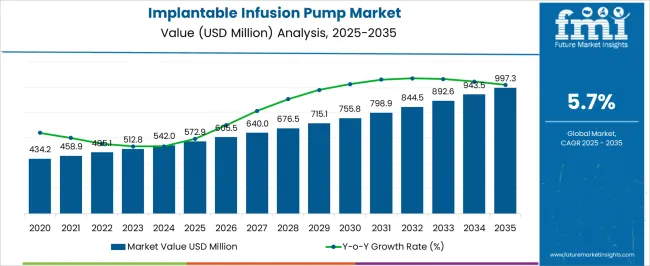

The Implantable Infusion Pump Market is estimated to be valued at USD 572.9 million in 2025 and is projected to reach USD 997.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Implantable Infusion Pump Market Estimated Value in (2025E) | USD 572.9 million |

| Implantable Infusion Pump Market Forecast Value in (2035F) | USD 997.3 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The implantable infusion pump market is experiencing steady expansion driven by the rising prevalence of chronic diseases and the growing need for long-term drug delivery systems. Advancements in microelectromechanical systems, miniaturized device design, and biocompatible materials are improving patient outcomes while reducing the risk of complications. These pumps offer precise drug delivery with programmable dosing capabilities, making them particularly effective in managing pain, cancer, and neurological conditions.

Increasing physician preference for targeted therapy combined with reduced systemic side effects is enhancing adoption rates across clinical settings. Regulatory approvals for novel drug-device combinations and increased R&D investments by medtech companies are contributing to product innovation.

Hospitals and specialty clinics are increasingly relying on implantable pumps for complex care pathways that demand consistent and controlled medication infusion. As healthcare systems shift toward patient-centered approaches and personalized medicine, the demand for advanced implantable infusion solutions is expected to accelerate across global markets.

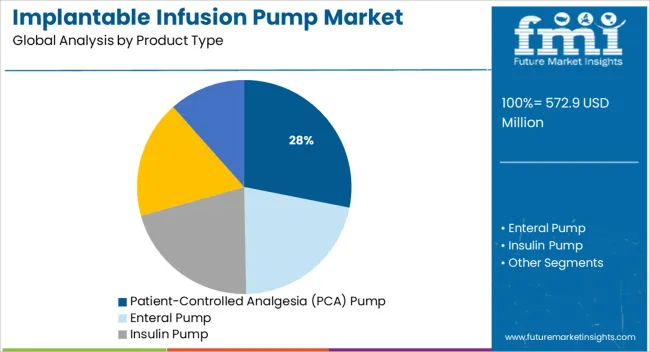

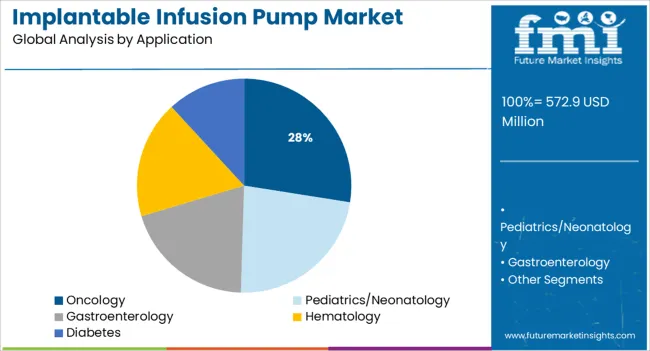

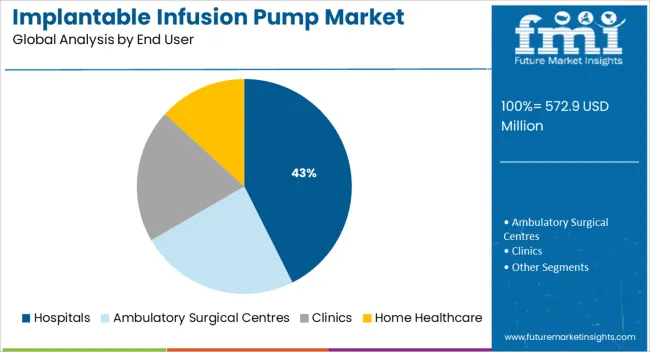

The market is segmented by Product Type, Application, and End User and region. By Product Type, the market is divided into Patient-Controlled Analgesia (PCA) Pump, Enteral Pump, Insulin Pump, Elastomeric Pump, and Syringe Pump. In terms of Application, the market is classified into Oncology, Pediatrics/Neonatology, Gastroenterology, Hematology, and Diabetes. Based on End User, the market is segmented into Hospitals, Ambulatory Surgical Centres, Clinics, and Home Healthcare. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Patient-controlled analgesia pumps are projected to account for 28.1% of total market revenue by 2025 within the product type category, positioning them as a leading choice. This growth is being driven by the ability of PCA pumps to empower patients with self-administered pain relief within prescribed safety limits, which reduces dependence on clinical staff and improves pain management outcomes.

The integration of programmable delivery systems and dose-lockout features ensures safety while enhancing patient comfort and satisfaction. PCA pumps are particularly favored in postoperative care and chronic pain conditions where personalized dosing is critical.

The adoption has been further supported by technological improvements in catheter compatibility and device miniaturization, allowing seamless implantation and better mobility. Healthcare providers have recognized PCA pumps as tools that improve care efficiency and reduce hospitalization times, reinforcing their leadership in the implantable infusion pump category.

In the application category, oncology is expected to hold a 27.5% revenue share in 2025, making it one of the primary drivers of demand for implantable infusion pumps. This segment’s prominence is attributed to the need for continuous and controlled administration of chemotherapy agents and supportive medications over extended periods.

Implantable infusion pumps are being increasingly utilized in cancer care to enhance drug efficacy, limit systemic toxicity, and reduce the burden of frequent hospital visits. Oncologists are adopting these devices to support ambulatory treatment plans and improve patient quality of life.

Innovations in programmable pumps that deliver cytotoxic agents directly to tumor sites or metastatic areas are supporting more targeted therapeutic approaches. Additionally, growing incidence rates of various cancers globally are fueling demand for infusion-based oncology management, contributing to the segment’s continued expansion.

Hospitals are projected to hold 42.6% of the total market revenue in 2025 within the end user category, establishing them as the dominant care setting for implantable infusion pump procedures. This leadership stems from hospitals’ capacity to handle surgical implantation, post-operative monitoring, and long-term care management under one roof.

The presence of multidisciplinary teams and specialized infrastructure enables comprehensive treatment protocols for patients with cancer, chronic pain, or neurological disorders. Hospitals also benefit from access to advanced diagnostic tools, anesthesia services, and recovery units that are essential for safe and effective pump implantation.

As reimbursement frameworks increasingly support device-based therapies, hospitals are investing in specialized infusion systems to expand service offerings and improve outcomes. The growing emphasis on integrated care models and the need for centralized data tracking further reinforce hospitals’ pivotal role in the delivery and management of implantable infusion pump therapies.

The principal factors propelling the expansion of the implantable infusion pump market are rising rates of cancer, diabetes, and obesity worldwide. A significant increase in implantable drug delivery techniques via surgeries is also driving up the consumption of infusion pump.

The delivery of chemotherapy agents and analgesics are the foremost activities; numerous implantable infusion pump are industrially obtainable to end users, which will drive sales at a significant rate over the forecasting period. The innovative implantable infusion pump provide long-term drug infusion at a differential or constant rate.

Contribution to progress from top manufacturers as a result of various factors, for example, growing prevalence of chronic diseases alongside an aging population, broadening adoption of convenient & advanced implantable infusion pump to reduce hospital facility use, and enduring increase in surgical procedural volumes.

Aside from that, advancements in technology and increased spending by manufacturers for the production of better implantable infusion pump will drive the development of this market, notably in the United States and Western Europe.

However, the FDA's stringent approval regulations for implantable infusion pump will constrain the industry's growth.

Furthermore, patient care risks and medical errors while drug delivery affiliated with implantable infusion pump in desirable areas may act as a limitation to the market's expansion. Product recalls and stringent regulations for innovative products may also restrict the overall implantable infusion pump market's growth throughout the forecast period.

North America is predicted to dominate the global Implantable Infusion Pump market in the coming years and account for a share of 36.7% of the global market in 2025. This dominance is due to the increasing number of chronic diseases, the purpose of healthcare infrastructure, and the presence of significant market players in the region.

Furthermore, supportive reimbursement programs covering the costs of implantable medical devices as well as the protocol inspired individuals in the region to choose such devices. Furthermore, the surging prevalence of chronic pain in the United States is anticipated to boost the market for implantable infusion pump.

According to CDC 2024 data, 20.4% of adults had chronic pain in 2020 and 7.4% of adults had severe pain that frequently restricted life or work activities. Both increased with age and were greatest among adults 65 and older.

As a result, soaring chronic pain cases are expected to increase demand for implantable infusion pump, which are surgically implanted to provide consistent drug delivery for pain management in non-cancer patients.

Furthermore, recent product authorization by the US Food and Drug Administration is anticipated to expand the regional market for implantable infusion pump.

The Asia Pacific, excluding Japan, is also predicted to experience substantial growth in the Implantable Infusion Pump Market owing to increased R&D activities, saturation in the advanced economies, and the advancement of healthcare infrastructure in this region.

The Asia-Pacific region, excluding Japan, has several small players that conduct business on a regional level and contribute to a significant portion of the Implantable Infusion Pump Market industry.

Improved medical infrastructure and steadily increasing disposable income in emerging economies such as China and India, among many others, are also cruising the implantable infusion pump market.

The market for implantable infusion pump in Europe is predicted to expand at a 6.2% annual rate from 2025 to 2035. The global increase in the healthcare sector is accelerating the development of the Europe infusion pump market. Europe is accounting for a share of 29.5% of the global market in 2025.

One of the key factors driving the expansion of the implantable infusion pump market is the emergence of the prevalence of chronic illnesses throughout the region. Clamor for ambulatory implantable infusion pump in home health care settings, as well as a boost in the number of ICU beds in countries with a high prevalence of COVID-19, compel market growth.

Cancer (Oncology) is anticipated to represent the largest portion of the implantable infusion pump application segment. This is due to the rise in cases of cancer among the global population.

Cancer was the second-leading cause of death globally in 2020, causing an estimated 542 million deaths, or one in every six deaths, according to the WHO 2024 data, and approximately 300,000 new cases of cancer are detected each year among children aged 0-19 years.

Furthermore, 9,503,710 new cancer cases were reported in Asia, according to data from the Global Cancer Observatory 2024. As a result, rising cancer cases around the world may augment growth in the oncology segment.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base. For instance,

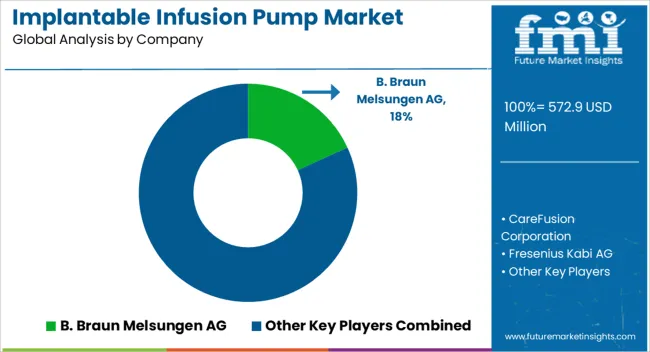

Some leading implantable infusion pump manufacturers include B. Braun Melsungen AG., CareFusion Corporation, Fresenius Kabi AG, Terumo Corporation, Medtronic Plc., Baxter International Inc., Smiths Medical, MOOG Inc., Johnson & Johnson Private Ltd., and Hospira, Inc., Flowonix, The Tandem Diabetes Care.

These key implantable infusion pump providers are adopting various strategies such as new product launches and approvals, partnerships, collaborations, acquisitions, mergers, etc. to increase their sales and gain a competitive edge in the global implantable infusion pump market. For instance,

The global implantable infusion pump market is estimated to be valued at USD 572.9 million in 2025.

The market size for the implantable infusion pump market is projected to reach USD 997.3 million by 2035.

The implantable infusion pump market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in implantable infusion pump market are patient-controlled analgesia (pca) pump, enteral pump, insulin pump, elastomeric pump and syringe pump.

In terms of application, oncology segment to command 27.5% share in the implantable infusion pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Implantable Drug Infusion Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Infusion Pump Market

Multi-therapy Infusion Pumps Market - Trends & Forecast 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

MRI-Compatible IV Infusion Pump Systems Market Growth – Trends & Forecast 2025-2035

Implantable Tibial Neuromodulation Market Forecast and Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Implantable Collamer Lens Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Implantable Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Infusion fluid holder Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Implantable Drug Eluting Devices Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA