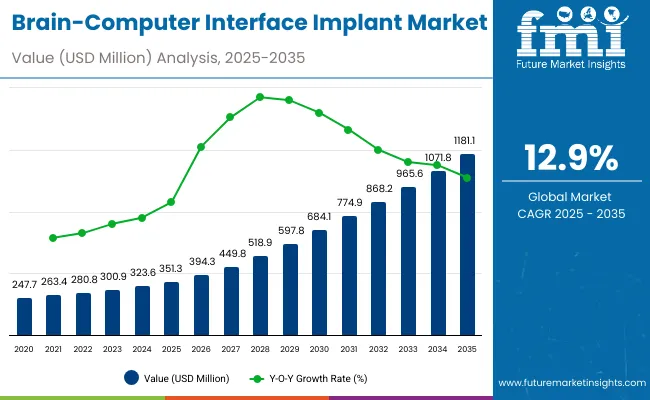

The global Brain-Computer Interface (BCI) Implant Market is projected to reach a valuation of USD 351.3 million by 2025 and expand to USD 1,181.1 million by 2035. This reflects a decade-long absolute growth of USD 830.7 million between 2025 and 2035. The market is expected to grow at a compound annual growth rate of 12.9%, resulting in an overall 3.3X increase during the ten-year forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 351.3 million |

| Industry Value (2035F) | USD 1,181.1 million |

| CAGR (2025 to 2035) | 12.9% |

This robust expansion is primarily driven by continued advancements in neuroprosthetics, brain-signal decoding algorithms, and FDA-backed clinical trials that support commercialization. During the first five-year period from 2025 to 2030, the Brain-Computer Interface (BCI) Implant Market is projected to expand from USD 351.3 million to USD 684.1million, adding approximately USD 332.8million, which accounts for 40.1% of the total decade growth.

The minimally invasive BCI segment will remain the dominant category, holding a substantial share by 2030, driven by its superior neural signal fidelity and use in clinical interventions like paralysis management and neuroprosthetics. Demand remains concentrated across hospital settings, with hospitals contributing over 50% of total adoption, largely due to increased implementation in post-stroke neurorehabilitation and neurosurgery departments.

In the second half from 2030 to 2035, the market will further expand by USD 497.9million, rising from USD 467.9 million to USD 623.2 million, which translates to 59.9% of total growth during the decade. The accelerated growth is expected due to expanded clinical trials, FDA fast-tracking programs, and university-led R&D projects. By 2035, invasive BCIs and minimally invasive BCIs together will capture a combined share of approximately 90.8%, reinforcing their sustained dominance.

In 2025, the BCI Implant Market is expected to reach a value of approximately USD 351.3 million, driven by a shift from research-only applications to clinically embedded neurotechnology systems. Growth will be propelled by hospital investments in neurorehabilitation, regulatory fast-tracking, and demand for implantable systems aiding communication and mobility for individuals with neurodegenerative conditions. Hospitals and academic centers are increasingly adopting invasive and minimally invasive systems embedded with real-time decoding interfaces, cloud-linked data storage, and AI-integrated processing to improve patient outcomes and expand functional applications.

The Brain-Computer Interface (BCI) Implant Market is witnessing strong growth due to increasing clinical demand for neurotechnology solutions that restore communication, mobility, and autonomy in patients with severe neurological impairments. Rising prevalence of conditions such as ALS, spinal cord injuries, and locked-in syndrome is driving hospitals and research institutes to invest in invasive BCI systems that offer high signal fidelity and real-time cognitive decoding.

Regulatory bodies like the FDA and EMA have accelerated innovation through Breakthrough Device Designations, allowing faster clinical integration. Furthermore, AI-driven neural signal processing, miniaturization of implants, and wireless interface advancements are making BCI systems more commercially viable.

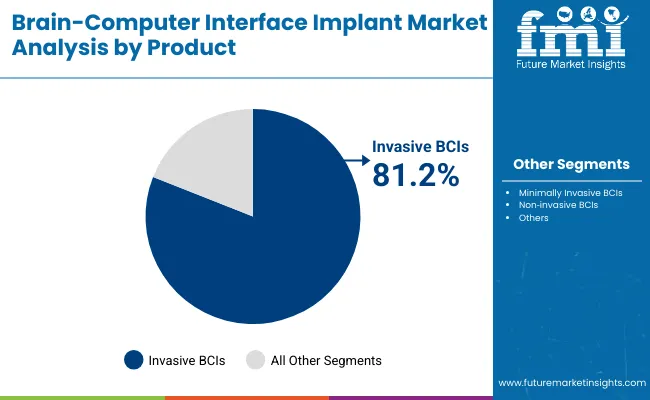

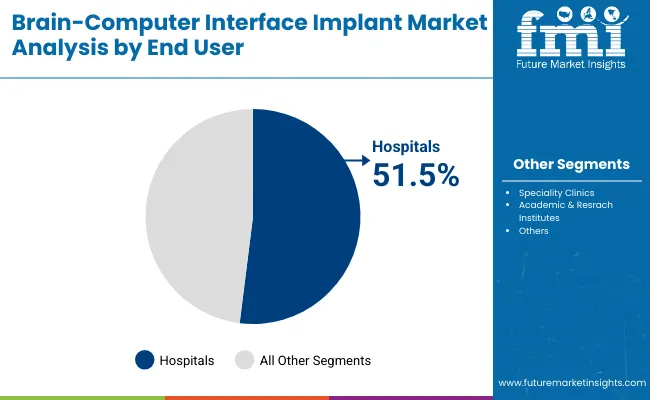

The market is segmented by product, technology, end-user, and region. Product categories include Invasive BCIs, Minimally Invasive BCIs, and Non-invasive BCIs, reflecting the varying levels of neural interface integration and clinical complexity. Based on End User, the segmentation includes Hospitals, Neurology Clinics, and Academic & Research Institutes, each playing a distinct role in clinical deployment, neuroprosthetic trials, and brain-machine interface research.

Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East and Africa, with North America and Europe leading in regulatory approvals, and Asia Pacific showing rising adoption in research-driven neurotechnology deployments.

| Product | Market Share (%), 2035 |

|---|---|

| Invasive BCIs | 79.5% |

| Minimally Invasive BCIs | 11.3% |

| Non ‑ invasive BCIs | 9.2% |

Minimally Invasive BCIs are expected to retain a dominant position, contributing 100.0% of the total market in 2025, owing to their superior neural signal accuracy and high clinical utility in treating severe motor and communication impairments. Their adoption has been primarily driven by clinical demand for direct cortical access, enabling real-time control of prosthetic devices and assistive technologies in patients with ALS, spinal cord injuries, and stroke.

Preference has increasingly shifted towards these systems due to their ability to deliver high-resolution brain signal capture, essential for precision-driven neuroprosthetics applications.Invasive BCIs is expected to leap from mid 2030and is predicted to hold a revenue share of 79.5% by 2035. Product development and trials have been incentivized by FDA Breakthrough Device designations, particularly in the USA, supporting the rapid translation of experimental implants into regulated hospital use. These factors have collectively reinforced the demand for invasive BCIs over non-invasive alternatives in high-acuity hospital and specialized neurorehabilitation settings.

| End User | Market Share (%), 2035 |

|---|---|

| Hospitals | 49.50% |

| Speciality Clinics | 35.00% |

| Academic & Research Institutes | 15.50% |

Hospitals Institutes are expected to remain the largest end-user segment in the BCI implant market, accounting for the highest treatment base by 2025 due to their critical role in neurosurgical interventions and post-acute neurological care. The majority of implantable BCI procedures, including those for paralysis restoration, epilepsy monitoring, and motor recovery, are conducted in hospital settings equipped with neurology and neurosurgery departments.

Demand has been reinforced by the increasing number of patients requiring invasive neural interface procedures and the growing availability of FDA-cleared BCI systems. Hospitals to hold a revenue share of more than 49.5% by 2035. Additionally, government-backed healthcare funding and reimbursement initiatives have supported BCI system acquisition in hospitals, especially those participating in brain-machine interface trials and rehabilitation programs for spinal cord injuries and ALS. These factors position hospitals as the primary driver of clinical-scale adoption of BCI implants.

The most significant growth driver in the Brain-Computer Interface (BCI) Implant Market is the regulatory support for clinical BCI innovation, particularly through the USA FDA’s Breakthrough Device Program, which has accelerated approvals for implants targeting conditions like ALS, spinal cord injuries, and locked-in syndrome. Hospitals and neuroscience centers are increasingly investing in implantable BCI systems due to their ability to restore communication and motor function.

Government-backed neurotechnology funding programs in the USA, Japan, and Europe are further catalyzing R&D and pilot deployments. As the number of patients requiring neurorehabilitation increases, demand for high-fidelity invasive BCIs with real-time decoding capabilities is driving procurement in tertiary care and academic research facilities.

Despite mounting clinical interest, the high complexity of neurosurgical implantation procedures remains a key restraint. The requirement for craniotomies or endovascular navigation, along with postoperative neuro-monitoring, limits access primarily to high-resource hospital environments. In addition, cost burdens related to surgical infrastructure, post-op care, and neural interface calibration often discourage adoption in mid-tier or rural hospitals.

Ethical considerations, regulatory liabilities, and patient apprehension over long-term implant safety further add to institutional hesitancy. Reimbursement gaps and lack of standardized surgical training also continue to hinder mass-market scaling.

A transformative trend reshaping the market is the integration of BCI implants into AI-driven, closed-loop assistive technology ecosystems. Leading players are no longer developing BCI hardware in isolation instead, they are embedding their devices within broader platforms that include speech-generating software, neural decoding algorithms, cloud-connected neurodata environments, and wearable IoT interfaces.

Companies like Neuralink and Precision Neuroscience are advancing beyond basic signal acquisition to build multi-layered neurotechnology stacks. These platforms are being adopted not only for medical use but also for cognitive enhancement research and long-term brain-machine symbiosis. As new clinical trials test AI-BCI systems for adaptive learning, movement restoration, and visual prosthesis, hospitals are evaluating BCI implants not just as therapeutic tools but as core components of next-generation neurocomputing infrastructure.

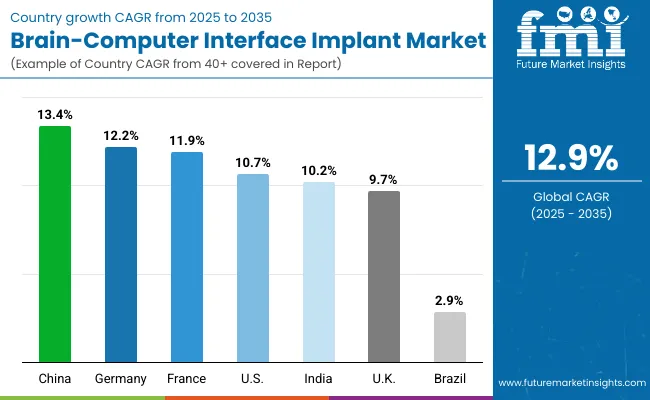

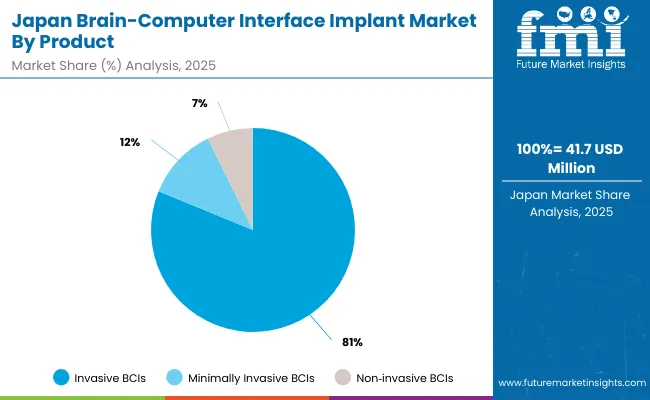

Asia Pacific will emerging as the fastest-growing region in the Brain-Computer Interface (BCI) Implant Market, projected to grow at a CAGR of more than 13.0% between 2025 and 2030. Among its leading contributors, Japan is expected to expand at a CAGR of 10.3%, supported by its robust neurotechnology research ecosystem and an aging population seeking assistive neuro-intervention solutions for conditions like ALS and stroke-related paralysis.

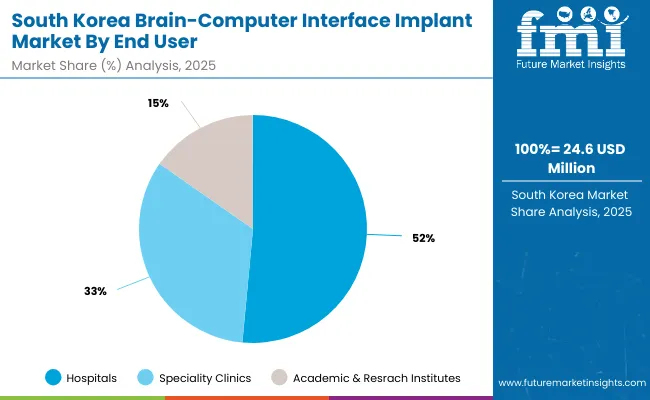

South Korea, growing at 9.9% CAGR, benefits from increased investments in academic neuroscience, clinical EEG applications, and government-backed cognitive research programs. The regional dominance is driven by the rapid expansion of neuroscience infrastructure in Tier 1 cities, cross-collaborations between academic institutes and hospitals, and innovation hubs in China, Japan, India, and South Korea that prioritize clinical trials and BCI integration into healthcare delivery models.

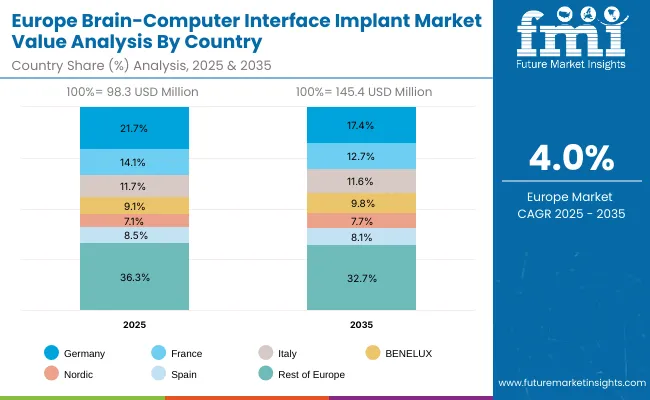

Europe is expected to grow steadily at a CAGR of 11.5% through 2035. Germany will expand at 12.2% CAGR, driven by its university hospital neurotech programs and increased public-private partnerships. France, with a higher 11.9% CAGR, benefits from national health reforms and state funding for assistive technology innovation. The UK is forecast to grow at 9.7% CAGR, fueled by NHS-backed BCI trial programs and infrastructure modernization in neuro-rehabilitation centers. Growth across Europe is reinforced by harmonized medical regulations, public funding for cognitive research, and clinical readiness for adopting invasive and non-invasive BCI solutions.

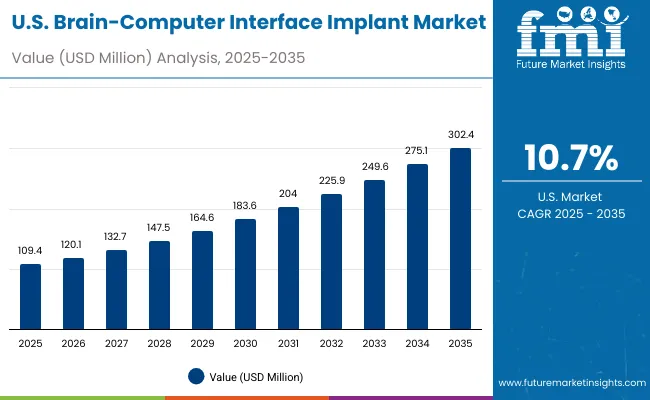

North America remains a mature yet innovation-led market, with the USA projected to grow at a CAGR of 10.7% between 2025 and 2035. Growth is primarily fueled by the FDA’s Breakthrough Device approvals, which have enabled early-stage human trials for invasive BCIs by companies like Neuralink and Synchron. The USA healthcare system’s early adoption of neuroprosthetic technologies for ALS, spinal injuries, and locked-in syndrome, combined with significant NIH and DARPA funding, has accelerated deployment. Additionally, rising surgical volumes, hospital-led research programs, and AI-integrated neurotechnology platforms are reinforcing BCI demand in clinical neurology and rehabilitation settings.

The BCI implant market in the United States is forecasted to grow at a CAGR of 10.7%, primarily driven by the FDA’s Breakthrough Device approvals and a sharp rise in hospital-led neurorehabilitation programs targeting patients with paralysis, ALS, and locked-in syndrome. Leading neurology centers and academic hospitals are upgrading their infrastructure to support surgical implantation and real-time BCI decoding systems, integrating AI-based software and wireless cortical interfaces. Growth is also being fueled by NIH and DARPA funding aimed at scaling human trials and assistive neurotechnology deployment.

The Brain-Computer Interface (BCI) Implant Market in the United Kingdom is projected to grow at a CAGR of 9.7% through 2035, driven by NHS-led initiatives focused on neurorehabilitation, assistive technologies, and digital health integration. Programs such as the NHS Long Term Plan and targeted innovation funding under NHSX are enabling academic hospitals and neurology centers to pilot invasive BCI systems for patients with severe motor impairments. Demand is further supported by the UK's growing emphasis on AI-powered medical devices, regulatory backing through the MHRA, and rising public investment in neurological research facilities.

The Brain-Computer Interface (BCI) Implant Market in Germany is projected to grow at a CAGR of 12.2%, driven by the country’s strong academic research ecosystem and public investment in neurotechnology innovation. Under initiatives linked to Germany’s High-Tech Strategy 2025 and funding from the German Research Foundation (DFG), university hospitals are scaling up BCI-related trials in cognitive restoration, ALS communication systems, and post-stroke rehabilitation. Germany’s adherence to strict medical device standards and surgical protocols is encouraging the deployment of high-precision invasive BCIs in clinical neurology departments.

The Brain-Computer Interface (BCI) Implant Market in India is expected to grow at a CAGR of 10.2%, making it one of the fastest-growing emerging markets globally. Growth is fueled by large-scale expansion in neuroscience research institutions, AI-enabled neurology departments, and rehabilitation centers across Tier 1 and Tier 2 cities. Rising incidence of neurological disorders, along with increasing academic focus on BCI technologies, has led to early-stage adoption of EEG-based and non-invasive BCI systems in premier hospitals. Indian research universities are also collaborating with local and international firms to develop low-cost BCI solutions optimized for domestic healthcare budgets and infrastructure.

The Brain-Computer Interface (BCI) Implant Market in China is projected to grow at a CAGR of 13.4% through 2035, supported by large-scale hospital modernization programs aligned with the Healthy China 2030 strategy. China’s Ministry of Health is rolling out clinical frameworks to enable precision diagnostics and neurological treatment via AI-integrated EEG and invasive BCI platforms. Urban hospitals are establishing neuroscience labs equipped with BCI systems, while regional facilities are adopting standard EEG and fMRI-integrated devices to boost cognitive care capacity. Domestic manufacturers are also scaling production of EEG/fMRI kits and are increasingly integrating signal analysis software for real-time brain mapping.

The Brain-Computer Interface (BCI) Implant Market in Japan is projected to reach USD 23.4million by 2035, with Invasive BCIs will account for 77.4% of the revenue share, reflecting Japan’s dual emphasis on surgical precision and neural recovery. This dominant share stems from Japan’s stringent clinical standards under JSHP (Japan Society of Healthcare Policy) and institutional investment in neurodegenerative disease management. Japan’s hospital infrastructure particularly in long-term care is increasingly integrating fMRI and EEG-based assistive systems for aging-related cognitive treatment. Furthermore, domestic suppliers are developing smart BCI modules with localized support.

The Brain-Computer Interface (BCI) Implant Market in South Korea is estimated at USD 14.0 million in 2035. This leadership is driven by Ministry of Health and Welfare (MOHW) directives mandating advanced neurological diagnostic infrastructure across tertiary care hospitals. Hospitals are adopting ISO-certified EEG and MEG workstations for real-time brain signal tracking and treatment of neurological impairments. Neuro-oncology and rehabilitation departments are integrating fMRI for cognitive mapping, supported by research collaborations with academic centers.

The Brain-Computer Interface (BCI) Implant Market is moderately consolidated, led by deep-tech innovators and neuroengineering pioneers pushing the boundaries of cognitive augmentation and assistive communication. Companies like Synchron are advancing minimally invasive vascular BCI platforms that integrate with medical imaging infrastructure and have progressed into human trials in the USA and Australia. Their implantable systems emphasize functional restoration in paralysis patients with scalable deployment potential.

Neurotechnology companies such as Neuralink and Precision Neuroscience are focused on high-channel neural recording devices with wireless transmission and surgical precision. Precision Neuroscience has the first approved implant in 2025. Neuralink is pioneering brain-controlled device operation, while Precision Neuroscience is targeting ultra-thin cortical strips for enhanced safety and broad patient applicability.

Paradromics is developing high-throughput neural interfaces for severe neurological conditions, aiming for robust data transmission and real-time decoding. BrainGate / Blackrock Neurotech continues to lead academic-clinical collaborations in motor restoration and neural prosthetics, with established protocols in university hospitals. CorTec GmbH is strengthening its position in closed-loop systems, supporting neural signal recording and stimulation in therapeutic research across Europe.

The market’s competitive edge is shifting toward biocompatible design, surgical ease, and clinical-grade software ecosystems to support scalable, regulatory-cleared BCI adoption across healthcare and research settings.

Key Development

| Item | Value |

|---|---|

| Market value | USD 351.3 million |

| Product type | Invasive BCIs, Minimally Invasive BCIs, and Non-invasive BCIs, |

| Technology | Electroencephalography (EEG), Magnetoencephalography (MEG), Electrocorticography (ECoG), and Functional Magnetic Resonance Imaging (fMRI), |

| End User | Hospitals, Speciality Clinics, and Academic & Research Institutes |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Synchron, Precision Neuroscience, Neuralink, Paradromics, BrainGate / Blackrock Neurotech, CorTec GmbH, Axoft & Inc., Onward Medical, Science Corporation |

| Additional Attributes | Dollar sales by application and regions, adoption trends of Next-Generation BCI Implants, Rising demand in Neuroscience & Cognitive Research, Growing demand across Assistive Technology and Neurorehabilitation Centers |

The global Brain-Computer Interface (BCI) Implant Market is estimated to be valued at USD 351.3 million in 2025.

The market size for BCI Implants is projected to reach USD 1,181.1 million by 2035.

The BCI Implant Market is expected to grow at a CAGR of 12.9% during this period.

Key product types include Invasive BCIs, Minimally Invasive BCIs, and Non-Invasive BCIs.

The Hospitals segment is projected to command the largest share at 51.5% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Implantable Tibial Neuromodulation Market Forecast and Outlook 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Implant-Borne Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Implantable Collamer Lens Market Size and Share Forecast Outlook 2025 to 2035

Computerized Physician Order Entry (CPOE) Market Size and Share Forecast Outlook 2025 to 2035

Implantable Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Computer Graphics Market Size and Share Forecast Outlook 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Implantable Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA