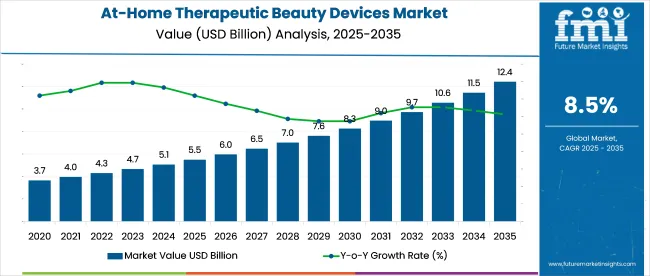

The at-home therapeutic beauty devices market is projected to reach USD 12.4 billion by 2035, advancing from USD 5.5 billion in 2025 at 8.5% CAGR.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.5 billion |

| Industry Value (2035F) | USD 12.4 billion |

| CAGR (2025 to 2035) | 8.5% |

Growth is being concentrated in upper-income urban households where dermatological service gaps, inflation-adjusted procedure costs, and time constraints have driven self-directed skincare. LED therapy masks, microcurrent toners, and RF-based lifting tools are being absorbed into daily routines not as luxuries, but as replacements for scheduled in-clinic care. USA buyers, contributing 29% of global revenue, are favoring FDA-cleared devices with condition-specific claims over general-use models.

At-home therapeutic beauty devices account for approximately 20-25% of the overall beauty devices market and make up nearly 100% of the home-use beauty devices category. Within the personal care appliances segment, their share ranges from 50-60%, reflecting dominance in grooming and skincare tools intended for individual use.

In the skincare and treatment devices category, these devices contribute about 55-80%, driven by growing consumer demand for non-invasive, at-home solutions. Within the expansive beauty and personal care products market, their presence remains limited to just 1-3%, signaling a niche but fast-growing segment.

In October 2024, NuFACE introduced the Trinity+ Complete, a next-generation at-home facial toning device that combines microcurrent therapy with red light technology. Designed for non-invasive skin rejuvenation, the device features three magnetized attachments to target facial muscles, smooth wrinkles, and stimulate ATP production.

It incorporates 36 red LED lights and delivers up to 425 microamps through precision microcurrent tips. Safety mechanisms automatically power down the unit after 20 minutes. “As we get older, we need to exercise more to keep our bodies toned and tight,” says NuFACE co-founder and CEO Tera Peterson. “The same concept goes for delicate facial muscles.”

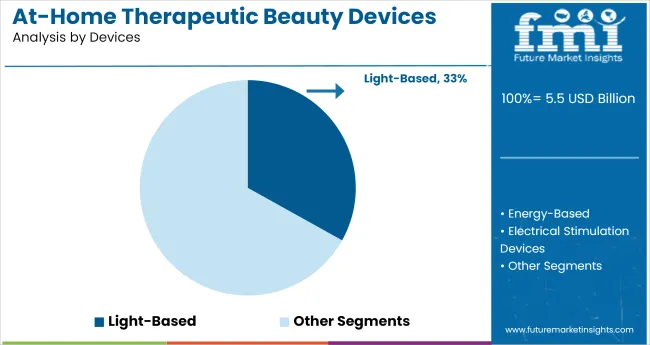

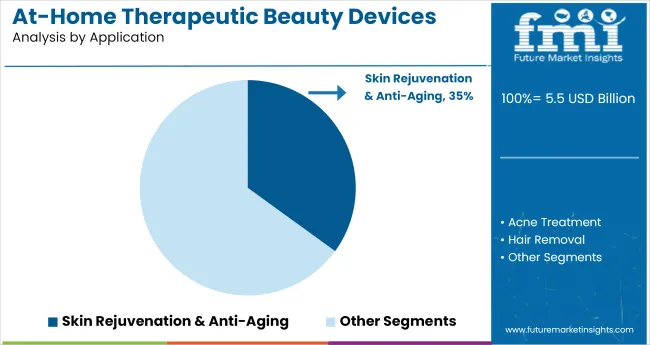

Athome therapeutic beauty devices market is segmented by product type into lightbased devices, radiofrequency devices, ultrasonic devices, and microneedle tools. By application, segmentation covers skin rejuvenation & antiaging, acne treatment, hair removal, pigmentation correction, and others.

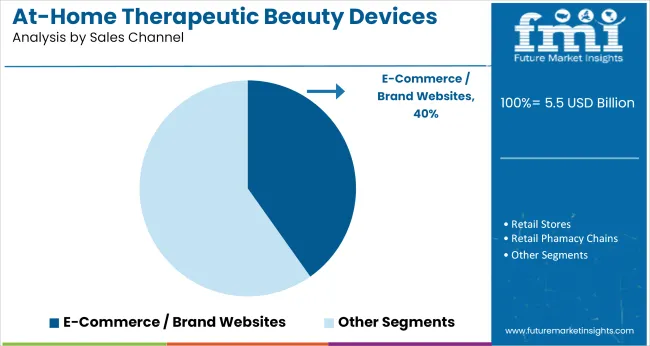

Sales channels include ecommerce/brand websites, specialty stores, pharmacies, and multibrand retail chains. Geographic coverage spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia.

Lightbased devices captured 30.2% share in 2024 and are projected to reach 33% in 2025, a 2.9point rise. Consumers are increasingly choosing LED, IPL, and low-level laser devices for at-home use due to ease of application and minimal downtime. Advances in wavelength control and device ergonomics have increased the adoption rate, particularly among users aged 30-55.

CurrentBody’s LED Light Therapy Mask, experienced a 22% increase in unit sales across North America in 2024. The product’s effectiveness in reducing fine lines and hyperpigmentation has been supported by dermatologist-backed studies and high-profile media coverage, making it a category driver.

Skin rejuvenation & anti-aging commanded a 32.1% share in 2024 and is set to reach 35.0% in 2025, a 2.9 point increase. Consumer focus on maintaining facial tone, reducing wrinkles, and improving skin elasticity is driving the segment.

Midlife consumers in developed economies are using these devices as an alternative to dermatological procedures, often with weekly routines supported by apps and guided treatments.NuFACE Trinity, has become a preferred option among USA women aged 35-54. Clinical results from NuFACE suggest measurable improvements in cheek contour and jawline definition within 60 days of use, explaining its continued demand across dermatology retailers and DTC platforms.

Ecommerce and direct brand websites held 37% share in 2024 and are forecast to rise to 40% in 2025, a 3.2point gain. Higher trust in official platforms for product authenticity, exclusive bundles, video instructions, and access to brand support is driving this shift.

Consumers increasingly prefer DTC channels due to convenience, discounts, and loyalty integrations that are not typically available through third-party marketplaces.Dermaflash’s Replenishment Subscription Program contributed to a 28% year-on-year increase in customer retention in 2024. The company’s bundled offers, automated shipments, and educational tools via its official site have helped secure long-term customer engagement in the anti-aging segment.

The at-home therapeutic beauty devices industry is being driven by advancements in technology and increasing consumer demand for personalized skincare solutions. Factors such as rising disposable incomes, technological innovations, and the influence of social media on consumer behavior are fueling this growth.

Drivers of Growth in At-Home Therapeutic Beauty Devices

The industry experienced strong growth, with global sales increasing by 18.5% YoY in H1 2025. Advancements in LED therapy, microcurrent, and radiofrequency (RF) technologies were key drivers. In North America, LED device sales rose by 22%, and microcurrent devices saw a 17% demand increase. Consumer adoption grew, with 63% of surveyed consumers preferring at-home devices for their convenience and cost-effectiveness. Social media influence also contributed, driving a 25% surge in online sales.

Key Challenges Slowing Industry Growth

The industry faces several challenges, including high initial costs, with premium devices priced at an average of USD 500 in 2025. Safety concerns persist, affecting 15% of users, as reports of skin irritation and burns from improper usage continue to rise. The regulatory hurdles are slowing industry growth, with 12% of new beauty devices in the EU facing approval delays. These challenges are impacting broader adoption, though improvements in safety standards and regulatory processes are expected to mitigate them.

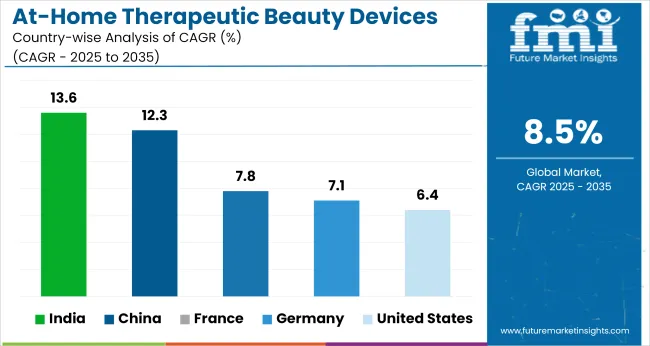

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

| Germany | 7.1% |

| China | 12.3% |

| France | 7.8% |

| India | 13.6% |

The global at-home therapeutic beauty devices market is expanding at 8.5% CAGR from 2025 to 2035. India, a BRICS member, leads with 13.6%, followed by China at 12.3%, both driven by device affordability and growing e-commerce penetration.

France and Germany, part of the OECD, show moderate growth at 7.8% and 7.1%, supported by aging users but limited by CE certification cycles. The United States, also in the OECD, trails at 6.4% due to market saturation and low subscription retention. Diverging growth reflects income sensitivity, policy timelines, and digital readiness.

This report analyses over 40 countries, with five key markets shared for reference.

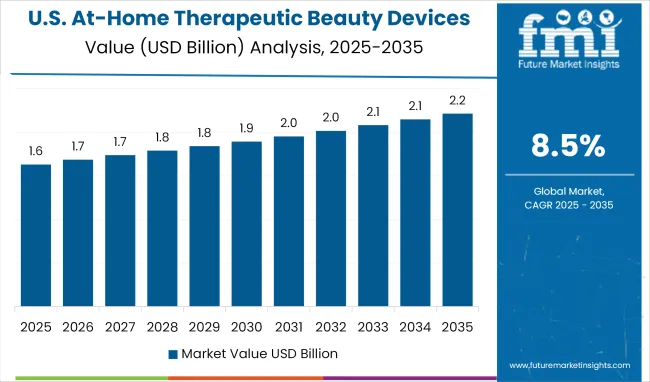

The USA market evolved from general-purpose facial tools and mass retail distribution during 2020 to 2024 toward more clinical-grade offerings between 2025 to 2035. A CAGR of 6.4% has been projected for the forecast period, compared to 4.2% in the historical phase. Initial demand was driven by basic cleansing and anti-aging tools available through pharmacies and wellness retailers.

However, the shift toward dermatologist-endorsed therapeutic routines, including LED and microcurrent devices, began reshaping consumer preference. Targeting women aged 35-64, new purchasing behavior was linked to telehealth-driven prescriptions and diagnostic-linked product recommendations.

Between 2020 to 2024, German consumers mainly opted for mono-functional cleansing and toning tools. The market grew at 4.9% during this phase. From 2025, preference shifted toward multifunctional therapeutic equipment such as microcurrent devices, contributing to a projected CAGR of 7.1%.

Purchase intent was influenced by safety certifications and energy efficiency. The integration of devices into public and private wellness initiatives aligned with rising trust in CE-certified tools. The industry has shown a consolidation in urban centers, especially Berlin and Munich, supported by local manufacturing incentives.

From 2020 to 2024, demand in China was dominated by basic imported products sold through cross-border platforms, growing at a CAGR of 8.2%. In contrast, 2025-2035 marks a period of domestic brand ascendancy, driving the market at an estimated 12.3% CAGR. Growth has been enabled by integration with mobile apps, AI diagnostics, and livestream commerce.

The industry is expanding across middle-income consumers seeking non-invasive skin therapies. Regulatory approvals for advanced modalities, such as RF and IPL, have unlocked high-velocity distribution across both public and private healthcare networks.

France 2020-2024 phase, which posted a 5.2% CAGR, was shaped by cosmetic-led demand centered in Paris and Lyon. The next decade, with a projected CAGR of 7.8%, shifts toward medically endorsed home-use devices embedded in cosmeceutical bundles.

Usage has extended to scalp and rosacea therapies, with strong trust built around CE Class II certifications. Public health agencies have supported awareness campaigns, encouraging broader uptake among aging consumers seeking non-surgical anti-aging regimens.

In 2020-2024, Indian demand was limited to urban elite users purchasing imported LED masks and tools via e-commerce, supporting a CAGR of 9.5%. Between 2025 to 2035, expansion has been driven by Ayurveda-integrated brands and regional D2C players offering bundled subscriptions, accelerating growth to 13.6%.

Affordability has improved due to local manufacturing in Gujarat and Karnataka. Adoption is rising sharply outside tier-1 cities, with rising interest in ultrasonic and RF-based facial tools for regular home use.

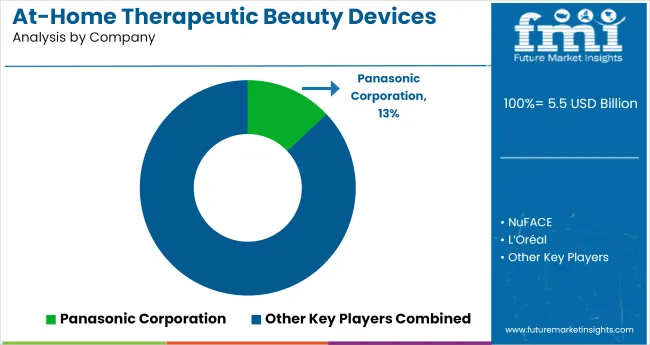

The at-home therapeutic beauty devices industry is moderately consolidated, featuring a mix of global conglomerates and tech-forward specialists. Panasonic Corporation, L’Oréal, and Koninklijke Philips N.V. lead the industry with diversified wellness portfolios and global distribution networks, supporting a steady stream of infrared, microcurrent, and LED-based devices.

NuFACE, YA-MAN, and Nu Skin Enterprises focus on facial toning and anti-aging applications, building loyal consumer bases via DTC channels and subscription models.

FOREO and Solawave have emerged as disruptors through influencer-led promoting and minimalist designs targeted at younger demographics. Regional players like Beurer GmbH and The Beauty Tech Group are scaling their footprint by offering FDA-cleared or CE-certified multifunctional tools.

Technology upgrades,particularly in ultrasonic, blue light therapy, and radiofrequency,remain critical to differentiation. Competitive strategies now center on modular devices, refillable cartridges, and clinical validation to build consumer trust and extend brand lifetime value in the self-care ecosystem.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 5.5 billion |

| Projected Industry Size (2035) | USD 12.4 billion |

| CAGR (2025 to 2035) | 8.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Devices Analyzed (Segment 1) | Light-Based, LED Therapy Devices, IPL (Intense Pulsed Light) Devices, Laser Devices, Energy-Based Devices, Electrical Stimulation Devices, Microdermabrasion Devices, Derma Rollers or Microneedling Devices, Massage Devices, Thermal Devices, Combination Devices |

| Applications Analyzed (Segment 2) | Skin Rejuvenation and Anti-Aging, Acne Treatment, Hair Removal, Hair Regrowth, Body Contouring, Pigmentation Treatment, Scar Reduction, Eye Care |

| Sales Channels Analyzed (Segment 3) | Retail Stores, Retail Pharmacy Chains, Supermarket and Departmental Stores, E-commerce or Brand Websites, Direct Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Panasonic Corporation, NuFACE, L’Oréal, Beurer GmbH, FOREO, Koninklijke Philips N.V., Solawave, Nu Skin Enterprises Inc, The Beauty Tech Group, YA-MAN, Cynosure, Syneron Candela |

| Additional Attributes | Dollar sales by device type and application, rising demand for LED and IPL-based therapies, e-commerce expansion in beauty tech, device bundling for multi-functional skincare, regional consumer preference patterns |

The industry includes light-based, LED therapy devices, IPL (intense pulsed light) devices, laser devices, energy-based devices, electrical stimulation devices, microdermabrasion devices, derma rollers or microneedling devices, massage devices, thermal devices, and combination devices.

The industry covers skin rejuvenation and anti-aging, acne treatment, hair removal, hair regrowth, body contouring, pigmentation treatment, scar reduction, and eye care.

These products are distributed through retail stores, retail pharmacy chains, supermarket and departmental stores, e-commerce or brand websites, and direct sales.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is projected to reach USD 12.4 billion by 2035.

The industry is expected to grow at a CAGR of 8.5% from 2025 to 2035.

Light-based devices are expected to dominate with a 33% share in 2025.

The industry is estimated to reach USD 5.5 billion in 2025.

South Asia & Pacific, particularly India, is expected to be the key growth region with a projected CAGR of 13.6%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Psychotherapeutic Combinations Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sinus Therapeutic Drugs Market – Trends, Growth & Forecast 2022-2032

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Elastic Therapeutic Tape Market Growth – Trends & Forecast 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA