etc. In 2024, the chronic pain sector dominated the brain implant therapeutics market, accounting for 58.8 percent of total revenue.

Rising consciousness among the public, technological advancements like BCIs (Brain-Computer Interfaces), which are implanted into the brain and use microscopic electrodes to track the activity of neurons, boost the demand for advanced brain implants. With such a huge population belonging to the aging category, they are more prone to the diseases like Parkinson’s, leading to a high brain implants market demand.

Brain Implant treatment will continue to see rising trend in demand as they could be used as a source to relieve chronic pain and enhance body movements. And also, to improve the patient’s mobility, technologies for brain implants such as motor neuron prostheses, Brain Computer Interfaces and micro electrode arrays will be extensively used in the near future. Besides, brain implants for seizures is also expected to grow in the years to come.

The rising numbers of neurological ailments contributes to the growth of brain implant surgery. These disorders have heightened the clinical need for long term alternatives like spinal cord stimulators and deep brain stimulators. The emergence of stress related and obesity related depression is also rising all over the world.

Due to these reasons, advanced brain implants technologies have been shown to play a significant role in giving depression treatment options. These diseases fuel the growth of global market for brain implant.

The inception of Magnetic Resonance Imaging(MRI) and Neurowave Medical Technologies are expected to shape up the market. To increase the patient’s mobility, technologies such as motor neuron prostheses, Brain Computer Interfaces (BCI) and micro electrode arrays are used.

Americans are far more likely to voice reservations about implanting computer chips in human brains than to express enthusiasm for the notion. The brain implant chip manufacturers are also exerting their efforts to bring more technologically advanced solutions. And roughly twice of them have opinion that they would not be willing to utilize this technology among them as those who say they would.

Furthermore, adults in the United States are likewise more inclined to view this form of technology as morally undesirable, while many are unsure about the moral implications. There are significant variances in religious organizations’ perspectives on this technology. Americans with strong religious devotion, including those who believe in gene editing, are more inclined to perceive such a device as "meddling with nature."

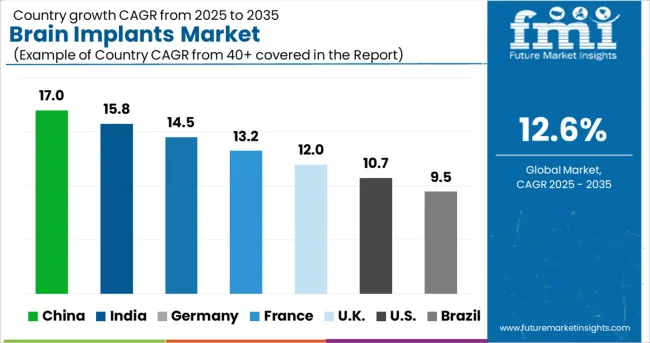

During the projection period, North American Brain Implants Market is predicted to be the leading market for Brain Implants. According to the reports presented by Alzheimer’s disease Facts and Figures, with the increase in the number of senior citizens in the United States, the number of new and current instances of Alzheimer's disease will also surge.

Unless medical breakthroughs to prevent, halt, or cure Alzheimer's disease are developed, the number of persons aged 65 and older with Alzheimer's disease is expected to rise to 12.7 Million by 2050.

In addition, a rise in government spending and programs on rising awareness of motion disorders are projected to boost demand for brain implant devices in the region. The Parkinson's Foundation, for example, invested USD 7.2 Million in 2024 to sponsor over 34 Parkinson's disease research initiatives. These factors are likely to increase the demand for brain implants in the region.

The United States is expected to account for the highest market of USD 26.7 Billion by the end of 2035. Currently, the USA market is estimated at USD 2 Million.

This is due to several factors such as an increase in the incidence of neurological disorders, high awareness of various medical options, developed healthcare facilities and presence of well-virtuous physicians. It is proclaimed that brain implants has proved to provide the best treatment for depression in the USA.

Market revenue through Deep Brain Stimulator is forecasted to grow at a CAGR of over 14.4% during 2025 to 2032. The contributing factors for such growth are technological advancements like rechargeable implantable pulse generators, robot-assisted implantation, and a rise in the adoption of advanced Deep Brain Stimulator systems in healthcare units and neuro centers.

Market growth will also be stimulated due to the increase in the elderly population and innovative products in the future. However, the high cost of DBS (Deep Brain Stimulator) devices, restricted access to advanced therapy, and side effects may hamper the brain implant market dynamics during the projection period.

Chronic Pain accounted for the highest revenue as well as a CAGR of around 13.4% for the demand for brain implants during the forecast period. Chronic pain is one of the core reasons as why individuals, mainly adults seek medical care. It hinders mobility, day to day activities, causes panic attacks and depressions and destroys lifestyle.

People suffering from chronic pain are more prone to have psychological disorders than those who do not experience it. According to research, 6%-35% of the individuals suffering from chronic pain also have comorbid anxiety illness, and almost 50% of patients have anxiety and depression symptoms.

Players in the market are constantly developing improved analytical solutions as well as extending their product offerings. The companies in brain implants market are focused on their alliances, technology collaborations, and product launch strategies. The Tier 2 Players in the market are targeting to increase their brain implant market share.

Some of the recent developments of key Neural Implants providers are as follows:

Similarly, recent developments related to companies in Brain Implants Market have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, China, Japan, South Korea, India, Australia, South Africa, Saudi Arabia, UAE and Israel. |

| Key Market Segments Covered | Product Type, Application, Region |

| Key Companies Profiled | Abbott Laboratories; Medtronic PLC; NeuroPace Incorporation; Nevro Corporation; Aleva Neurotherapeutics SA; Synapse Biomedical Incorporation; Boston Scientific Corporation; Sapiens Neuro; Edwards Lifesciences Corporation |

| Pricing | Available upon Request |

The global brain implants market is estimated to be valued at USD 8.1 billion in 2025.

It is projected to reach USD 26.7 billion by 2035.

The market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types are deep brain stimulator, spinal cord stimulator and vagus nerve stimulator.

deep brain simulation for parkinson’s disease segment is expected to dominate with a 35.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Brain Fingerprinting Technology Market

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Auditory Brainstem Response Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Wireless Brain Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA