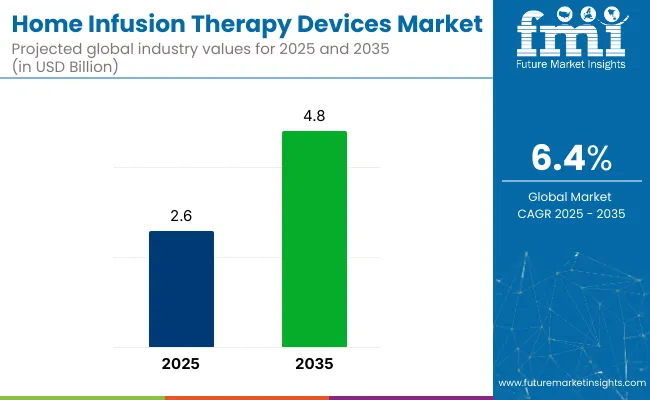

The global home infusion therapy devices market is valued at USD 2.6 billion in 2025 and is poised to reach USD 4.8 billion by 2035, registering a CAGR of 6.4%. This growth is expected to be driven by the rising prevalence of chronic illnesses such as cancer, diabetes, and immune disorders, alongside a strong global push toward home-based healthcare.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 2.6 Billion |

| Projected Market Size (2035) | USD 4.8 Billion |

| CAGR (2025 to 2035) | 6.4% |

Increased patient preference for comfort, reduced hospital visits, and cost-effective treatment alternatives have been positioning home infusion as a preferred therapeutic pathway in both developed and emerging markets. The shift toward decentralizing healthcare services has been reinforced by advancements in remote monitoring and the integration of telehealth services.

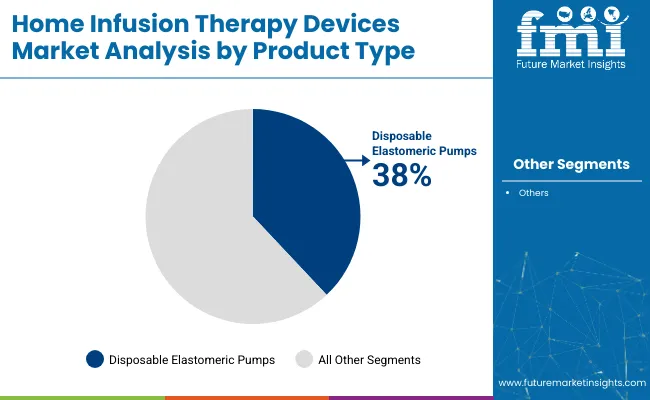

In 2025, the home infusion therapy devices market is expected to be led by disposable elastomeric pumps, which are projected to account for 38% of the total market share by device type, owing to their portability, cost-efficiency, and ease of use in antibiotic and chemotherapy delivery.

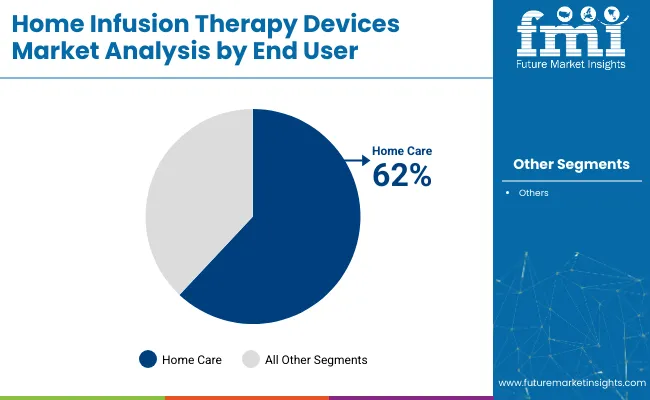

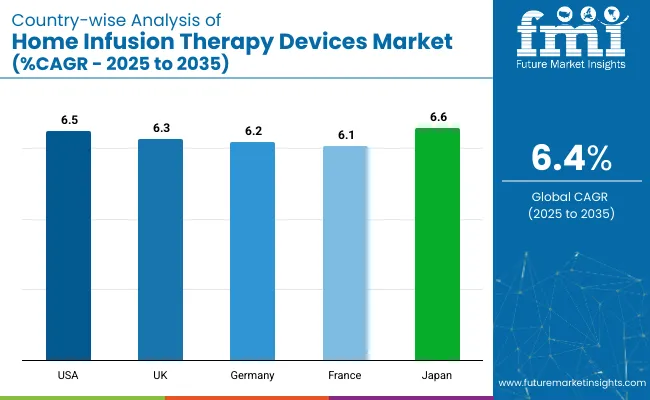

Simultaneously, home care settings are anticipated to dominate the end-user segment, capturing approximately 62% of the market share, driven by the growing demand for patient-centric, home-based treatment models. Among the countries analyzed, Japan is forecasted to register the highest CAGR of 6.6% between 2025 and 2035, supported by an aging population, robust investment in digital health infrastructure, and widespread adoption of AI-integrated infusion systems.

Challenges such as high device costs and regulatory hurdles are being addressed through flexible reimbursement models, improved compliance tracking, and the adoption of sustainable product materials. As smart healthcare ecosystems continue to evolve, the home infusion therapy devices market is expected to remain a pivotal segment in modern chronic care delivery.

Innovations in device technology have been prioritized, with manufacturers focusing on programmable infusion systems, IoT-enabled monitoring, and extended battery life. These advancements are being integrated to enhance treatment accuracy, reduce human error, and support remote supervision, enabling caregivers and healthcare providers to ensure safer and more efficient home-based infusion therapy.

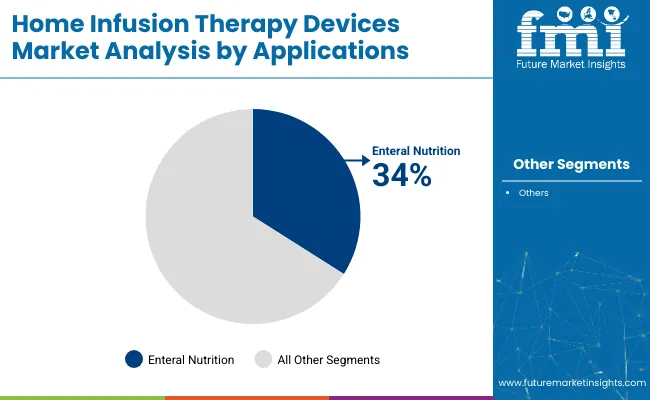

The market is segmented into product type, application, end user, and region. By product type, the market is divided into disposable elastomeric pumps, insulin pumps, PCA pumps, electronic ambulatory pumps, and infusion system accessories. Based on application, the market is categorized into enteral nutrition, parenteral nutrition, chemotherapy, antibiotic administration, and others (pain management, hydration therapy, immune globulin therapy, and antiviral treatments).

In terms of end user, the market is segmented into home care settings and long-term care centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Disposable elastomeric pumps are projected to lead the product type segment, accounting for 38% of the global market share by 2025. Their use has been encouraged by portability, cost-efficiency, and ease of operation in home-based settings for therapies such as antibiotics and chemotherapy.

Home care settings are expected to account for 62% of the total market share in 2025, driven by rising demand for decentralized treatment, reduced hospitalization costs, and growing support for remote patient care models.

Enteral nutrition is projected to lead the application segment, accounting for 34% of the global market share, due to its applicability in managing long-term nutritional support for patients with gastrointestinal and neurological conditions.

The home infusion therapy devices market is being influenced by the growing shift toward home-based chronic care, the integration of smart infusion technologies, and efforts to minimize hospital stays. Demand has been supported by cost-effective treatment options, increased patient comfort, and expansion of digital health infrastructure.

Recent Trends in the Home Infusion Therapy Devices Market

Challenges in the Home Infusion Therapy Devices Market

The USA home infusion therapy devices market is expected to grow at a CAGR of 6.5% from 2025 to 2035. This expansion is being driven by a rising chronic disease burden, the integration of smart infusion technologies, and supportive reimbursement frameworks that are encouraging home-based treatment.

The UK home infusion therapy devices market is projected to grow at a CAGR of 6.3% during the forecast period. Growth has been supported by the shift toward decentralized healthcare, the aging population, and government incentives promoting digital health infrastructure.

Germany’s home infusion therapy devices market is forecasted to expand at a CAGR of 6.2% from 2025 to 2035. Growth is being supported by robust healthcare infrastructure, high awareness of patient safety, and the country’s commitment to personalized medicine.

The home infusion therapy devices market in France is anticipated to grow at a CAGR of 6.1% over the forecast period. Emphasis on quality care, environmental sustainability, and integrated treatment planning is encouraging adoption of home infusion systems, especially in long-term care and post-acute recovery.

Japan’s home infusion therapy devices market is projected to grow at a CAGR of 6.6% through 2035. With a rapidly aging population and advancements in medical technology, the country continues to prioritize home-based chronic care using precision-engineered, smart infusion systems.

The home infusion therapy devices market is considered moderately consolidated, with several international companies accounting for significant market shares, while regional manufacturers and niche technology players continue to introduce specialized solutions. Competitive positioning has been shaped by advancements in device connectivity, strategic collaborations with homecare providers, and expansion into emerging healthcare markets.

Tier-one firms such as Becton, Dickinson and Company (BD), Baxter International Inc., Fresenius Kabi AG, ICU Medical, Inc., and Smiths Medical have been focusing on smart infusion solutions, wireless integration, and ergonomic design improvements. These companies have invested in AI-enabled drug delivery systems, expanded their product portfolios through acquisitions, and partnered with telehealth providers to support remote monitoring and personalized infusion therapy.

Recent Home Infusion Therapy Devices Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.6 billion |

| Projected Market Size (2035) | USD 4.8 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in units |

| By Device Type | Disposable Elastomeric Pumps, Insulin Pumps, PCA Pumps, Electronic Ambulatory Pumps, Infusion System Accessories |

| By Application | Enteral Nutrition, Parenteral Nutrition, Chemotherapy, Antibiotic Administration, Others (Pain Management, Hydration Therapy, Immune Globulin Therapy, Antiviral Treatments) |

| By End User | Home Care Settings, Long-Term Care Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Japan, South Korea, China, India, Australia |

| Key Players | Becton, Dickinson and Company (BD), Baxter International Inc., Fresenius Kabi AG, ICU Medical, Inc., Smiths Medical, Nipro Corporation, Johnson & Johnson, F. Hoffmann-La Roche Ltd, Pfizer Inc., Terumo Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is expected to reach USD 4.8 billion by 2035.

The global market is projected to grow at a CAGR of 6.4% during this period.

Disposable elastomeric pumps are expected to lead with a 38% market share in 2025.

Home care settings are anticipated to account for 62% of the total market share in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 6.6% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Home Devices Market Size and Share Forecast Outlook 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Multi-therapy Infusion Pumps Market - Trends & Forecast 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

At-Home Therapeutic Beauty Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Endovascular Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Intraosseous Infusion Devices Market Report - Demand & Forecast 2025 to 2035

Neonatal Phototherapy Devices Market Report – Demand & Forecast 2017-2027

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Demand for Homecare Medical Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

High-Flow Oxygen Therapy Devices Market Analysis – Size, Share & Growth 2025–2035

Hyperbaric Oxygen Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA