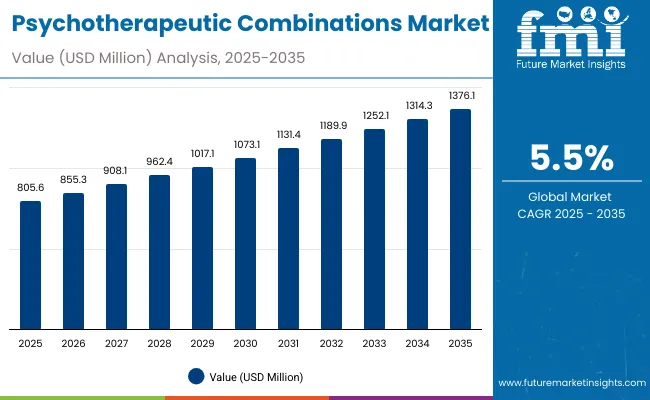

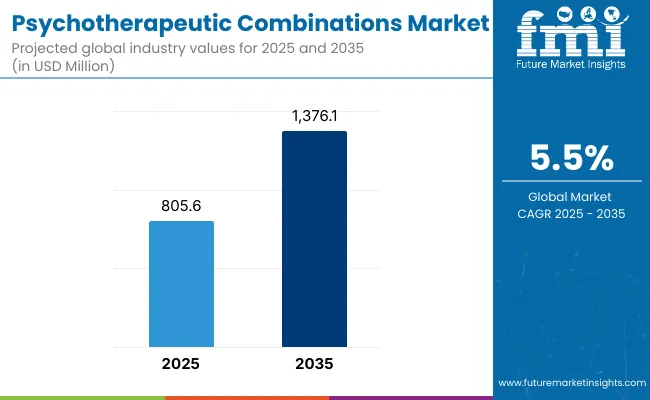

The global psychotherapeutic combinations market is projected to grow from USD 805.6 million in 2025 to approximately USD 1,376.1 million by 2035, recording an absolute increase of USD 570.5 million over the forecast period. This translates into a total growth of 70.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035.

Psychotherapeutic Combinations Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 805.6 million |

| Forecast Value in (2035F) | USD 1,376.1 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing prevalence of complex psychiatric disorders, rising demand for combination therapies, and growing focus on treatment-resistant mental health conditions.

Quick Stats for Psychotherapeutic Combinations Market

Between 2025 and 2030, the psychotherapeutic combinations market is projected to expand from USD 805.6 million to USD 1,052.9 million, resulting in a value increase of USD 247.3 million, which represents 43.3% of the total forecast growth for the decade.

This phase of growth will be shaped by rising awareness about mental health treatment options, increasing demand for personalized therapeutic approaches, and growing penetration of combination therapies in emerging markets. Pharmaceutical companies are expanding their psychotherapeutic combination portfolios to address the growing demand for effective treatment solutions for complex psychiatric conditions.

From 2030 to 2035, the market is forecast to grow from USD 1,052.9 million to USD 1,376.1 million, adding another USD 323.2 million, which constitutes 56.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized pharmacy channels, integration of digital health platforms with combination therapy management, and development of personalized treatment protocols.

The growing adoption of evidence-based medicine and healthcare provider recommendations will drive demand for clinically proven psychotherapeutic combinations with enhanced efficacy and safety profiles.

Between 2020 and 2025, the psychotherapeutic combinations market experienced steady expansion, driven by increasing recognition of treatment-resistant psychiatric conditions and growing acceptance of combination therapy approaches.

The market developed as healthcare providers recognized the need for comprehensive treatment solutions to address complex mental health disorders. Clinical research and regulatory approvals began emphasizing the importance of combination therapies in achieving better patient outcomes for challenging psychiatric conditions.

Market expansion is being supported by the increasing prevalence of treatment-resistant psychiatric disorders and the corresponding demand for more effective therapeutic approaches. Modern healthcare providers are increasingly focused on combination therapies that can address multiple symptoms simultaneously, improve treatment adherence, and reduce the burden of polypharmacy.

The proven efficacy of specific drug combinations in treating complex conditions like schizophrenia, major depressive disorder, and bipolar disorder makes them essential components of comprehensive psychiatric treatment plans.

The growing emphasis on personalized medicine and precision psychiatry is driving demand for tailored combination therapies that address individual patient needs and genetic profiles. Healthcare provider preference for simplified medication regimens that combine multiple active ingredients in single formulations is creating opportunities for innovative drug development.

The rising influence of clinical guidelines and evidence-based treatment protocols is also contributing to increased adoption of proven psychotherapeutic combinations across different patient populations and therapeutic areas.

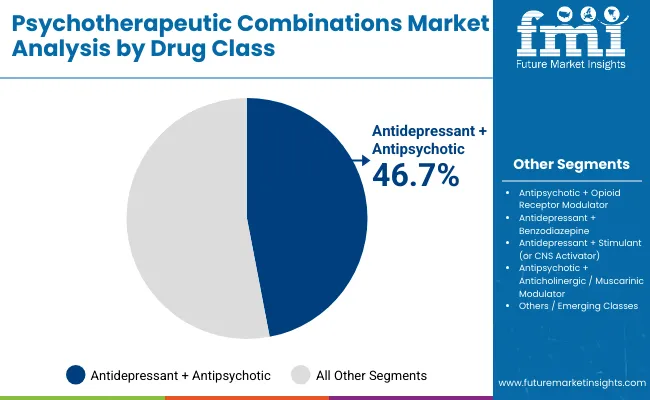

The market is segmented by drug class, indication, sales channel, and region. By drug class, the market is divided into antidepressant + antipsychotic, antipsychotic + opioid receptor modulator, antidepressant + benzodiazepine, antidepressant + stimulant, antipsychotic + anticholinergic/muscarinic modulator, and others/emerging classes.

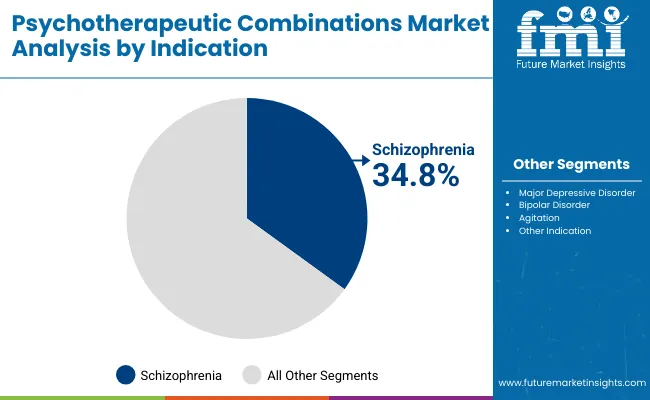

Based on indication, the market is categorized into schizophrenia, major depressive disorder, bipolar disorder, agitation, and other indications. In terms of sales channel, the market is segmented into retail pharmacies, hospital pharmacies, drug stores, and e-commerce pharmacy. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The antidepressant + antipsychotic combination is projected to account for 46.7% of the psychotherapeutic combinations market in 2025, reaffirming its position as the category's dominant drug class. Healthcare providers increasingly recognize the synergistic benefits of combining antidepressant and antipsychotic medications for treating complex psychiatric conditions, particularly treatment-resistant depression with psychotic features and certain bipolar disorders. This combination addresses both mood symptoms and psychotic manifestations, providing comprehensive therapeutic coverage.

This drug class forms the foundation of most treatment protocols for severe mental health conditions, as it represents the most clinically validated and widely accepted combination approach in psychiatry. Regulatory approvals and extensive clinical research continue to strengthen confidence in these formulations.

With increasing recognition of the complexity of psychiatric disorders requiring multi-targeted approaches, antidepressant + antipsychotic combinations align with both acute treatment and long-term management goals. Their broad therapeutic utility across multiple indications ensures sustained market dominance, making them the central growth driver of psychotherapeutic combination demand.

Schizophrenia is projected to represent 34.8% of psychotherapeutic combinations demand in 2025, underscoring its role as the primary indication driving combination therapy adoption. Healthcare providers recognize that schizophrenia's complex symptomatology, including positive symptoms, negative symptoms, and cognitive impairments, often requires multi-modal treatment approaches that single-agent therapies cannot adequately address. Combination therapies offer enhanced efficacy in managing treatment-resistant cases and reducing relapse rates.

The segment is supported by the chronic nature of schizophrenia requiring long-term therapeutic management and the growing recognition that combination approaches can improve patient compliance and quality of life. Additionally, healthcare systems are increasingly adopting evidence-based treatment guidelines that recommend specific combinations for optimal outcomes. As clinical understanding of schizophrenia's neurobiological complexity advances, combination therapies will continue to play a crucial role in comprehensive treatment strategies, reinforcing their essential position within the psychotherapeutic market.

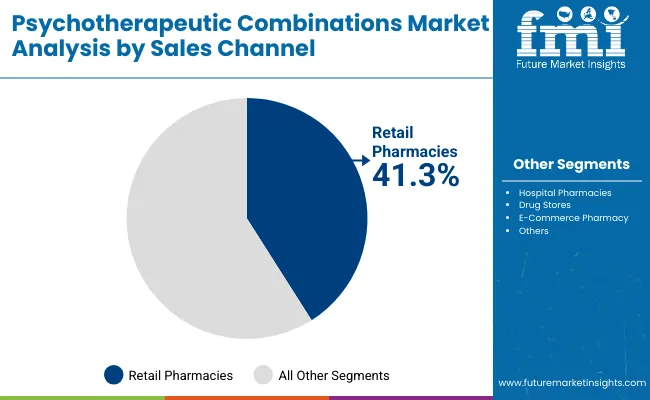

The retail pharmacies channel is forecasted to contribute 41.3% of the psychotherapeutic combinations market in 2025, reflecting the primary role of community pharmacies in psychiatric medication dispensing and patient care.

Patients with chronic psychiatric conditions rely on accessible, convenient pharmacy services for ongoing medication management, making retail pharmacies the cornerstone of psychotherapeutic combination distribution. This channel provides essential services including medication counseling, adherence monitoring, and coordination with healthcare providers.

The segment benefits from established relationships between patients and pharmacists, who provide continuity of care and medication management support. Retail pharmacies also offer advantages in terms of insurance coverage processing, generic substitution options, and patient convenience through extended hours and multiple locations.

With growing emphasis on community-based mental health care and patient-centered pharmacy services, retail pharmacies serve as critical access points for psychotherapeutic combinations, making them fundamental drivers of market accessibility and growth.

The psychotherapeutic combinations market is advancing steadily due to increasing recognition of treatment-resistant psychiatric conditions and growing demand for comprehensive therapeutic approaches. However, the market faces challenges including complex regulatory pathways, potential for increased side effects, and concerns about drug interactions. Innovation in combination formulations and personalized treatment protocols continue to influence product development and market expansion patterns.

Expansion of Hospital Pharmacies and Specialty Care Channels

The growing adoption of specialized psychiatric care facilities is enabling more sophisticated combination therapy management and monitoring. Hospital pharmacies offer comprehensive medication management services, including therapeutic drug monitoring and adverse event management, that are particularly important for complex combination regimens. Specialty care channels provide access to psychiatric specialists who can optimize combination therapy selection and dosing.

Integration of Digital Health Platforms and Medication Management Systems

Modern pharmaceutical companies are incorporating digital health technologies such as medication adherence monitoring, electronic prescribing systems, and patient portal integration to enhance combination therapy management. These technologies improve medication compliance, enable real-time monitoring of therapeutic outcomes, and provide better coordination between healthcare providers. Advanced digital platforms also enable personalized dosing recommendations and early identification of potential drug interactions or adverse events.

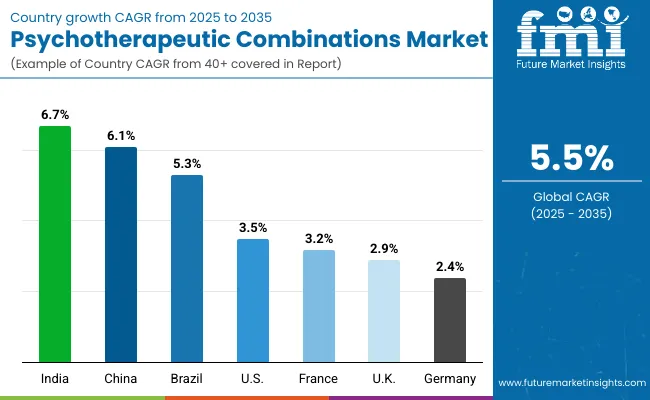

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

| China | 6.1% |

| Brazil | 5.3% |

| USA | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| Germany | 2.4% |

The psychotherapeutic combinations market is experiencing varied growth globally, with India leading at a 6.7% CAGR through 2035, driven by expanding healthcare infrastructure, increasing mental health awareness, and growing access to psychiatric medications. China follows at 6.1%, supported by healthcare system reforms, increasing recognition of mental health importance, and expanding pharmaceutical coverage.

Brazil shows growth at 5.3%, emphasizing improved access to psychiatric care and combination therapy adoption. Europe records 4.0% growth, focusing on evidence-based treatment protocols and comprehensive mental health care systems. The USA shows 3.5% growth, representing a mature market with established treatment patterns and regulatory frameworks.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from psychotherapeutic combinations in China is projected to exhibit steady growth with a CAGR of 6.1% through 2035, driven by ongoing healthcare system reforms and increasing recognition of mental health as a priority health issue. The country's expanding healthcare infrastructure and growing availability of specialized psychiatric services are creating significant opportunities for combination therapy adoption. Major international and domestic pharmaceutical companies are establishing comprehensive distribution networks to serve the growing population of patients requiring complex psychiatric treatment across urban and developing regions.

Revenue from psychotherapeutic combinations in India is expanding at a CAGR of 6.7%, supported by increasing healthcare accessibility, growing mental health awareness, and expanding pharmaceutical market presence. The country's large patient population and increasing recognition of psychiatric conditions are driving demand for effective combination therapy solutions. International pharmaceutical companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality psychiatric medications.

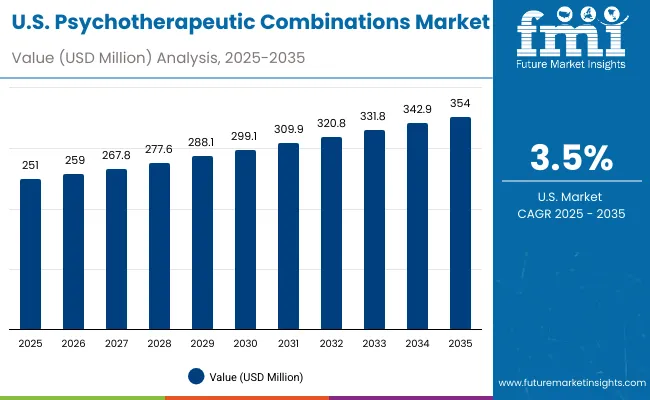

Demand for psychotherapeutic combinations in the USA is projected to grow at a CAGR of 3.5%, supported by well-established psychiatric care systems and evidence-based treatment guidelines. American healthcare providers consistently utilize combination therapies for treatment-resistant conditions and complex psychiatric presentations. The market is characterized by mature treatment protocols, comprehensive insurance coverage, and established relationships between healthcare providers and pharmaceutical companies.

Revenue from psychotherapeutic combinations in Brazil is projected to grow at a CAGR of 5.3% through 2035, driven by healthcare system development, increasing access to psychiatric care, and growing recognition of mental health importance. Brazilian healthcare providers are increasingly adopting combination therapy approaches for complex psychiatric conditions, supported by expanding pharmaceutical market presence and improved treatment accessibility.

Revenue from psychotherapeutic combinations in the UK is projected to grow at a CAGR of 2.9% through 2035, supported by the National Health Service framework and comprehensive evidence-based treatment guidelines that facilitate appropriate use of combination therapies for complex psychiatric conditions. British healthcare providers consistently utilize established protocols for combination therapy management, emphasizing patient outcomes and treatment optimization within integrated care systems.

Revenue from psychotherapeutic combinations in Germany is projected to grow at a CAGR of 2.4% through 2035, supported by the country's well-established psychiatric care infrastructure, comprehensive healthcare coverage, and systematic approach to mental health treatment. German healthcare providers emphasize evidence-based combination therapy utilization within structured healthcare frameworks that prioritize clinical effectiveness and patient safety.

Revenue from psychotherapeutic combinations in France is projected to grow at a CAGR of 3.2% through 2035, supported by the country's comprehensive healthcare system, established psychiatric care infrastructure, and systematic approach to mental health treatment. French healthcare providers emphasize evidence-based combination therapy utilization within integrated care frameworks that prioritize patient outcomes and treatment continuity.

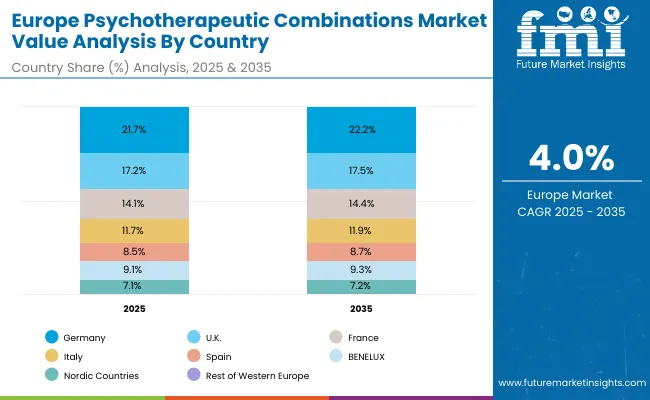

The psychotherapeutic combinations market in Europe is projected to expand steadily through 2035, supported by increasing adoption of polypharmacy in psychiatry, rising prevalence of complex mood and anxiety disorders, and ongoing clinical innovation in multi-target therapies.

Germany will continue to lead the regional market, accounting for 21.7% in 2025 and rising slightly to 22.2% by 2035, supported by a strong clinical research base, reimbursement pathways, and robust psychiatric care infrastructure. The United Kingdom follows with 17.2% in 2025, increasing to 17.5% by 2035, driven by NHS adoption of advanced treatment guidelines, digital mental health integration, and broadening specialist networks.

France holds 14.1% in 2025, edging up to 14.4% by 2035 as psychiatric hospitals expand multi-drug therapy protocols and demand grows for tailored treatment regimens. Italy contributes 11.7% in 2025, remaining broadly stable at 11.9% by 2035, supported by strong regional mental health programs and growing clinical trial participation. Spain represents 8.5% in 2025, inching upward to 8.7% by 2035, underpinned by strengthening access to psychiatric services and patient support programs.

BENELUX markets together account for 9.1% in 2025, moving to 9.3% by 2035, supported by innovation-friendly regulatory frameworks and academic-industry collaboration. The Nordic countries represent 7.1% in 2025, marginally increasing to 7.2% by 2035, with demand fueled by progressive healthcare systems and early adoption of evidence-based psychiatric care. The Rest of Western Europe moderates from 10.6% in 2025 to 8.7% by 2035, as larger core markets capture a greater share of investment, clinical trials, and adoption of combination therapy protocols.

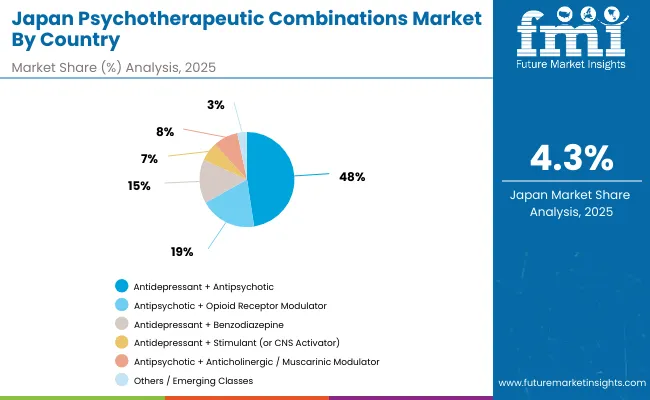

The psychotherapeutic combinations market in Japan is set to remain diversified across several therapy pairings in 2025, reflecting clinical preferences in psychiatric practice and evolving prescribing patterns. Antidepressant + Antipsychotic combinations dominate with a 47.6% share in 2025, supported by their central role in managing treatment-resistant depression, bipolar disorder, and psychotic features within mood disorders.

Antipsychotic + Opioid receptor modulator regimens represent 19.3% in 2025, gaining traction from pipeline approvals targeting schizophrenia with adjunctive mood stabilization benefits. Antidepressant + Benzodiazepine therapies hold 14.9%, sustained by their widespread use for acute anxiety comorbidities and rapid symptom relief in depressive disorders.

Meanwhile, Antidepressant + Stimulant (CNS activator) pairings account for 6.5%, driven by off-label use in refractory depression and ADHD-related comorbid presentations. Antipsychotic + Anticholinergic / Muscarinic modulator regimens contribute 8.4%, largely to manage extrapyramidal side effects associated with long-term antipsychotic therapy. The remaining 3.3% is attributed to emerging classes and novel mechanism-based combinations, reflecting the growing role of precision psychiatry and experimental adjunctive approaches entering clinical practice.

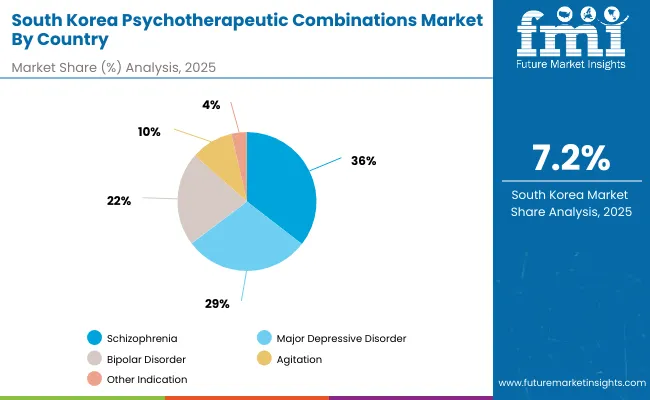

The psychotherapeutic combinations market in South Korea in 2025 is shaped by strong demand across core psychiatric indications, reflecting both clinical prevalence and treatment guidelines. Schizophrenia accounts for the largest share at 35.5%, supported by high rates of antipsychotic utilization, long-acting injectable adoption, and increasing integration of adjunctive therapies to address treatment resistance.

Major depressive disorder (MDD) follows with 29.2%, driven by the rising burden of depression, heightened mental health awareness, and wider reimbursement for antidepressant-antipsychotic combination protocols. Bipolar disorder contributes 21.8%, supported by the established use of mood stabilizers in tandem with antidepressants and antipsychotics to manage both manic and depressive episodes.

Agitation-related indications hold 9.9%, reflecting growing prescribing of rapid-acting combinations in psychiatric emergencies and elderly care. The remaining 3.6% is attributed to other indications, including anxiety spectrum disorders, PTSD, and emerging neuropsychiatric use cases, highlighting opportunities for pipeline therapies and expanded clinical adoption.

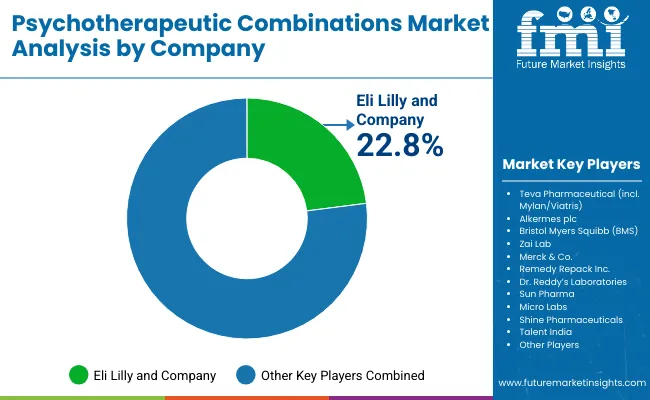

The psychotherapeutic combinations market is characterized by competition among established pharmaceutical companies, specialty mental health focused firms, and generic drug manufacturers. Companies are investing in clinical research, regulatory compliance, strategic partnerships, and healthcare provider education to deliver effective, safe, and accessible combination therapy solutions. Drug development, clinical validation, and market access strategies are central to strengthening product portfolios and market presence.

Eli Lilly and Company, USA-based, leads the market with 22.8% global value share, offering clinically-proven psychotherapeutic combinations with a focus on efficacy and patient outcomes. Teva Pharmaceutical provides comprehensive generic and branded combination products with emphasis on accessibility and cost-effectiveness. Alkermes plc focuses on innovative formulation technologies and specialized delivery systems for combination therapies. Bristol Myers Squibb delivers established combination products with strong clinical evidence and healthcare provider acceptance.

Zai Lab operates in key Asian markets with focus on bringing innovative combination therapies to underserved patient populations. Merck & Co. provides comprehensive psychiatric medication portfolios including combination products across multiple therapeutic areas. Remedy Repack Inc. specializes in customized packaging and medication management solutions for combination therapies. Dr. Reddy's Laboratories, Sun Pharma, Micro Labs, and Shine Pharmaceuticals provide generic alternatives and specialized formulations to enhance market accessibility and patient access to essential combination treatments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 805.6 Million |

| Drug Class | Antidepressant + Antipsychotic, Antipsychotic + Opioid Receptor Modulator, Antidepressant + Benzodiazepine, Antidepressant + Stimulant, Antipsychotic + Anticholinergic/Muscarinic Modulator, Others/Emerging Classes |

| Indication | Schizophrenia, Major Depressive Disorder, Bipolar Disorder, Agitation, Other Indication |

| Sales Channel | Retail Pharmacies, Hospital Pharmacies, Drug Stores, E-Commerce Pharmacy |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Eli Lilly and Company, Teva Pharmaceutical, Alkermes plc, Bristol Myers Squibb, Zai Lab, Merck & Co., Remedy Repack Inc., Dr. Reddy's Laboratories, Sun Pharma, Micro Labs |

| Additional Attributes | Dollar sales by combination type and therapeutic indication, regional demand trends, competitive landscape, healthcare provider preferences for specific combinations, integration with specialty pharmacy channels, innovations in extended-release formulations, patient adherence monitoring, and clinical outcome optimization |

The global psychotherapeutic combinations market is valued at USD 805.6 million in 2025.

The size for the psychotherapeutic combinations market is projected to reach USD 1,376.1 million by 2035.

The psychotherapeutic combinations market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key combination type segments in the psychotherapeutic combinations market are antidepressant + antipsychotic combinations, anxiolytic + antidepressant combinations, and mood stabilizer + antipsychotic combinations.

In terms of combination type, antidepressant + antipsychotic combinations segment is set to command 46.7% share in the psychotherapeutic combinations market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Psychotherapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA