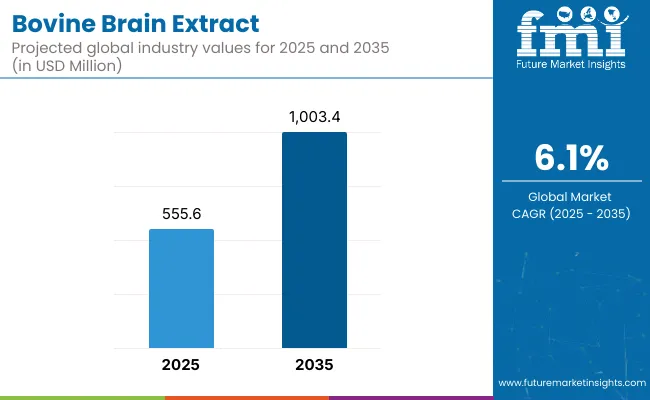

The bovine brain extract market is projected to attain a valuation of USD 555.6 million in 2025, expanding to approximately USD 1,003.4 million by 2035. This increase of USD 447.8 million over the decade translates to a growth of over 80.6%, effectively reflecting a 2X expansion in market size. The compound annual growth rate (CAGR) during this period has been estimated at 6.1%, underscoring a steady, demand-driven expansion supported by rising applications in cognitive support, neurological recovery, and advanced nutritional supplementation.

Bovine Brain Extract Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 555.6 million |

| Extract Forecast Value in (2035F) | USD 1,003.4 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the first half of the forecast period (2025-2030), the market is expected to rise from USD 555.6 million to nearly USD 745.0 million, adding USD 189.4 million, which accounts for approximately 42.3% of the total decade’s growth. This growth phase is likely to be influenced by increasing adoption in encapsulated supplement formulations and early clinical exploration into neuro-regenerative ingredients. Significant gains are anticipated in cognitive health support, particularly within North American and European markets, where regulatory familiarity and consumer awareness are more mature.

In the second phase (2030-2035), the market is projected to increase by USD 258.4 million, contributing the remaining 57.7% of the total growth, and reaching the USD 1 billion milestone. This acceleration is expected to be driven by wider integration of bovine brain-derived peptides into medical nutrition, functional food products, and cosmeceutical formulations. Supplementation formats with enhanced bioavailability, supported by clinical validation and digitized personalization, are expected to reshape consumer engagement and value delivery across the market.

From 2020 to 2024, the bovine brain extract market grew from an estimated USD ~410 million to USD 555.6 million, driven primarily by demand for pharmaceutical-grade and encapsulated cognitive support solutions. During this period, the competitive landscape was led by biological material suppliers, who held a dominant share by offering standardized, research-ready formulations across regulated industries.

Growth was driven by academic research, early cosmeceutical exploration, and clinical interest in neuro-supportive bioactives. Service-based models including custom formulation, GMP certification support, and regulatory documentation contributed under 15% of market value but showed rising potential.

By 2025, demand is expected to surpass USD 555.6 million, with revenue share gradually shifting toward functional and cosmetic-grade innovations. Traditional bulk extract suppliers are now facing competition from digitally integrated nutraceutical brands and therapeutic peptide formulators, offering enhanced traceability, application-specific peptides, and regionally customized delivery systems. Competitive advantage is moving beyond raw extract volume to ecosystem integration, bioavailability optimization, and B2B customization at scale.

The growth of the bovine brain extract market is being propelled by rising interest in neurotrophic and bioactive compounds derived from animal organ sources. A resurgence in demand for cognitive enhancement supplements and neurological support formulations has been observed, particularly among aging populations and individuals with neurodegenerative conditions. Bovine brain extract has been positioned as a promising ingredient due to its richness in phospholipids, peptides, and other neuro-supportive constituents.

Greater scientific validation and improved extraction technologies have allowed for more efficient isolation of targeted compounds, enhancing product standardization and safety. Additionally, the shift toward natural and organ-specific nootropics is expected to support sustained consumer adoption.

Application expansion into cosmeceuticals and functional nutrition is also underway, driven by interest in regenerative skincare and medical nutrition. Regulatory adaptability and rising R&D investments by supplement manufacturers have further contributed to market momentum. Going forward, greater personalization and formulation innovation are anticipated to unlock untapped potential across global markets.

The bovine brain extract market has been segmented across product type, application, purity grade, source, sales channel, and end user to offer a comprehensive view of demand drivers and consumption behavior. Product segmentation ranges from raw extracts and injectable formulations to encapsulated supplements and functional ingredients.

Application-wise, utilization spans cognitive support, neurological regeneration, and dermatological or pharmaceutical end-uses. Purity grades such as pharmaceutical, food, and cosmetic categories have been adopted to suit regulatory and therapeutic requirements. The market has also been bifurcated by source, with both organic and conventional extraction pathways being pursued.

On the distribution front, sales channels include pharmacies, supplement manufacturers, online platforms, and institutional buyers. Finally, a diverse end-user base encompassing clinics, nutraceutical firms, cosmetic brands, and research institutions has been targeted, each with unique specification standards and purchasing behavior.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Encapsulated Supplements (Capsules, Tablets) | 25% |

| Functional Ingredients (Peptides, Phospholipids) | 22% |

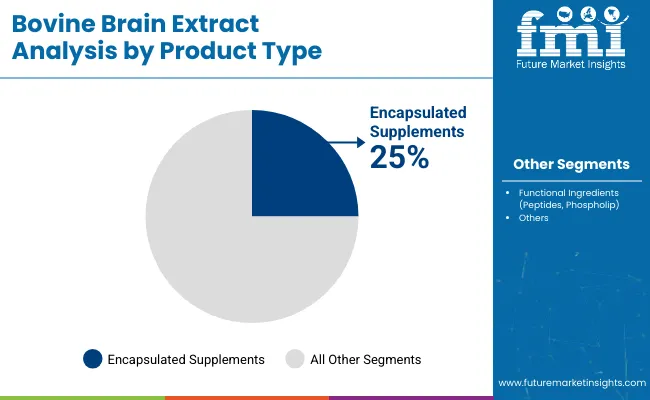

The encapsulated supplements segment is projected to capture 25% of total revenue in 2025, driven by growing consumer acceptance of easy-to-consume, over-the-counter neuro-nutritional products. These formulations have been preferred due to their portability, shelf stability, and ability to deliver standardized dosages of bioactive compounds.

Manufacturers are prioritizing capsule and tablet formats to support scalability and consumer familiarity. Functional ingredients have followed closely, contributing 22%, as demand for phospholipid- and peptide-enriched solutions grows across clinical and wellness applications. Meanwhile, injectable formulations and cosmetic extracts are expected to grow faster over the decade due to expanding niche applications and higher-value positioning.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Cognitive & Memory Support Supplements | 25% |

| Cosmetic & Dermatological Applications | 22% |

| Neurological Health & Nerve Regeneration | 20% |

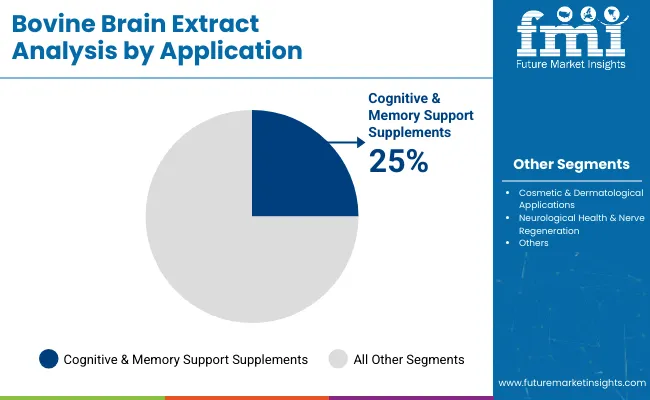

Cognitive & memory support applications are forecasted to lead with a 25% share in 2025, underpinned by rising demand for neuroprotective supplementation in aging populations and performance-focused consumers. Products in this category are being positioned as daily-use cognitive enhancers, with bovine brain extract marketed for its naturally occurring phosphatidylserine, sphingolipids, and other neuro-nutrients.

Cosmetic and dermatological uses, with a 22% share, are rapidly expanding due to the inclusion of bioactive peptides in anti-aging creams and skin renewal solutions. Neurological regeneration and medical nutrition are also expected to attract greater clinical investment due to their high relevance in managing neurodegenerative conditions.

| Purity Grade | Market Value Share, 2025 |

|---|---|

| Pharmaceutical Grade | 45% |

| Food Grade | 35% |

| Cosmetic Grade | 20% |

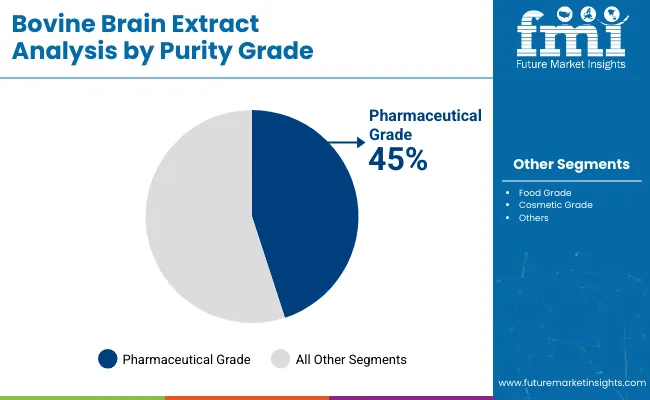

Pharmaceutical-grade bovine brain extract is set to dominate with a 45% market share in 2025, reflecting its widespread use in clinical and therapeutic formulations, especially injectables and medical nutrition solutions. Regulatory demands for traceability, sterility, and therapeutic consistency have made this grade the preferred choice among clinical buyers and R&D institutions. This segment has benefited from advanced purification processes and strict compliance with pharmacopeial standards.

Food-grade products, comprising 35%, continue to serve the functional food and dietary supplement sectors. Cosmetic-grade extracts account for 20%, with increased use in skin-enhancing topical formulations. Going forward, advancements in purification and traceability are expected to further enhance demand for pharmaceutical-grade materials, especially in regulated markets.

Regulatory sensitivity and source authenticity concerns continue to challenge wider adoption of bovine brain extract, even as demand accelerates across cognitive health, neurological therapy, and cosmetic formulations. Technological refinement and bioactivity validation remain central to unlocking mainstream integration across global supplement and medical markets.

Rising Demand for Neuroprotective and Nootropic Ingredients in Preventive Healthcare

Growing awareness of neurodegenerative disorders and mental performance optimization has fueled demand for naturally sourced nootropic compounds. Bovine brain extract has been increasingly positioned as a valuable source of phosphatidylserine, sphingolipids, and neuroactive peptides compounds known to support cognitive resilience, memory retention, and synaptic repair.

The ingredient’s origin in organ-specific bioactivity has aligned with evolving consumer preferences for targeted, nature-derived solutions in brain health. Supplement manufacturers have responded by launching standardized formulations for daily cognitive support, particularly in aging populations and knowledge-driven workforce segments. As preventive neurology continues to be prioritized in both clinical and wellness sectors, demand for such specialized ingredients is expected to remain resilient.

Ethical, Religious, and Regulatory Scrutiny Over Animal-Derived Neuroextracts

Despite functional efficacy, adoption has been hindered by regulatory ambiguity and consumer hesitancy surrounding animal organ extracts, particularly those sourced from bovine neurological tissue. Concerns related to disease transmission (e.g., prion risks), ethical considerations, and religious dietary laws have led to cautious policy environments in several markets.

Product approvals often require exhaustive traceability, purification, and GMP certification, increasing entry barriers for new players. In religiously sensitive regions, demand remains restricted, and plant-based cognitive alternatives are being preferred. As clean-label and ethical sourcing pressures intensify, only rigorously controlled, transparently labeled bovine extracts are expected to gain regulatory and consumer acceptance.

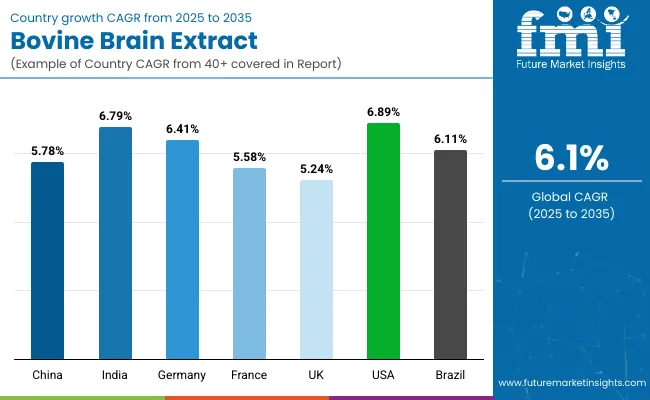

| Countries | CAGR |

|---|---|

| China | 5.78% |

| India | 6.79% |

| Germany | 6.41% |

| France | 5.58% |

| UK | 5.24% |

| USA | 6.89% |

| Brazil | 6.11% |

The global bovine brain extract market is expected to display considerable variability in growth rates across key countries, shaped by diverse factors such as regulatory stringency, healthcare infrastructure, consumer receptivity to organ-derived nutraceuticals, and manufacturing capabilities.

North America, particularly the United States, is forecasted to lead with a CAGR of 6.89%, supported by strong nutraceutical innovation pipelines, favorable clinical trial infrastructure, and established consumer awareness regarding cognitive health supplements. Advanced regulatory mechanisms and rising demand for precision neuro-nutrition have further reinforced USA market maturity.

In India, growth is projected at 6.79%, driven by expanding preventive healthcare trends, increased acceptance of organ-based wellness solutions in traditional and integrative medicine, and a rapidly formalizing supplement distribution ecosystem. Cost-effective production environments and a growing domestic demand for brain health supplements are expected to sustain upward momentum.

Germany is poised to expand at a 6.41% CAGR, propelled by stringent pharmaceutical-grade standards and a strong consumer base for clinically validated functional ingredients. Meanwhile, China is anticipated to grow at 5.78%, reflecting a cautious yet steady integration of bovine-sourced extracts within cosmeceutical and neurological applications, amid evolving regulatory clarity.

Slower growth in France (5.58%) and the UK (5.24%) reflects regional ethical sensitivities and a growing shift toward plant-based nootropics. Brazil, at 6.11%, is projected to benefit from rising nutraceutical penetration and localized sourcing initiatives within Latin America.

| Year | USA Bovine Brain Extract |

|---|---|

| 2025 | 133.3 |

| 2026 | 140.1 |

| 2027 | 147.9 |

| 2028 | 155.7 |

| 2029 | 165.6 |

| 2030 | 176.8 |

| 2031 | 186.5 |

| 2032 | 198.6 |

| 2033 | 212.4 |

| 2034 | 225.5 |

| 2035 | 240.1 |

The bovine brain extract market in the United States is projected to grow at a CAGR of 6.89% between 2025 and 2035, reflecting strong alignment with the country’s expanding nutraceutical, clinical nutrition, and anti-aging wellness sectors.

This growth has been underpinned by increasing investment in functional supplements targeting cognitive decline and memory enhancement among aging populations. Advanced clinical validation and stringent product quality standards have helped position USA-manufactured bovine brain extract as a trusted source for pharmaceutical-grade and food-grade formulations.

Demand has been notably high from neurological research centers and nutraceutical firms, especially those focusing on therapeutic interventions for age-related cognitive disorders. Use in formulated capsules and cognitive support blends has seen sustained year-on-year adoption, supported by e-commerce distribution and practitioner-led product endorsements. Furthermore, the cosmetic industry has been integrating bovine-derived peptides in regenerative dermatology applications, contributing to segmental expansion.

As regulatory frameworks continue to favor organ-based bioactives with traceable sourcing, the USA market is expected to retain its leadership in product innovation and premium-grade production.

The bovine brain extract market in the United Kingdom is projected to expand steadily at a CAGR of 5.24%, supported by niche demand in cognitive health and dermatological innovation. Adoption has remained restrained by ethical concerns and religious preferences, yet significant traction has been observed in premium wellness channels.

Pharmaceutical-grade formats have gained favor in clinical and institutional settings, particularly among senior health and memory-care formulations. Cosmetic brands are exploring bioactive peptides for skin rejuvenation, where efficacy and origin traceability are prioritized.

India’s bovine brain extract market is forecasted to grow at a robust CAGR of 6.79%, supported by increasing demand for traditional and functional wellness solutions. A strong inclination toward natural healing and ayurvedic integration has enabled early acceptance of bovine-derived ingredients in cognitive support and neurological recovery.

B2B nutraceutical manufacturers are actively adopting pharmaceutical- and food-grade extracts, with affordability and localized sourcing emerging as key value drivers. Improved regulatory support and evolving clinical validation frameworks are expected to reinforce trust among consumers.

In China, the bovine brain extract market is anticipated to grow at a CAGR of 5.78%, shaped by cautious regulatory progression and rising interest in organ-derived skincare and neuro-wellness. Although stringent animal-based product scrutiny has limited mass-market access, premium cosmetic and nutraceutical brands have begun formulating peptide-rich products with verified sourcing.

Urban populations are increasingly seeking high-function wellness ingredients, especially those associated with brain performance and skin renewal. Tier-1 markets have been the first movers in embracing therapeutic extracts via direct-to-consumer and premium channels.

| Countries | 2025 |

|---|---|

| UK | 20.1% |

| Germany | 21.3% |

| Italy | 9.1% |

| France | 14.3% |

| Spain | 9.7% |

| BENELUX | 6.5% |

| Nordic | 5.8% |

| Rest of Europe | 13.2% |

| Countries | 2035 |

|---|---|

| UK | 18.0% |

| Germany | 21.9% |

| Italy | 11.7% |

| France | 12.8% |

| Spain | 9.6% |

| BENELUX | 5.7% |

| Nordic | 6.0% |

| Rest of Europe | 14.3% |

Germany’s bovine brain extract market is projected to expand at a CAGR of 6.41%, backed by a structured nutraceutical ecosystem and strong consumer demand for scientifically validated ingredients. Pharmaceutical-grade extracts are favored in clinical nutrition and cognitive therapy markets, where formulation consistency and safety credentials are non-negotiable.

Dermatological clinics are increasingly adopting peptide-based actives in anti-aging and skin-repair regimens. The country’s regulatory alignment with EU food and supplement policies has enabled smoother market entry, particularly for GMP-compliant suppliers offering therapeutic-grade ingredients.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Raw Bovine Brain Extract (Concentrates, Powders) | 18.0% |

| Encapsulated Supplements (Capsules, Tablets) | 28.0% |

| Injectable Formulations (for Medical Use) | 16.0% |

| Functional Ingredients (Peptides, Phospholipids) | 23.0% |

| Cosmetic Ingredients (Anti aging, Skin Repair) | 15.0% |

The bovine brain extract market in Japan is projected to reach a value of USD 23.4 million in 2025, with encapsulated supplements contributing 28% andfunctional ingredients accounting for 23% of total market value. This product-level split reflects Japan’s prioritization of convenience, safety, and clinical substantiation in both consumer wellness and therapeutic formulations.

Encapsulated formats have gained traction due to their pharmaceutical-like delivery and compliance with dosage precision standards. Functional ingredients particularly neuroactive peptides and phospholipids are being explored in clinical nutrition and premium food categories.

This product trend has been shaped by Japan’s aging population and a cultural inclination toward preventive care, where brain health and longevity are focal priorities. Moreover, cosmetic applications are rising in relevance, with bovine-derived peptides being formulated into anti-aging skincare under strict quality controls. Injectable formulations remain more niche, used primarily in research-based and controlled clinical environments.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Cognitive & Memory Support Supplements | 27.0% |

| Neurological Health & Nerve Regeneration | 19.0% |

| Medical Nutrition (Neurodegenerative Disease Support) | 17.0% |

| Cosmetic & Dermatological Applications | 22.0% |

| Research & Pharmaceutical Use | 15.0% |

The bovine brain extract market in South Korea is projected to reach USD 16.7 million in 2025, with Cognitive & Memory Support Supplements leading at 27%, followed closely by Cosmetic & Dermatological Applications at 22%. This distribution reflects the country’s advanced functional food culture and high consumer engagement with bio-enhanced wellness products. Cognitive support supplements are being widely adopted by both aging adults and high-performance professionals, where demand for neuroactive peptides and brain-boosting nutrients continues to rise.

The cosmeceutical industry in South Korea globally recognized for innovation and skin science leadership has also begun integrating bovine-derived peptides into anti-aging and cell-regeneration skincare lines. Clinical trials and dermatological endorsements are expected to further accelerate this segment.

Neurological regeneration and medical nutrition are being explored through research alliances between biotech firms and hospitals, highlighting South Korea’s role in therapeutic innovation. R&D institutions are showing increasing interest in bovine brain extract as a potential candidate in neurodegenerative disease models and advanced brain health research.

| Players | Global Value Share 2025 |

|---|---|

| Sigma-Aldrich | 9% |

| Others | 91% |

The bovine brain extract market is moderately fragmented, with global biopharmaceutical leaders, mid-sized nutraceutical innovators, and specialized extract formulators competing across cognitive, medical, and cosmeceutical applications.

Global players such as Sigma Aldrich (Merck KGaA), Lonza Group, andATCC have been positioned at the forefront, owing to their deep-rooted capabilities in tissue-derived bioactives, pharmaceutical-grade processing, and stringent regulatory compliance. Their strategies have increasingly prioritized GMP-certified extraction, neuroactive compound standardization, and clinical-grade supply for research and therapeutic use.

Established mid-tier companies such as MP Biomedicals, Cell Applications, Inc., andThomas Scientific have been addressing demand for laboratory-scale and functional ingredient solutions, particularly in academic and biotech research. These players have remained competitive by offering ready-to-use extracts, high-purity formats, and application-tailored solutions for neurological assays, memory support formulations, and skin regeneration research.

Niche-focused suppliers including Viscoll (Livecell™), Hangzhou Panta Trading Co., Ltd., Beijing Hongrun Baoshun Technology Co., Ltd., andMorNatural Health Solutions have catered to regional markets and B2B supplement firms, emphasizing traceable sourcing and cost-efficient production.

Competitive differentiation is now transitioning from ingredient purity alone to ecosystem-based offerings—combining extract standardization, regulatory documentation, clinical validation, and personalized formulation support. Market leadership is expected to depend on scalability, transparency, and the ability to align with evolving neuro-nutrition and cosmeceutical trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 555.6 Million |

| Product Type | Raw Extracts (Powders, Concentrates), Encapsulated Supplements (Capsules, Tablets), Injectable Formulations, Functional Ingredients, Cosmetic Ingredients |

| Application | Cognitive & Memory Support Supplements, Neurological Health & Nerve Regeneration, Medical Nutrition, Cosmetic & Dermatological Applications, Pharmaceutical R&D |

| Purity Grade | Pharmaceutical Grade, Food Grade, Cosmetic Grade |

| Source | Organic Bovine Brain Extract, Conventional Bovine Brain Extract |

| Sales Channel | Pharmacies & Drugstores, Nutraceutical & Supplement Manufacturers (B2B), Research Institutions & Laboratories, Cosmetic Ingredient Suppliers, Online Retail |

| End User | Medical Professionals & Clinics, Nutraceutical Companies, Cosmetic Companies, Researchers & Academics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sigma Aldrich (Merck KGaA), Lonza Group, ATCC, MP Biomedicals, Cell Applications, Inc., Thomas Scientific, Viscoll (Livecell™), Beijing Hongrun, Panta Trading, and MorNatural Health . |

| Additional Attributes | CAGR by product type and application, growth in cognitive & cosmeceutical applications, therapeutic adoption in neurological nutrition, ethical sourcing trends, regulatory alignment (FDA, PMDA, CDSCO), GMP-grade certification impact, organic vs. conventional sourcing shifts, demand forecasting by purity grade, use in clinical R&D and anti-aging solutions, regional dynamics shaped by population aging, and market entry pathways for B2B supplement formulators. |

The global Bovine Brain Extract is estimated to be valued at USD 555.6 million in 2025.

The market size for the Bovine Brain Extract is projected to reach USD 1,003.4 million by 2035.

The Bovine Brain Extract is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in the Bovine Brain Extract Market are raw extracts, encapsulated supplements, injectable formulations, functional ingredients, and cosmetic ingredients.

In terms of application, the Cognitive & Memory Support Supplements segment is projected to command the largest share at 25% in the Bovine Brain Extract Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bovine Pericardial Valve Market Size and Share Forecast Outlook 2025 to 2035

Bovine High-Mountain Disease Market Size and Share Forecast Outlook 2025 to 2035

Bovine Lactoferrin Market Size and Share Forecast Outlook 2025 to 2035

Bovine Gelatin Market

Hydrolyzed Bovine Collagen Market

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA