The global Therapeutic Respiratory Devices Market is estimated to be valued at USD 55.40 billion in 2025 and is projected to reach USD 86.03 billion by 2035, registering a compound annual growth rate of 4.5% over the forecast period.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 55.40 billion |

| Industry Value (2035F) | USD 86.03 billion |

| CAGR (2025 to 2035) | 4.5% |

The therapeutic respiratory devices market is evolving rapidly due to rising cases of chronic respiratory diseases and the growing elderly population. This shift is encouraging healthcare systems to adopt early-stage, long-term respiratory care strategies. Technological advancements particularly in portable, AI-integrated, and home-use devices are supporting this transformation by enabling remote monitoring and enhancing treatment precision.

The move toward patient-centric and home-based care is gaining traction, driven by convenience, reduced hospital visits, and improved outcomes. As healthcare infrastructure modernizes and patients demand more personalized, accessible care options, the market is expected to grow with a strong emphasis on digital integration, preventive treatment approaches, and strategic industry collaboration to address the expanding burden of respiratory disorders.

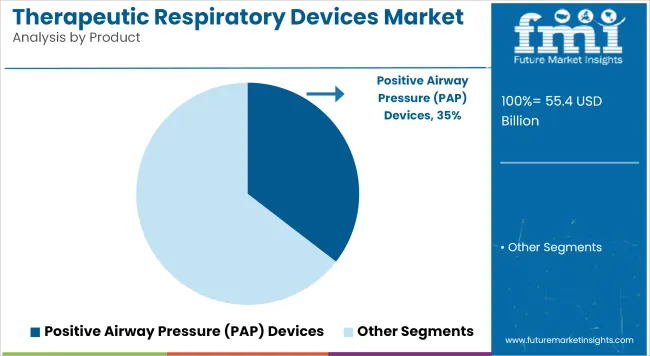

Positive Airway Pressure (PAP) devices have been identified as the dominant product category in the therapeutic respiratory devices market, contributing approximately 35.45% of total revenue in 2025. This leading position has been attributed to the rising global burden of obstructive sleep apnea (OSA), particularly among aging populations and individuals with comorbidities like obesity and cardiovascular conditions.

The widespread deployment of auto-titrating PAP systems, along with improvements in device ergonomics and digital compliance tracking, has further enhanced patient adherence. Growth in this segment has also been facilitated by expanded clinical guidelines advocating early diagnosis and non-invasive respiratory support. Strategic collaborations between device manufacturers and sleep clinics have supported broader market access.

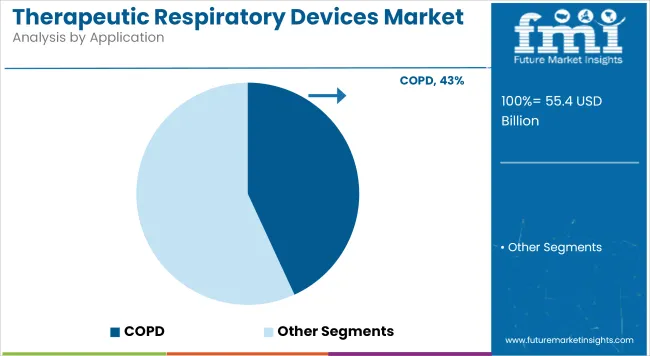

The application of therapeutic respiratory devices for Chronic Obstructive Pulmonary Disease (COPD) is projected to generate 43.12% of total market revenue in 2025, making it the leading segment by disease type. The growth of this segment has been driven by the rising incidence of COPD globally, particularly in aging populations and among smokers in emerging and industrial economies.

Long-term exposure to air pollution and occupational hazards has also been identified as a major contributing factor. Demand for long-term oxygen therapy and non-invasive ventilation has been steadily rising due to the progressive and irreversible nature of COPD. Furthermore, international respiratory health frameworks have recommended early intervention with ventilatory support, which has expanded the utilization of therapeutic devices.

Hospitals are expected to account for 51.34% of the total market revenue in 2025, making them the leading end-use segment in the therapeutic respiratory devices market. This dominance has been driven by the presence of specialized critical care units, trained respiratory therapists, and access to advanced diagnostic and therapeutic tools.

Complex respiratory interventions, including invasive and non-invasive ventilation, are often initiated and managed within hospital settings. Hospital preference has also been reinforced by rising admissions for acute respiratory failure, pneumonia, and post-operative respiratory complications. Enhanced reimbursement frameworks for inpatient respiratory care, especially in developed healthcare economies, have supported the uptake of therapeutic devices.

Affordability, Maintenance, and User Adherence

This is especially critical in low-resource settings, where high upfront costs, maintenance application particularly in resource-scarce settings, and limited patient education on how to use the device pose significant challenges.

Clinical effectiveness could be diminished by device misuse, low therapy adherence and supply chain bottlenecks. They also often have shortages of trained respiratory therapists and gaps in insurance coverage for at-home therapies.

AI Integration, Wearables, and Remote Respiratory Support

AI-infused breathing pattern assessment, remote adherence tracking, and cloud-based spirometry are revolutionizing long-term respiratory management. Wearable respiratory monitors, non-contact ventilation and ultra-quiet nebulizers are improving user experience and compliance. There’s a rising need for smart home-ready oxygen concentrators, tele-respiratory therapy platforms and cross-platform analytics tools that enable personalized care and population-level disease tracking.

The United States therapeutic respiratory devices market is growing at a rapid pace due to the high prevalence of chronic respiratory diseases like COPD, asthma, and sleep Apnea. The market for non-invasive ventilation systems, oxygen concentrators, and portable nebulizers in homecare and clinical setting is thriving.

Emerging technologies, such as Bluetooth-enabled devices and AI-driven monitoring systems, are improving patient adherence and facilitating remote disease management. Medicare and private insurers are also making reimbursement support, driving widespread adoption, especially for the elderly.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK therapeutic respiratory devices market is bolstered by the NHS’s emphasis on respiratory health and the rising natural pressure of environmental conditions induced diseases such as air pollution. Utilization of CPAP machines, humidifiers, and airway clearance systems for mids and guidelines for obstructive/restrictive pulmonary conditions has also increased.

Home-based therapy is growing, driven by digital connectivity and remote patient monitoring tools. Device manufacturers in the UK and distributors who want to support decentralized care delivery are focusing on small and efficient power devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The EU therapeutic respiratory devices market is led by Germany, France and Italy on account of strong availing healthcare infrastructure, aging population and strong diagnostic capabilities. There is high demand for advanced ventilators, spirometers and high-flow nasal cannula systems used in hospital and post-acute care environments.

European Union rules driving the adoption of homecare and tele monitoring are fuelling investment in portable, user-friendly respiratory technologies. Antimicrobial materials, noise reduction and how the equipment can integrate with cloud-based platforms and empower better patient outcomes are key focuses by manufacturers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

The market for therapeutic respiratory devices in Japan is expanding steadily due to a changing demographic, with a booming elderly population and an increasing incidence of respiratory conditions such as pneumonia and interstitial lung diseases. Compact, quiet, and high-precision ventilator support systems are being adopted by Japanese hospitals and homecare providers.

Innovations in humidification technology, as well as integrated diagnostic-therapeutic respiratory platforms, further augments the market. Government policies promoting early intervention and chronic disease management are driving demand for long-term respiratory support equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Surging digitization of healthcare in South Korea; rising asthma and COPD prevalence; and government-supported respiratory health programs are supporting growth of the South Korean therapeutic respiratory devices market. Hospitals and homecare are investing in smart respiratory devices providing real-time monitoring, auto-adjusting pressure, and wireless data sharing.

Demand for both preventive and therapeutic respiratory solutions growing due to air pollution concerns and rising awareness about patients, Manufacturers, both domestically and internationally, are emphasizing ergonomics, portability and cost-effective delivery models.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

The therapeutic respiratory devices market is witnessing intense competition driven by continuous innovation, strategic collaborations, and portfolio diversification. Market participants are actively investing in R&D to develop compact, AI-enabled, and patient-centric devices tailored for both clinical and homecare environments.

Emphasis is being placed on integrating remote monitoring features and cloud-based data analytics to enhance therapy adherence and patient outcomes. Strategic alliances with healthcare providers, technology firms, and telehealth platforms are being pursued to strengthen distribution and after-sales support. Regulatory approvals for next-generation devices are being accelerated, reflecting strong pipeline activity.

Additionally, players are expanding their geographical reach through partnerships and acquisitions, especially in high-burden respiratory regions. Competitive differentiation is being shaped by product reliability, user convenience, and digital integration.

Key Development

The overall market size for the therapeutic respiratory devices market was USD 55.40 billion in 2025.

The therapeutic respiratory devices market is expected to reach USD 86.03 billion in 2035.

The demand for therapeutic respiratory devices will be driven by rising prevalence of chronic respiratory diseases such as COPD and asthma, increasing geriatric population, growing demand for home healthcare solutions, and advancements in portable, non-invasive, and smart respiratory technologies.

The top 5 countries driving the development of the therapeutic respiratory devices market are the USA, China, Germany, Japan, and India.

The positive airway pressure (PAP) devices segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Psychotherapeutic Combinations Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sinus Therapeutic Drugs Market – Trends, Growth & Forecast 2022-2032

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Elastic Therapeutic Tape Market Growth – Trends & Forecast 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

At-Home Therapeutic Beauty Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA